Business

Why you should invest in property after retirement

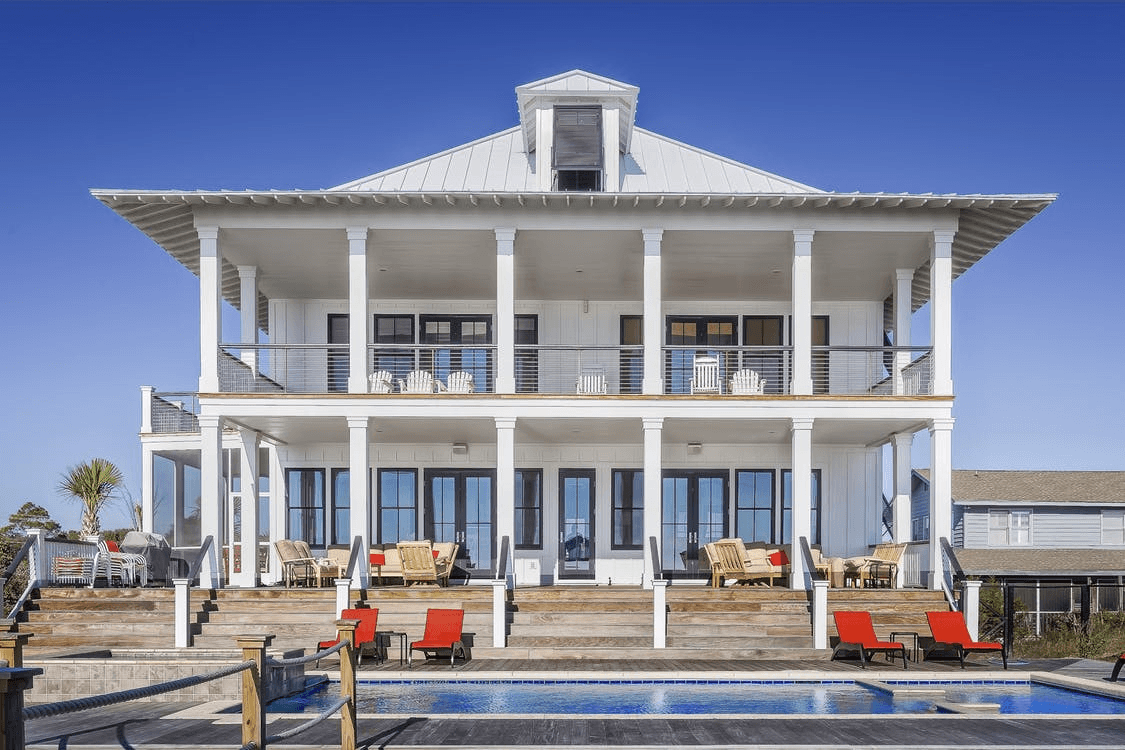

You can use some of your retirement funds to buy a new property. This will give you a steady stream of cash inflow in the form of rentals.

So, have you finally retired? If your answer is yes, then gone are the days when your time wasn’t your own. No more 9 to 5! Now you’re free to spend your life as you want and your savings will finally be put to good use.

With no fixed source of income, you’ll need to be vigilant about where you invest your savings. After retirement, you will still need to maintain your lifestyle, and it’s important that you invest your money wisely.

However, how can an older couple who are retiring spend their money wisely? There are many options for you to invest your money in and the most popular one is property.

You can use some of your retirement funds to buy a new property. This will give you a steady stream of cash inflow in the form of rentals. There are some pros and cons to this idea and the biggest disadvantage is that you’d have to take on the responsibilities of a landlord. Although rental properties earn well, they have a tendency to cause problems too.

So if you don’t want to deal with the hassles of being a landlord, you should steer clear of this option. That being said, investing in a property is bound to increase your financial stability. With a regular cash flow every month, you will not have to worry about anything, and you can just sit back to enjoy the retired life.

Tips for retiree property investment

Here are some helpful tips for those who are thinking of investing in a new home in their retirement. Start off by doing your research. You don’t want to end up with a property that’s more of a hassle than a helping hand.

- Know your budget and take into account all your cash flows

- Consider all the future costs to be incurred in the process

- Buy in an area that’s in demand

- Be practical when making the decision and don’t go for a property that has frills attached

The trends these days suggest that the future of retirement communities is bright and hence, investing in them would be a wise decision. (Source)

Retirement villages

With over 75 million baby boomers in the world today, it has become imperative to provide for all their housing needs. This demand has given rise to a large number of retirement villages on the Central Coast, Hunter Valley and Lake Macquarie areas in Australia. With a plethora of advantages, it is by far, one of the best long-term investment options around. Many of the more modern retirement village facilities include bowling greens, swimming pools, libraries and more. Since not all retirement villages are structured the same, it’s important to consider these factors before investing in retirement communities.

- Find out whether renting is allowed

- Do your research and find out the amenities offered by the village

- Ask questions to evaluate the real value of the property

Once you’ve made sure that the property is in perfect condition and offers everything that would appeal to a resident, you can go forward with the purchase. The trends these days suggest that the future of retirement communities is bright and hence, investing in them would be a wise decision. Just make sure you are aware of the risks involved in the process.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Business3 days ago

Business3 days agoLegal Process for Dividing Real Estate Inheritance

-

Markets2 weeks ago

Markets2 weeks agoStock Markets Surge Amid Global Uncertainty, But Storm Clouds Loom

-

Fintech9 hours ago

Fintech9 hours agoPUMP ICO Raises Eyebrows: Cash Grab or Meme Coin Meltdown?

-

Africa1 week ago

Africa1 week agoMorocco Charts a Citizen-Centered Path for Ethical and Inclusive AI

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-400x240.jpg)

![Kevin Harrington - 1.5 Minutes to a Lifetime of Wealth [OTC: RSTN]](https://born2invest.com/wp-content/uploads/2023/12/kevin-harrington-80x80.jpg)

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041-400x240.jpg)

![RDE, Inc. [ OTC: RSTN ] is set to soar in a perfect storm](https://born2invest.com/wp-content/uploads/2024/02/pexels-burak-the-weekender-187041-80x80.jpg)

You must be logged in to post a comment Login