Business

Is housing recovery seen in the real estate industry?

Are interest hikes, rising home values and increasing rental fees indications of a progressive housing recovery in the real estate market?

Jeff was a small business owner in New Hampshire. One Tuesday afternoon, his neighbor called…

“You need to get home NOW! There’s a dumpster in your yard, a padlock on your door, and a bunch of guys are ransacking your house!”

Completely panicked, Jeff dropped everything and raced home. When he got there, he found most of his family’s possessions either in a heap in the front yard or tossed inside the dumpster.

Without warning or notice, the bank had foreclosed his house and sold it at auction just a few days earlier. In a single afternoon, the life he’d worked so hard to build for his wife and three daughters was gone!

It’s a story we heard all too often following the 2008 housing crisis.

Unfortunately, despite what you’re hearing from the mainstream media about real estate today—how it’s booming and can only go up from here—it’s a story we’re going to start hearing again and again in the coming years.

Some people have benefited from the record-breaking bull market and housing recovery. But it’s been mostly the richest Americans who own most of the financial assets.

Hundreds of millions of Americans who don’t belong to the one percent, who were crushed in the last crisis, haven’t been able or willing to participate in the recovery. For them, things haven’t gotten better. They’ve gotten worse.

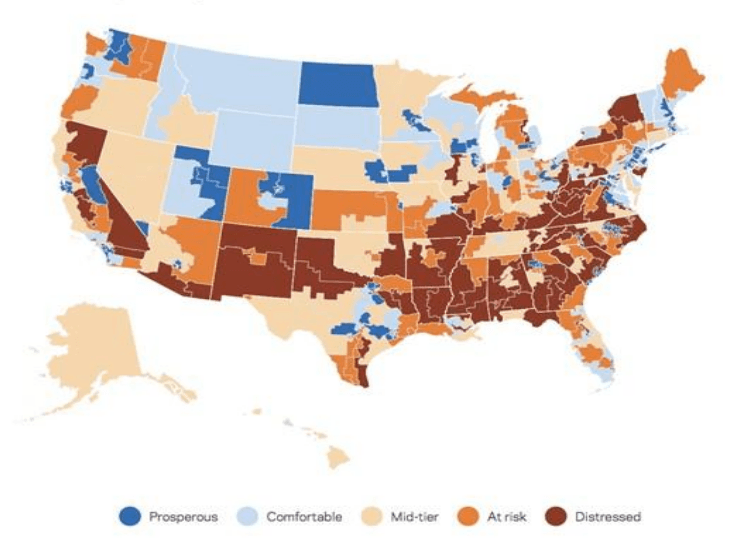

And this map proves it:

National map of Congress district distress scores

(Source: www.eig.org)

See all that blue?

It’s not who voted for Hillary. Instead, those are the prosperous parts of America where there’s been strong economic growth, new jobs, rising home values, and higher pay over the past two decades.

It’s no surprise that most of that prosperity is concentrated in the fast-growing western cities and tech hubs… like San Francisco, Seattle, and Austin, TX.

But see all that orange and red?

That’s the other America this “recovery” left behind—the old industrial cities that were once the engine of our economy.

Where today, residents are more likely to die sooner, have more frequent health problems, flat or decreasing home values, and earn less money with fewer job opportunities.

Where more than 38 million American households can’t afford their housing… an increase of 146 percent over the past 16 years.

Where nearly seven million homeowners are either underwater on their mortgage or barely above break even.

Where one in five households are currently broke or in debt.

And possibly the scariest statistic of them all.

Where nearly half of all Americans say they don’t have enough money to cover a $400 emergency expense. That means even a tiny bump in the road, like an unexpected medical expense, the loss of a job or decrease in pay, a slight increase in the daily cost of living, or an increase in their mortgage interest rate would send millions spiraling into the same situation as Jeff.

And that one percent? They’re in for a shellacking of their own because they are so heavily invested in overinflated financial assets.

So, forget all the fake news you’re hearing about the real estate market being safe again because of the shortage of inventory and record home starts.

Forget about the record highs in the stock market.

And most definitely forget about all the promises the White House and Congress have made.

The truth is, we’re already starting to see the cracks deepening in stocks and in this fake “housing recovery” all across America.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoFrance’s Nuclear Waste Dilemma Threatens Energy Future

-

Fintech7 days ago

Fintech7 days agoKraken Launches Krak: A Game-Changing Peer-to-Peer Crypto Payment App

-

Africa2 weeks ago

Africa2 weeks agoAgadir Welcomes Nearly 570,000 Tourists by May 2025

-

Impact Investing2 days ago

Impact Investing2 days agoEuropeans Urge Strong Climate Action Amid Rising Awareness and Support

You must be logged in to post a comment Login