Business

This Quant Beat the S&P 500 By 475% — Get Access @ 30% Off This Black Friday

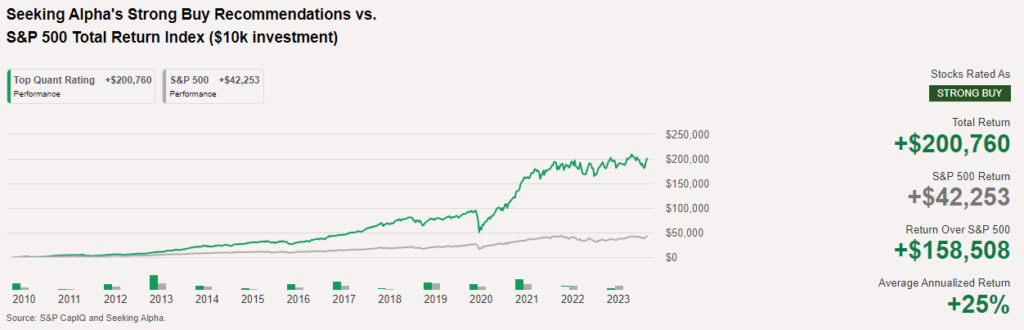

If someone told you there’s a quant out there that’s outperformed the S&P 500 by 475% over the last 10 years, you’d want in on the action, right? Turns out, you can. That quant is none other than the Seeking Alpha Quant ‘Strong Buy’ ratings. And the best part is, you can get access today (along with a bunch of other powerful stock analysis tools and the best research out there) for 30% off.

If you’ve been investing for a while, there’s a good chance you’ve heard of Seeking Alpha. And, if you have, then there’s a good chance you also know about its Quant ratings.

But did you know how the Seeking Alpha Quant has performed over the last 10 years?

Here’s how that looks.

So let’s break this down.

- In the last 10 years, the S&P 500 would have returned $42,253 on an initial $10k investment.

- In that same period, the Seeking Alpha Quant ‘Strong Buy’ ratings returned $200,760 on that same initial investment.

- That means the Seeking Alpha Quant ratings outperformed the S&P 500 by 475%, delivering an annualized return of 25%.

- For comparison, Warren Buffett’s legendary status rests on a mere 19.8% annualized return.

That’s huge.

And so is the 30% off premium subscriptions Seeking Alpha is currently offering as part of the Black Friday festivities.

Here’s why:

- As a reminder, the Seeking Alpha Quant ‘Strong Buy’ ratings outperformed the S&P 500 (and Warren Buffett) by an absolute boatload.

- Access to Seeking Alpha Quant requires a premium subscription.

- That subscription usually goes for $239 per year.

- 30% off bags you a subscription for just $167 for the first year.

And yes, like all good discounts, this is a limited-time offer. So, if you wanna get in on the action, make sure you do it before December 5.

Never Heard of Seeking Alpha? — You’ve Been Missing Out

In case you’ve never heard of Seeking Alpha, here’s a little introduction to what’s on offer (because there’s a whole lot more than just its Quant ratings).

- Financial News, Research, and Analysis: The cornerstone of the Seeking Alpha product is the massive amount of financial news, research, and analysis available in one spot. We’re talking about pretty much every breaking news item for thousands of stocks along with up-to-date research and analysis from thousands of professional analysts.

- An Active Investment Community: Beyond official news and professional analysis, Seeking Alpha is also a great place for crowd-sourced intelligence and ideas — particularly the discussions in the comments section on articles. There is also plenty of user-generated content from contributors, crowd-sourced stock ratings, author Q&A sections, and plenty more.

Now, as for why you might want to upgrade to a premium subscription, that’s for all of the extra features you unlock — including full access to all the research and analysis (a lot of which is subscriber-only).

Also, with 30% off until December 5 (nabbing you a $239/year product for just $167), there’s never been a better time to at least test out the Seeking Alpha premium waters.

Here’s What You Get When You Upgrade to Seeking Alpha Premium

Beyond the research, analysis, news, and crowd-sourced ideas, Seeking Alpha has a lot to offer its premium subscribers.

Here’s a quick rundown of what you can expect:

- Access to All Financial News, Research, and Analysis: As we already mentioned, free users only have limited access to the best research and analysis articles. Premium subscribers, on the other hand, can eat their hearts out with full, unlimited access. This alone is worth the cost of entry.

- Access to the Seeking Alpha Quant Ratings: Remember that thing about Seeking Alpha Quant’s ‘Strong Buy’ ratings outperforming the S&P 500 by a huge margin? If that’s not worth a premium subscription, then I don’t know what is.

- Custom Stock Ratings Alerts: Seeking Alpha tracks stock ratings from its authors, and Wall Street sell-side analysts, along with its own proprietary Quant ratings. As a premium subscriber, you can set up custom alerts so you get notified the moment any of these ratings change for any given stock.

- Powerful Stock Screeners: Seeking Alpha Premium provides you with an incredibly powerful stock screener that allows full customization. Or, if you’re in a hurry, just use one of their preset screeners. Our favorite is the “Top Rated Stock Screener” which screens stocks that have the so-called ‘trifecta’ of strong buy ratings (Wall Street, Seeking Alpha authors, and the all-seeing, all-knowing Quant).

- 10 Years of Historical Data: Whether you want to dig into price history, buy/sell ratings, or financial reports, a world of historical data is at your fingertips with a Seeking Alpha premium subscription.

- Link Your Portfolios at Multiple Brokerages: Using secure, end-to-end encryption provided by a third party, Seeking Alpha can automatically import your current stock holdings, making it a doddle to start setting up alerts and keeping track of your investments.

- Custom Analysis Formats: Beyond stock ratings and articles, Seeking Alpha premium subscribers also get access to other useful stock analysis tools, such as “Bulls vs. Bears” overviews, “notable calls”, and other stock research tools.

And did we mention you can grab all of this for just $167 for your first year?

Dive Deeper Than Ever With Premium

Of course, all of this is just scratching the surface of what you get with Seeking Alpha Premium. For the sake of saving space, we’ve necessarily had to cut out some of the details.

But, to give you just a small taste of what lies ahead for you to discover yourself, let’s take a quick look at the Quant ratings.

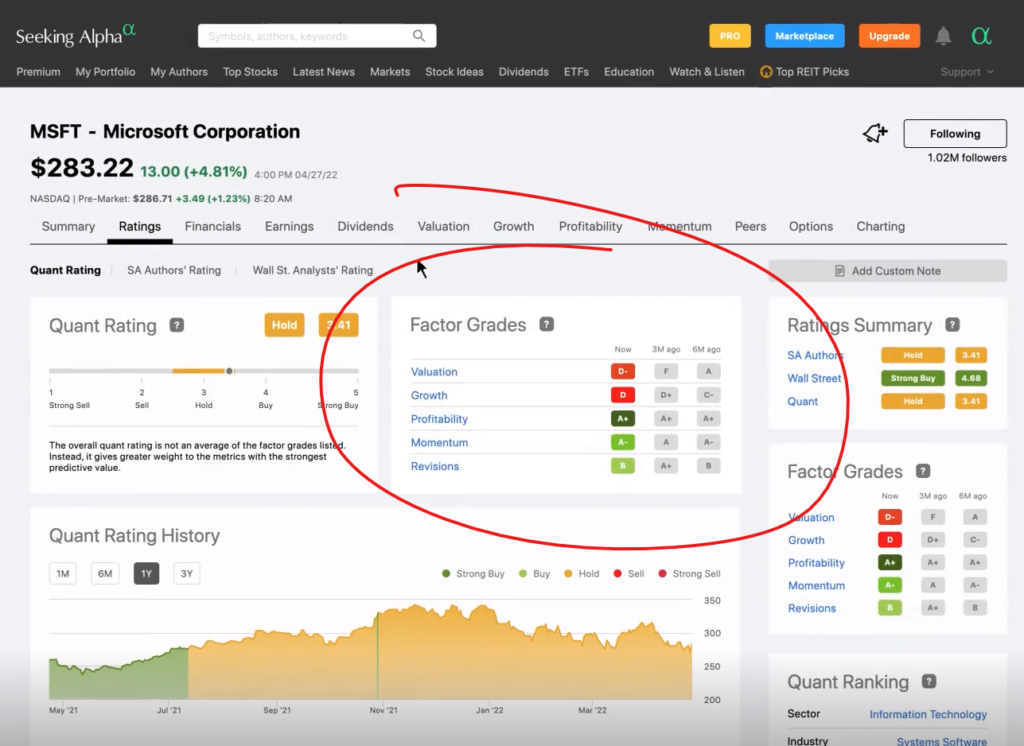

As we’ve already alluded to, Seeking Alpha Quant ratings work a lot like normals buy/sell ratings. The only difference is, there’s a super-intelligent bot doing the rating. However, did you know that, far from being a mysterious black box, you can peer right into the ratings?

Take this following screen, for example — an overview of Microsoft Corporation [NASDAQ: MSFT]. Look out for the “Factor Grades” section.

Now, as for what those factor grades are, they’re the main components used to score a stock and give the Seeking Alpha Quant rating.

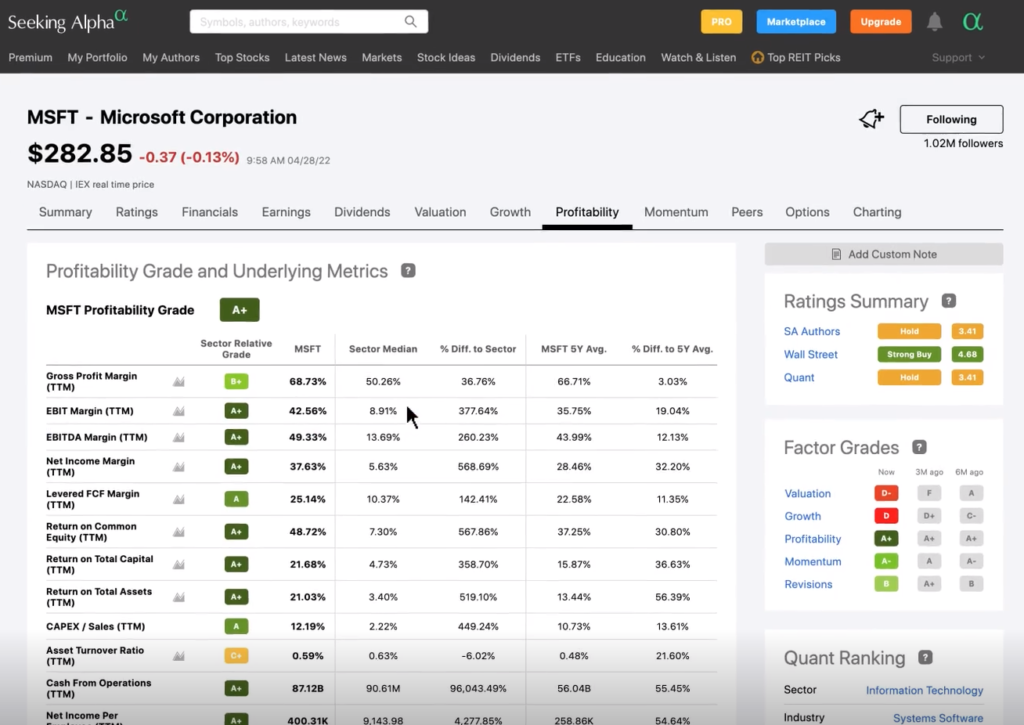

And, for each of those factors, you can dive even deeper. Here’s what happens if you click on the “profitability” grade for Microsoft.

As promised, there are no black boxes here. As a Seeking Alpha Premium subscriber, you get to peek under the hood and get all the details you want.

The only question is, how deep will you go?

Actually, scratch that. There are actually two questions.

Here’s the second:

Did you know Seeking Alpha is currently offering 30% off on your first year as a premium subscriber?

Sign up before December 5 to get what’ll usually cost you $239 for just $167 for your first year.

__

(Featured image by John Angel via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing6 days ago

Impact Investing6 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business3 days ago

Business3 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech1 week ago

Fintech1 week agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich