Business

Rice posts strong weekly export sales; Cotton futures rally

As Mexico challenges U.S. tariffs, rice imports struggled to keep up. Cotton delivers another success following its triumphant harvest last week.

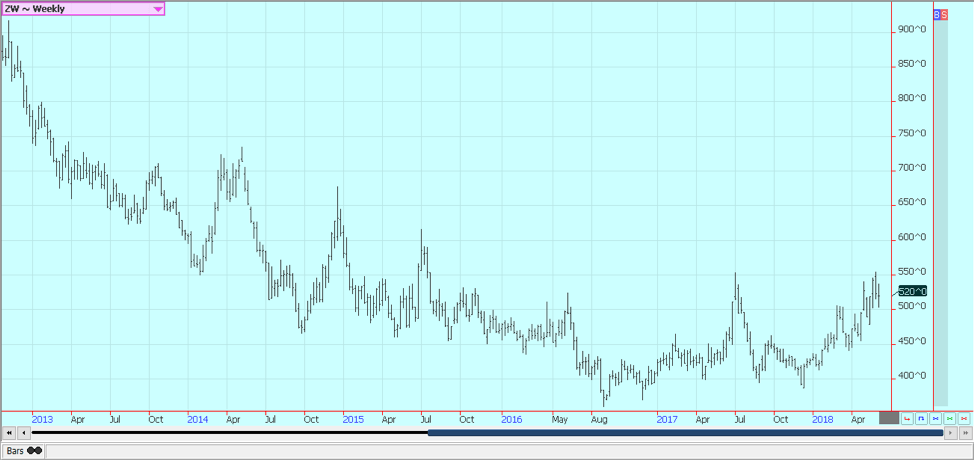

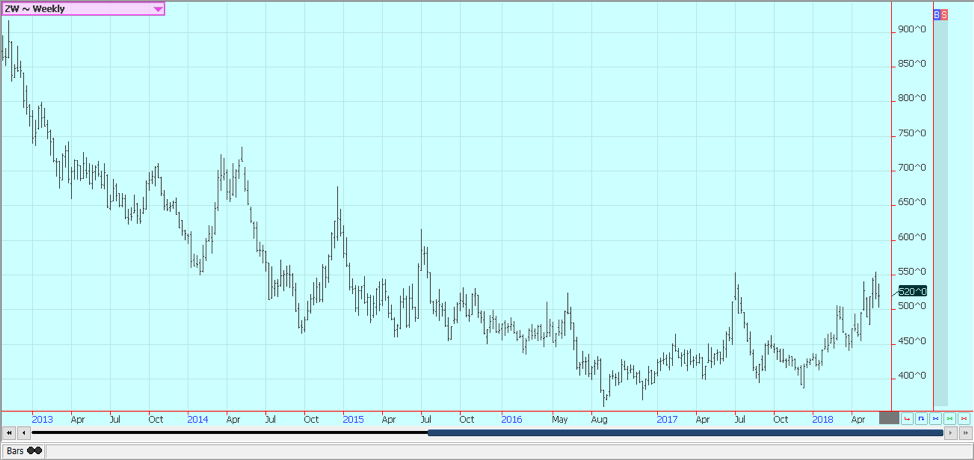

Wheat

Wheat markets were slightly lower on the week as some speculative selling was seen after testing a previous spike on the weekly charts during the previous week. The previous high was made in July of last year at 553.5 basis Chicago futures. July futures made a high of 554 before turning lower, and further long liquidation was seen last week as the winter wheat harvest in the US starts to expand.

The harvest is underway in most of the Great Plains, and yield reports are highly variable. One report indicated yields anywhere from in the teens to about 50 bushels per acre. There is no real estimate of abandoned acres available. The harvest is expected to move fast due to the generally sharply reduced yield potential due to dry conditions in the western Great Plains. Harvest is underway in the southern Midwest, and good crops are expected in the region.

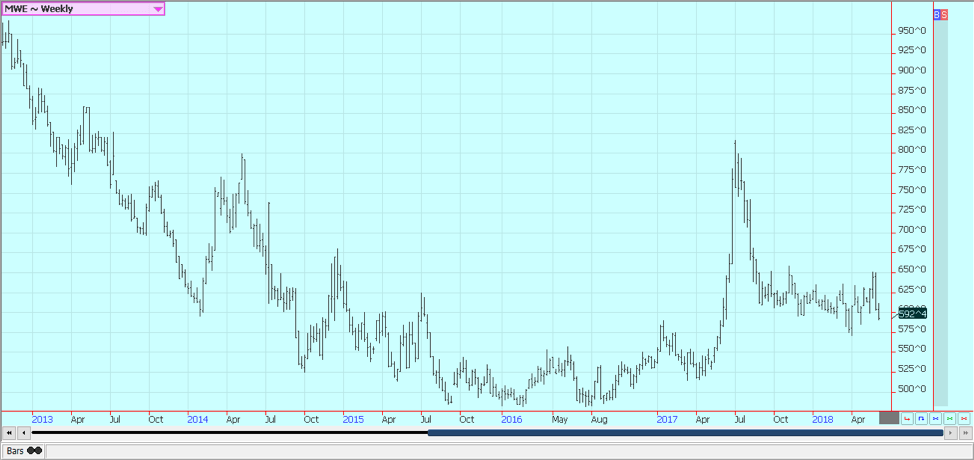

USDA will issue new supply and demand and also production reports tomorrow. Production estimates are unchanged to slightly lower from last month. Minneapolis spring wheat is weak due to improved conditions in the northern Great Plains and on into Canada that is allowing for good planting progress and initial growth. Parts of Canada have seen rains, although a few areas are still too dry.

Conditions in other parts of the world remain important to the trade. The weather focus remains mostly on the Black Sea area, or Ukraine and southern Russia and then into Kazakhstan. These areas are too dry and there is the talk of yield loss. Western spring wheat areas have been too wet and cold. Australia has been dry. India and Pakistan have been very hot. European wheat production estimates have been steadily cropping due to adverse weather seen during the growing season. Black Sea prices are continuing to work higher due to the weather problems.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

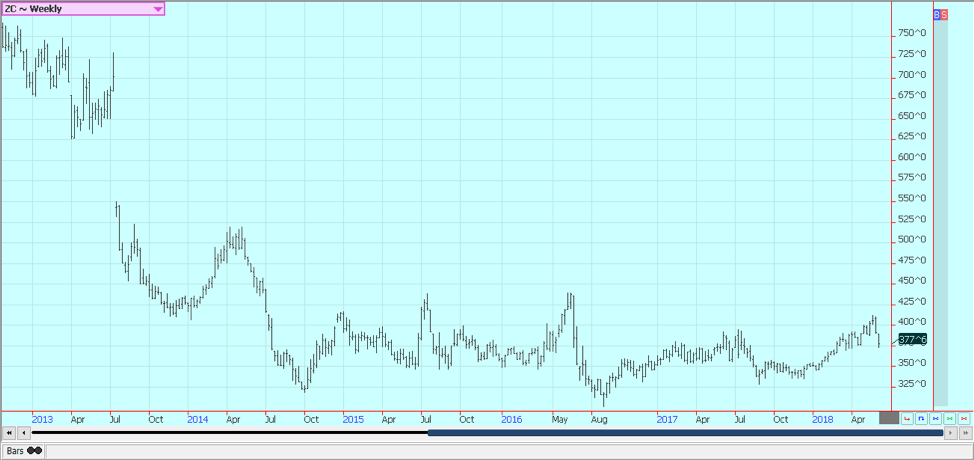

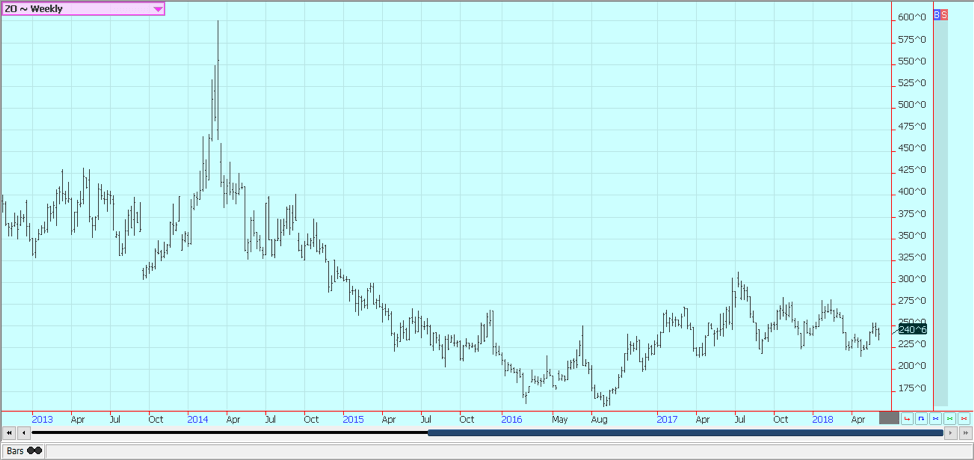

Corn

Corn closed lower on ideas that corn crops are in good condition in the Midwest and on trade fears created by the US government. No one knows what is going on in the talks with Mexico or any other tariff target, and the market is waiting for some answers. It is not expecting much as the president often changes his mind and could several times before something eventually sticks. In the meantime, the market is starting to prepare for more bad news as Mexico is the largest buyer of US corn and should start to look elsewhere for supplies.

Ideas that corn crops are in good condition in the Midwest also keep some selling interest alive. USDA condition ratings have been very high and should remain high as the crop has been planted and is mostly emerged and growing well. However, there are still dry pockets scattered around the Midwest, mostly in southern and western areas. Some northern areas have had way too much rain, with this area mostly concentrated near the Iowa-Minnesota border.

Domestic demand remains strong, and demand for ethanol is expected to remain strong. The weather problems with the winter corn crop in Brazil continue with no real rains in sight for major growing areas. There are chances for the crop to get smaller if rains do not appear. There are no rains in the forecast.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

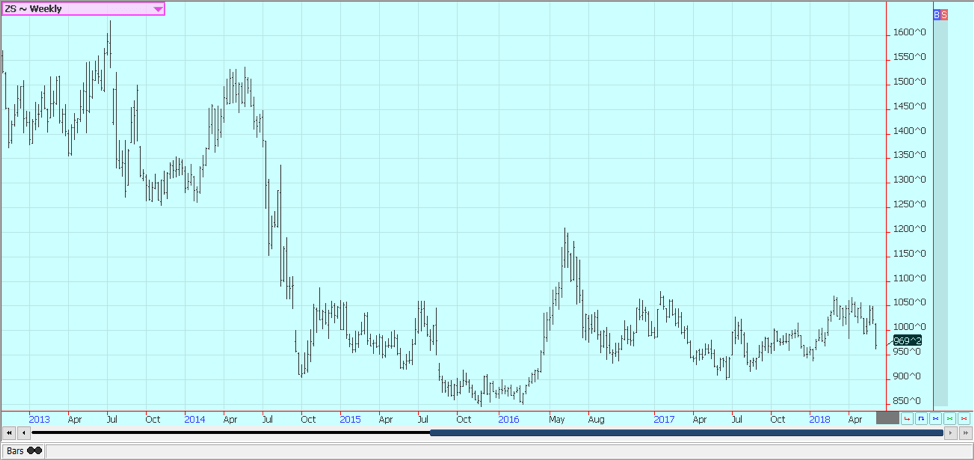

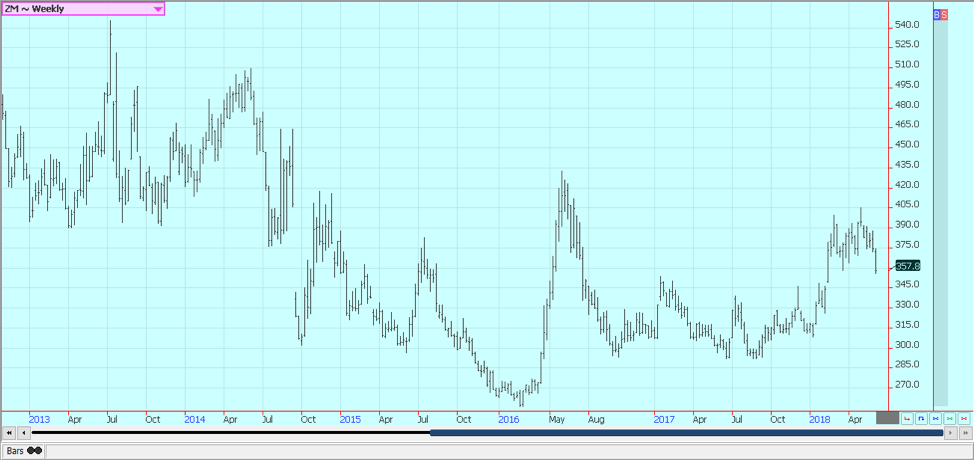

Soybeans and soybean meal

Soybeans and products were lower again on Friday due to ideas of good weather and on continuing fears about new Chinese demand. Many traders were also selling before the G-7 meetings held over the weekend in Canada. It was a tough weekend for the US due to the trade disputes and tariff wars started by the US. But, the main problem of soybean demand remains the US-China trade war. The Chinese made an offer to resolve the trade dispute with the US, but no response has been seen yet from Washington.

The offer included purchases of up to $70 billion in agricultural and energy goods, but made no mention of intellectual property rights. The issue of intellectual property rights seems to be a big problem to get resolved, and it might be difficult as the Chinese say they are abiding by all agreements in the area. China said that the offer would be withdrawn and no longer valid if tariffs are instituted in response.

The Trump administration previously said it was moving ahead with tariffs even though the negotiations between the two countries were going very well. The US went ahead with tariffs on metals imports from the EU, Canada, and Mexico a couple of weeks ago. There will be retaliation, and it is possible that grains and oilseeds will see new or increased tariffs.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

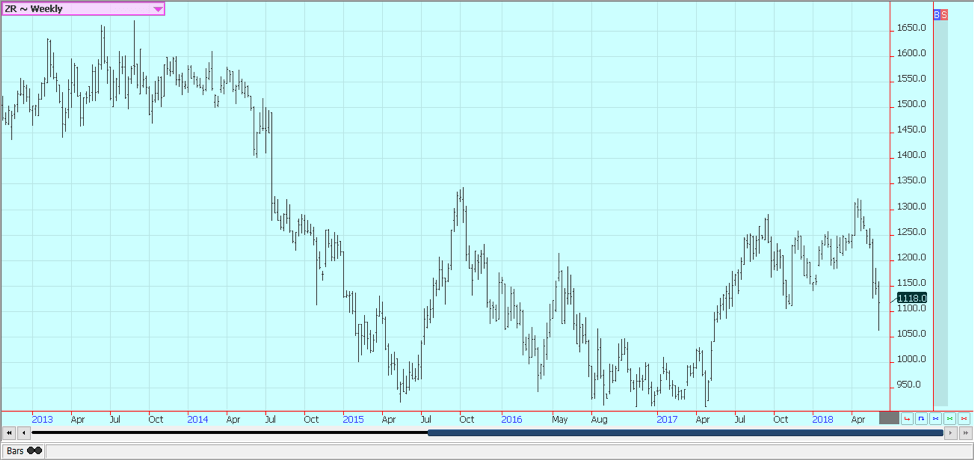

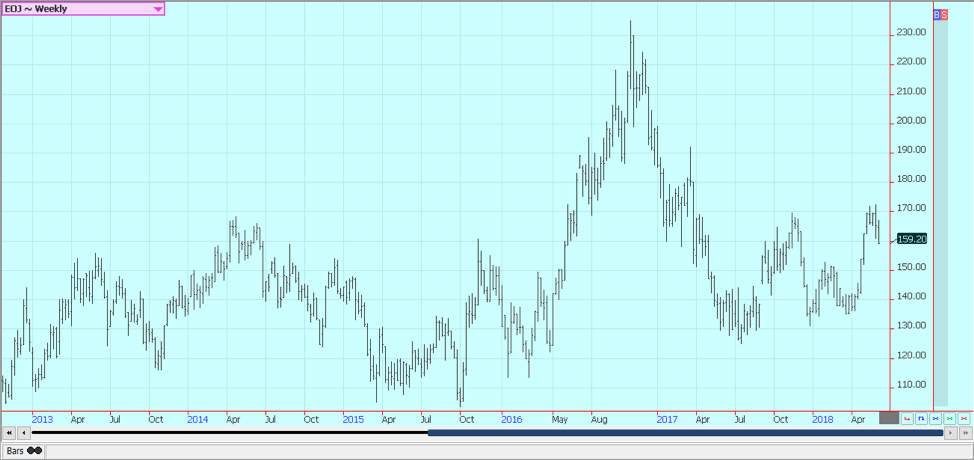

Rice

Rice was a little lower on Friday but held another assault on the downside seen in early trading. Futures were lower for the week but climbed back to previous support areas after plunging to levels not seen since last summer. The strong weekly export sales report was due to late reporting of some shipments to Mexico and had no real support for futures late last week. The market fears that this demand is gone and might not come back again very soon.

Trade tensions remain a focal point as Mexico is the largest buyer of US rice. Mexico announced some of the markets it would use to retaliate against the US tariffs, and grains were not on the list. There were reports that Mexico will include a tariff on milled rice, but not rough rice. Mexico mostly buys rough rice. Potential Iranian and Iraqi demand was hurt when Trump did not certify Iran a couple of weeks ago and moved to get a new nuclear deal with them.

US export prices are high right now, and that is hurting demand, but the US is said to have little rice that it can export now, anyway. Cash market traders say that the domestic cash market remains about unchanged. USDA showed that the crop is in good condition last week, and good conditions are expected in the data tonight. USDA should make few changes in the domestic estimates for tomorrow but might increase exports of old crop and cut ending stocks a bit.

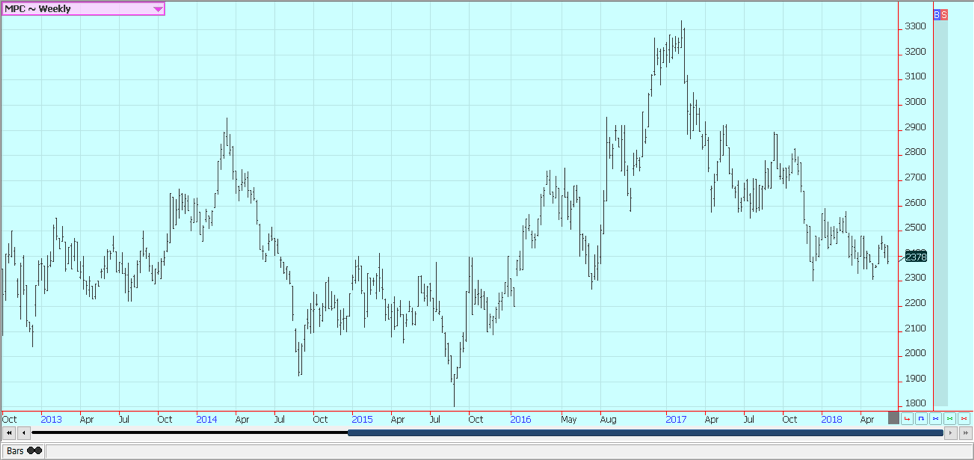

Weekly Chicago Rice Futures © Jack Scoville

Palm oil and vegetable oils

World vegetable oils prices were lower last week but generally held to recent trading ranges. Only canola broke down and turned short-term trends from up to down last week. The other markets show the potential to work lower as production ideas remain generally high and as world vegetable oils demand has turned soft. Palm oil moved a little lower on weaker demand reports from the private sources. They showed that month to month export demand was down more than 10% on a month to month basis as demand from India and Europe has been soft.

The market has held well despite the reduced demand and has held firm overall. However, it is moving back now to the lower end of the recent trading range. The weekly charts show that futures are mostly in a big trading range. The US-China trade dispute could shift some of the demand to Palm Oil, especially since the soybeans and soybean meal market has been under pressure in China. China has been importing mostly from Indonesia.

Soybean oil was locked in a sideways trend all week and also closed lower. Trends are turning down in the market as it worries about US mandates for biofuels. A potential agreement on biofuels collapsed last week, and ideas are that short-term demand could be hurt. However, keeping the same mandates in place could help biofuels demand longer term as US demand will be held together and imports will be difficult as the US has instituted tariffs against Argentina and Indonesia.

Canola found some support from the trade war and the weather but closed lower as some beneficial rains were reported and planted area ideas are high. Farmers were active planting, although some parts of the Prairies have turned very dry. Some parts of the western Prairies saw some beneficial rains last week, but many areas were missed. Offers from farmers were down last week as they plant and wait for higher prices and as they work at getting the planting done.

Weekly Malaysian Palm Oil Futures © Jack Scoville

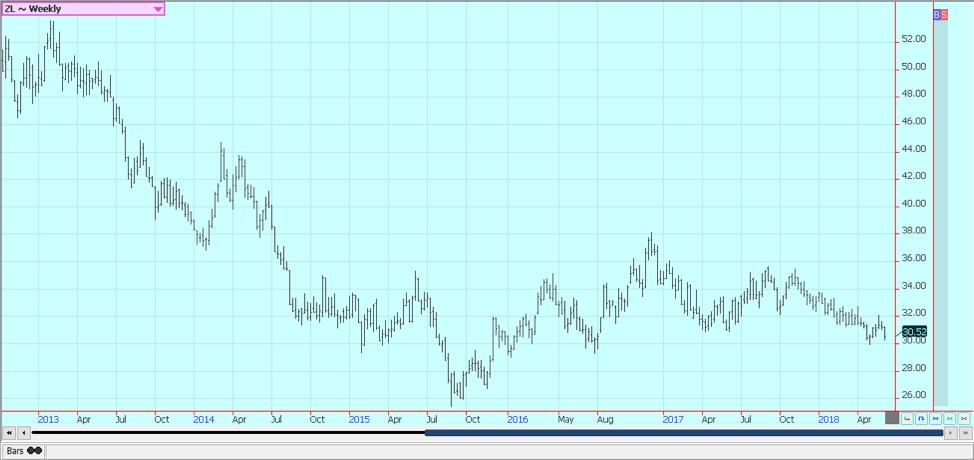

Weekly Chicago Soybean Oil Futures © Jack Scoville

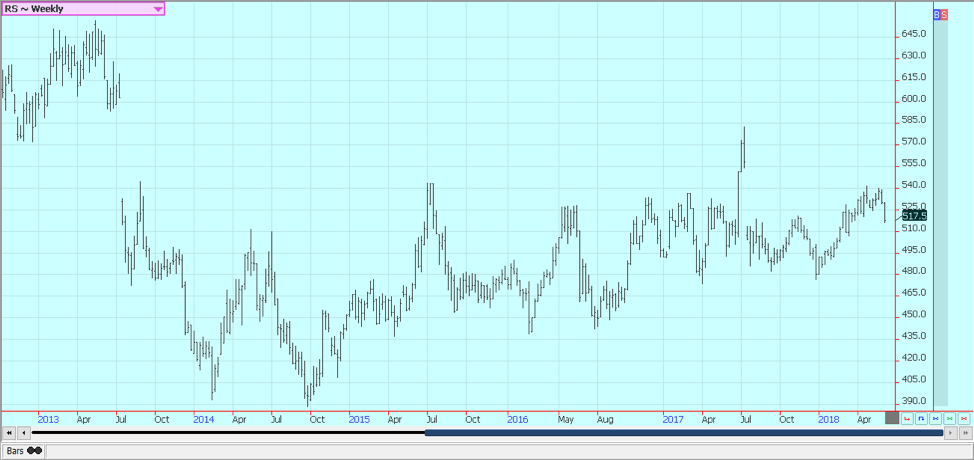

Weekly Canola Futures © Jack Scoville

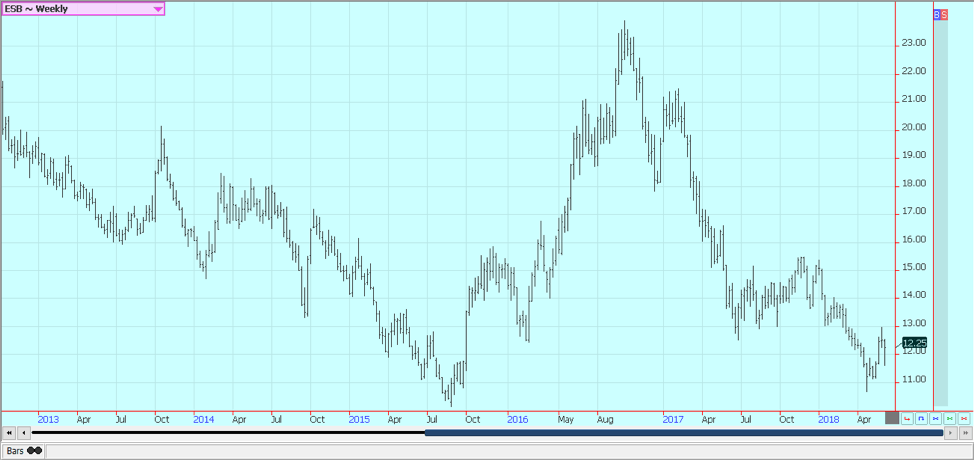

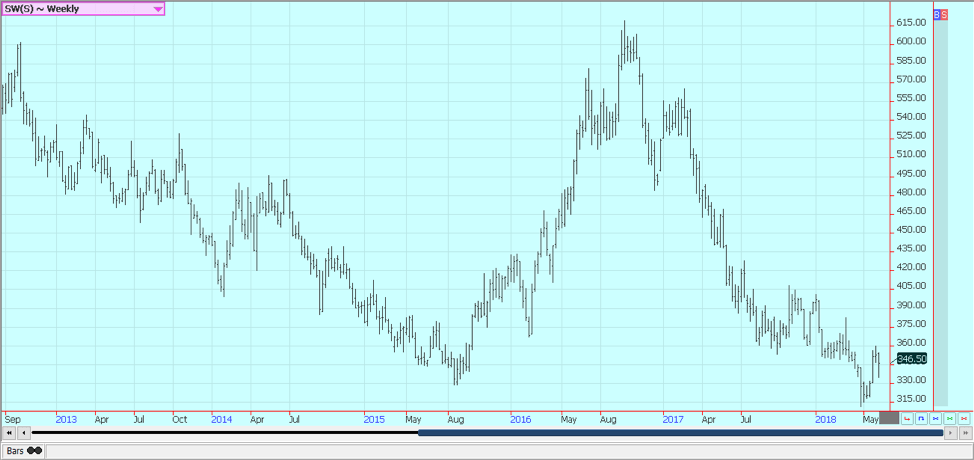

Cotton

Cotton was higher again last week, and trends are still up on the weekly charts. Futures held support and closed near the weekly highs. It looks very likely that the rally can continue as the mills will spend the next two weeks covering on-call positions in the futures market. This means they need to buy futures, and some of this buying might have started last week.

Ideas are that US cotton especially is in a bad spot due to the extreme weather in western Texas. The Southeast US began to dry out last week. The weather is bad in India and China, with big heat seen in India and Pakistan and too much rain in China. Lost Chinese production could mean increased sales for the US, especially now since the US will have the quality the Chinese need.

Drought conditions are developing in Pakistan, but the monsoon has arrived in southern India and should spread through the subcontinent in the next couple of weeks. There are ideas that the US is now running short of high-quality cotton to deliver to the exchange and to overseas buyers. Demand remains strong in export markets.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ was lower as Florida weather remains good and demand prospects do not. The hurricane season has started.. There are no storms or áreas of interest yet in the Atlantic, but something could be forming that might come close to the state this week. Traders are worried about demand and are noting improved production prospects for Florida.

The tariff wars between the US and Canada, Mexico, and the EU are hurting export demand ideas. The EU imports a lot of FCOJ and these exports could be hurt by any retaliation made by Europe. The EU has indicated that FCOJ will be on the list of ítems subject to increased tariffs and that the measures will be enacted next month.

The growing conditions in Florida should continue to improve as the rainy season appears to be underway. The market is still dealing with a short crop against weak demand. Demand is bad enough that year on year inventories are increasing even with the very bad production last year. Florida producers are seeing golf ball sized or larger fruit. Conditions are reported as generally good. Brazil could use more rain as Sao Paulo has been hot and dry. Generally, good conditions are reported in Europe and northern Africa.

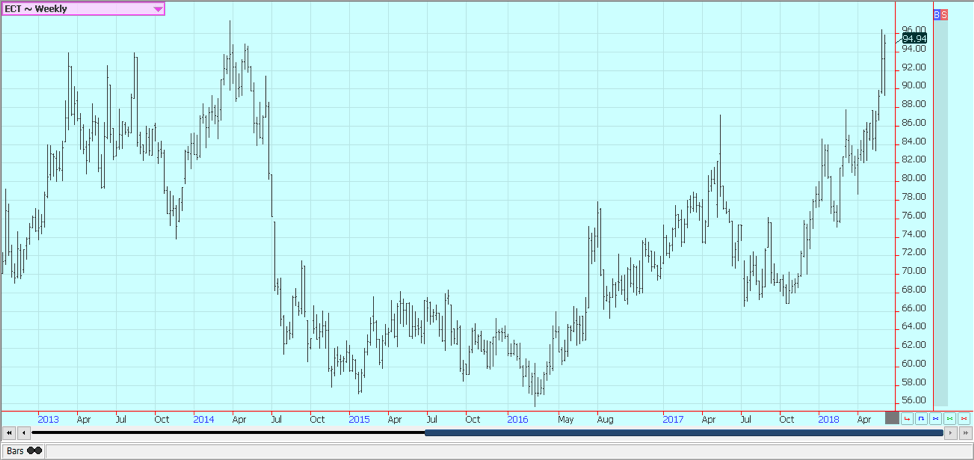

Weekly Frozen Concentrated Orange Juice Futures © Jack Scoville

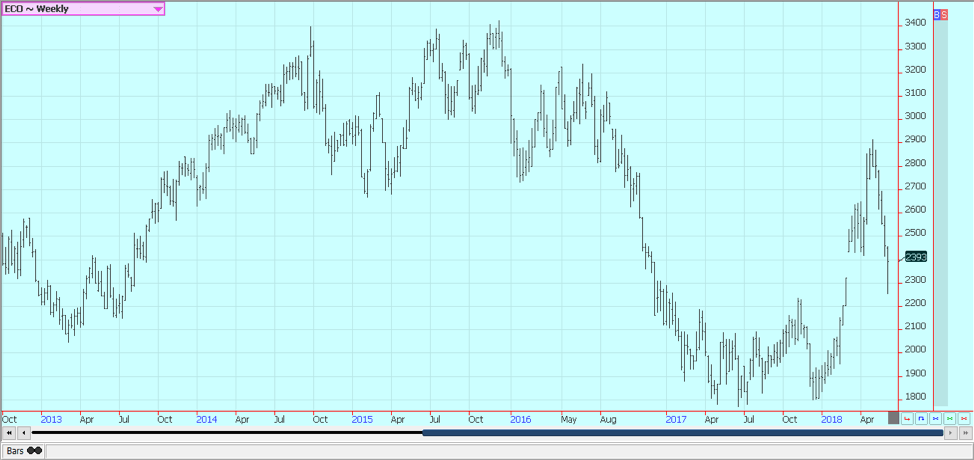

Coffee

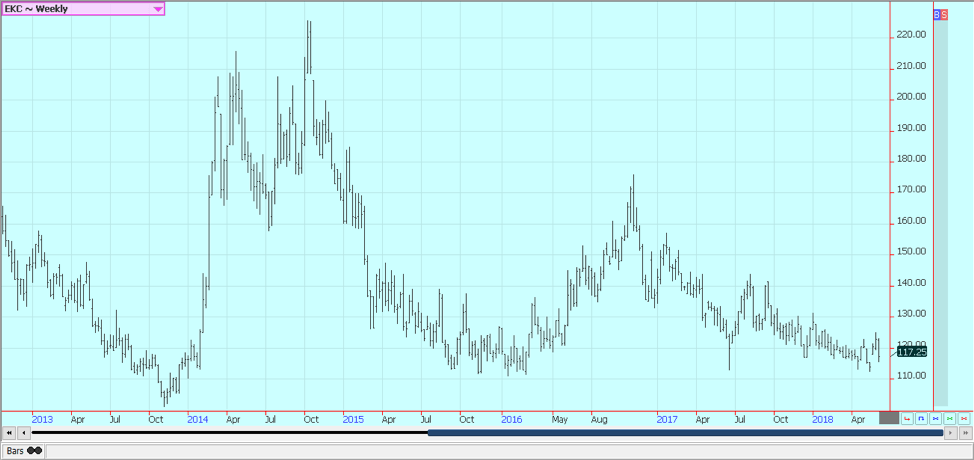

Futures in New York and London were lower for the week. Brazil remains in focus as the harvest is underway. Brazil announced that it would buy some Robusta in the world market to cover short domestic production. It remains mostly dry in Arabica areas, and there is no rain in the forecast for the next week. The truckers strike has delayed shipments for a significant amount of coffee just as the harvest is beginning. However, it does not appear that buyers are looking for alternatives right now.

Origin is still offering in Central America and is still finding weak differentials. It has been a little dry so far this year in the region. Speculators anticipate big crops from Brazil and from Vietnam this year and have remained short in the market. Robusta remains the stronger market as Vietnamese producers and merchants have not been willing to sell at current prices. Reports indicate that supplies in the country are less on lower than expected production. Vietnamese cash prices are weaker this week with good supplies noted in the domestic market. Current rains in the country are favorable for the crops, and production for the coming year is expected to recover.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

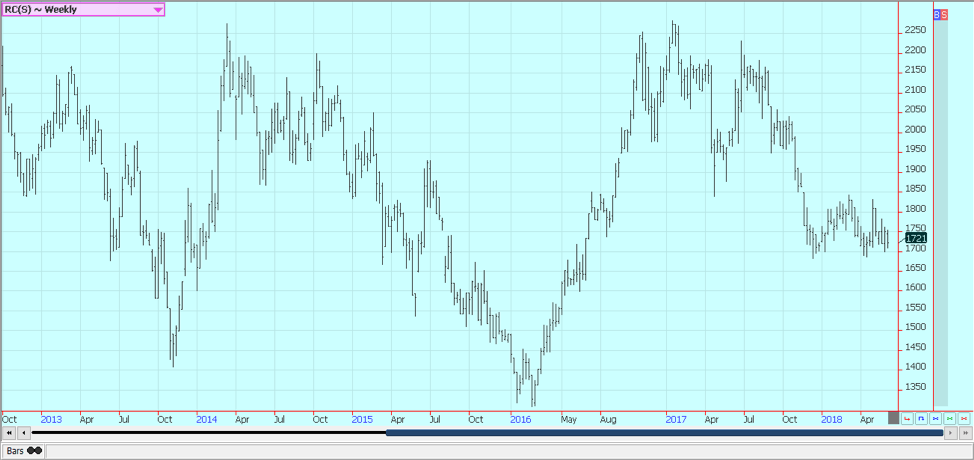

Sugar

Futures were lower in both markets on ideas of ample world supplies. Both markets have formed bottoms on the daily and weekly charts, but have also failed at resistance areas. New York held support and now looks to set up a trading range. Prices have been supported by the dry weather in Brazil and also the truckers strike there that is now settled. Shipments to mills and ports have started again. It is dry in parts of Brazil, including some sugarcane production areas, and there is some talk of losses to the crop in the near future unless rains return soon. There are no real rains in the forecast for now. However, the initial harvest has been big and processing has been more active than last year.

India is back to export sugar this year after being a net importer for the last couple of years. The government is subsidizing industry and producers to help maintain an active market flow and to prevent the buildup of sugar in storage. However, the moves announced by the government would not cover much of the problem. Storage would be provided for about a third of the available sugar and the funds will not be enough to solve the financial problems of many mills. India could raise the internal price or try to stockpile supplies in meetings that are now scheduled for this week. Thailand has produced a record crop and is selling. The Middle East and North African buyers are reported to be buying normal or less than normal amounts of sugar in the world market right now.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

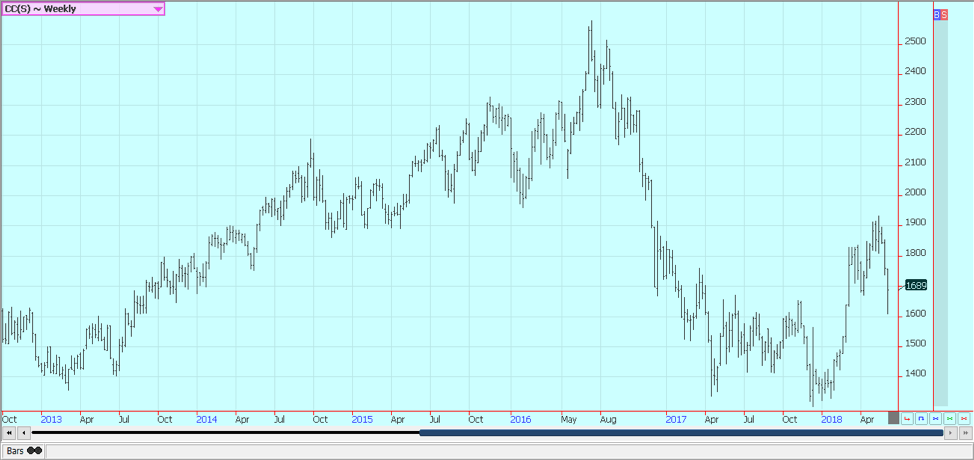

Cocoa

Futures were lower in both markets last week but closed in the upper third of the weekly trading range. The market has filled a big gap now and closed firm, so higher prices are possible this week. Longer term trends remain down, so upside potential, if any, this week might be limited. It is possible that cocoa has now made a significant top in both markets. Funds have turned sellers and appear ready to continue to liquidate long positions due in part to the trend change.

Fears that developed about the EU economy over the weekend spilled into cocoa as Europe is the largest per capita consumer of chocolate in the world. Italy is having problems again and there are fears that the problems there could spread to other EU states. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. Conditions also appear good in East Africa and Asia. The mid-crop harvest is active in West Africa.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech1 week ago

Biotech1 week agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Africa6 days ago

Africa6 days agoFrance and Morocco Sign Agreements to Boost Business Mobility and Investment

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoItaly’s Listed Companies Reach Strong ESG Compliance, Led by Banks and Utilities

-

Fintech3 days ago

Fintech3 days agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

You must be logged in to post a comment Login