Featured

Dividend calendar – what is it good for?

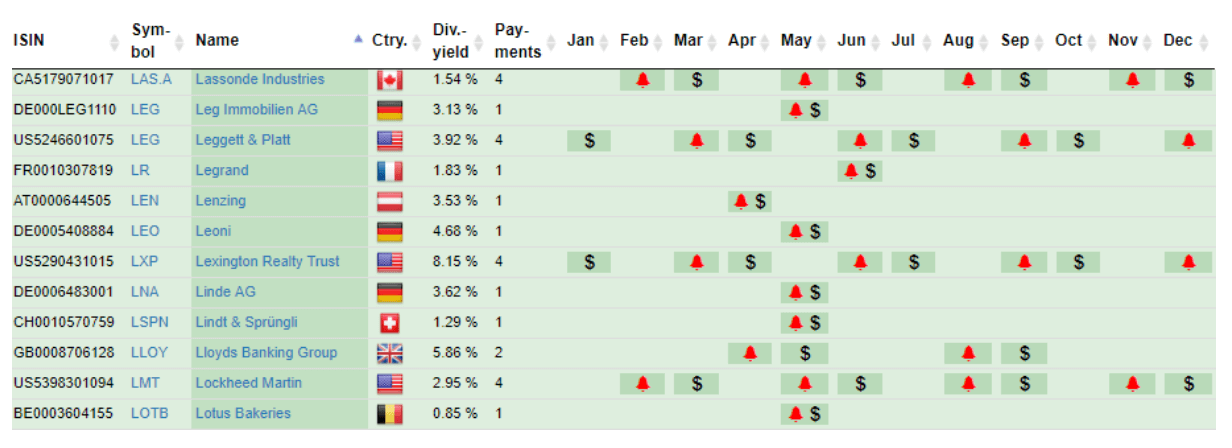

A dividend calendar can be used by investors as a planning instrument and motivator, making it a good option for dividend investors.

Dividend calendars are popular amongst investors. You could almost believe that at ex-date and payment-date, there is a discount on the stock. And at the beginning, I didn’t quite understand why this keyword is searched in different variants more than 10,000 times a month. After all, the stock price reacts to paid dividends by dropping for the same amount (at least in theory).

A dividend calendar showing months of both ex-date and payment date. © Torsten Tiedt

But this way of thinking is short-sighted. A dividend is the only way for the long-term investor to get cash from his investments because he cannot buy anything from the daily ups and downs on the stock market. From an investor’s point of view, a dividend calendar is a series of paydays on which he can expect cash.

Furthermore, some investors are dependent on their dividend income. And those who aren’t are simply looking forward to the expected cash. Cash flows are an excellent motivator to invest in a disciplined manner over a longer period instead of consuming all available money. And it needs a longer period to invest, because only after several years the compound interest comes to bear, turning an initially manageable dividend into a considerable amount of money.

A good dividend calendar is therefore both a planning instrument and a motivator and can thus be a real help for dividend investors. I guess, I finally got it.

(Featured image by DepositPhotos)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoVolatile Outlook for Enlivex Therapeutics as Investors Await Clinical Catalysts

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoInter IKEA Launches Electric Truck Fleet to Decarbonize Heavy-Duty Logistics in Italy

-

Markets3 days ago

Markets3 days agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

-

Markets1 week ago

Markets1 week agoCotton Market Weakens Amid Demand Concerns and Bearish Trends

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-400x240.jpg)

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-80x80.jpg)

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041-400x240.jpg)

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041-80x80.jpg)

You must be logged in to post a comment Login