Featured

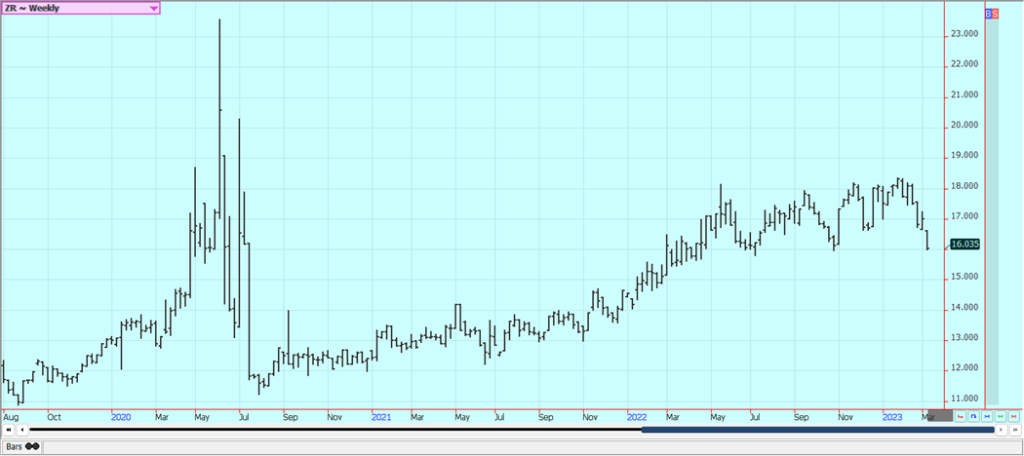

Rice Demand for Exports Was Slow to Moderate

Rice was narrowly sharply lower again last week. Trends are down on the charts. The USDA WASDE reports showed reduced export demand but this was already factored into the price structure as the selling had come before the release of the reports. Demand has been good from domestic sources. Export demand has been uneven but was a marketing year high in the most recent weekly export sales report

Wheat: Wheat markets were lower last week in trading in response to the WASDE reports and on reports that Russian offers continue to hit the world market and world prices. USDA made no changes to the US supply or demand but did cut world-ending stock levels. The funds maintain a huge short position in this market. The problem remains demand as world supplies are not so large and US inventories are less as well. Ideas that big Russian offers and cheaper Russian prices would be a feature for a while in the world market were the driving force for the weaker prices, and price weakness could continue. The war in Ukraine continues, but Russia is expected to allow the grain export program to continue in one form or another. Ideas are that both Australia and Russia are harvesting record to near-record Wheat crops this year. Russia has a large production and is undercutting most world prices in the international market. The demand for US Wheat in international markets has been a disappointment all year and has been hindered by low prices and aggressive offers from Russia.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

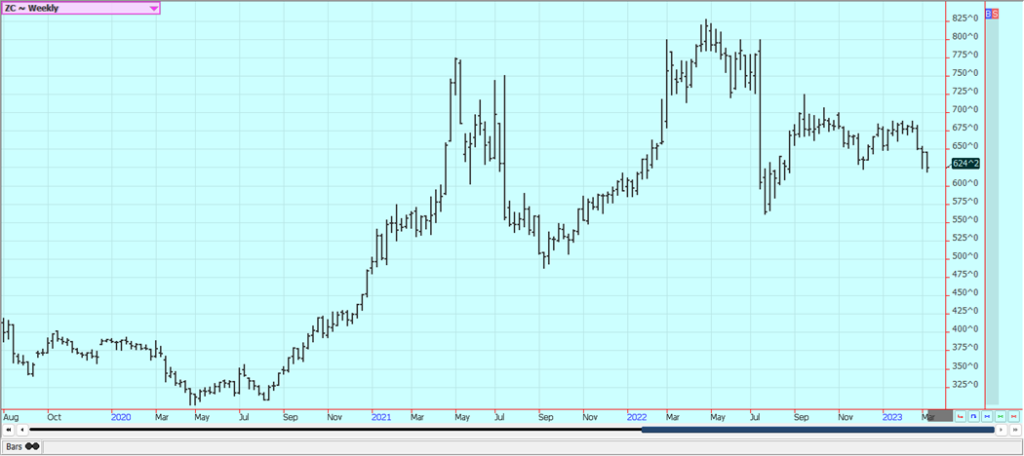

Corn: Corn closed lower last week on selling tied to the release of the WASDE reports and forecasts for good weather conditions for the growing season in the US. Oats were higher. USDA left the supply side unchanged in its WASDE reports for the US but cut export demand and also increased US and world-ending stock levels. US prices are currently very competitive with those from South America and US demand could improve because of the price differentials. Prices from South America should now remain strong as countries there concentrate on Soybeans exports, so the US has a chance now to see export demand improve. The Brazil Winter crop is harvested and China has been buying the surplus. The Summer crop and the Argentine crop is developing under stressful conditions. The next Winter crop is going into the ground in good conditions, but it has been wet so the Soybeans harvest has been delayed and the Corn planting is becoming delayed as well. Reports indicate that the weather is now better in central and northern Brazil and that the Corn planting pace is improved. However, Brazilian sources say that 20% of the Winter crop could be planted outside of the ideal window so yields could be hurt in the end. NOAA is forecasting that La Nina will develop this Summer and replace El Nino. US growing conditions are usually good when this happens.

Weekly Corn Futures

Weekly Oats Futures

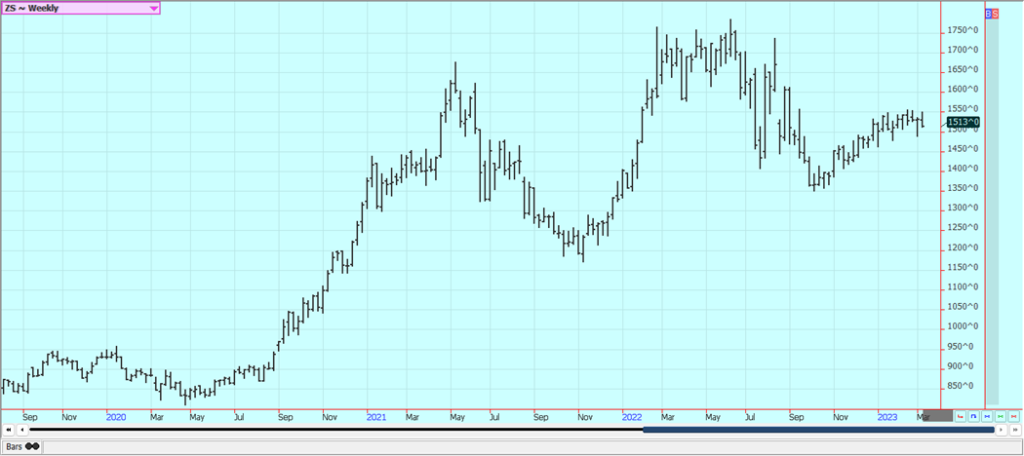

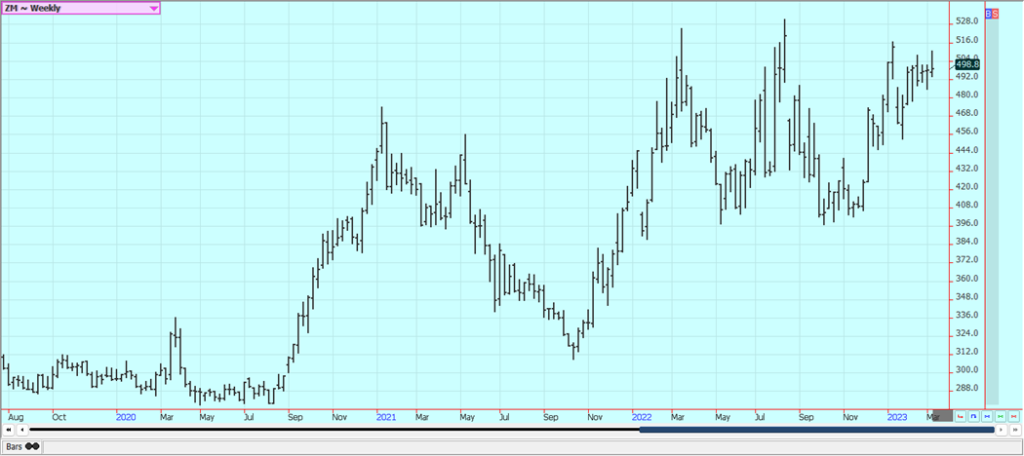

Soybeans and Soybean Meal: Soybeans were lower last week on selling tied to the response to the release of the WASDE reports that showed reduced domestic demand but much more export demand. Selling also came from ideas of increased Brazil offers into the world market and reduced US export demand. Reports from Brazil show that basis levels there are under pressure due to the large crop being harvested now. Forecasts from NOAA for very good growing conditions in the Midwest were also a factor. Argentine production was cut but Brazil production was not and the Brazil crop is coming to export channels and that is bearish to US prices. Soybeans export demand is flowing to Brazil now. Argentina is the world’s largest exporter of Soybeans products while the US and Brazil battle for supremacy in Soybeans exports. The South American harvest coming to export channels now. It remains hot and dry in Argentina and crop conditions are getting worse. Production ideas there are still dropping and the Rosario exchange now estimates production near 27 million tons. Weather is becoming less important now as the harvest is already underway in central and northern Brazil and will spread south soon. Central and northern Brazil have seen harvest operations interrupted by too much rain but the weather is now improving and the harvest pace is increasing. Production potential for Brazil is called very strong even with potential problems and losses in the south. Argentine production ideas continue to drop with the drought as planting is delayed and the crops already in the ground are stressed.

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

Rice: Rice was narrowly sharply lower again last week. Trends are down on the charts. The USDA WASDE reports showed reduced export demand but this was already factored into the price structure as the selling had come before the release of the reports. Demand has been good from domestic sources. Export demand has been uneven but was a marketing year high in the most recent weekly export sales report. Rice demand has been an issue for the market all year. There is not much going on in the domestic market right now although mills are milling for the domestic market in Arkansas and are bidding for some Rice. Markets from Texas to Mississippi are called quiet. Demand in general has been slow to moderate for Rice for exports. Planting is active in Texas and southern Louisiana.

Weekly Chicago Rice Futures

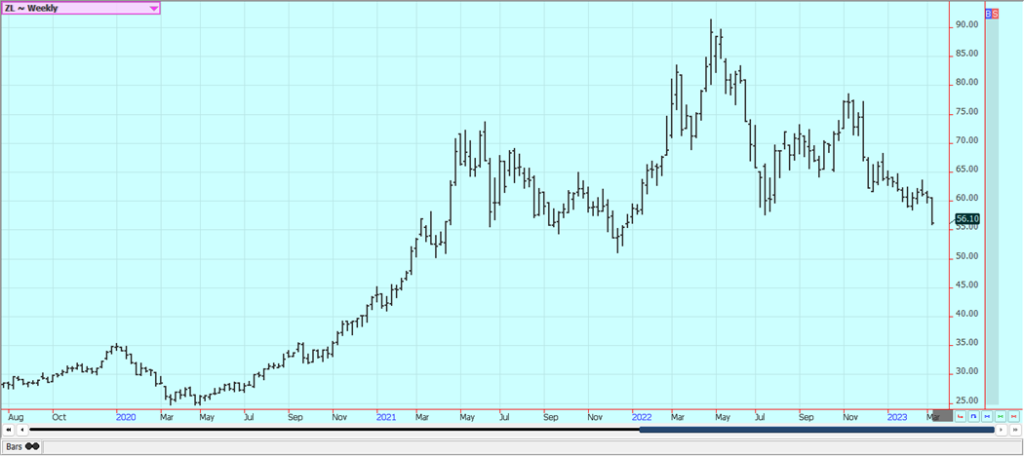

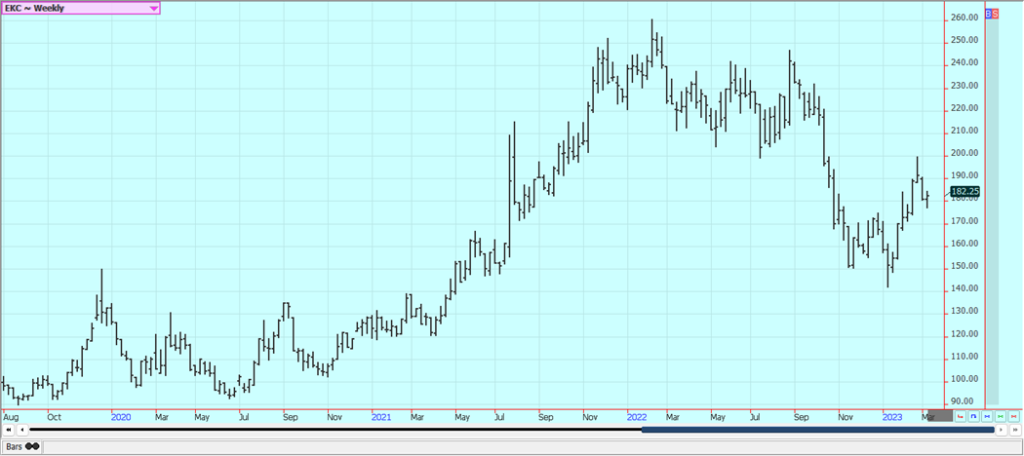

Palm Oil and Vegetable Oils: Palm Oil closed lower last week on demand concerns and despite ideas that prices can remain elevated due t bad weather in Malaysia and the potential for increased demand from India and especially China. Indonesia is now revoking some export permits to keep internal prices controlled and to support the biofuels industry. The controls are expected to last through Ramadan. Peninsular Malaysia is getting flooding rains. Flash floods are being reported. Canola was lower on price action in Chicago and on demand concerns as ideas that Brazil will capture demand for the world market. Brazil is expected t dominate the oilseeds market for the next few months. Soybean and Palm Oil were lower as was European Rapeseed. Reports indicate that domestic demand has been strong due to favorable crush margins. Production was much improved this year on better weather during the Summer. It is dry in the southern and southwestern prairies now and this could mean reduced yields when the production season begins in a couple of months.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton was lower last week and has now broken down in a convincing way from a sideways trading pattern established last November on follow-through selling tied to the WASDE reports and on disappointing weekly export sales. The reports were negative to prices as USDA left US demand alone and raised world-ending stocks. Demand ideas are improving. Demand was very strong in the report the previous week and has been ramping up for the last couple of months, but fell off. Some ideas that demand could soon increase more as China could start to open its economy in the next couple of weeks. China has also started buying again from Australia after refusing imports from that country for political reasons.

Weekly US Cotton Futures

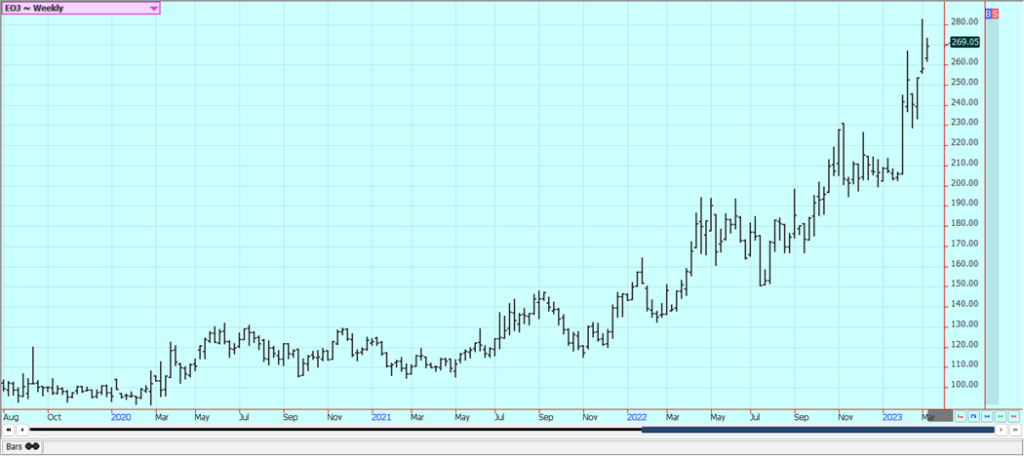

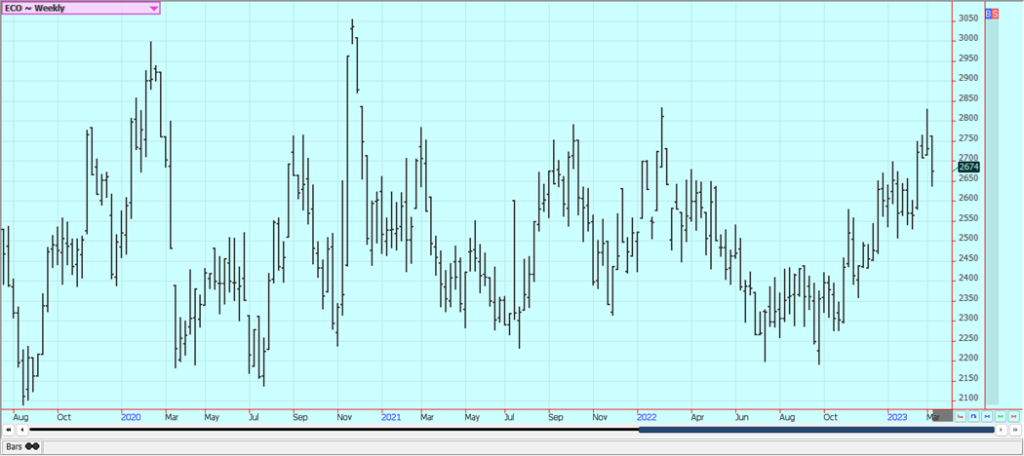

Frozen Concentrated Orange Juice and Citrus: FCOJ was higher last week and remains supported by very short Orange production estimates for Florida. The market tone is mixed as USDA slightly raised Florida Oranges production estimates to 16.1 million boxes from 16.0 million in its previous estimate and more than 60% below the production from last year. The crop is still very short but the size of the crop could be factored into the price now. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that has hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for production around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and the conditions are rated good. Brazil continues to export to the EU and is increasing its exports to the US. Mexico is also exporting to the US. The Florida Dept of Citrus reported that inventories are still 38.5% below last year. Nielsen said that Orange Juice retail prices hit a new high in the US. This is the fifth consecutive month of new highs reported and the highest price reported since at least 2001. The current price is now 8.85/gallon, up 14% from last year.

Weekly FCOJ Futures

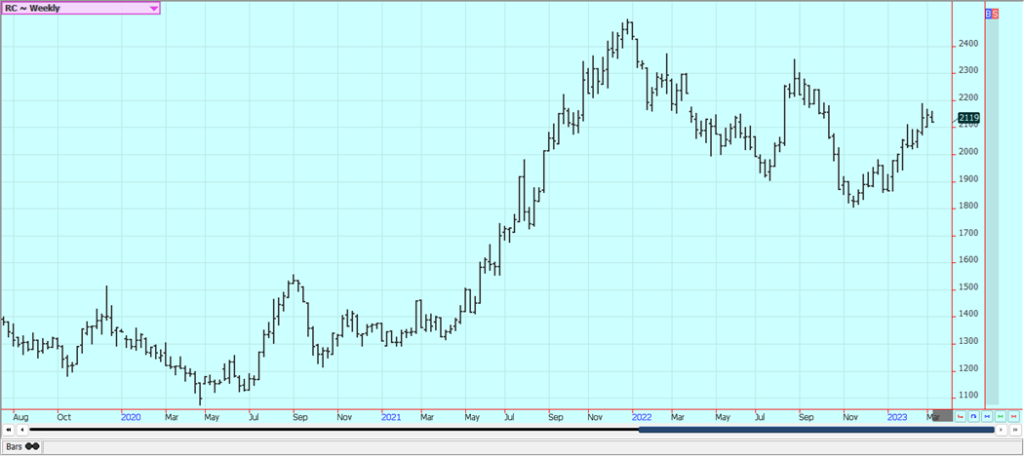

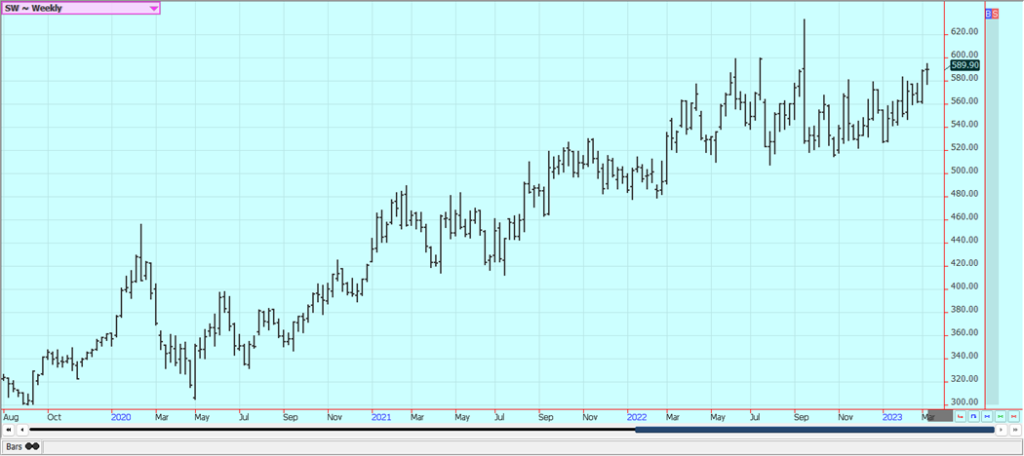

Coffee: New York closed a little higher and London closed a little lower last week. Differentials are now weakening in Brazil, Honduras, and Colombia as the rally has increased offers. However, CECAFE showed that Brazil exports were just 2.4 million bags in February, down one-third from a year ago. Ideas of big production for Brazil continue due primarily to rains falling in Coffee production areas now. Vietnam is estimated to have very good production this year due to a good growing season. There are ideas that the production potential for both countries has been overrated. The weather in Brazil is currently very good for production potential but worse conditions seen earlier in the growing cycle hurt the overall production prospects as did bad weather last year. Vietnam is getting less rain now to aid harvest progress but the volumes offered have not increased.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

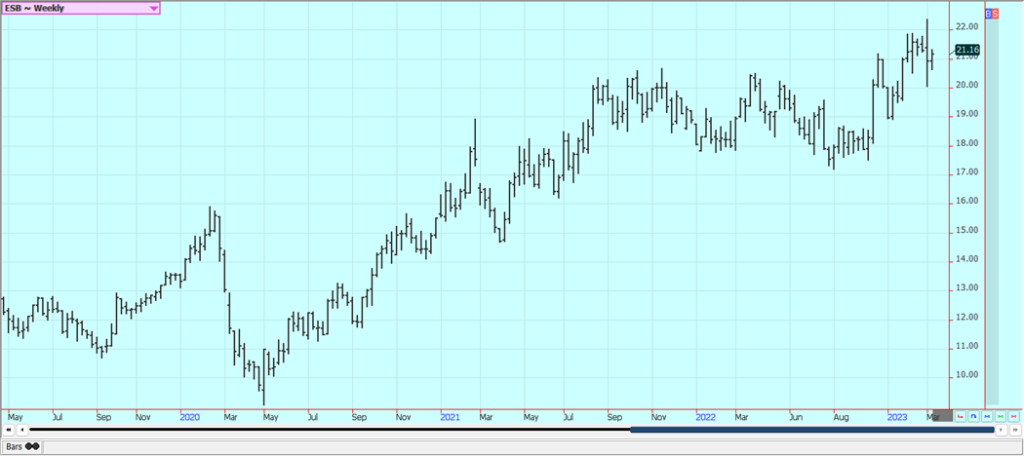

Sugar: New York and London closed a little higher as Indian production remains a concern. Indian production is thought to be 33 million tons this year or less and the market has had to ration that supply via price. Thailand mills are closing earlier than expected so the crop there might be overrated and Brazil’s production is solid this year. Reports from private analysts suggest that Brazil can have a 13% increase in center-south production. Center-south mills crushed 72,000 metric tons of cane in the period, down 55% from the same time last year, Unica said Friday. The mills produced 381 tons of sugar and 154.7 million liters of ethanol. The production mix for the second half of February was 4.8% sugar to 95.2% ethanol, compared with 100% ethanol in the same period last year. In the period from April 1 through Feb. 28, mills in the region crushed 542.5 million tons of cane, up 3.8% from the same period a year earlier. Sugar production rose 4.5% to 33.5 million tons, and ethanol output climbed 3.7% to 28.2 billion liters. The production mix for the season through Feb. 28 was 45.9% sugar to 54.1% ethanol, compared with 45% sugar and 55% ethanol in the same period a year earlier. Good production prospects are seen for crops in central and northern areas of Brazil, but the south has seen drier weather. There is concern that the rainy areas will stay too wet and delay the harvest and dilute the Sugar concentrations in the cane in central areas. European production is expected to be reduced again this year, with French planted area likely to decline to a 14-year low for Sugarbeets. Some analysts now say that Chinese production could be the lowest in six years due to bad growing conditions.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

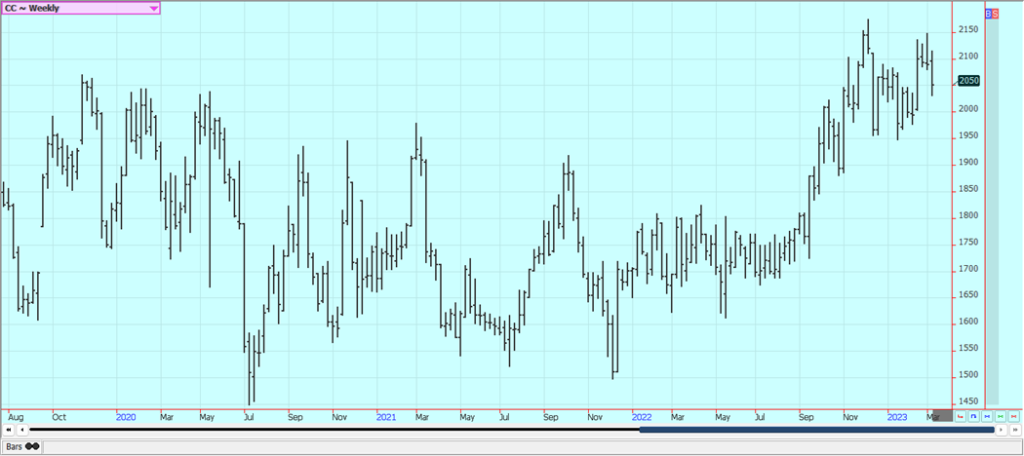

Cocoa: New York and London closed lower last week even as West African exporters are not offering. Wire reports said that a lot of Ivory Coast Cocoa is getting smuggled to other countries for export due to higher prices being paid. Trends are down in both New York and London. The talk is that hot and dry conditions reported in Ivory Coast could curtail mid-crop production, but main crop production ideas are strong. Those ideas changed a little over the previous weekend due to heavy rains reported in Cocoa areas of the country. Ghana has reported disease in its Cocoa to hurt production potential there. The rest of West Africa appears to be in good condition. Good production is reported for the main crop and traders are worried about the world economy moving forward and how that could affect demand. The weather is good in Southeast Asia. The Ivory Coast Cocoa grind was 58,452 tons in February, 16% higher than last year.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by 41330 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Cannabis2 weeks ago

Cannabis2 weeks agoScientifically Verified F1 Hybrids Set New Benchmark for Indoor Cannabis Yield and Consistency

-

Biotech1 day ago

Biotech1 day agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Fintech1 week ago

Fintech1 week agoImpacta VC Backs Quipu to Expand AI-Driven Credit Access in Latin America

-

Impact Investing5 days ago

Impact Investing5 days agoClimate Losses Drive New Risk Training in Agriculture Led by Cineas and Asnacodi Italia