Biotech

From SoftBank to Tencent and OrbiMed: Who Is Investing in the Oncology Sector?

Various investors, including SoftBank Vision, Apollo, OrbiMed, Tencent, and RA Capital Management, are funding oncology research and innovation. Collectively, investments in the sector exceed $17 billion, with notable contributions like RA Capital’s $2.4 billion across 29 companies. The sector, comprising over 23,600 companies, generated 13,020 investment rounds last year, reflecting strong financial backing and growth.

Who is funding innovation and research in oncology? In a sector that generates an annual expenditure of $400 billion, different investment funds, banks and private companies support and encourage improvements in the sector. SoftBank Vision, Apollo, OrbiMed or Tencent are some of the companies that have invested in various companies and start-ups, according to data from the Oncology 2024 report prepared by Start Us Insights.

Specifically, Softbank Vision has invested a total of $1.7 billion in seven companies in the oncology sector. Tencent, for its part, has backed five companies with $2 billion and Apollo financed at least one company with $1.8 billion.

In the case of OrbiMed, the disbursement was 1.5 billion dollars in the sponsorship of 33 companies, while CDH Investments financed seven companies with a total of 1.6 billion dollars. According to the report, RA Capital Management is the fund that has invested the most, with 2.4 billion dollars , distributed among 29 companies in the oncology sector.

Other major investors included Arch Venture Partners, which raised $1.8 billion in funding for fifteen companies, and Gilead Sciences, which backed six companies for a total of $1.4 billion. All in all, the investment value of the sector exceeded $17 billion, demonstrating the financial support in the sector.

Oncology medicine generated 13,020 investment rounds in the last year

The document also provides other relevant data on oncology, such as that the cancer industry is made up of more than 23,600 companies and 4,556 start-ups. However, the figure is 0.63% lower than that recorded in the 2023 report. In total, the sector generates 2.8 million jobs and 136,000 new employees were added in the last year alone.

For each round of investment generated last year, the oncology industry received an investment of $32 million, with more than 3,100 investors. In addition, the report states that more than 13,020 rounds of financing were closed and more than 4,840 companies benefited from these injections.

According to another report recently published by the Iqvia Institute, spending on oncology medicine is expected to reach $409 billion worldwide by 2028. In 2023 alone, spending was $223 billion. The growth will be accompanied by an increase in the rate of cases worldwide, which could reach 32 million by 2050.

Innovative Startups in Oncology

The Start Us report highlights five promising start-ups for their innovation and development in recent years, bringing advances of significant value to oncology. The first of these is the Swiss company Cancer Research and Biotechnology, which develops non-toxic small molecule drugs to treat cancer by restoring the balance in cellular metabolic pathways.

US-based Biobohemia, meanwhile, is known for using antigen-based technology to improve cellular cancer vaccines. By identifying the properties of cancer cells, the technology simultaneously enables composition and purification control. It also improves existing cellular compositions and creates new ones, giving rise to the Santavac brand of cancer vaccines that target virtually any solid cancer.

The report also highlights Spain’s Aptadel Therapeutics , which uses aptamer ribonucleic acid (RNA) technology to deliver therapeutic agents with high specificity and enhanced safety for the treatment of various types of cancer. The Spanish company’s product portfolio treats childhood cancer, particularly Ewing’s sarcoma, which affects bones and soft tissues and includes a low survival rate for metastatic cases.

Australian company AdvanCell uses targeted alpha therapy to deliver alpha particle radiation directly to cancer cells. And finally, the report highlights Singapore-based Axcynsis Therapeutics, which offers AXC, AxcynMAB, AxcynCYS and AxcynDOT therapies. Its AxcynMAB platform integrates advanced antibody discovery with computational technologies to develop high-performance antibodies.

__

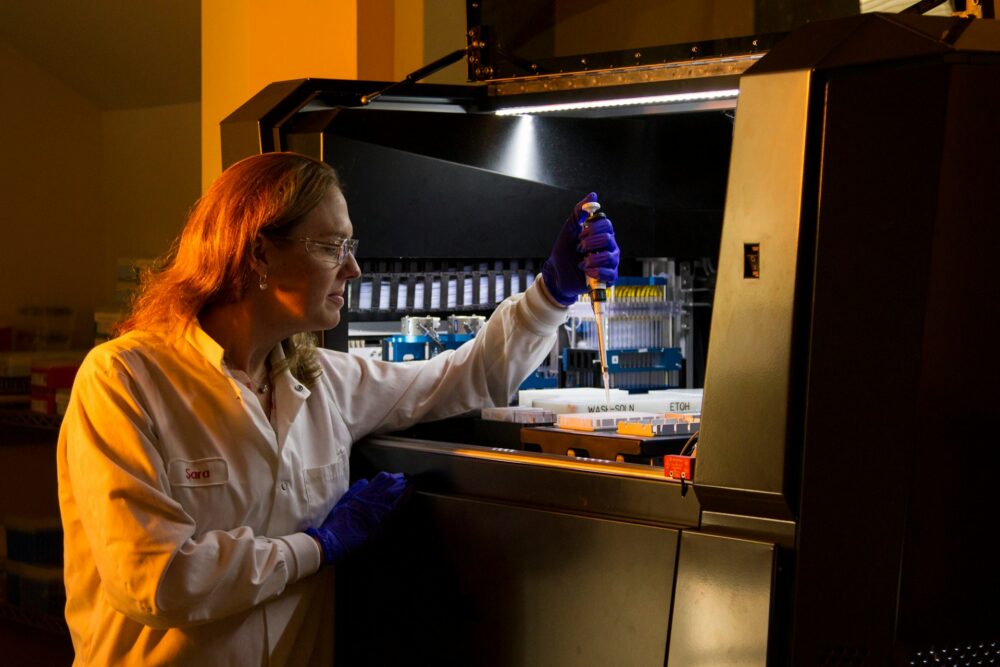

(Featured image by National Cancer Institute via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in PlantaDoce. A third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us

-

Biotech5 days ago

Biotech5 days agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Fintech2 weeks ago

Fintech2 weeks agoImpacta VC Backs Quipu to Expand AI-Driven Credit Access in Latin America

-

Fintech2 days ago

Fintech2 days agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

-

Impact Investing1 week ago

Impact Investing1 week agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia