Featured

Fed interest rates unchanged but 3 more hikes are expected for 2019

The Fed held interest rates steady after its meeting last week amid a strong U.S. economy. However, one more hike is expected before the year ends.

“The stock market is a device to transfer money from the impatient to the patient”—Warren Buffett, American businessman, investor, philanthropist, the “Sage of Omaha”, Chairman and CEO Berkshire Hathaway

“Thousands of experts study overbought indicators, head-and-shoulders patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict the markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.”—Peter Lynch, American investor, funds manager Magellan Funds 1977–1990

“History provides a crucial insight regarding market crisis: they are inevitable, painful and ultimately surmountable.”—Shelby M.C. Davis, founder, Davis Selected Advisors, philanthropist

It may come as no surprise that most investors underperform the markets or even lose money. According to one study, the average active stock investor from 1997 to 2016 earned 3.98 percent vs. a return of 10.16 percent for the S&P 500.

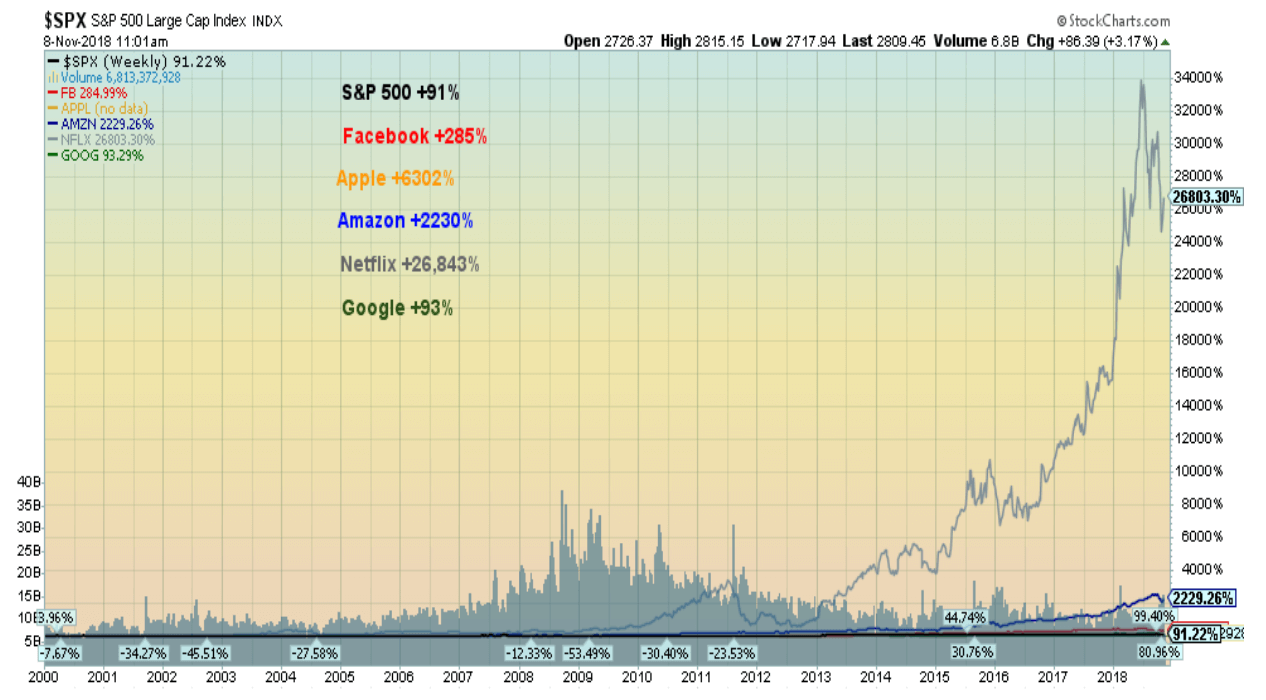

The same would probably hold true for Canada. Most traders lose money (some estimates have it as high as 95 percent) and eventually give up. Many investors underperform because of a lack of understanding of economic and investment cycles and/or they jump around too much from one investment strategy to another. Or they chase the flavor of the day, only to get caught at the top (FAANG stocks, marijuana stocks, high-tech/dot.com stocks in the late 1990s).

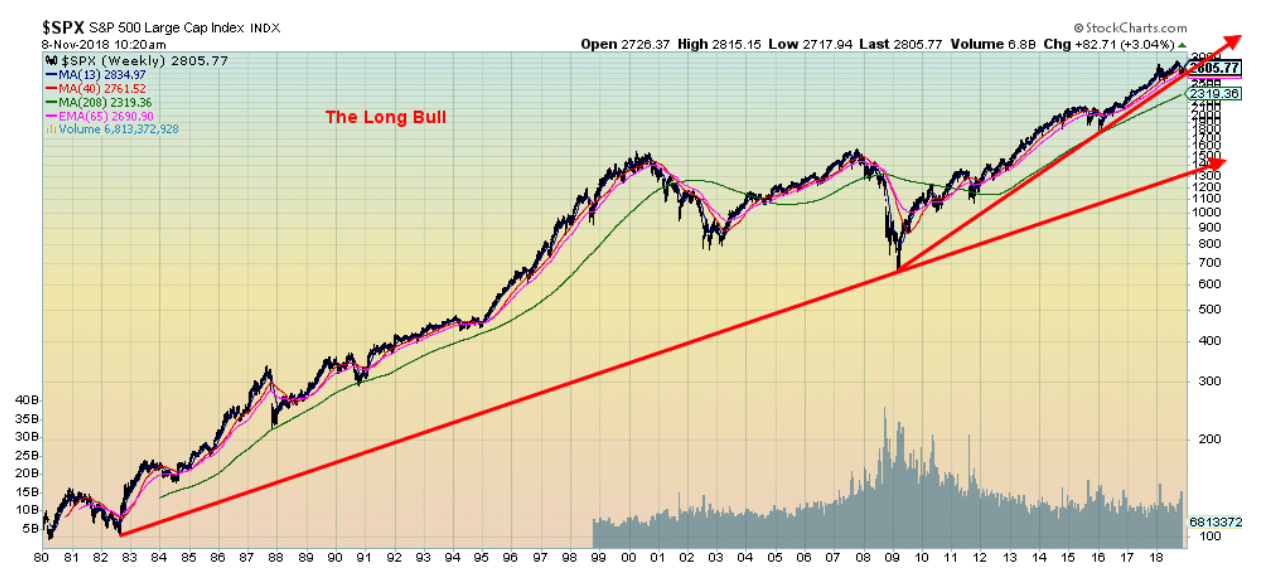

What has been proven is that the slow, steady approach is the eventual winner. The short-term may hurt sometimes, but over time, the market keeps on rising.

Grant you, that can take some time. Following the crash of 1929 and the Great Depression and war, someone who bought the market at the top in 1929 had to wait until 1958 on an inflation-adjusted basis just to get back to break-even. Twenty-nine years is a long time. The same for someone who bought at the top in 1966. The market didn’t break even on an inflation-adjusted basis again until 1995—again, a period of 29 years.

This time around, investors were lucky. Someone who bought the top in 2000 only had to wait until 2014 to break even. Still, 14 years is a long time.

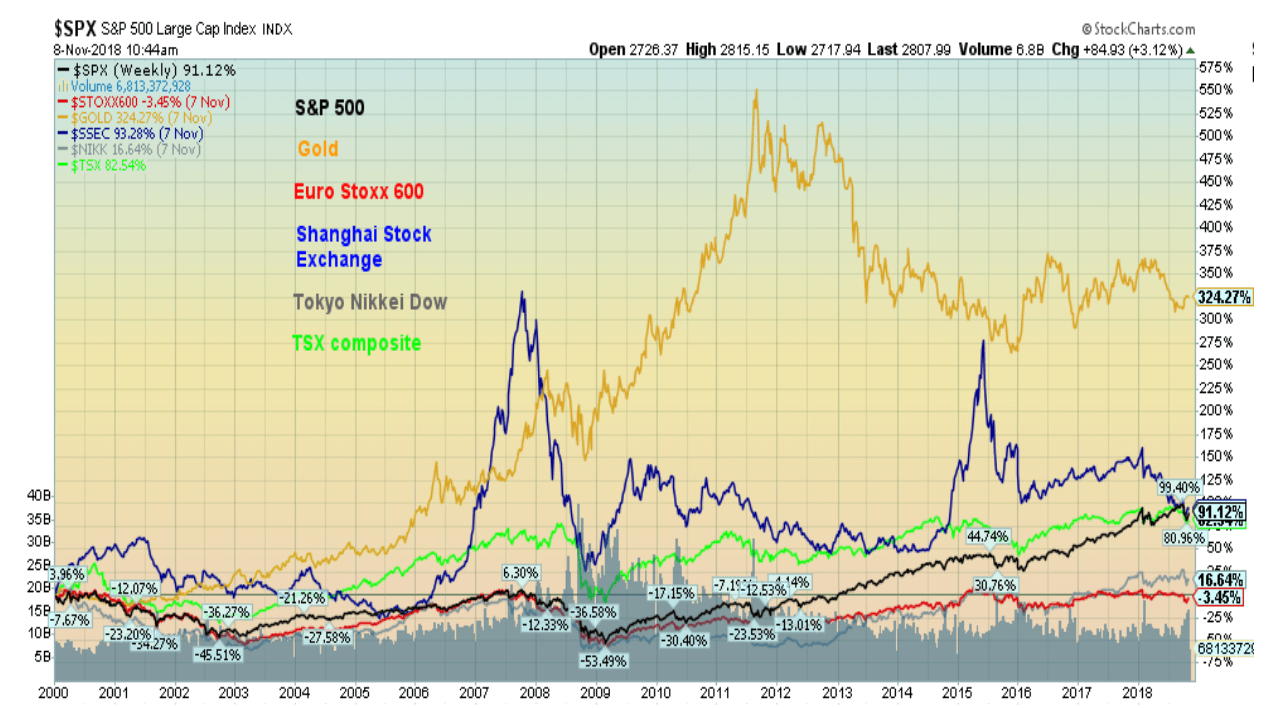

Today, there are markets that have been in multi-year bear markets. Using the term bear market may be an overstatement, as even long-term bears have bull and bear moves within them.

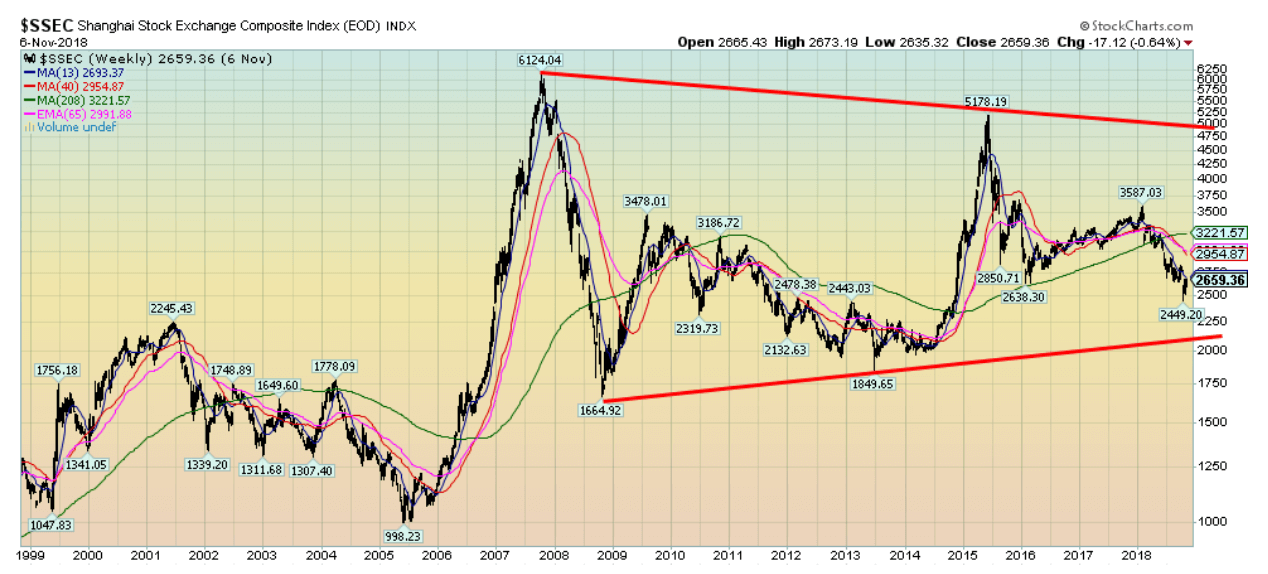

Two markets that come to mind are China’s Shanghai Stock Exchange (SSEC) and the Tokyo Nikkei Dow (TKN). The SSEC topped back in October 2007. Eleven years later the SSEC remains down 57 percent from that top. That is despite a strong bull run-up in 2014–2015.

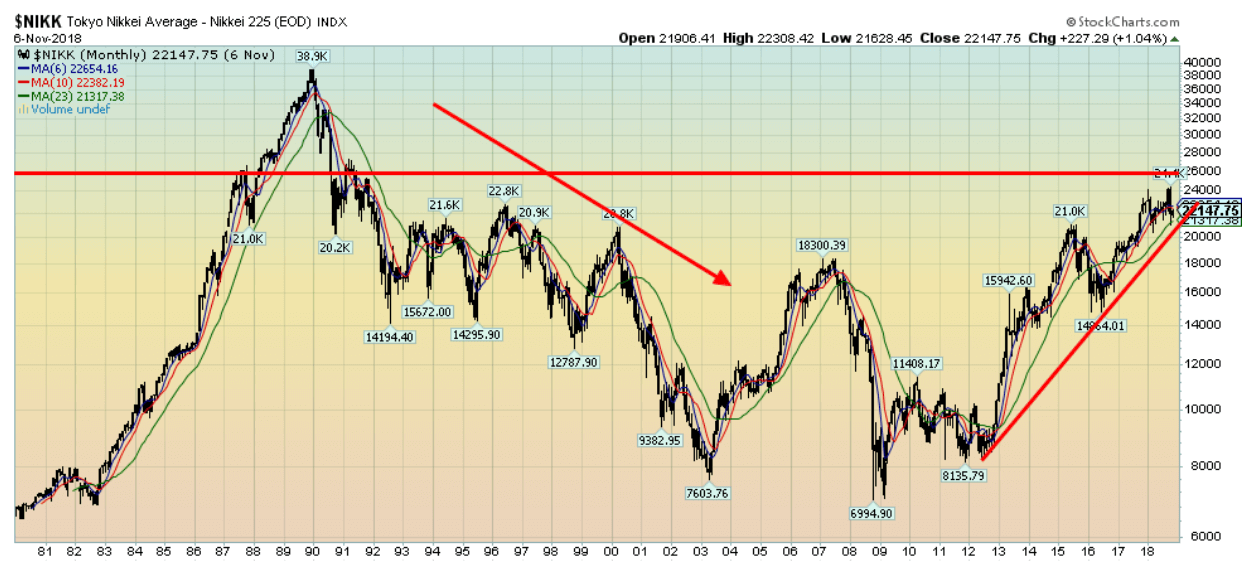

The TKN has fared even worse. The TKN topped way back in 1990. Twenty-eight years later, the TKN remains down 43 percent. Again, that is despite two bulls: 2003–2007 and again 2009–present.

© David Chapman

© David Chapman

For 28 years, the Japanese economy has been going through a series of recessions and feeble recoveries. The Chinese economy had been for years the world’s leader for growth. Since peaking in 2008, the Chinese economy has been growing at a slower pace. There are signs the Chinese economy will continue to show slower growth. Interesting story that there are 50 million empty apartments in China. That is a lot of apartments to fill. It suggests to us that there are, no doubt, problems in the real estate sector, and the need to build more units is most likely non-existent.

Slower growth in China has global implications. The SSEC is currently trading below its four-year MA and its 40-week MA levels that suggest that the SSEC is already in a bear market. The TKN continues to hold above its breakdown point that could define a bear market from a bull market.

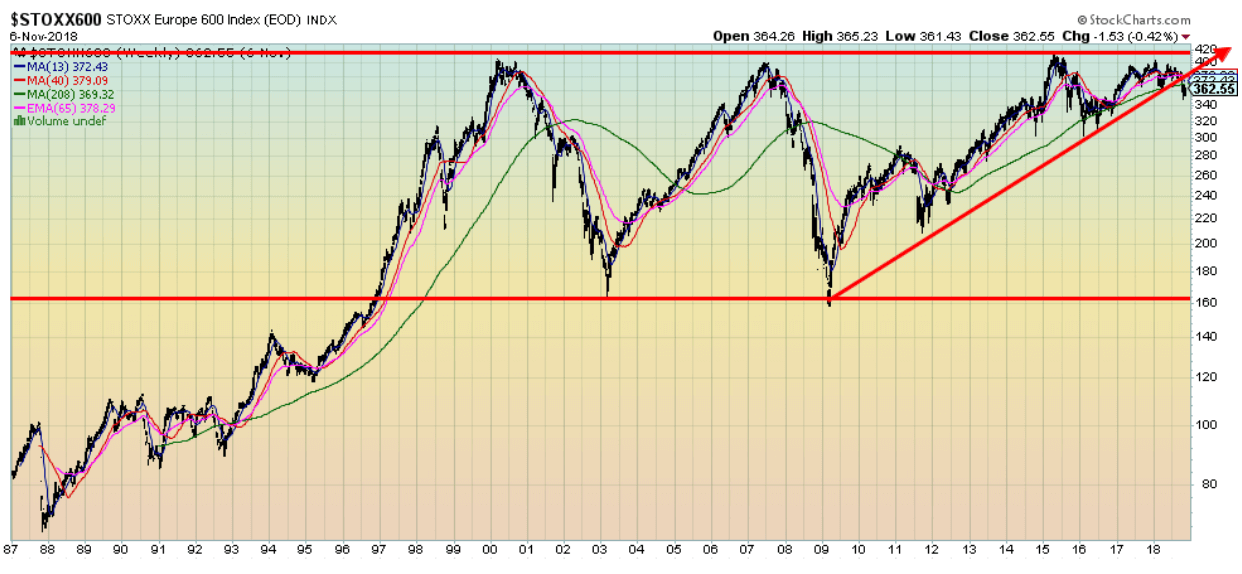

The EU markets, as represented by the STOXX Europe 600 Index, has failed over a period of 18 years to fully recoup the highs of 2000. Now, the STOXX is breaking down under its 40-week and four-year MA’s, suggesting it may be entering a new bear market.

The euro economy has grown only at a feeble pace for years, despite years of QE and ultra-low interest rates. The euro area has serious banking problems in Italy and banking problems continue in Greece, Spain, Portugal, and elsewhere. There are signs of slowing growth in the EU. The year-over-year GDP reported for Q3 2018 showed a sharp slowing from Q2, with Q3 growth of only 1.7 percent vs 2.2 percent in Q2. Growth peaked back in Q3 2017 at 2.8 percent. Since then, it has been all downhill.

© David Chapman

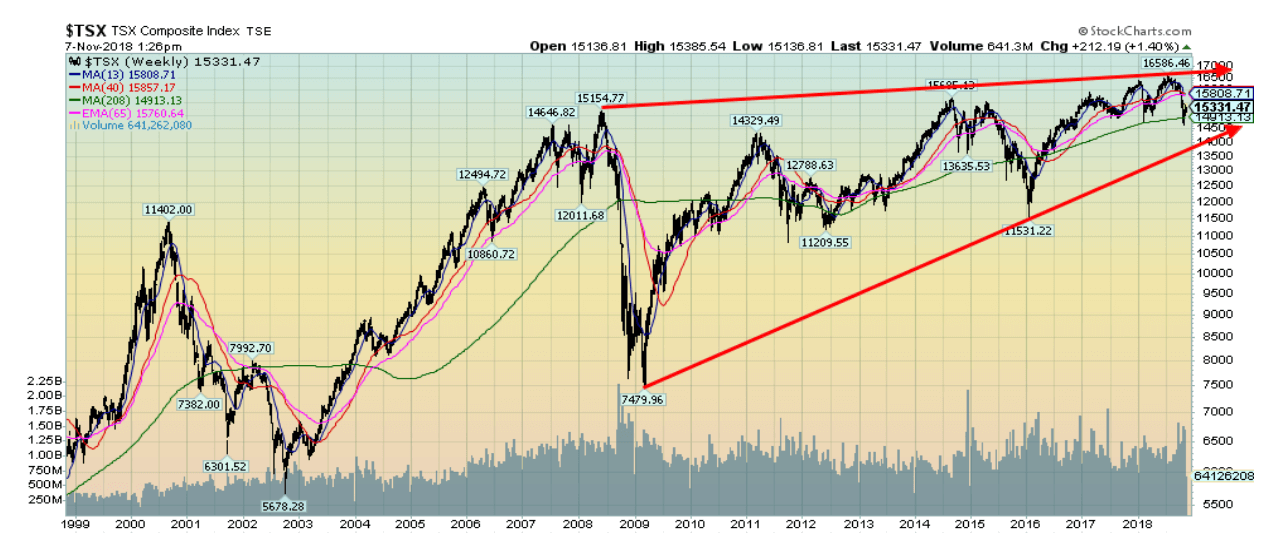

The Canadian market has not fared much better than other markets. Since topping in 2008, the TSX Composite has gained only 1.2 percent. Ten years is a long time to effectively make nothing. That is, assuming you survived the 2008 financial collapse.

© David Chapman

Since 2009, global stock markets have been on a tear, fueled by record low interest rates, endless rounds of quantitative easing (QE), and record amounts of debt. The result has been a bubble in many markets—stocks, housing, and especially debt.

If one only looks at the run-up from March 2009 it appears as if stocks are the only place to be. The S&P 500 is up 282 percent in that time frame to lead the pack. It would also appear that gold is not what you want to own. Gold is up only 30 percent in the same period. But when one looks at the performance since the beginning of the century the picture is different.

© David Chapman

Many people have rightly noted that despite a years-long historical bull market, their RRSP or their 401K is not growing. It is easy to see when putting it in a longer-term perspective. A 50 percent correction such as the one experienced in 2007–2009 requires the market to rise 100 percent just to get back to break even. So maybe 2009 is not the best spot to measure the long-term success of the market. Noting how the markets have performed since the beginning of the century is a much better perspective. 2000 marked the top of the long 1980s, 1990s bull market. What followed that top were two of the worst bear markets in modern history.

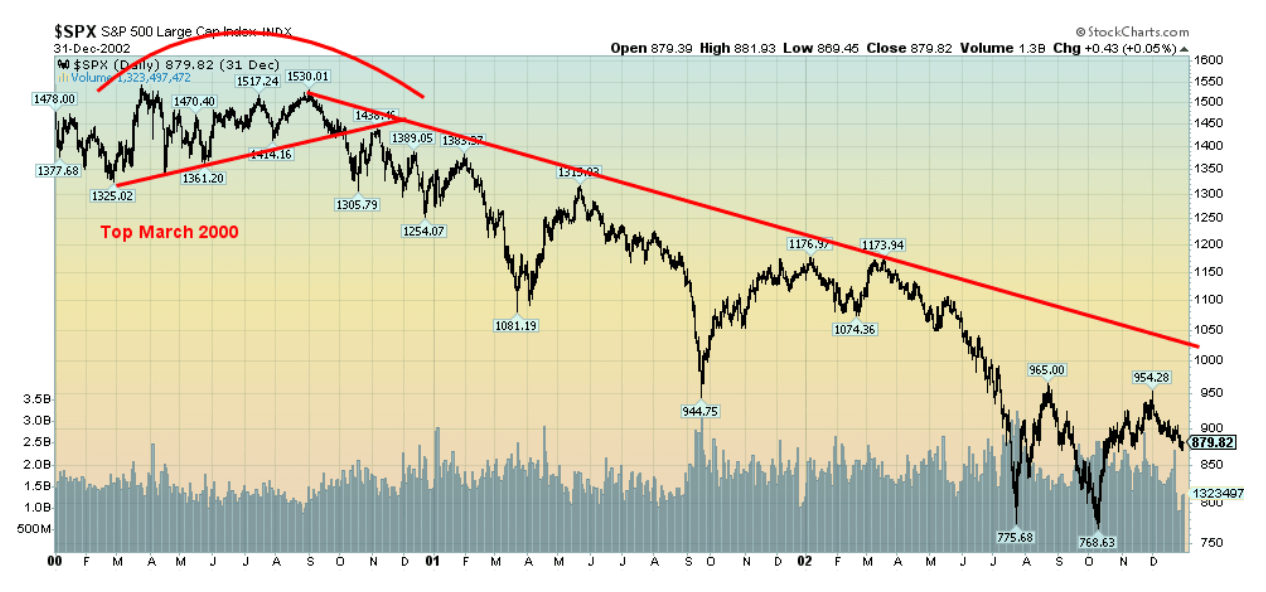

From 2000 to 2002, the S&P 500 fell 50 percent. The decline from 2007 to 2009 was worse: down 58 percent. The S&P 500 crawled back to break even with the 2007 top only to fall once again. It took until April 2013 for the S&P 500 to regain the 2007 high.

© David Chapman

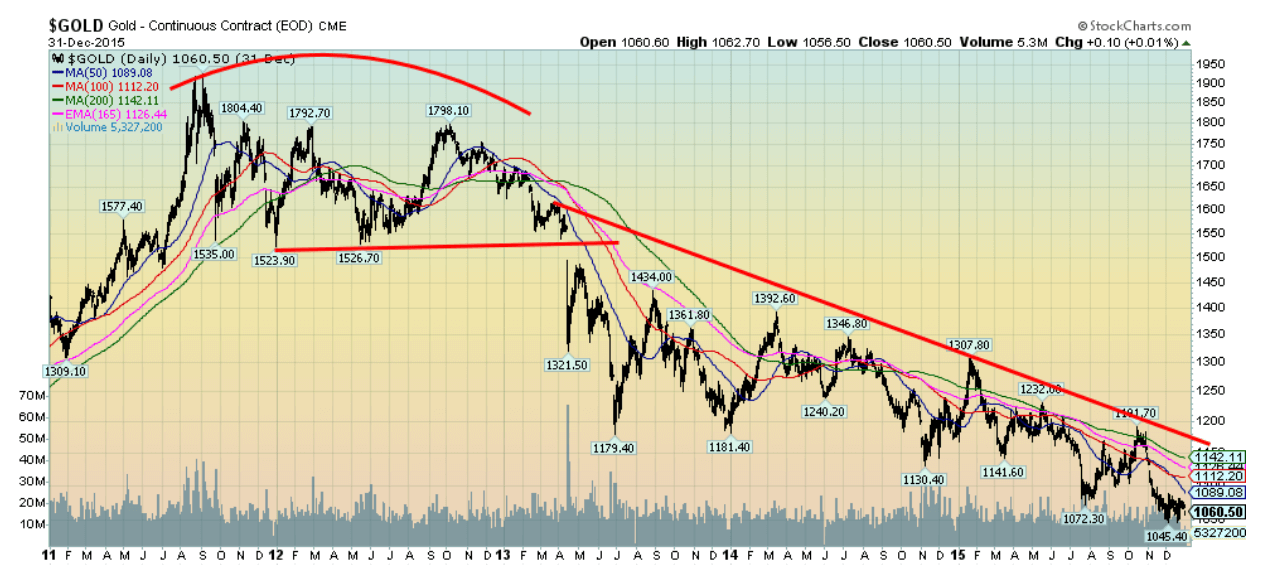

Despite topping in 2011 and experiencing a seven year and counting bear market for gold, it remains the best performer since 2000, up 324 percent. Gold is a hedge against crisis in government and the economy. It was interesting to note as the markets fell into a bear in 2000–2002, gold was rising. While gold initially fell along with the market in 2008, it recovered sooner and was the leader out of the worst market decline since the Great Depression. From the bottom in November 2008 to its high in September 2011 gold was up 180 percent.

From 2000 to the present, the S&P 500 has gained only 91 percent or roughly 5 percent per year. But as one can see, there were the two big interruptions in 2000–2002 and 2007–2009. The Shanghai Stock Exchange (SSEC) gained 93 percent but its last top as we saw was in 2007. Canada’s TSX Composite is up 82 percent since the beginning of the century, but one has to choose carefully which sector to be in. Bringing up the rear is the Tokyo Nikkei Dow (TKN), up just under 17 percent while the Euro Stoxx 600, the EU’s broadest index is actually down, losing 3.5 percent.

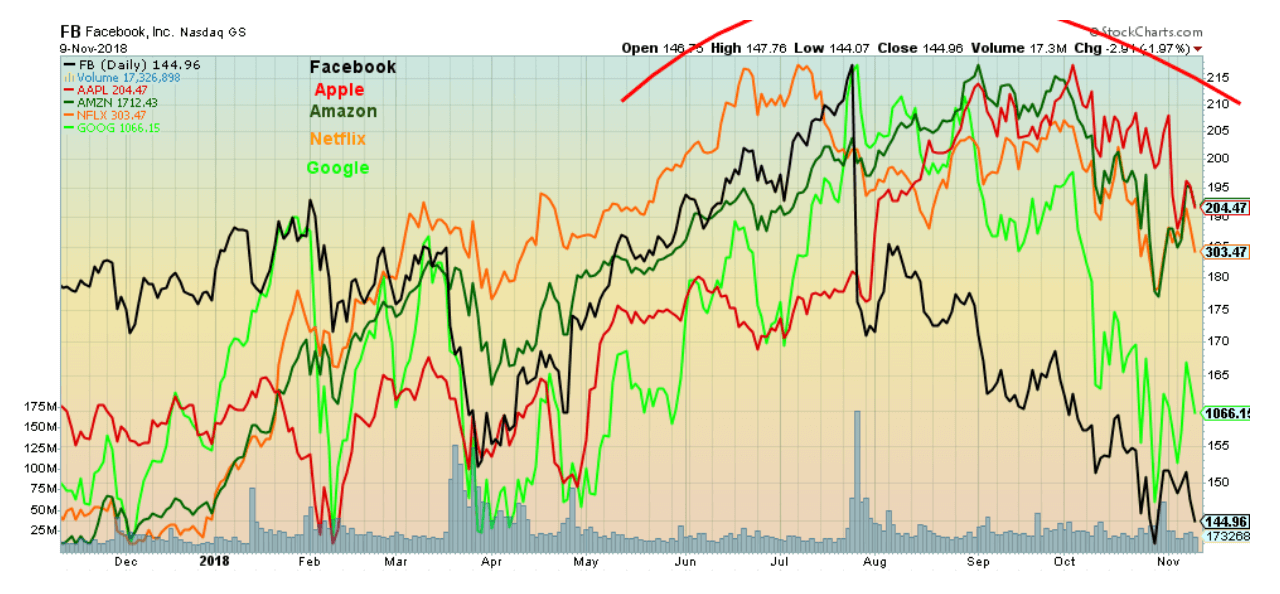

We have noted that the rally since 2009 has been narrow, led primarily by the FAANGs (Facebook, Apple, Amazon, Netflix, and Google).

© David Chapman

The chart above again shows the performance since 2000. One can see the dominance of Netflix. Strip the FAANGs out of the S&P 500 and the performance becomes considerably less. But history shows high flyers can, “when the music stops,” drag the market down. Netflix subscriber growth fell short. The stock fell. Google was hit with a $5 billion fine in Europe. Facebook has been facing problem after problem with breaches and ongoing pressure on chairman and founder Mark Zuckerberg to step down. Apple is facing potentially serious competition from China’s Huawei.

The stock markets have been on a tear since 2009. There are now signs that the “party” may be coming to an end. We have noted that the recent plunge in the markets saw the S&P 500 fall all the way back to just above its April 2018 low, effectively wiping out all of the gains since then. The market also closed under its 200-day MA. This is signaling to us that the bull market that began in March 2009 may be over and that a new bear may be underway. Absolute confirmation would come when the market takes out the February/April 2018 lows. Still, a bear market has many twists and turns. A reminder that, during the 2000–2002 decline, the market put in many ups and downs before succumbing in the latter part of 2001 after the events of 9/11. Even during the 2007–2009 decline, the market went back and forth for several months before collapsing in September 2008. Our expectations are no different this time.

We have often talked about cycles, noting in the past the potential presence of a 75-year cycle and its half-cycle derivatives—37.5 years and 18.75 years. Cycles tend to divide into twos and threes. The 18.75-year cycle appears to divide into threes—a 6.25-year cycle (range 5–8 years)—but it could also be a half-cycle of 9.375 years (range 7–11 years). 1974 proved to be a half-cycle low from 1932, while 2009 appears to be the culmination of the 75-year cycle, coming as it did 77 years later. The 18.75-year cycle has a range of 13–21 years. It is possible from 1974 that the 18.75-year cycle bottomed in 1987 and again in 2009. Major cycle lows such as the 75 and the 37.5-year cycle often saw a secondary collapse some 6–15 years after the primary collapse. The 1937–1938 collapse would qualify dating from 1929–1932 as would the 1980–1982 stock market decline dating from the 1973–1974 collapse.

For the 6.25-cycle low (range 5–8 years), we note, counting from the key 1974 low, important lows in 1982 (8 years), 1987 (5 years), 1994 (7 years), 2002 (8 years), and 2009 (7 years).

From the 2009 major low we noted an important low in 2015–2016 coming 6/7 years after that low. That was most likely our 6.25-year cycle low. The next one is due in 2020–2023 or maybe out to 2024. That is when the low is due, not when the market crests. The tops came in 1929, 2000, and 2007, but the final bottom didn’t come until 1932, 2002, and 2009. Given signs that we may have topped now, it may not be the time to be complacent going forward. If history is any guide, our expectations are for a decline of 30 percent to 50 percent (or more) to take place over the next few years. It just won’t be straight down.

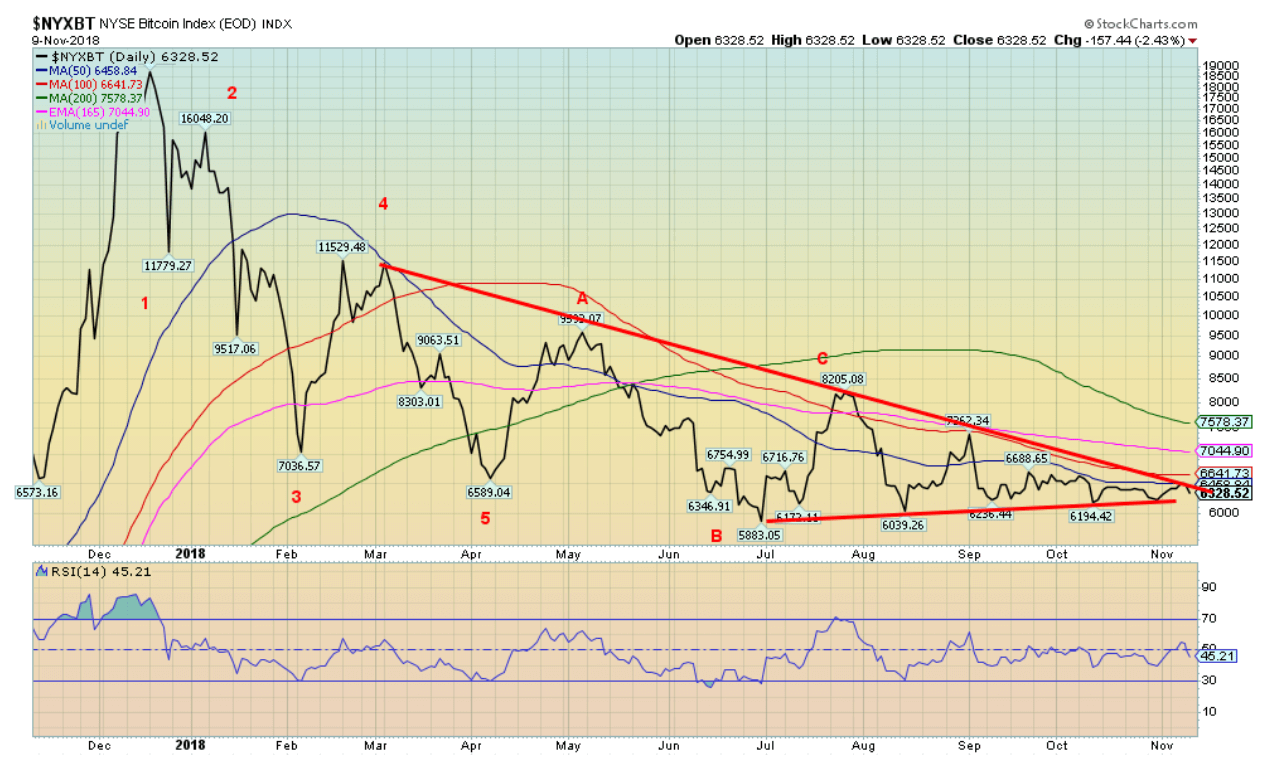

Bitcoin watch!

© David Chapman

The boredom continues. Bitcoin traded in a narrow range during the week between $6,300 and $6,500. Seems the spread is becoming increasingly narrow. Over the past month the range has been roughly between $6,100 and $6,700. Since mid-October that range has narrowed again. As Bitcoin approached $6,500 on November 7 bullish stories abounded that the breakout was eminent. That quickly soured as Bitcoin fell right back and the stories turned bearish.

So, which is it? Bull or bear? More likely bear, but really Bitcoin needs to break under $5,800 to confirm that a bear decline is underway. Until then, the range trading should continue even as it appears it is becoming narrower. The trouble is, the universe is just not expanding for Bitcoin and the cryptos, even as the number of cryptos grows. The industry must grow or it will die—or at least become mortally wounded. We have, from the start, stated we believe the universe cannot deal with so many cryptos and many (most) will just die. As well, unless the universe expands for usage Bitcoin and cryptos are in danger of extinction.

What is the point as regulators circle? Anonymity was the appeal. But regulators want transparency and you can’t have both.

The market cap of all cryptos, as of Friday, November 9, was $212.3 billion, up $6.2 billion on the week. The number of cryptos listed at Coin Market Cap rose to 2,093, up one from the previous week. There were 16 cryptos listed as having a market cap of $1 billion or more, led by Bitcoin with a market cap of $110.9 billion. The number of dead coins listed at Dead Coins finally rose to 936 from 929 the previous week.

Nothing more really to say. Breakout is over $6,800 and breakdown is below $5,800. But the coil appears to suggest it should be a breakdown. But an upside breakout cannot be ruled out. If it did, it would be most likely a false breakout.

© David Chapman

Markets and trends

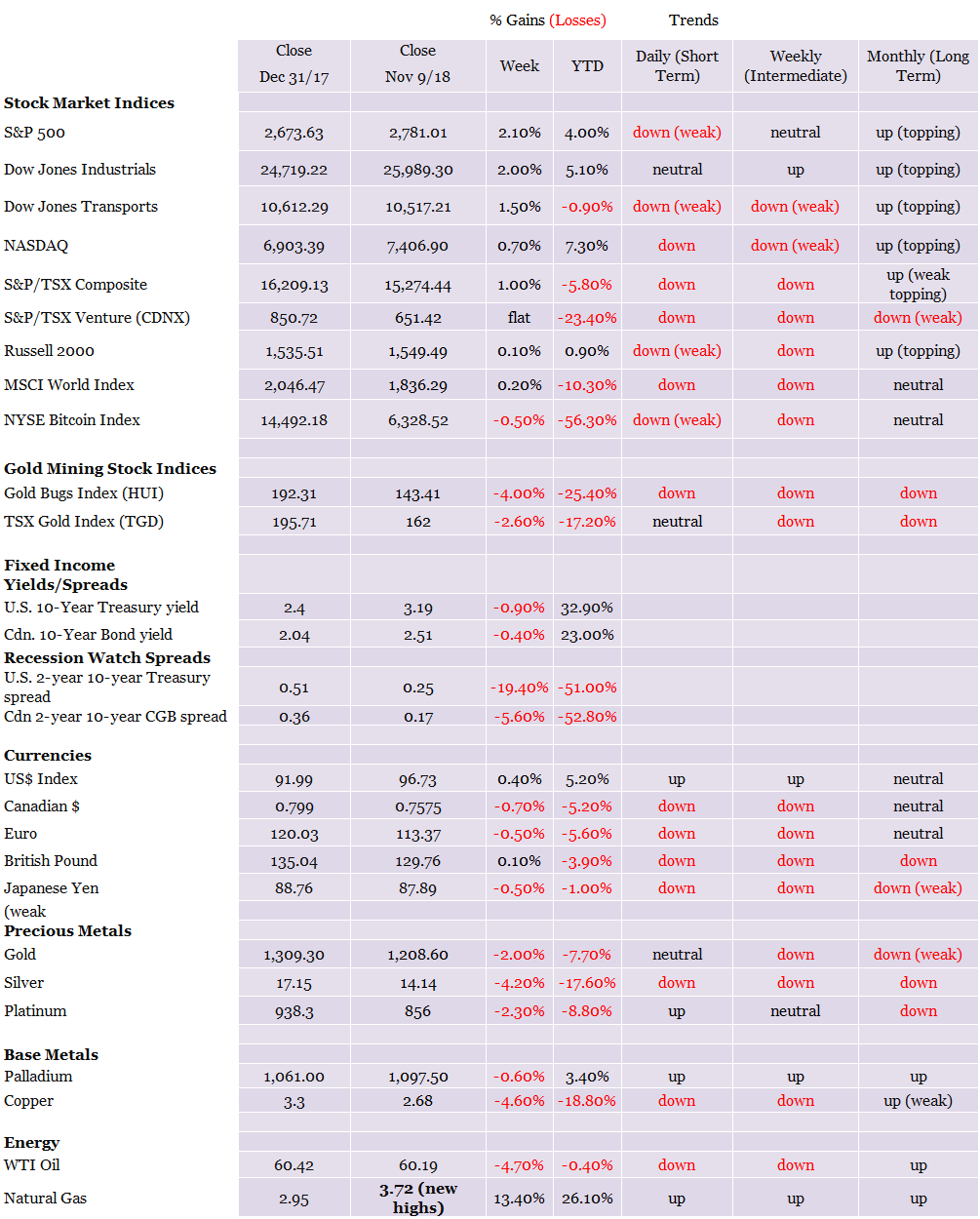

New highs/lows refer to new 52-week highs/lows. © David Chapman

© David Chapman[/caption]

© David Chapman[/caption]

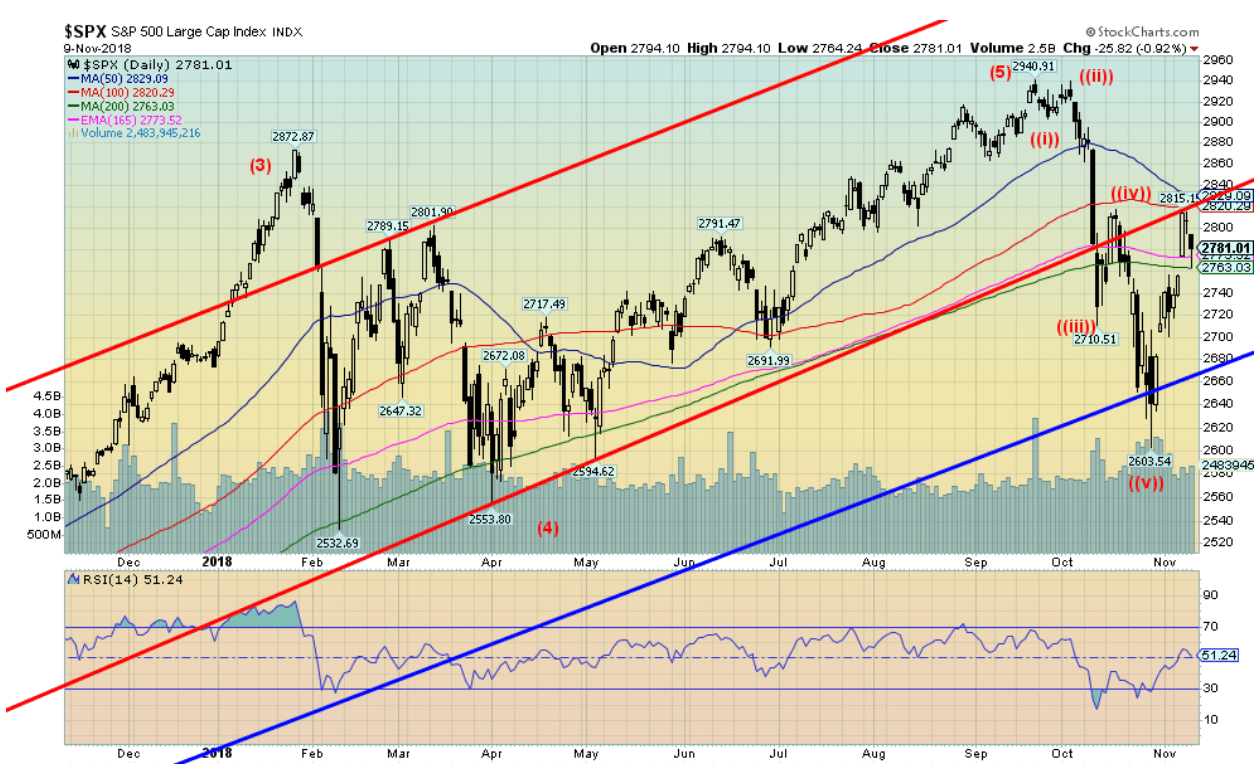

The S&P 500 may have completed a 5-wave down structure in October. It penetrated the up-trend line from the March 2009 low (the blue line). The rebound has taken us back to the 100-day MA and just below the 50-day MA. This could signal the end of the first wave of a corrective pattern that should unfold over the next few months.

As we explain below, we expect that a choppy market could follow over the next several months before the market succumbs to a deeper plunge, possibly later in 2019 and into 2020. While we fell short of taking out the February/March lows we did take out the 200-day MA, something we didn’t do in February/March. This suggests we have now entered a bear market. But again, as we explain below, an unfolding bear is not just about plunges that endlessly go down but all sorts of hooks that give everyone hope.

We expect to also see a number of bullish stories that this is just another correction as in February/March and the market will recover to new highs, so “buy the dip.” It might, but any new highs should be short-lived and not exceed the September high by much. It will also become a market for traders who will buy the dip and then unload into the rally. This plunge effectively wiped out all the gains from the March low. Following a nine-year bull market, we believe that it will be followed by a three-year bear market that could wipe out 30 percent–50 percent.

© David Chapman

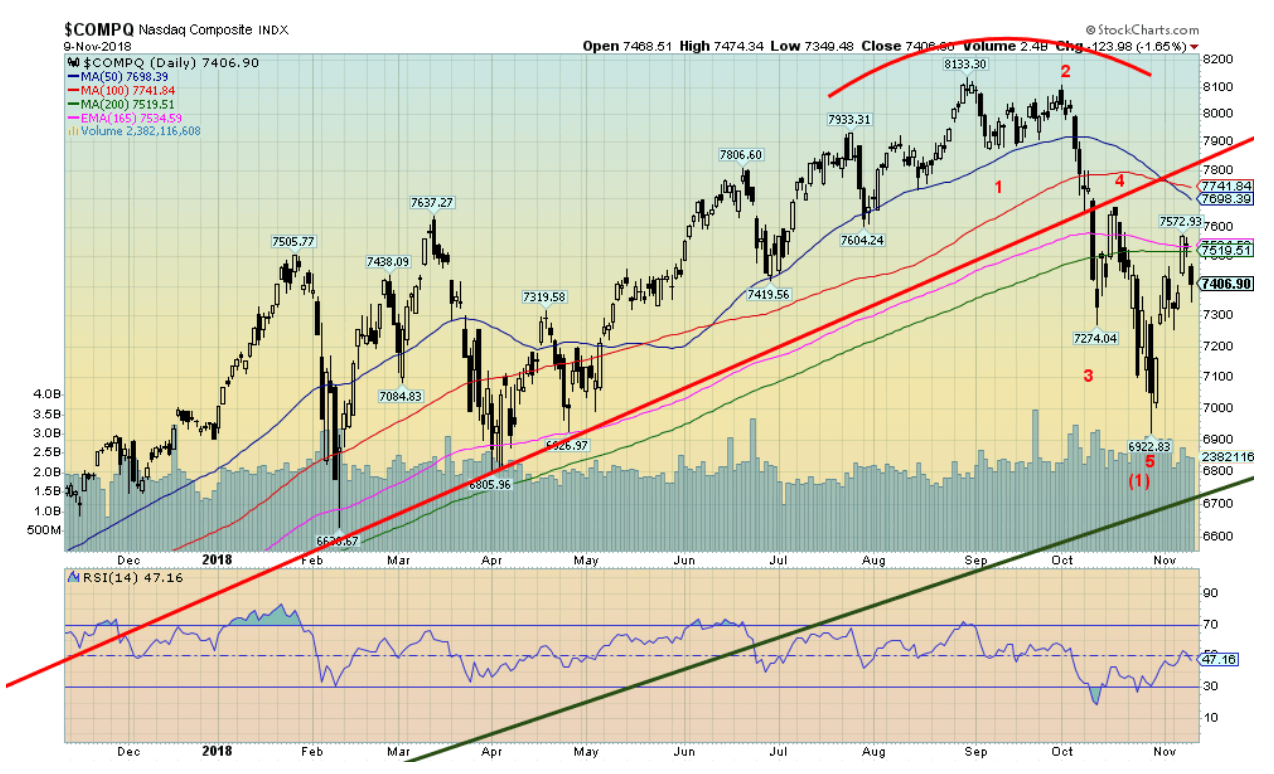

The NASDAQ, dominated by the high-tech stocks, took quite the tumble in September/October, losing at one point about 15 percent. There appears to be a distinct 5-wave decline from the August high. That suggests to us that this is a wave of primary degree and another signal that we could be in the early stages of a new bear market. Unlike what happened in February/March 2018, this time the NASDAQ plunged through the 200-day MA.

The green line is the up-trend line from the March 2009 low so it fell just short of that. It may not be so lucky the next time. Resistance is up to 7,700 and 7,900. Only above 7,900 are new highs possible.

© David Chapman

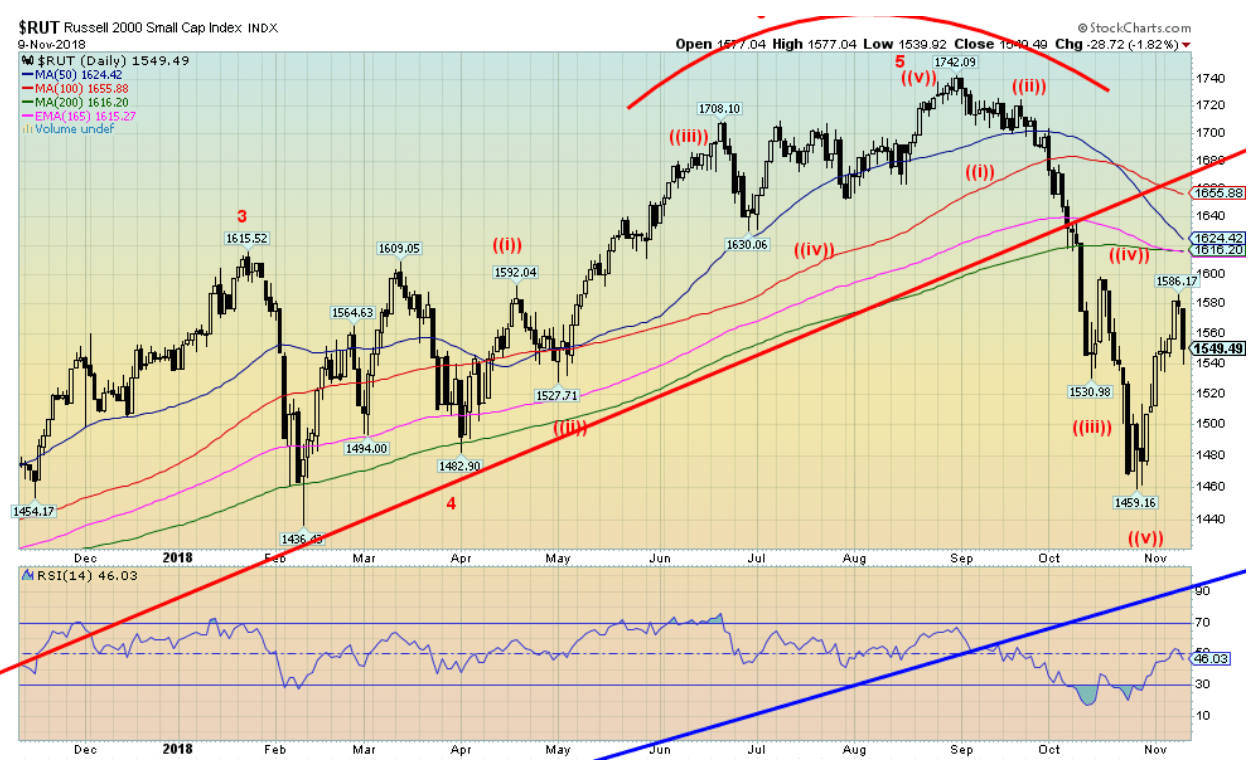

It appears as if the Russell 2000 just fell off a cliff. The market peaked back in August, and then in September, there was a mini-crash that didn’t end until the end of October. All told, the Russell 2000 fell over 16 percent. The blue line coming up is the trend line from the March 2009 low. The red trend line was the trendline up from the February 2016 low. So, while the up-trend line from the 2009 low remains intact, it may not last that way. But first the rebound rally that could easily take the Russell 2000 back to 1,600 or even somewhat higher. Only regaining 1,700 would suggest that new highs are possible.

© David Chapman

We are showing this chart of the S&P 500 2000–2002 to show that the markets in a bear do not go straight down. Indeed, while the S&P 500 topped in March 2000 the big break didn’t come until late 2000. In between, the S&P 500 was quite choppy in a back-and-forth manner. Even after it broke, there were significant upswings in March/April 2001 and again September 2001/February 2002 before capitulation and the collapse into the final low. We call these waterfall declines because of the way the market chops around in a downward motion, plunges (a waterfall), and rebounds back only to plunge again—followed by another rebound and then the final plunge which is usually the worst. Overall, this took almost three years from start to finish. Expect the current bear to follow a similar path. The first year could be a choppy affair that even sees new highs occasionally.

© David Chapman

Here’s gold to illustrate the same phenomenon. The period is 2011-2015. Gold topped in September 2011. Initially, it went off a cliff in a steep decline. Then a very choppy wild market followed into October 2012 before a serious decline got underway. The plunge (waterfall) came in April 2013 when gold plunged $200 – in a day. The bottom wasn’t found until June 2013. After chopping around again the rest of 2013 and most of 2014 gold began its final wild descent into the final low in December 2015. The key once again was the wild chopping around during the first year following the peak. We expect the current bear not to be much different.

© David Chapman

If the FAANGs led the market up, the FAANGs may lead the market down. After climbing through 2018, they all appear to have peaked and rolled over with Facebook and Google taking the biggest falls. But the others are rolling over as well. The five have dominated the stock market in taking it to record highs. They may lead the opposite way as well.

© David Chapman

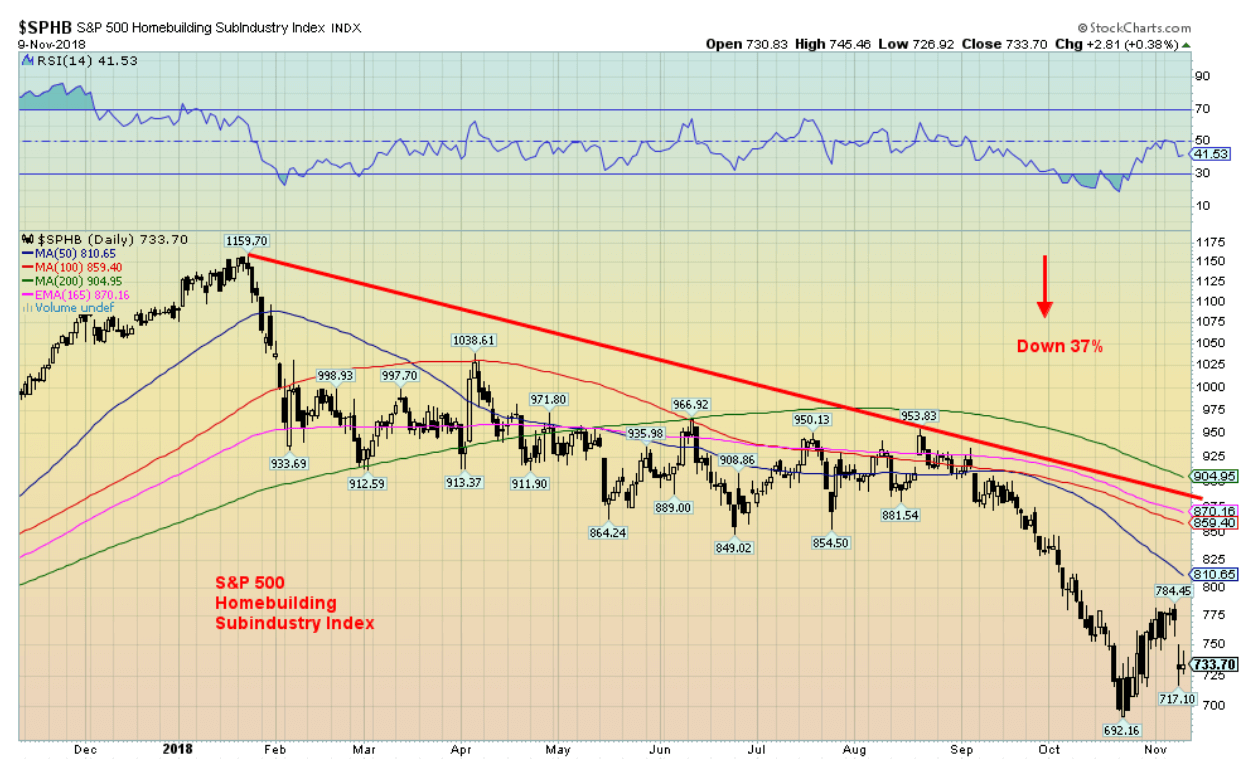

If the economy is doing so well, why is the homebuilding sub-industry index (SPHB) down 37 percent from its highs in January 2018? Yes, 37 percent. At one point it was down over 40 percent. Housing is one of the keystones of the economy, but instead, this index has been in a bear market since April.

© David Chapman

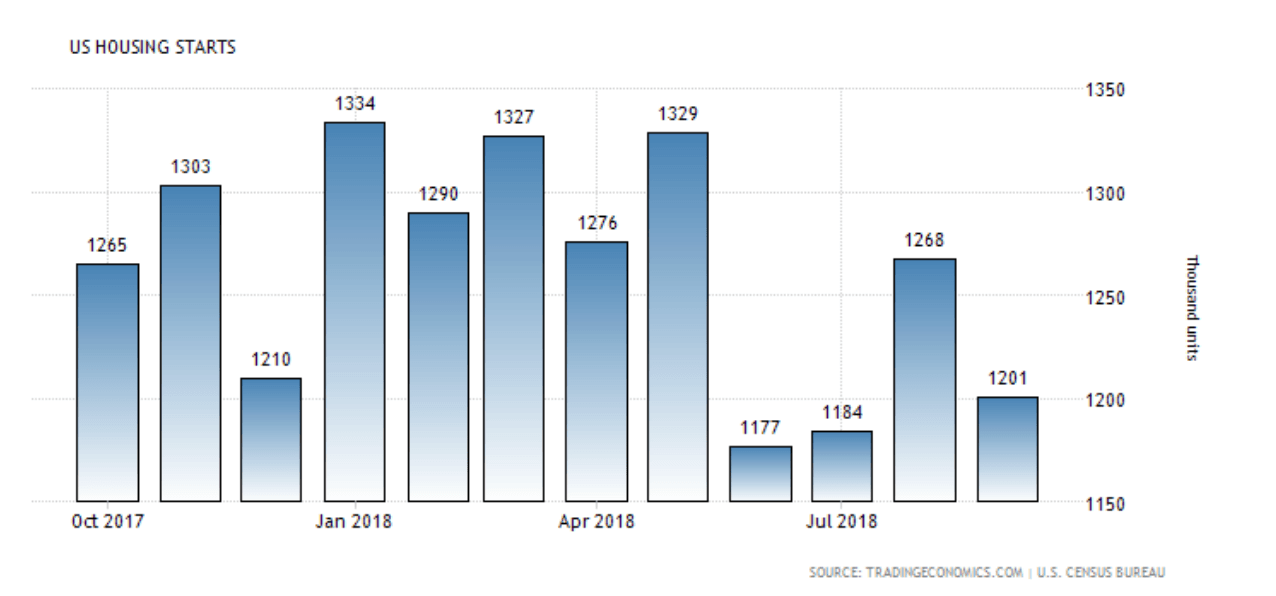

Maybe the homebuilding index is down because housing starts are sliding? Housing starts are down 10 percent from the levels seen in January. They were actually down more in June and July, but there was a strong rebound in August only to slide again in September. Housing starts peaked back in 2005 at the top of the housing boom of the early 2000s.

© David Chapman

The same is noticed for new home sales. The latest numbers showed that new home sales are down 22 percent from the peak seen last November 2017. Current levels are nowhere near the peak seen in the mid-2000s at almost 1,400 thousand units. The same is being seen for existing home sales. They are down 10 percent from their peak seen in November 2017. They too had a peak in the mid-2000s of 7,250 thousand units, nowhere near the latest sales of 5,150 thousand units. This all fits with why the homebuilding index is down so sharply.

© David Chapman

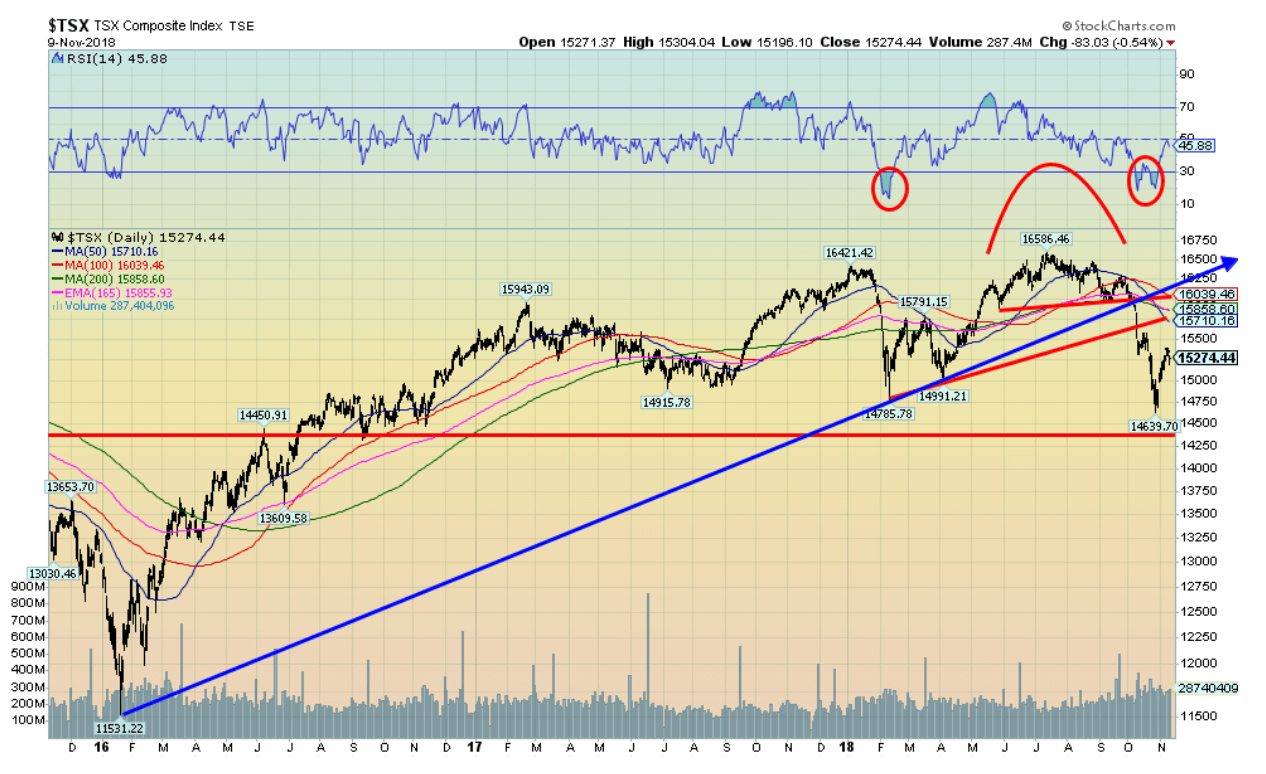

The chart of the TSX Composite suggests that we have entered a bear market. The TSX Composite took out the February 2018 low on this plunge and has now been under the 200-day MA since early October. It is the longest prolonged time under the 200-day MA since the decline in 2015/2016. Note, as well, that the TSX Composite not only took out the February 2018 low but also the low for 2017. This is another sign that we have entered a bear market. Our expectations now are that the TSX Composite should not exceed 16,000 on any rebound rallies. A breakdown under 14,500 could send the composite into another down phase that could challenge the lows of 2016 near 11,500. The caveat is that if the TSX Composite were to regain above 16,000 and especially above 16,500 then new highs are probable. But will it mean a new bull market? We appear to have completed five waves up from the 2009 low and in Elliott wave terms that normally is terminal.

© David Chapman

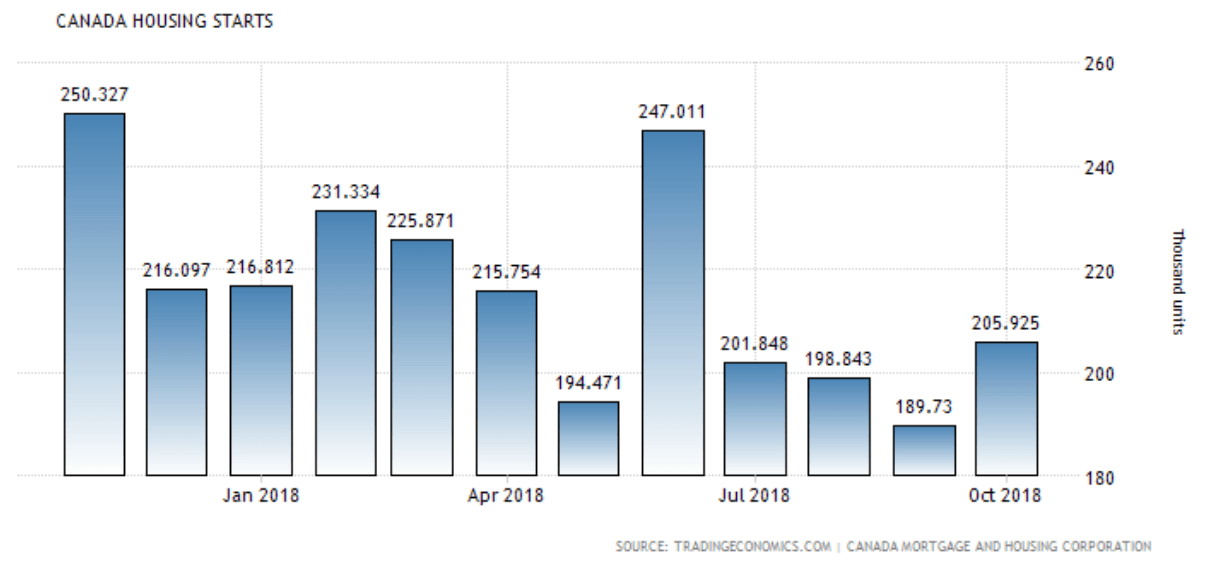

As in the U.S. Canada’s housing starts have weakened. While October saw an upward bump, it remains down 18 percent from the high seen a year ago. Except for the blip in June 2018 housing starts in Canada have been on a downward trajectory. That is also translating into new home sales and existing home sales especially for homes over $3 million that are down roughly 45 percent in the high-end markets of Toronto and Vancouver.

© David Chapman

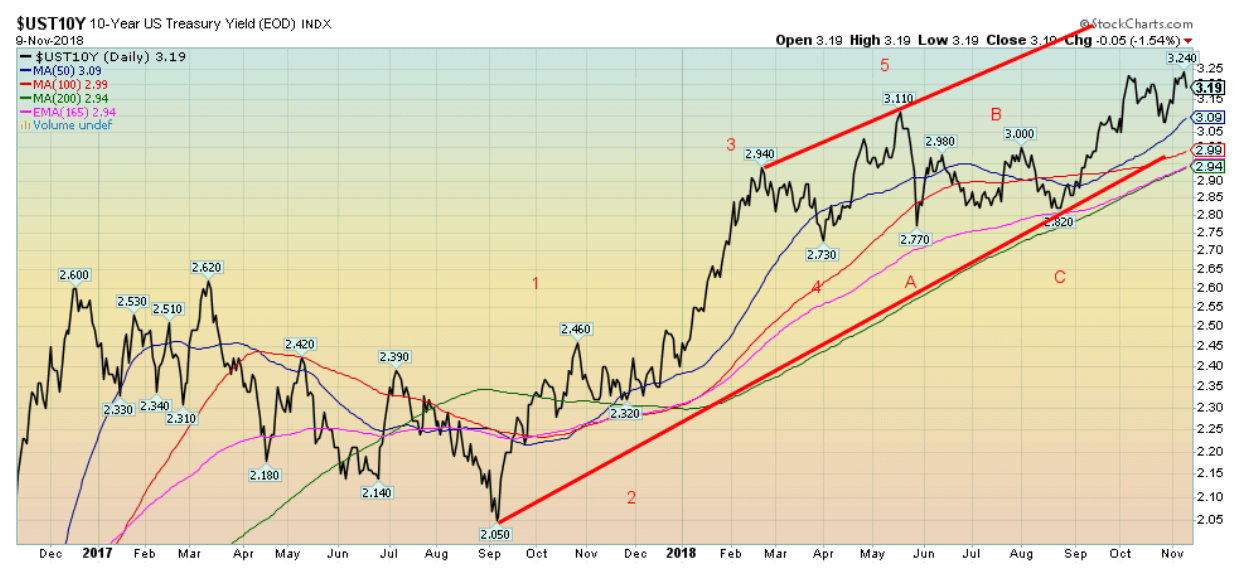

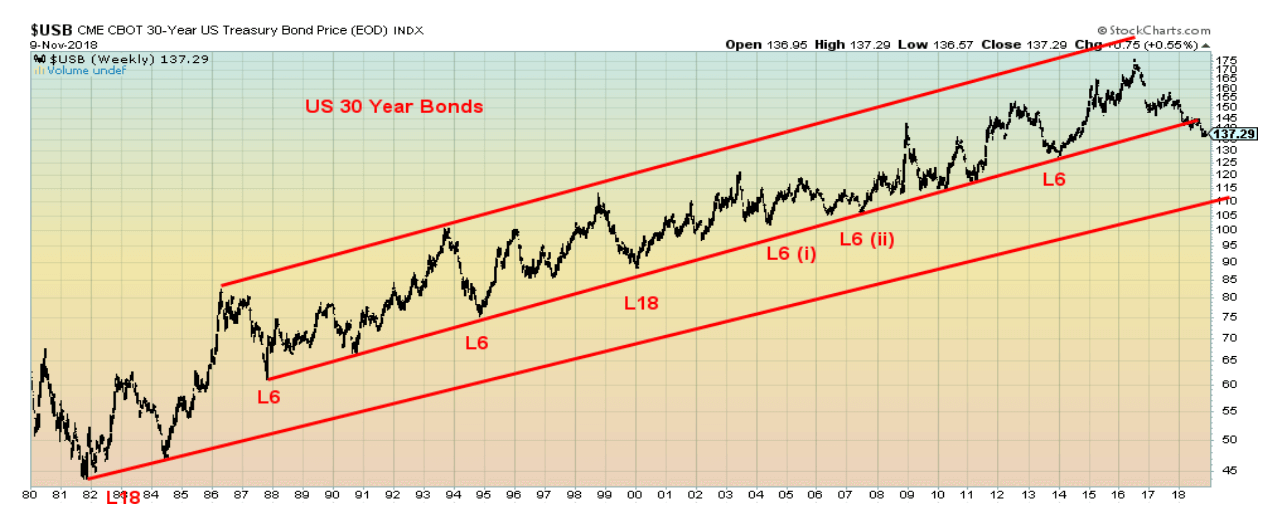

The 10-year U.S. Treasury note rose to a small new high this past week at 3.24 percent before turning and closing lower at 3.19 percent. While it is possible that the yields have peaked, we remain short of our target of 3.45 percent. Only a breakdown under 3 percent might suggest that a high is in. Hawkish words from the Fed and continued decent economic numbers are helping to push the 10-year higher. The 6-year cycle for bonds is not expected to bottom (price – high in yield as yields move inversely to price) sometime in 2019. Starting with a major low in price in 1981 when bond prices were at multi-year lows, there were significant lows in 1987, 1994, 2000, 2006/2007, and 2013. See the chart below of the 30-year U.S. Treasury bond. Note that the 30-year could be breaking a 30-year up trend line. If that’s correct, then that would suggest to us that bond prices have reached their zenith for years to come. The L18 suggests an 18-year cycle. If correct, then bond prices would be making a key 18-year cycle low sometime into 2019.

© David Chapman

Recession watch spread

© David Chapman

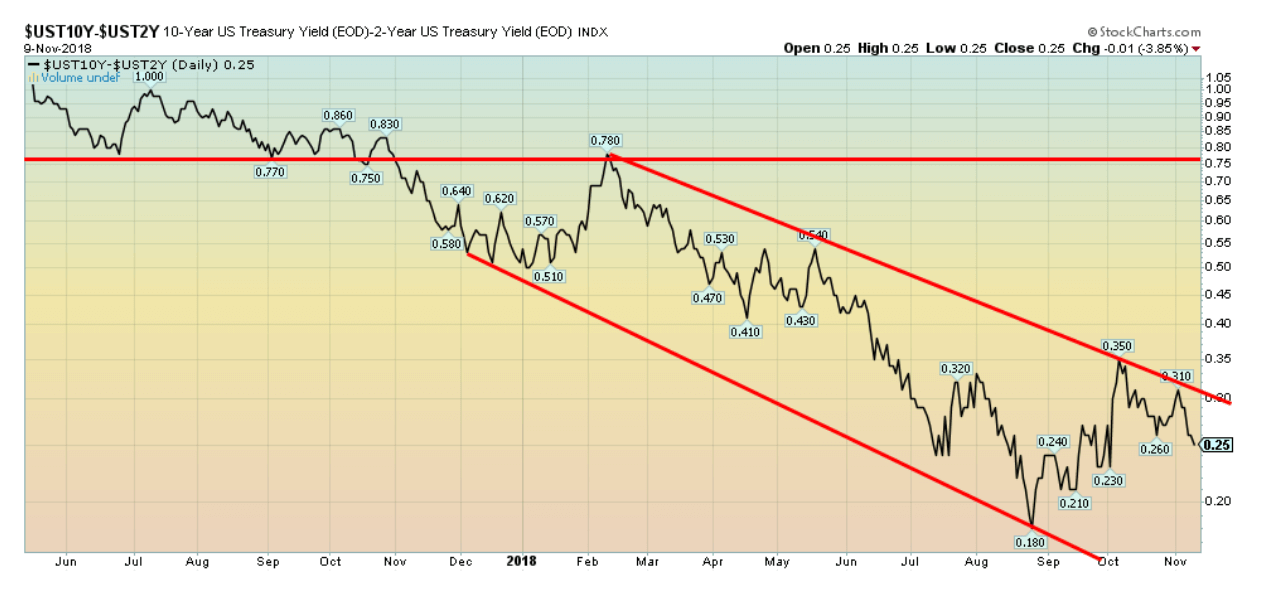

The 2–10 recession watch spread slipped to 25 bp this past week from 26 bp. This keeps the downward trend intact. This should now be starting our final downward trend to a negative spread sometime in 2019. We are still expecting the spread to go negative possibly by mid-2019, and then it needs to remain negative for roughly 6 months before a recession might start. With the Fed signaling potentially four more hikes that would raise the Fed rate to around 3.25 percent.

© David Chapman

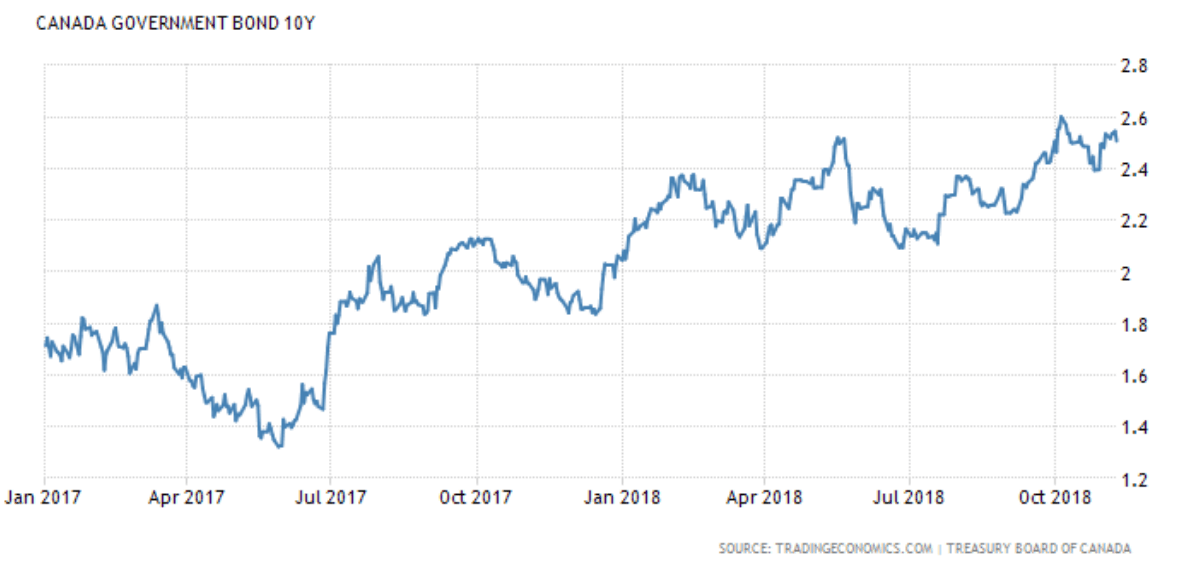

The Canadian 10-year Government of Canada bond remains in a bull mood (yield) as they closed at 2.51 percent on Friday. That is shy of the recent high of 2.60 percent and down from last week’s 2.55 percent. The BofC is maintaining a less accommodative stance is are expected to hike the key BofC rate again, especially if the Fed hikes in December as expected. Canada’s 2–10 spread continued to narrow, falling to 0.17 percent this past week, and down from 0.18 percent the previous week. Could the 10-year have made a high? Difficult to say at this stage. A breakdown under 2.40 percent would suggest a high is in.

© David Chapman

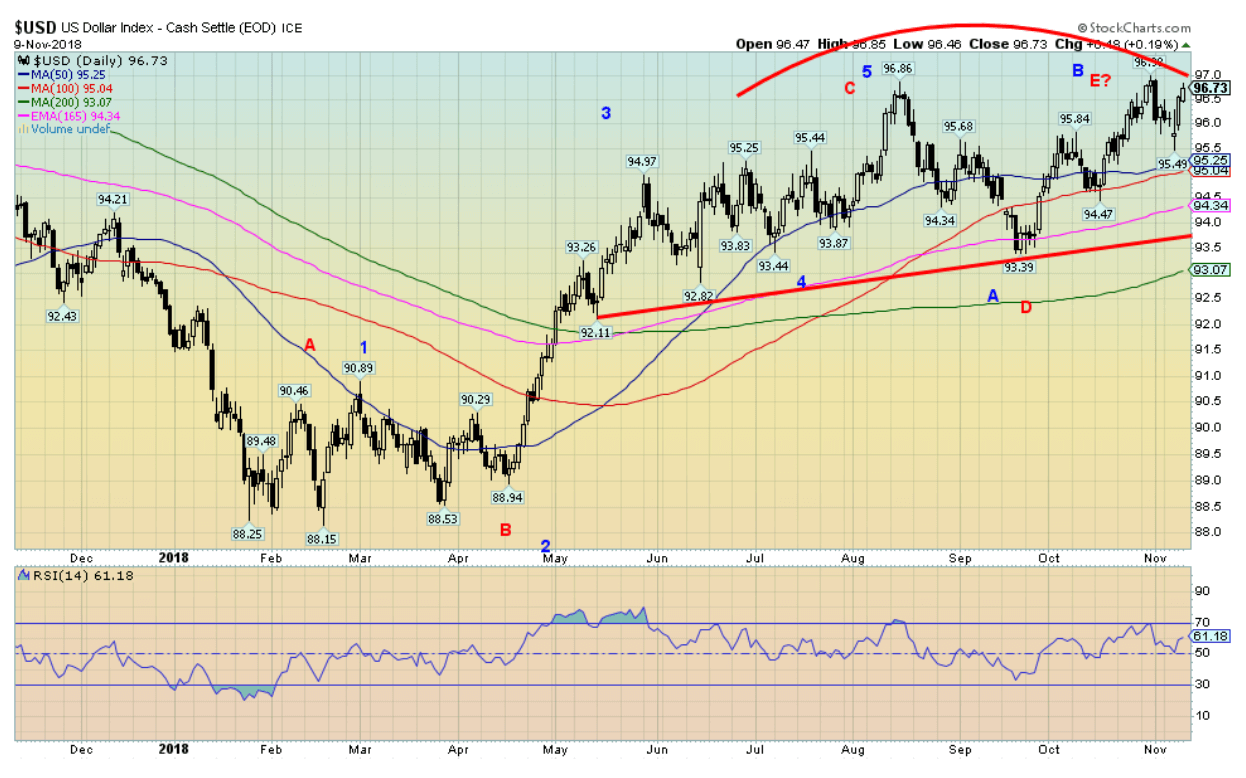

With the Fed affirming its hawkish interest rate stance and continued signs that the U.S. economy remains strong, the U.S. dollar rallied again this past week. The US$ Index rose 0.4 percent this past week to close at 96.73. This leaves the US$ Index just short of its recent high closing of 96.90. New highs could see the US$ Index move over 97 and target up to 98.50. Only a breakdown under the recent low of 95.49 might change the more bullish scenario. Minimum targets after new highs over 97 could target 97.35 then 97.60 and up towards 98. Other major currencies suffered. The Cdn$ broke down under 76 to 75.75 off 0.7 percent, the euro fell 0.5 percent, and the Japanese yen was off 0.5 percent although the British pound was up a small 0.1 percent. The major currencies remain negative on the year. Sentiment towards the euro remains dismal—around 9 percent. It is the opposite for the US$ Index where sentiment is up around 90 percent. Interestingly, speculators are now holding a larger position in long US$ Index futures than they held when the US$ Index hit up towards 103 back in December 2016. When they are already holding large bull positions and sentiment is over 90 percent the question becomes, who is left to buy?

© David Chapman

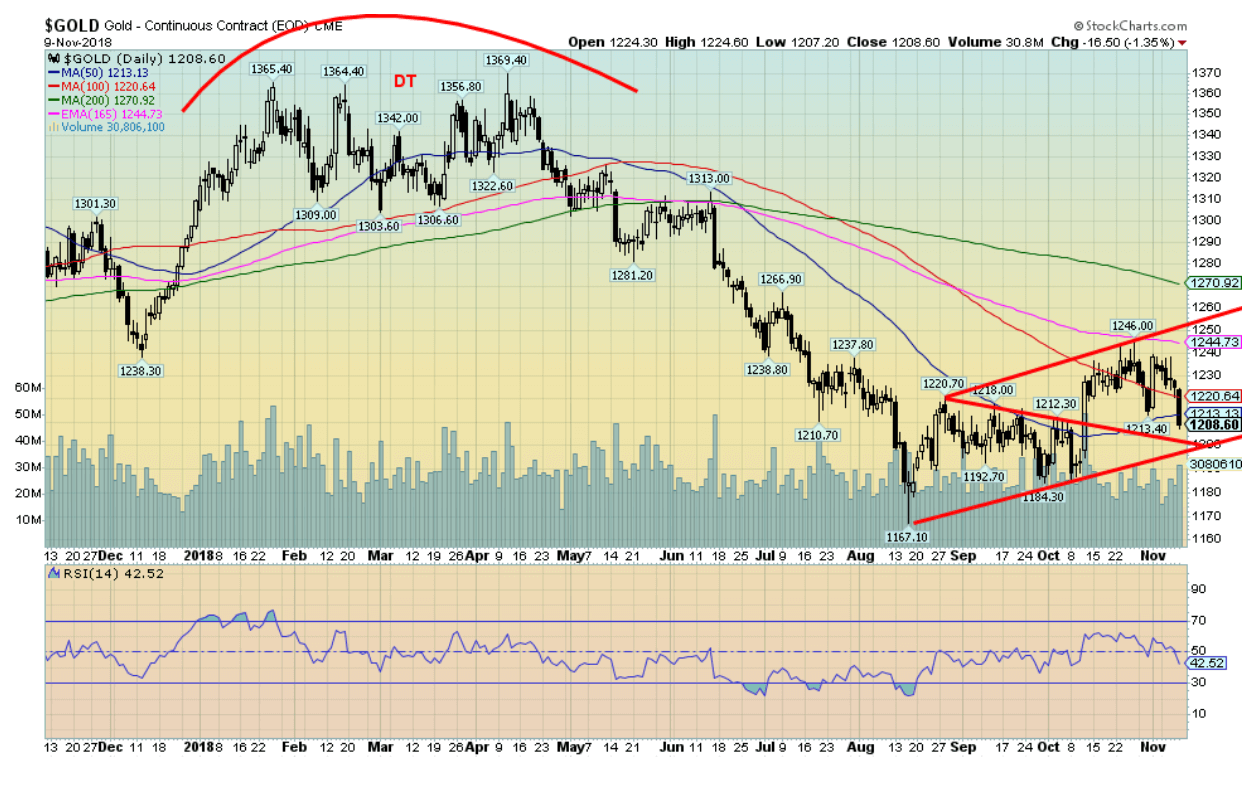

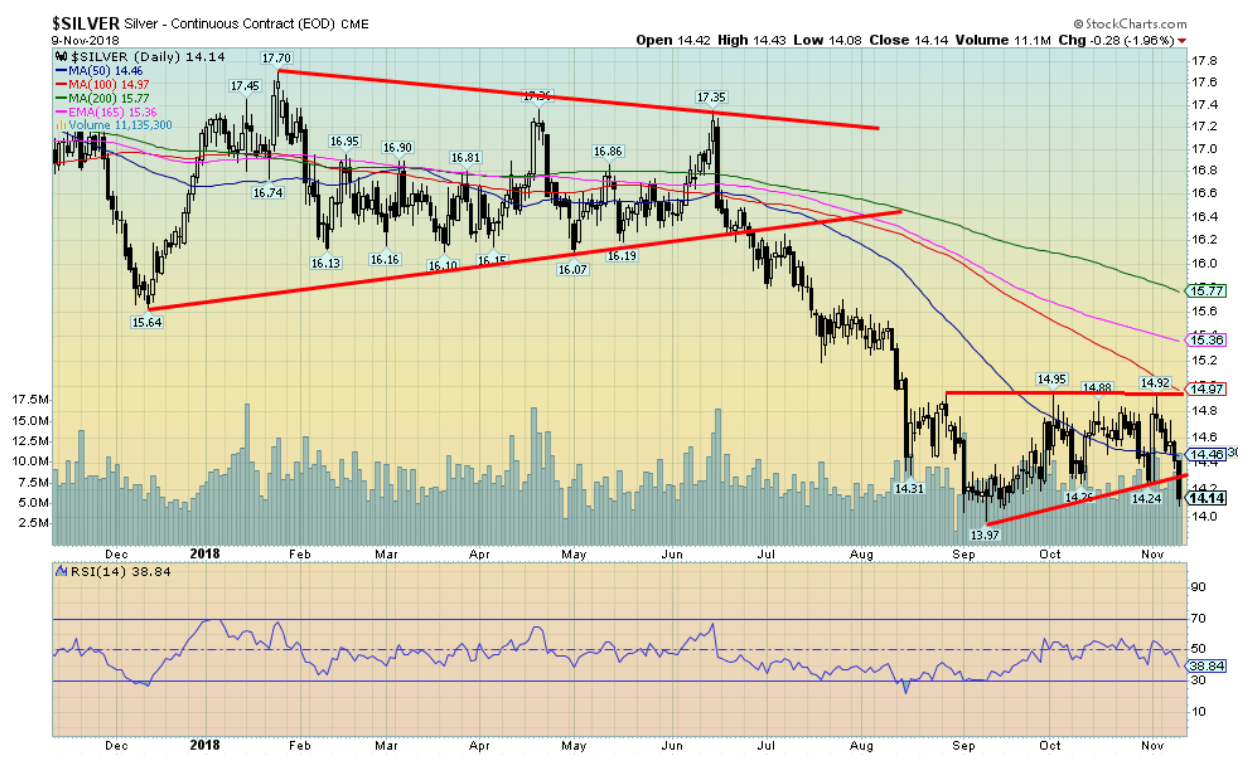

Gold did not have a good week. A hawkish Fed helped push the U.S. dollar up this past week, thus helping to push down gold prices. The Fed reaffirmed its tightening monetary stance (QT) and that is seen as negative for gold. At the Fed meeting this past week the Fed held interest rates steady as expected, but reiterated their plans for another hike in December and potentially three more in 2019. The continued strong performance of the U.S. economy also helped firm interest rates and ease gold prices. Overall gold fell 2 percent this past week. Silver was hit even harder down 4.2 percent while platinum dropped 2.3 percent and palladium fell 0.6 percent. Copper was also hit off 4.6 percent. Gold tested down to the lower level of our support zone of $1,210, closing slightly below that level at $1,208. This suggests to us that there is the potential for further losses. The past few years have seen a weak November and even into December, so what we are seeing is like the negative seasonals that seem to dominate this time of year. Gold should find a low either in late November or early December and begin what we believe could be a powerful C wave to the upside (see next chart). A break below $1,200 could suggest a strong test of the recent $1,167 low. Given the current weakness in silver, we could see silver make new lows but not gold. That would be a positive divergence.

© David Chapman

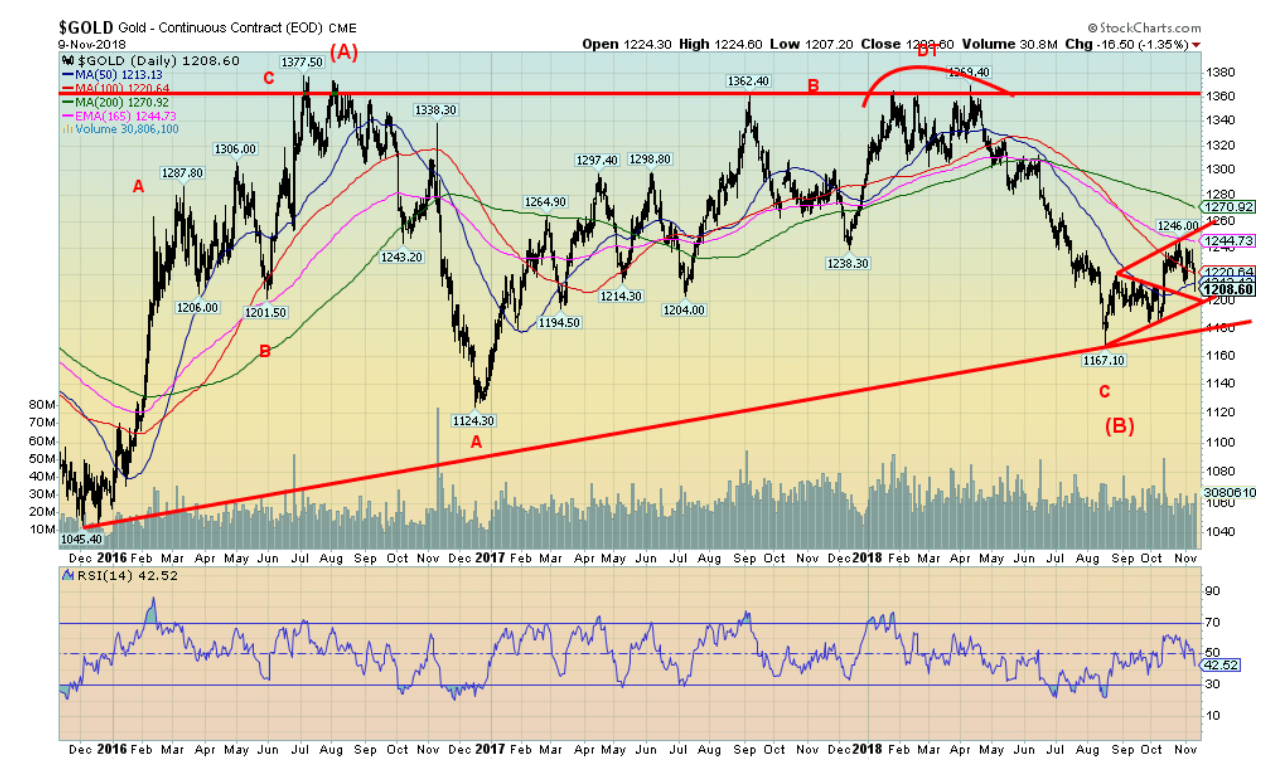

Our longer-term chart of gold, dating from the key low seen in December 2015 traces out what we believe has been a large ABC-type pattern. Too many of the waves unfold in threes, suggesting to us all of this is corrective in nature. Gold fell in what appears as five waves down from the key 2011 top at $1,923. The low at $1,045 in December 2015, we believe, was the culmination of a 7.4-year cycle as defined by Ray Merriman of MMA Cycles. The 7.4-year cycle breaks down normally into three 34-month cycles (range 28–40 months, although this could be out to 42 months). As to the 7.4-year cycle (could also be a 7.8-year cycle) dating from the key August 1976 low, there were key lows in February 1985, March 1993, August 1999 or its double bottom in April 2001, and the low of October 2008. The last three lows were 90 and 86 months apart. The next 34-month cycle is due October 2018 +/- 6 months. So, we have been making lows during this period and given the action this past week we may not be quite finished yet. The pattern since the 2015 low appears to be unfolding as a huge ABC pattern. The A and B waves may be finished, leaving us the C wave. We continue to believe that wave should soon be underway and it could be powerful move to the upside. C waves can do that. Minimum targets could be once again the $1,370 zone but it could range up to $1,525. If we exceed that level, then a move to the next target level over $1,700 could get underway. Only a breakdown under $1,125 could change the potentially more bullish scenario. We doubt that should happen.

© David Chapman

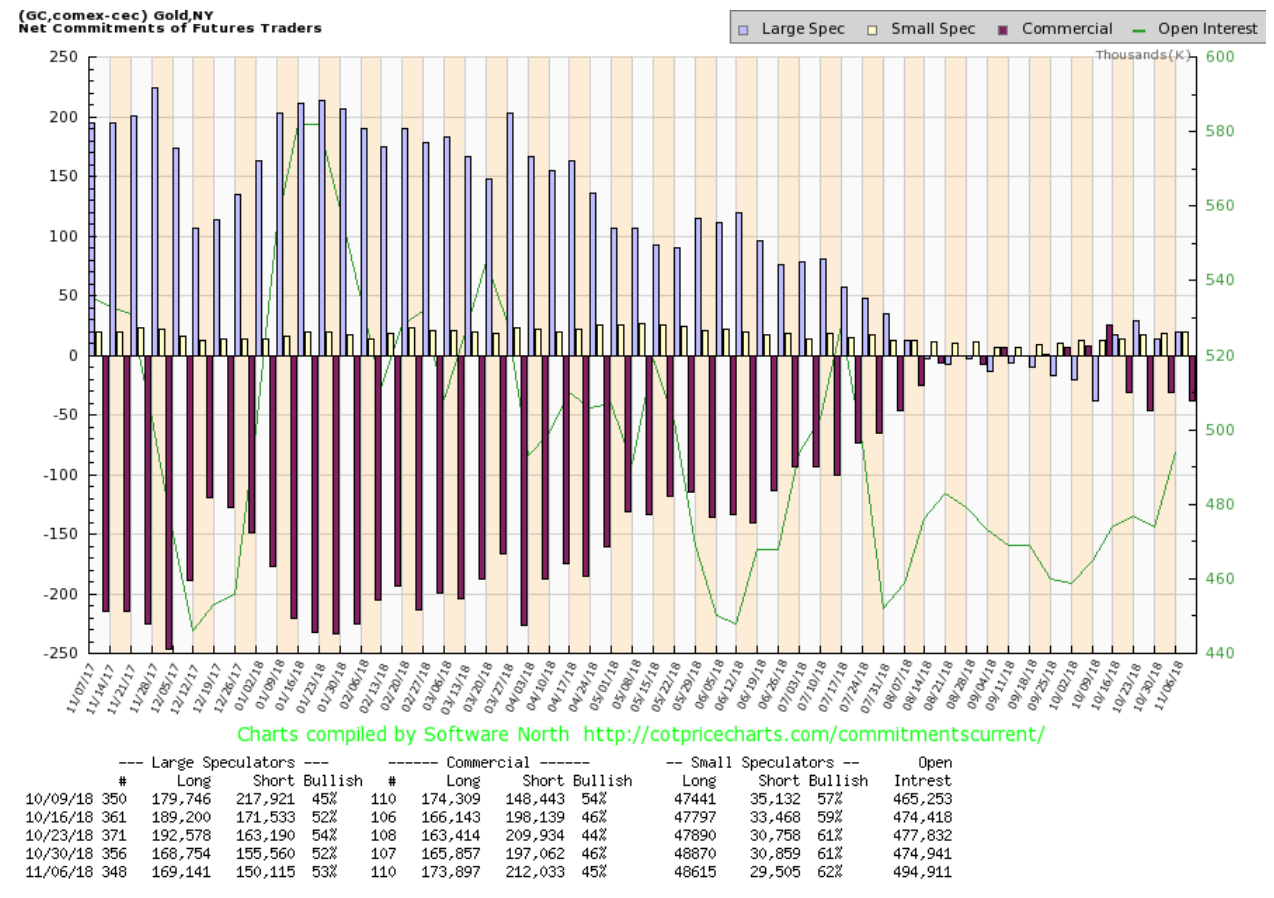

The commercial COT for Gold slipped this past week to 45 percent from 46 percent. Oddly the long position rose by roughly 8,000 contracts as the short open interest position rose 15,000 contracts. The large speculators COT (hedge funds, managed futures etc.) rose to 53 percent from 52 percent. Managed futures continue to hold near record short positions in gold futures. While the commercial COT slipped, it is not yet in what we would consider bear territory. So, our interpretation of gold’s commercial COT remains bullish despite the pullback in gold prices this past week.

© David Chapman

Silver broke down this past week under what appeared to be a forming bullish triangle. It proved not to be so bullish after all. Given that the close of $14.14 was a mere 17 cents from the recent low of $13.97, there is a distinct possibility that silver prices will see new lows. Any drop to new lows that is not also confirmed by gold could set up some positive divergences. There is some support down to $14, but below that new lows and the potential for a decline to $13.25/$13.50. The pattern that was forming appeared bullish but the reality was a break to the downside instead. That should set up another buying opportunity.

© David Chapman

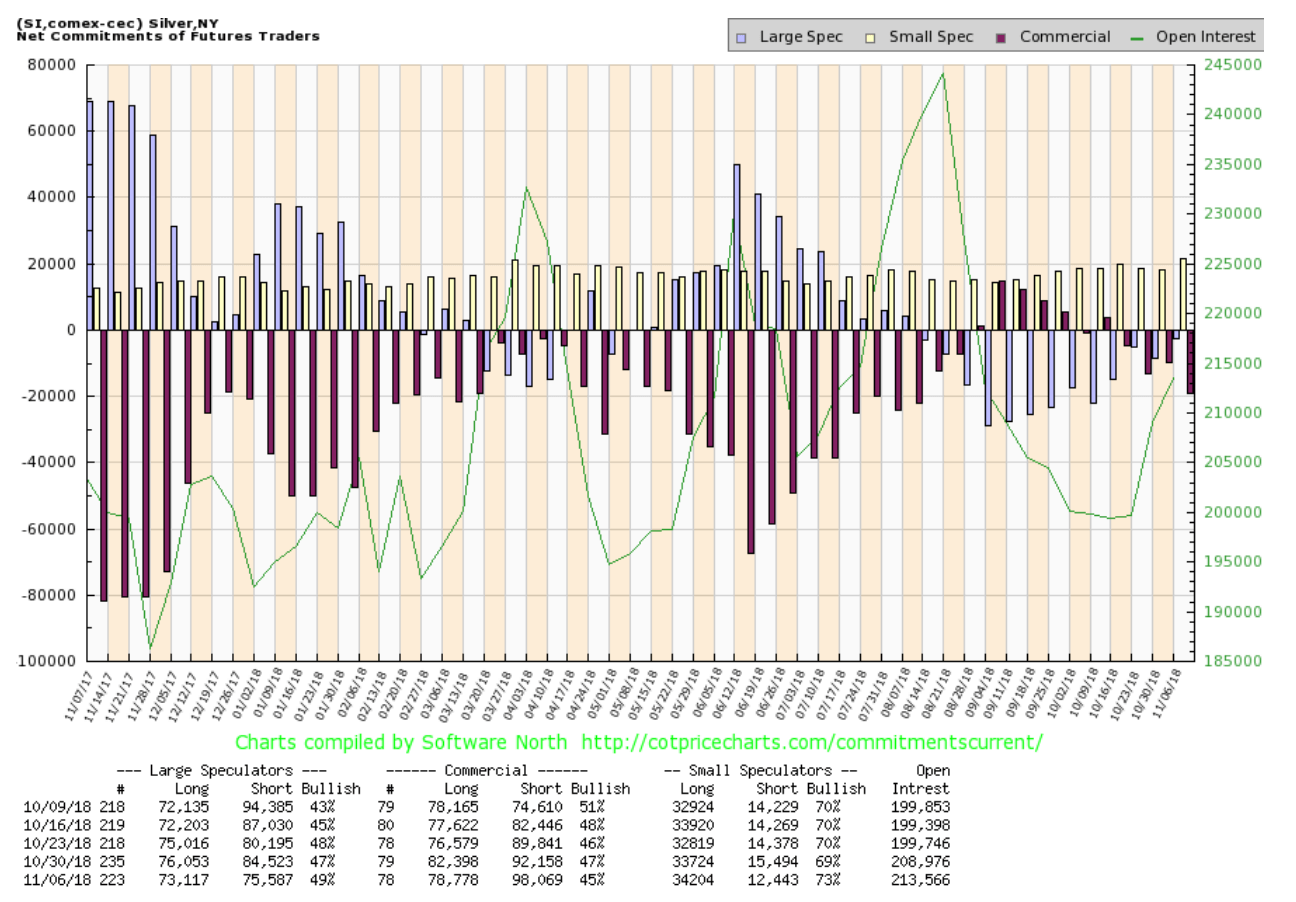

The commercial COT for silver slipped to 45 percent this past week from 47 percent. Long open interest fell roughly 2,500 contracts while short open interest rose about 6,000 contracts. This is a setback but it does not change the continuing bullish outlook for silver despite the price setback this past week. We’d look for the commercial COT to improve again as silver prices move lower, thus maintaining the bullish outlook for silver the commercial COT implies. The large speculators COT rose to 49 percent from 47 percent. However, the large speculators still maintain a somewhat bearish stance even as the commercials continue to appear bullish.

© David Chapman

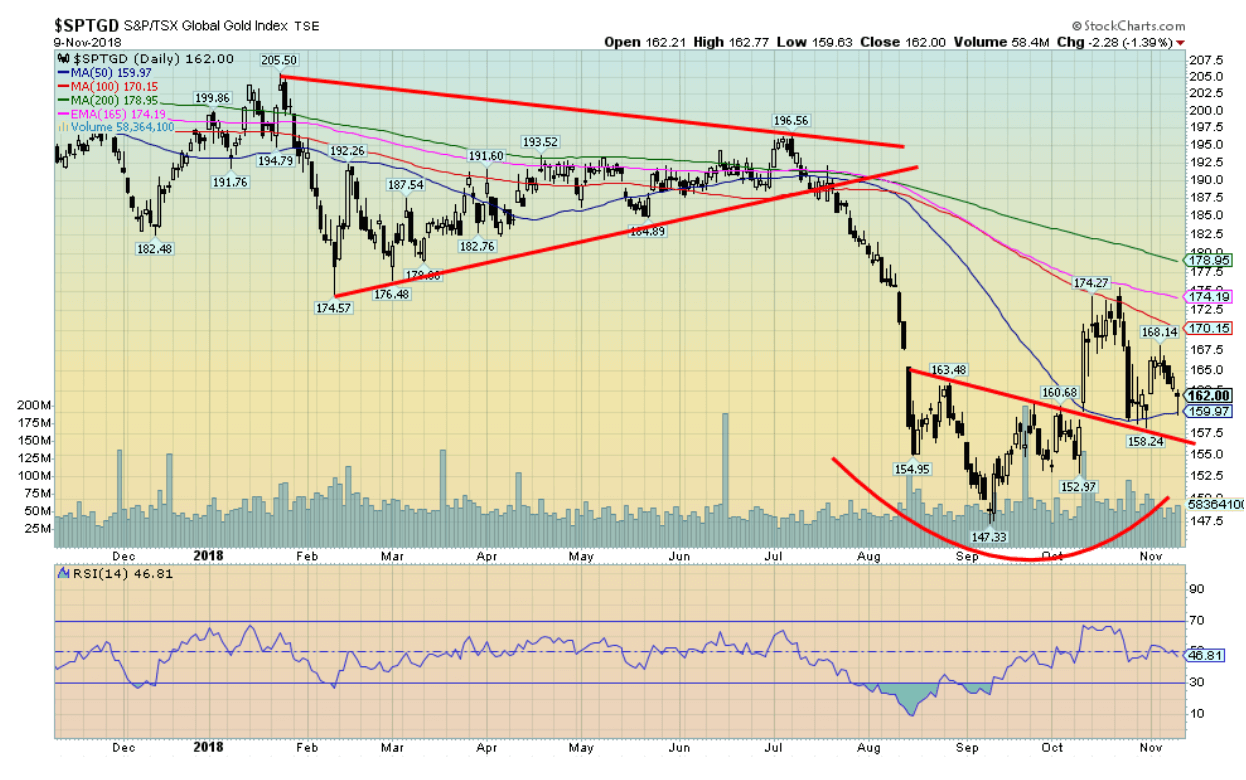

The TSX Gold Index (TGD) suffered a setback this past week, given lower gold and silver prices. The TGD fell 2.6 percent. The Gold Bugs Index (HUI) fared worse, losing 4 percent. Despite the decline, the TGD remains up about 10 percent from the lows. As we noted, this would be an ideal time to set up some divergences between the gold indices and gold and silver. Usually, at lows we see lower lows for gold or silver or both, but higher lows for the gold stocks. We believe this will play out once again. A break below 157.50 could suggest a test of the 147.33 low or even a marginally lower low. While we doubt that, it is something to keep in mind. On Friday, November 9, the TGD tested down to the 50-day MA before rebounding and closing back about where it opened. That could be a small hammer, a sign that a temporary low may have been hit. The TGD bounced off of the 50-day MA. Note it failed earlier at the 100-day MA. Note that the TGD hit its target of 174.70 from the small head and shoulders pattern that developed at the recent low. So far, this looks like a test of the neckline or the breakout point.

© David Chapman

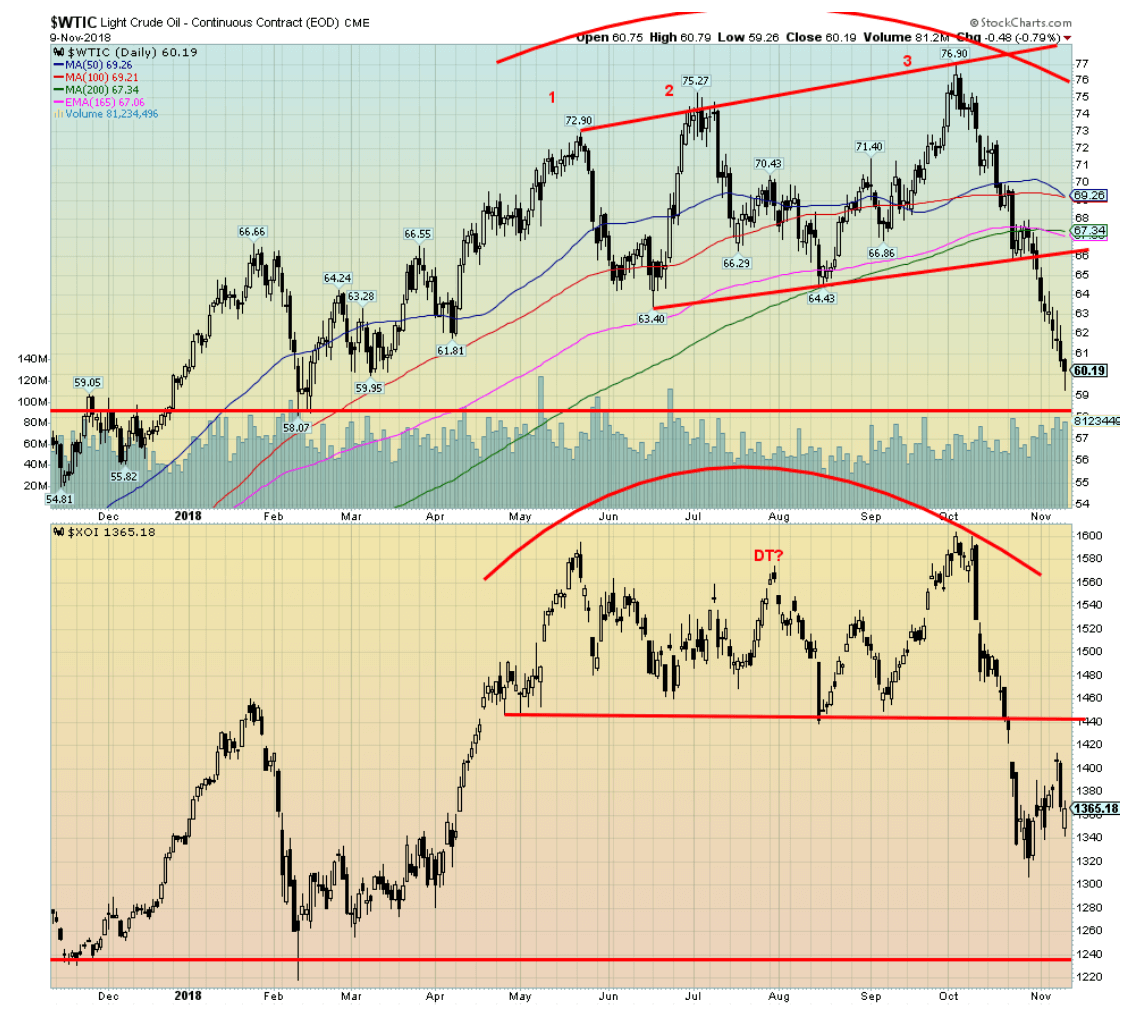

The mini-bear in WTI oil continues. Trends have turned down, both short and intermediate. The potential target is for a decline to $52.50. The shortage that was expected because of Iran sanctions never materialized because of the exemption from sanctions granted to eight countries who are major importers of Iranian oil. Result: instead of a shortage, a surplus. The Philadelphia Oil & Gas Index (XOI) also closed lower but is off its recent low. The XOI has a potential target of 1,270 with the low thus far 1,307. Canada’s TSX Energy Index (TEN) has been weak as well, primarily because of the lower price for Canadian crude. For WTI Oil, however, it was the 10th consecutive day of declines and the 5th straight week of declines. There is some support at $58, but below that level, the target zone of $52.50 could be seen. We are starting to hear all sorts of bearish stories about oil, including falling once again below $40 and even all the way down to $10. Bearish stories seem to abound at a potential low. Certainly, with an RSI down to 20 for WTI oil, odds now favor a rebound at a minimum. The higher low for the XOI may be a clue.

Chart of the week

Note: Shaded area denotes recession © David Chapman

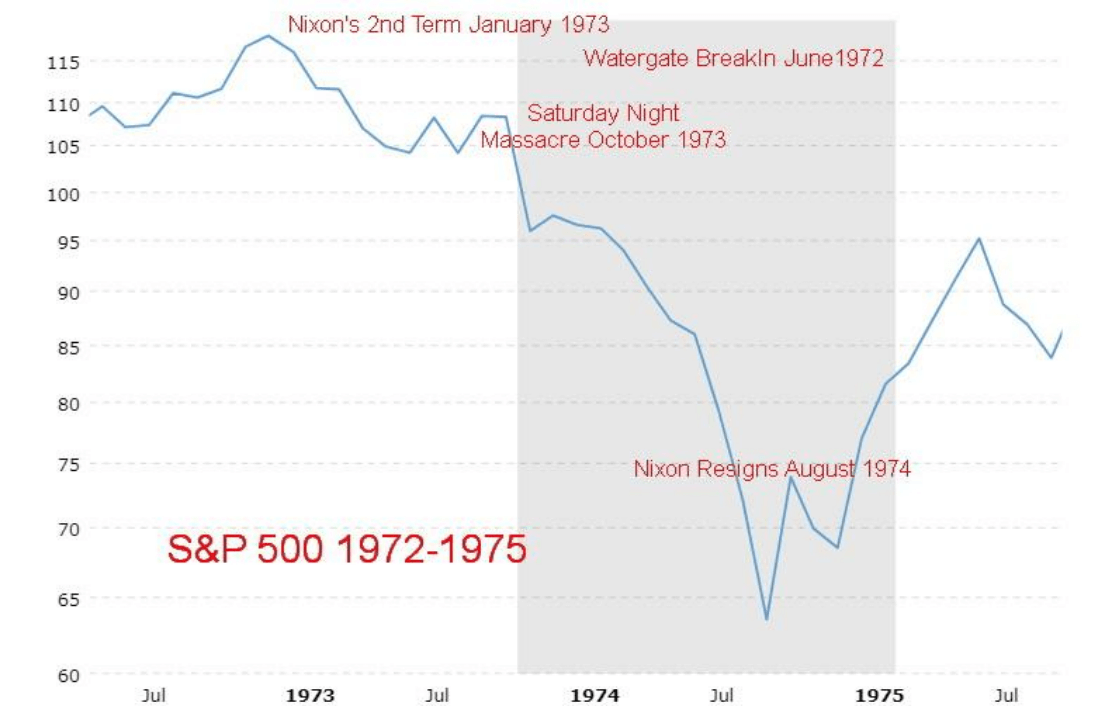

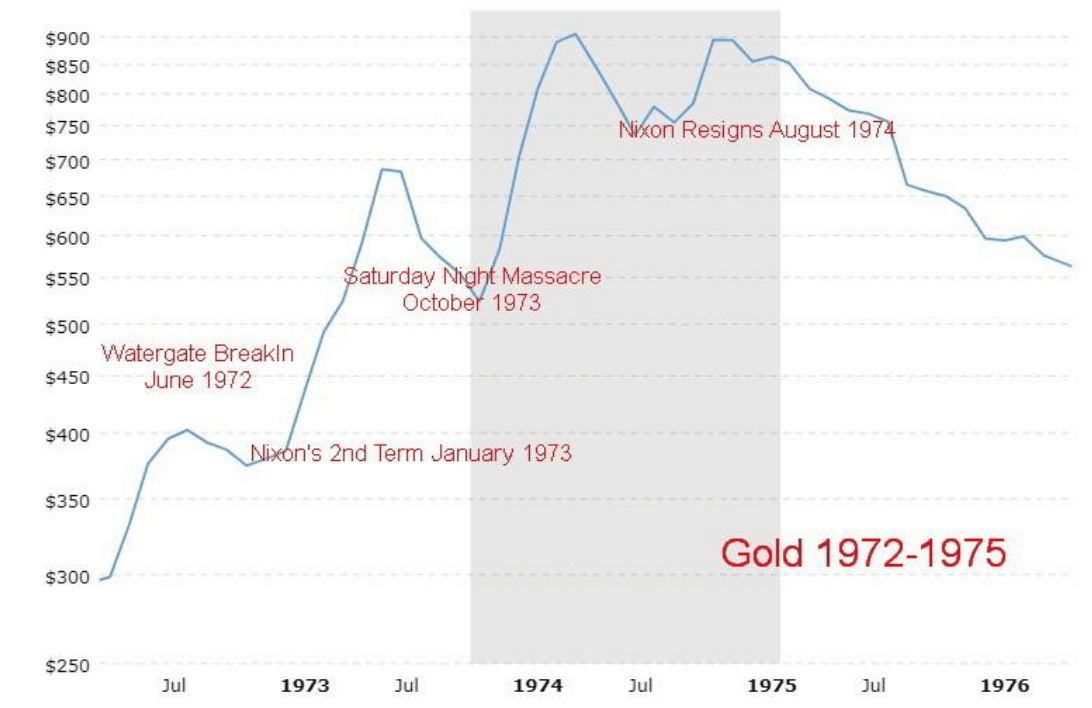

The firing of Attorney General Jeff Sessions immediately on the heels of the mid-term election results brought back memories of another investigation and firing from 45+ years ago. Yes, Watergate. Only this time it is the Mueller probe. The appointment of Matthew Whitaker as the interim Attorney General with his vocal criticism of the Mueller probe, coupled with his disdain for the courts, reminded us of the potential for a “Saturday Night Massacre.” Whitaker has criticized the Supreme Court’s power to review legislative and executive acts and declare them unconstitutional. Whitaker is also known as a loyal supporter of President Donald Trump.

Whitaker appears to now have unlimited authority over the Mueller investigation. His appointment has been questioned as he has not been confirmed by the Senate. Even if he were unable to fire Mueller there are ways he could hamper the investigation such as cutting their funding. Nonetheless, given some comparison to the Watergate investigation some 45+ years ago, we thought we’d look at how the stock markets and gold responded.

Stock markets topped in January 1973 and started a long decline that didn’t see a bottom until December 1974. President Richard Nixon’s inauguration for his second term started in January 1973 following his re-election in November 1972. The “Saturday Night Massacre” took place on October 20, 1973, when President Nixon ordered Attorney General Elliot Richardson to fire the Watergate special prosecutor Archibald Cox. Richardson refused and resigned immediately. Nixon then ordered Deputy Attorney General, General William Ruckelshaus to fire Cox. He refused as well and resigned. Next in line was Solicitor General Robert Bork and he complied. Courts later ruled the firing was illegal.

From January 1973 until President Richard Nixon resigned in August 1974, the S&P 500 fell some 38 percent. By the time the markets bottomed in December 1974, they were down over 45 percent. Watergate was not the only reason the markets fell as the Arab oil embargo broke out in October 1973, coinciding with the “Saturday Night Massacre.” We should also note that this was a period when President Nixon was making many negative remarks about Fed Chairman Arthur Burns. This is not dissimilar to the many negative comments made by President Trump about Fed Chairman Jerome Powell.

The question here is: what is the potential for another “Saturday Night Massacre,” only this time with a compliant Attorney General? Considering both Whitaker’s and Trump’s disdain for the Mueller investigation, the possibility is high, subject to whether Whitaker actually has the power to carry out Trump’s orders. That is not clear as Whitaker’s appointment, as noted, has not been confirmed by the Senate. But the potential for the firing of a special prosecutor looking into the potential connection of the President to a scandal is not unlike the events of 45+ years ago. Markets are not likely to respond well.

But what about gold?

Note: Shaded area denotes recession © David Chapman

Gold started climbing after Nixon’s re-election against the backdrop of the emerging Watergate scandal. Following the “Saturday Night Massacre” in October 1973 gold took off again. From January 1973 until Nixon’s resignation in August 1974 gold rose 137 percent. Altogether, until December 1974, gold was up 182 percent. Curiously gold was topping just as the stock market was bottoming. Gold was doing its job of acting as a hedge against political (government) risk.

It’s early, and we admit we are conjecturing as to what might happen. But, given signs of a topping stock market and a bottoming gold market, it might be wise to hold some gold, given the possible political risks going forward.

—

DISCLAIMER: David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. We do not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be considered a solicitation of an offer or sale of any security. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor before proceeding with any trade or idea presented in this newsletter. We share our ideas and opinions for informational and educational purposes only and expect the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor.

-

Africa2 weeks ago

Africa2 weeks agoBank of Africa Launches MAD 1 Billion Perpetual Bond to Boost Capital and Drive Growth

-

Markets2 days ago

Markets2 days agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto1 week ago

Crypto1 week agoBitcoin Recovers After U.S. Strikes Iran, While Altcoins Face Sharp Losses

-

Africa7 days ago

Africa7 days agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

You must be logged in to post a comment Login