Featured

S&P follows through on interest rates; Bitcoin climbs again

The S&P improves to a weekly high following Trump’s criticism of interest rates. Bitcoin attains another high at $7,501 but may soar as high as $10,000.

“Economics is extremely useful as a form of employment for economists” —John Kenneth Galbraith

The modern conservative is engaged in one of man’s oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness” —John Kenneth Galbraith

“The only function of economic forecasting is to make astrology look respectable” —John Kenneth Galbraith

“In economics the majority is always wrong”—John Kenneth Galbraith

John Kenneth Galbraith is giant amongst economists. Well, at least amongst liberal economists. He was born in Iona Station, Ontario on October 15, 1908 and passed away in Cambridge, Massachusetts on April 29, 2006. Amongst his influential books were “American Capitalism” (1952), “The New Industrial State” (1967), and “The Affluent Society”(1958). His main criticizers were well-known economists Milton Friedman, Paul Krugman and Robert Solow. Economists could sometimes be placed in two camps—Galbraith or Friedman.

Galbraith served in the Democrat administrations of John F. Kennedy and Lyndon Johnson. He also served as the U.S. Ambassador to India during the Kennedy administration. He was made an Officer of the Order of Canada and was awarded the U.S. Presidential Medal of Freedom.

One of his main theses rejected the technical analysis (differs from the technical analysis we do) and mathematical modeling of neoclassical economics. He believed they were divorced from reality. He believed economic activity could not be distilled into inviolable laws but instead was a complex product of the cultural and political milieu of the day.

One of his books was about “The Great Crash, 1929” (1955) in which he warned of the dangers of an unrestrained speculative mood without proper government oversight. We wonder what he would have thought of the financial crash of 2008, the recession of 2007–2009, and the massive taxpayer bailout that took place after the collapse. We also wonder what he might think today with the unrestrained massive growth of global debt—now estimated at $247 trillion—the massive run-up in stock markets, and the threat of global trade wars and the breakdown of the global economic order created by the U.S. following WW2. Today, it is President Trump and the U.S. that is leading the breakdown.

He was a firm believer in investments in society, including investments in infrastructure, education, and health. We wonder how he would have viewed the massive military buildup by the U.S., currently at the expense of investments in infrastructure, education, and health.

One thing he firmly believed was that speculative bubbles were inherent in a free market system because of mass psychology and that “vested interests” would, in effect, participate in speculative euphoria. Financial memory is notoriously short. Previous financial collapses were somebody else’s mistakes and “this time it is different.” No, it is only the circumstances and the amount of debt that is different. All collapses are financial collapses and in today’s world of unrestrained massive debt, it threatens to be the biggest collapse ever.

Here is Galbraith on debt: “All crisis have involved debt that, in one fashion or another, has become dangerously out of scale in relation to the underlying means of payment.”—from A Short History of Financial Euphoria

It was interesting to read a poll by Angus Reid, reported by the CBC, showing that 1 in 6 Canadians is struggling with finances. Also, according to the poll, more than a quarter of Canadians are suffering from serious financial hardship; they can’t afford to go to a dentist and are borrowing money to buy groceries. A recession would most likely make this even worse.

Without having seen a comparable study for the U.S., the suspicion is that it is actually worse. Consumer (personal) debt in the U.S. totals $19 trillion with student debt at $1.5 trillion and credit card debt $1 trillion. Securitized auto loans stand at over $1.1 trillion. Personal debt per citizen stands at over $58,000. Personal debt in 2008 stood at $17.1 trillion. Compared to the rise in federal government debt, the rise in personal debt has been relatively constrained. It took consumers a number of years to recover from the 2007–2009 financial crash and recession.

But it gets worse. Officially, upwards of 39 million people in the U.S. live in poverty. The actual number is suspected to be closer to 45 million. Over 39 people are on food stamps and over 166 million out of a population of 328 million collect benefits of some sort. Grant you, that includes seniors on Medicare and Social Security. But there are only 52 million retirees while almost 58 million receive Medicaid. Despite Obamacare, over 27 million have no health insurance. Median income adjusted for inflation has barely budged since 2000. According to statistics, average savings per citizen are about $5,000 vs. average debt per citizen of $58,000. Income and net worth inequality have grown considerably since the beginning of the century.

While the consumers have problems, the real risk lies in the banking system. Deutsche Bank, one of the world’s largest banks, has failed Fed stress tests. Deutsche Bank has been placed on the Federal Deposit Insurance Corporation (FDIC) list of problem banks. That only pertains to Deutsche Bank’s U.S. operations. Deutsche Bank, Germany, is still deemed safe, at least according to ECB stress tests that are not as stringent as the Fed’s. But banking problems lurk in Europe, particularly Italy, with an estimated €224 billion of nonperforming loans. That is over 25 percent of all loans. Other EU countries with high nonperforming loans as a total of all loans include Greece, Romania, Portugal, Ireland, Czech Republic, Bulgaria, Romania and Cyprus. Greece is still being negatively impacted by the sovereign debt crisis of 2011 and still has not exited its bailout program.

But there are also sovereign debt problems in Venezuela, Argentina and Ukraine. A number of smaller African countries (i.e., Republic of Congo) and Asian countries (i.e., Afghanistan) have serious debt problems, but most of them are too small to cause a global meltdown. The largest debt growth since the financial crisis of 2008 has been in China, but the Chinese maintain strong growth and have the wherewithal to contain problems. But slower Chinese growth due to trade wars could cause problems elsewhere.

Many point out the U.S. is bankrupt, and when one considers their unfunded liabilities of $114 trillion in Medicare and Social Security, it does seem they are on the road to ruin. But the U.S. economy is strong relative to many others; also, the US$ is still the world’s reserve currency, which gives them an advantage many others do not have. Still, it is disconcerting to know that U.S. Federal Debt has grown by almost $1.4 trillion in the past year and is up $1.2 trillion since Trump took office (yes, initially, it did dip). The U.S. is expected to add almost $1.2 trillion/year for the next decade, thanks to the Trump tax cuts. U.S. debt to GDP currently stands at 105 percent and is expected to rise over the next year or two to 108 percent.

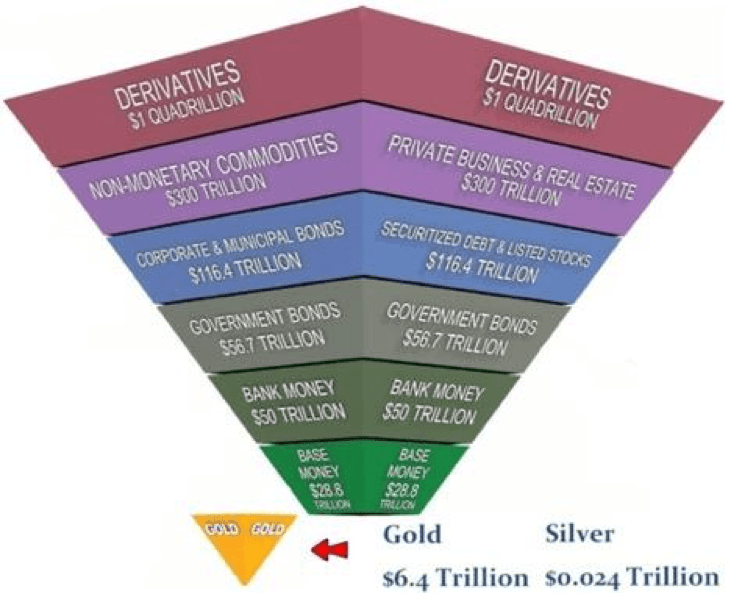

Here’s an interesting chart. This inverted chart is known as an Exter’s Pyramid (sometimes called Exter’s Golden Pyramid). It was named after its creator John Exter, an American economist and former member of the Board of Governors of the Federal Reserve. What it depicts is asset classes in terms of risk and size. While notionally derivatives are at the top, their actual risk is considerably lower. No, there is not really a risk of $1 quadrillion of derivatives blowing up. But the massive amount of growth in asset values since the 1970s has been largely due to massive growth of credit and with the help of derivatives. If it hadn’t been for credit and derivatives, the valuation of all assets would be considerably lower. Assets are merely promises to pay or perform something in the future.

© David Chapman

Note what is on the bottom of the pyramid—yes, gold (and silver). They are at the bottom of the base for good reason. There is not that much of it. It is nobody’s liability. The higher one goes in the pyramid the riskier the asset. High-risk assets now make up the bulk of the pyramid. “Systemic risk” is prevalent throughout the financial system especially with $247 trillion of debt outstanding. We don’t know where the next financial crisis will come from, but after nine years of recovery and expansion time is running out. A trigger could cause a contagion whereby a financial collapse in one spot soon spreads elsewhere before spreading around the world and threatening to bring down the global financial system.

Over the past 20 years, we’ve had two scares: first in 1998 and then in 2008 where, without the ability of the central banks to bail out the financial system, we could have had a global financial meltdown. Today, the central banks are more compromised than ever and no longer have the ability to bail out another global financial crisis. That is why the Western countries passed bail-in legislation whereby it is depositors and bond holders whose funds will disappear to bail out the financial system in the event of another systemic meltdown.

While nobody seems to want gold and silver now (we are talking physical gold and silver, not paper gold and silver that overwhelms the physical), it is highly likely to soar in price as other assets tumble in value. Everything was created by debt, but gold and silver were created by digging it out of the ground. Yet in today’s depressed market, fewer are digging and that should create shortages further down the road. Debt to GDP ratios are at such huge levels the Western countries (EU, Japan, US/Canada, etc.) have reached levels that one might have considered only for banana republics thirty years ago.

It is interesting to note that, while many think the stock market is the place to be, and although the Dow Jones Industrials (DJI) has gone up 2,700 percent, since August 1971 when the world went off the gold standard, gold is actually up 3,300 percent in the same timeframe. Grant you, gold was fixed at $35 back in those days. Yet, surprisingly, many consider gold as high risk. Despite price fluctuations, it actually is not.

Galbraith’s economic theories did not carry the day. Yet he had numerous excellent ideas that might have stemmed today’s potential for another global financial crisis. After nine years, it is not a question of will it happen—it is a question of when. Owning a little gold and silver should help protect you because at least it is real and tangible.

Bitcoin watch!

© David Chapman

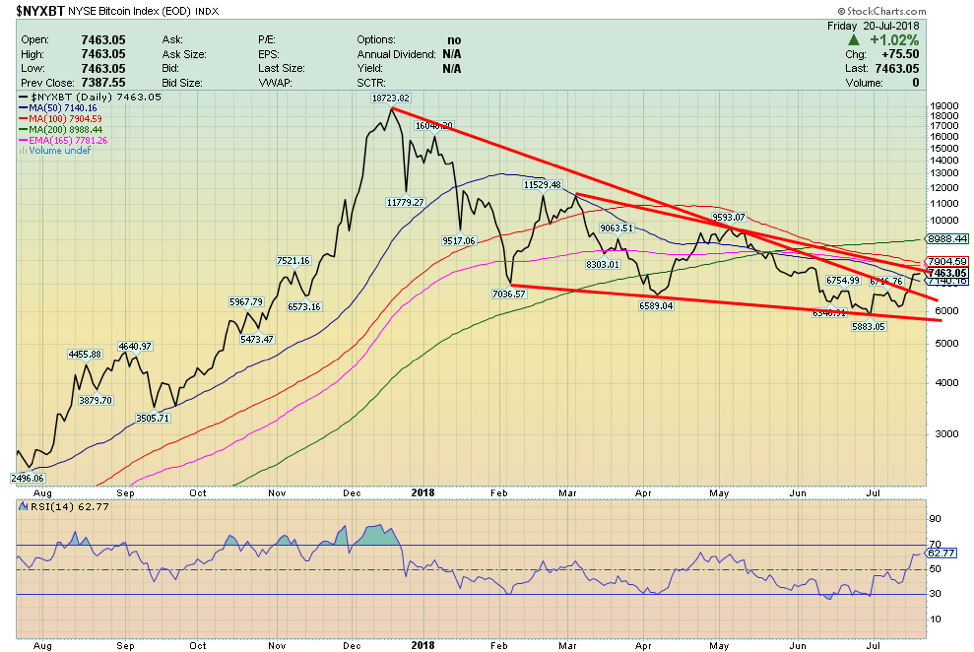

Institutional investors. That appears to be the prime reason Bitcoin and other cryptocurrencies have suddenly jumped. Goldman Sachs and BlackRock are amongst the firms showing interest in Bitcoin and other currencies. It sparked some to speculate that cryptocurrencies could be in the same position as tech stocks in 1995. The next five years saw massive gains in tech stocks, culminating in a blow-off in 2000, followed by a crash that wiped billions off the market. Many high-tech stocks went from $100 to pennies and many others just disappeared.

Certainly, there is no doubt that if institutional players jumped in in a big way that it could push the market substantially higher. It is still by most measurements a small market. But it also seems rather optimistic to state that Bitcoin will soar to $65,000. If correct, there is still a lot of work to be done.

As the chart shows, Bitcoin appears to have broken out to the upside. One could argue the pattern was a descending wedge, although we usually prefer them to be steeper. It wasn’t. But, nonetheless, the triangle could suggest that Bitcoin may rise to $10,500. There is resistance around $7,500. The high, so far, has been seen at $7,501. As we head into the weekend Bitcoin is showing signs it should break out over $7,500 and head for the next level.

According to Coin Market Cap, the market cap of all cryptos has jumped to $281 billion, up $32 billion on the week from $249 billion. The number of cryptos has also taken a big jump with 1,656 listed, up from 1,615 the previous week. This week, we picked up BigONE Token (BIG), Sharkcoin (SAK), Birds (BIRDS), and Smoke (SMOKE). There are 18 coins listed as having a market cap of $1 billion or higher. Bitcoin gained about 19 percent on the week. Others having a big week for cryptos over $1 billion included Stellar (XLM), up 47 percent, Cardano (ADA), up 29 percent, and Dash (DASH), gaining about 20 percent. The number of deceased, hacked, or parody coins listed at Dead Coins rose to 876 from 862 the previous week.

© David Chapman

Markets and trends

% Gains (Losses) Trends

| Close

Dec 31/17 |

Close

Jul 20/18 |

Week | YTD | Daily (Short Term) | Weekly (Intermediate) | Monthly (Long Term) | |

| Stock Market Indices | |||||||

| S&P 500 | 2,673.63 | 2801.83 | flat | 4.8% | up | up | up (topping) |

| Dow Jones Industrials | 24,719.22 | 25,058.12 | 0.2% | 1.4%

|

up | up | up (topping) |

| Dow Jones Transports | 10,612.29 | 10,741.50 | 1.9% | 1.2% | neutral | up (weak) | up (topping) |

| NASDAQ | 6,903.39 | 7,820.20 (new highs) | (0.1)% | 13.3% | up | up | up (topping) |

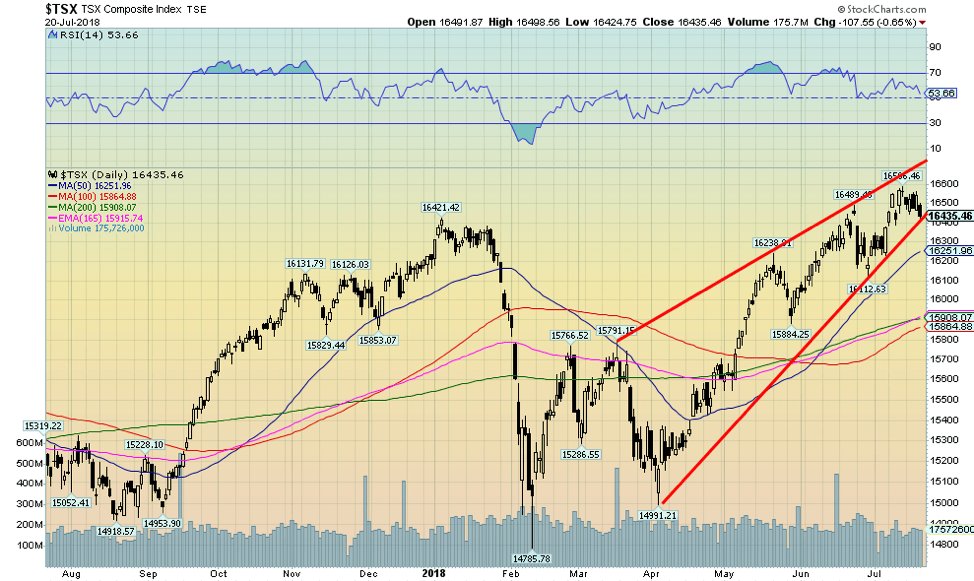

| S&P/TSX Composite | 16,209.13 | 16,435.46 | (0.8)% | 1.4% | up | up | up (topping) |

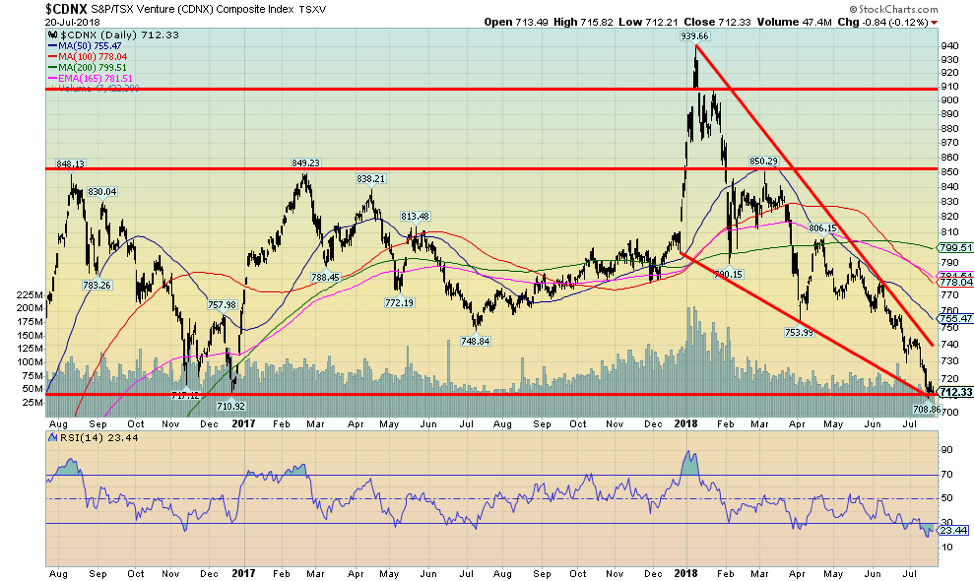

| S&P/TSX Venture (CDNX) | 850.72 | 712.33 | (1.8)% | (16.3)% | down | down | neutral |

| Russell 2000 | 1,535.51 | 1,696.81 | 0.6% | 10.5% | up | up | up (topping) |

| MSCI World Index | 2,046.47 | 1,981.51 | 0.5% | (3.2)% | neutral | down | up (topping) |

| NYSE Bitcoin Index | 14,492.18 | 7,463.05 | 19.3% | (48.5)% | up | down | neutral |

| Gold Mining Stock Indices | |||||||

| Gold Bugs Index (HUI) | 192.31 | 172.02 | (0.9)% | (10.6)% | down | down | neutral |

| TSX Gold Index (TGD) | 195.71 | 188.84 | flat | (3.5)% | down (weak) | neutral | neutral |

| Fixed Income Yields/Spreads | |||||||

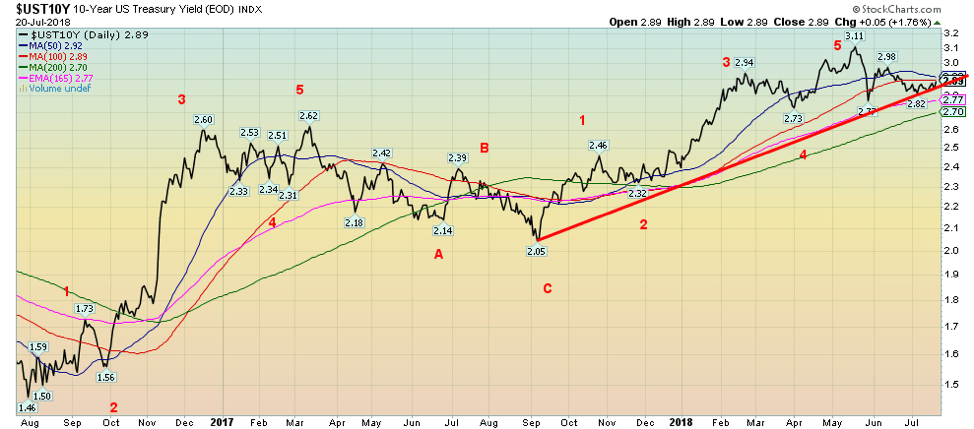

| U.S. 10-Year Treasury yield | 2.40 | 2.89 | 2.1% | 20.4% | |||

| Cdn. 10-Year Bond yield | 2.04 | 2.18 | 1.9% | 6.9% | |||

| Recession Watch Spreads | |||||||

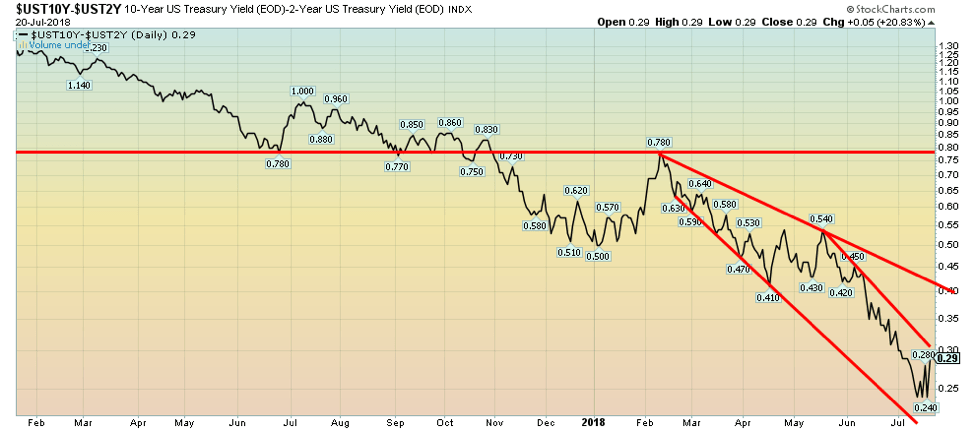

| U.S. 2-year 10-year Treasury spread | 0.51 | 0.29 | 20.8% | (43.1)% | |||

| Cdn 2-year 10-year CGB spread | 0.36 | 0.25 | 25.0% | (30.6)% | |||

| Currencies | |||||||

| US$ Index | 91.99 | 94.23 | (0.3)% | 2.4% | up (weak) | up | down (weak) |

| Canadian $ | 0.7990 | 0.7620 | 0.1% | (4.6)% | down (weak) | down | down (weak) |

| Euro | 120.03 | 117.25 | 0.4% | (2.3)% | up (weak) | down | up |

| British Pound | 135.04 | 131.32 | (0.8)% | (2.8)% | down | down | down (weak) |

| Japanese Yen | 88.76 | 89.69 | 0.8% | 1.1% | down | down | neutral |

| Precious Metals | |||||||

| Gold | 1,309.30 | 1,231.10 | (0.8)% | (5.6)% | down | down | neutral |

| Silver | 17.15 | 15.55 | (1.6)% | (9.3)% | down | down | down |

| Platinum | 938.30 | 829.50 | (0.1)% | (11.6)% | down | down | down |

| Base Metals | |||||||

| Palladium | 1,061.00 | 888.90 | (4.7)% | (16.4)% | down | down | up |

| Copper | 3.30 | 2.76 | (0.7)% | (16.4)% | down | down | up (weak) |

| Energy | |||||||

| WTI Oil | 60.42 | 68.26 | (3.9)% | 13.0% | neutral | up | up |

| Natural Gas | 2.95 | 2.76 | 0.4% | (6.4)% | down | down | neutral |

New highs/lows refer to new 52-week highs/lows. © David Chapman

© David Chapman

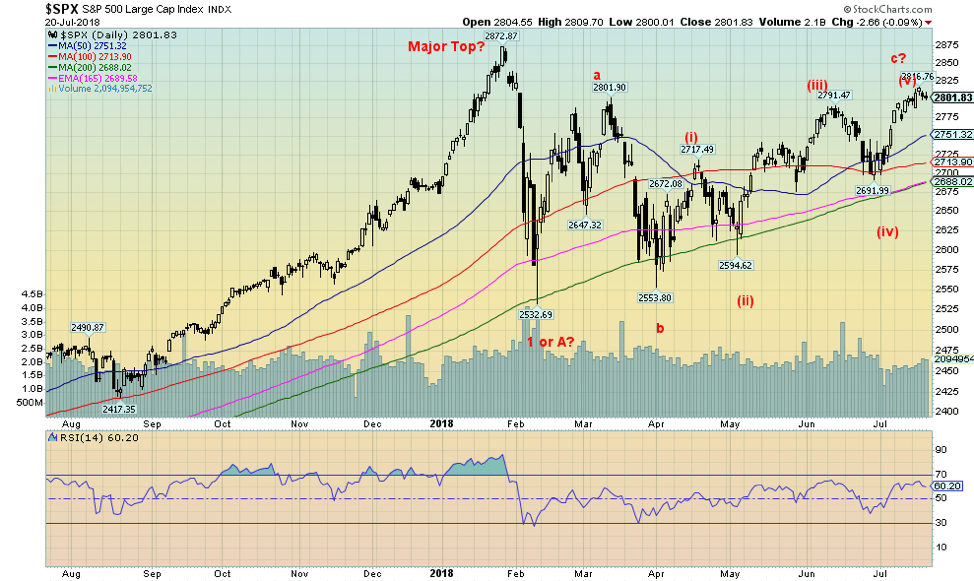

The S&P 500 moved to new highs for the current up move this past week. It faltered on Friday following Trump’s criticism of Fed Chairman Jerome Powell and his comments about the US$ and interest rates. We discuss Trump and the Fed later under Bonds. In the end, the S&P 500 was flat on the week. The Dow Jones Industrials (DJI) gained less than 0.2 percent, the Dow Jones Transportations (DJT) was up 1.9 percent thanks to lower oil prices, while the NASDAQ actually fell 0.1 percent. Elsewhere, the TSX Composite lost 0.8 percent, the TSX Venture Exchange (CDNX) continued its woes down 1.8 percent. Internationally, the London FTSE 100 was essentially flat, the Chinese Shanghai Index fell a small 0.1 percent, the Paris CAC 40 was off 0.6 percent, but the German DAX rose 0.2 percent and the Tokyo Nikkei Dow (TKN) was up 0.4 percent.

Nothing has really changed. The S&P 500 continues to trace out what appears to be a complex corrective pattern that could still have a few more months to go. Trump’s clash with Fed Chair Jerome Powell hurt the market on Friday but only mildly. It remains to be seen whether the conflict could unnerve the stock markets, but it certainly could. As one can see, volume on this rise has been anemic. The break above the March high at 2,801 suggests there is some potential that the S&P 500 could make new all-time highs. The S&P 500 breaks under 2,750, but the major breakdown does not occur until under 2,690. There would be further support down to 2,530.

Potential fights with the Fed and currency wars, coupled with trade wars, could still be the “ungluing” of this market.

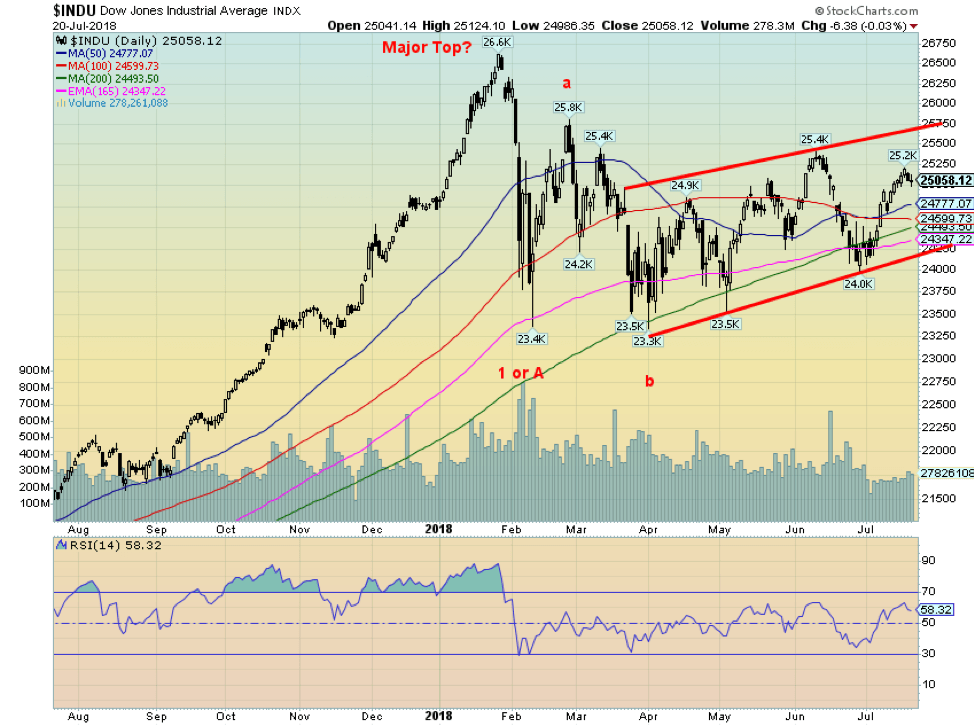

© David Chapman

Here is the Dow Jones Industrials (DJI). Looks similar to the S&P 500 except, unlike the S&P 500, the DJI has failed, so far, to make any new highs for the current up move. As with the S&P 500, we can’t tell just yet whether the DJI has topped. But until the DJI makes new highs to confirm the S&P 500, this could be a significant divergence. It is noted that the NASDAQ made new all-time highs even as the S&P 500 only made new highs for the current move up. The Dow Jones Transportations (DJT), like the DJI, remains short of new highs. There are a number of divergences. The problem with divergences is that they are only divergences until either confirms each other or the market, in this case, breaks to the downside.

Divergences are often seen at major highs and lows. Note how the 200-day MA has held the market for the past few months. But all of this action reminds us of 2000 when the markets diverged in January and March, then spent the next six months going up and down but never again making new highs. In late 2000, the market started to crack to the downside as the high-tech crash got underway. This market also reminds us of the gold market in 2012. Gold topped in September 2011 at over $1,900, then spent the next year going back and forth from roughly $1,700 to $1,525.

In October 2012, it made its final top and then cracked in early 2013, crashing $400. Markets can fool people following potentially significant tops as we saw in January. These extended corrective moves constantly give investors the feeling that it is just a matter of time before the market breaks to new highs. Then they get chopped, as was seen in 2000 and 2012. From what we are seeing so far, another downside surprise could be setting up. But it might not happen for a few more months. The DJI breaks down under 24,200.

© David Chapman

If this rising or ascending wedge triangle is correct, then the rally for the TSX Composite could be on its last legs. A breakdown under 16,400 would confirm the breakdown. Ascending wedge triangles have a tendency to go back to where they started. That suggests a move back to 14,990. New highs above 16,506 might stave this off for a short while, but this wedge triangle looks increasingly dangerous.

© David Chapman

If the TSX Composite looks dangerous, the TSX Venture Exchange (CDNX) looks increasingly juicy. The opposite of an ascending wedge triangle is a descending wedge triangle. Just like an ascending wedge is bearish, the descending wedge is bullish. If this pattern is correct, then the CDNX has the potential to go all the way back to its earlier highs at 940.

Note the RSI is down at 23. Sentiment towards the junior index is exceedingly low. The CDNX is also at significant support back where it was in December 2017. This pattern has tremendous potential for those who participate in the junior market. The market is roughly 50 percent junior mining companies. Some individual companies could double or triple or more.

© David Chapman

For the most part, long interest rates really didn’t do much this past week. The 10-year U.S. Treasury note rose slightly to 2.89 percent, up from 2.83 percent the previous week. We consider this a bounce back and unless we can take out 2.98 percent/3.00 percent on the upside, we believe we have seen our high at 3.11 percent. What is unconfirmed is the breakdown and that won’t occur until the yield falls under 2.70 percent. Irrespective of what we might think about Trump’s looming war with the Fed, odds might actually favor a rush into U.S. Treasuries for safety reasons.

Yes, Trump’s war with the Fed. In what could prove to be a very dangerous move, Trump has picked a fight with the Federal Reserve, saying he was against a strong dollar and “not thrilled” about more hikes in interest rates. The US$ fell and commodities rose. In an editorial in The Globe and Mail, columnist Ian McGuigan described Trump’s attack on Fed Chairman Jerome Powell akin to waking up to a bloody horse’s head (“Trump’s meddling in Fed Policy could backfire,” Ian McGuigan, The Globe and Mail ROB, July 21, 2018). Bottom line: Presidents, or Prime Ministers for that matter, don’t criticize central bank policy, at least not publicly. Central banks are independent of the government and any thought that the government could mess around in monetary policy could cause markets to “freak.”

Oh, it has happened before. Lyndon Johnson fought with Fed Chair William McChesney Martin. The confrontation was monumental as Martin refused to bend. Martin had been around for some time as he was appointed by President Truman and had served through the Eisenhower and Kennedy White House as well. There was also considerable tension between former President Richard Nixon and Fed Chair Arthur Burns.

But will this end here or will it escalate? Given Trump’s propensity to shake things up and fire people who don’t do his bidding this might actually happen. But it would be disastrous. It’s one thing to fire Steve Bannon; it’s another to meddle with the Fed. Either Trump doesn’t know this or he doesn’t care. He was want to get what he wants. But to fire a Fed Chair now would be disastrous. What Trump doesn’t seem to get is that his policies are actually forcing the Fed’s hand. They will most likely have to stick to their plan to hike rates in September and December just to show that it is the Fed in charge, not Trump.

The massive tax cuts have helped raise inflation and, yes, stimulated the economy further. It is also going to create humungous deficits for the next decade. Already, debt has soared over $1 trillion under Trump and the forecasts are for $1 trillion deficits. Would Trump fire Powell? It is not likely as that would unleash considerable uncertainty on to markets—the US$ would fall further and the stock markets would probably crash. But it might help bond yields as they would fall but the short end would rise. None of this is positive.

Recession watch spread

© David Chapman

Given Trump’s musings about the Fed Chair, longer-dated rates edged higher while short rates were softer largely because of the uncertainty Trump created. Odds still favor a rate hike in September despite Trump, as for Powell not to hike rates in September would send the wrong message that Trump may now be in charge, not Powell. The 2–10 spread jumped to 0.29 percent this past week, up from 0.24 percent the previous week. Canada saw its 2–10 spread rise as well to 0.25 percent from 0.20 percent. Keep in mind, though, the trend is still down and odds favor the downtrend to continue. There is some resistance at 0.30 percent, but above that, a run to 0.40 percent could occur. None of it signals any recession right now. Historically, the recession didn’t occur until we at least saw roughly six months of a negative 2–10 spread. But the trend remains the same and our thought remains that the spread should go negative sometime in 2019.

© David Chapman

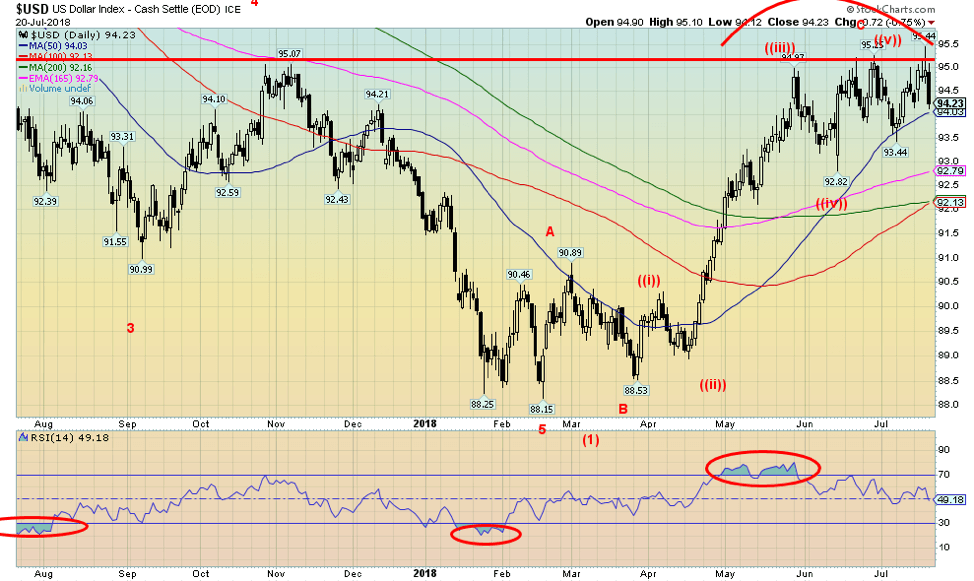

Are currency wars about to erupt? That is the potential conclusion from President Trump’s latest Twitter storm, accusing China and the EU of currency manipulation. Our “Chart of the Week” looks at the Chinese Yuan, which has been falling sharply lately. Nonetheless, Trump’s Twitter storm attacked China and the EU as not only currency manipulators but as well for manipulating interest rates lower. That unleashed his tirade against Fed Chairman Jerome Powell that we discussed under bonds. All of this is so interrelated now it is difficult to separate one from the other. Nonetheless, Friday’s action saw the US$ Index plunge 0.72 to 94.23 after hitting a high earlier in the week of 95.44. It constitutes a reversal week with a new high and a lower close. Overall, the US$ Index only lost 0.3 percent but was down 1.3 percent from the high. At the other end, the Euro gained almost 0.4 percent, the Japanese Yen was up 0.8 percent, while the Cdn$ was up a smaller 0.1 percent. Because of Brexit woes, the British Pound fell almost 0.8 percent.

It is a dangerous game of brinkmanship that Trump is playing and it is becoming increasingly acrimonious. Trump has raised the ante recently by suggesting tariffs on $500 billion of Chinese goods, up from $200 billion. The Chinese will retaliate. The consequences of a currency war go far beyond the US$ and the Yuan. It impacts the global economy. Oil, gold, and other commodities all jumped higher on the news. The potential collateral damage in all of this is emerging market debt. Not sure one would want to own any right now. If global trade collapses, even we are not sure what will happen. Trump has threatened to pull the U.S. out of the WTO and if that happened the global trade order that was created by the U.S. would collapse or at minimum struggle. A currency war could mean further losses for the US$. Trump has almost deemed it so as he clearly wants a lower US$. And, as we discussed under Bonds, this puts the Fed in an extremely uncompromising position. We’d also have both a trade war and a currency war.

Technically the US$ Index has reversed this past week and appears poised for more losses. This is three thrusts above 95, each one slightly higher than the other. We have noted this pattern in the past and following the third thrust look out below. The breakdown probably comes under 94 with confirmation under 93. Only new highs above 95.44 could change this increasingly negative looking scenario.

© David Chapman

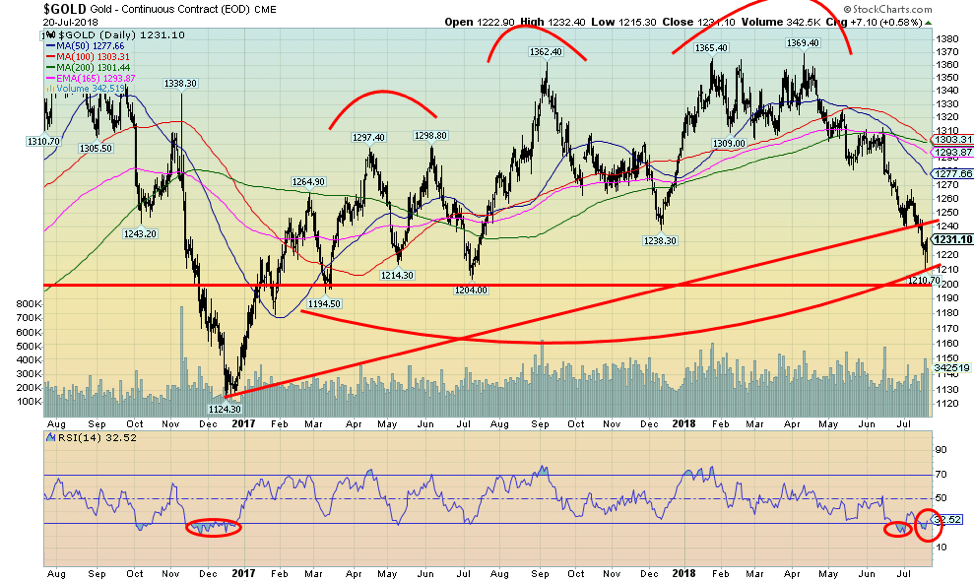

Thanks to Donald Trump picking a fight with the Fed over interest rates and the US$, the US$ fell on Friday and gold prices jumped $7 ($9 for cash gold). Gold prices rose from a sub 30 RSI for the second time recently. The drop in gold prices has been vicious and has caused many to throw in the towel. But with huge negative sentiment rivaling what we saw at the bottom of markets in 2015 and 2001, a potential substantial rally could soon get underway. We couldn’t help but notice a rather huge spike in volume in the SPDRS Gold Shares (GLD-NYSE) this week and absolutely huge volume in the Direxion Daily Gold Miners Index Bull 3X ETF (NUGT-NYSE). The latter is affectionately known as the “Nuggets.”

If the pattern that formed back in February/April 2018 was a double top at $1,365 and $1,369, the target was to at least $1,240/$1,250. Instead, we tested lower to a low of $1,210. That tested our major line in the sand at $1,200. A breakdown under that level could have meant a huge washout decline to $1,100. While we doubted it, we couldn’t dismiss it. But gold has some daunting tasks ahead as there is clear resistance up to around the old support of $1,310. But above $1,320 we could start a strong rally. Major resistance would remain at $1,365/$1,370. There is the old saying that the time to buy is when there is blood on the streets. And right now, the gold and precious metals market is bleeding.

For the record, gold fell 0.8 percent this past week, silver fell 1.6 percent, but platinum was down only 0.1 percent. It was palladium that was hit hard, down 4.7 percent while copper was down 0.7 percent. All bounced back from new lows to the downside after Trump’s attack on the Fed. Wouldn’t it be ironic that Donald Trump becomes the catalyst for a new gold bull. Everything he is doing is ultimately good for gold even if it doesn’t feel like it right now.

© David Chapman

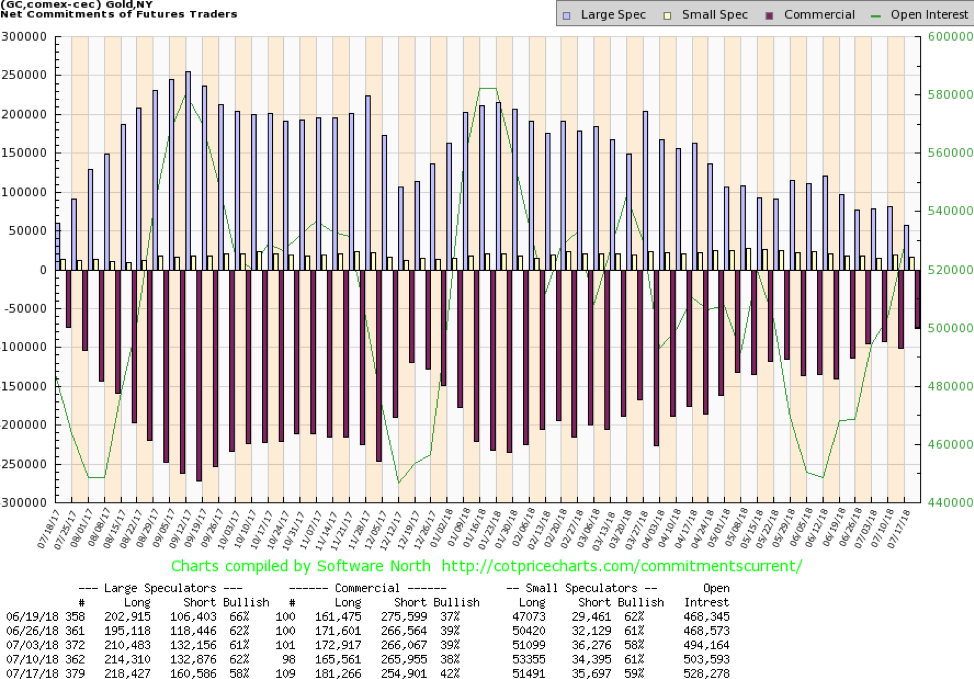

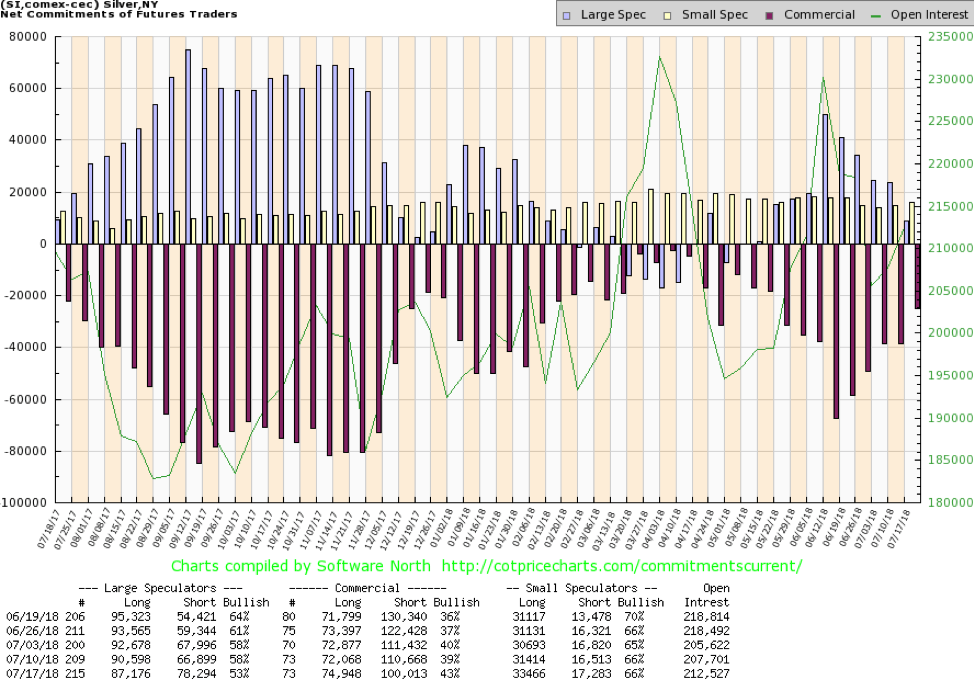

There is some hope for optimism as the gold commercial COT improved this past week to 42 percent from 38 percent the previous week. The large speculators COT (hedge funds, managed futures, etc.) fell to 58 percent from 62 percent. The large speculators have a history of being caught at market bottoms and tops. The commercial COT saw long open interest jump almost 16,000 contracts while short open interest fell roughly 11,000 contracts. The large speculators COT also saw long open interest rise by about 4,000 contracts but it was the huge 28,000 contracts rise in short open interest that caught the eye. This is the best we have seen the commercial COT since December 2017, just before a good rally that saw gold rise from $1,238 to $1,369.

© David Chapman

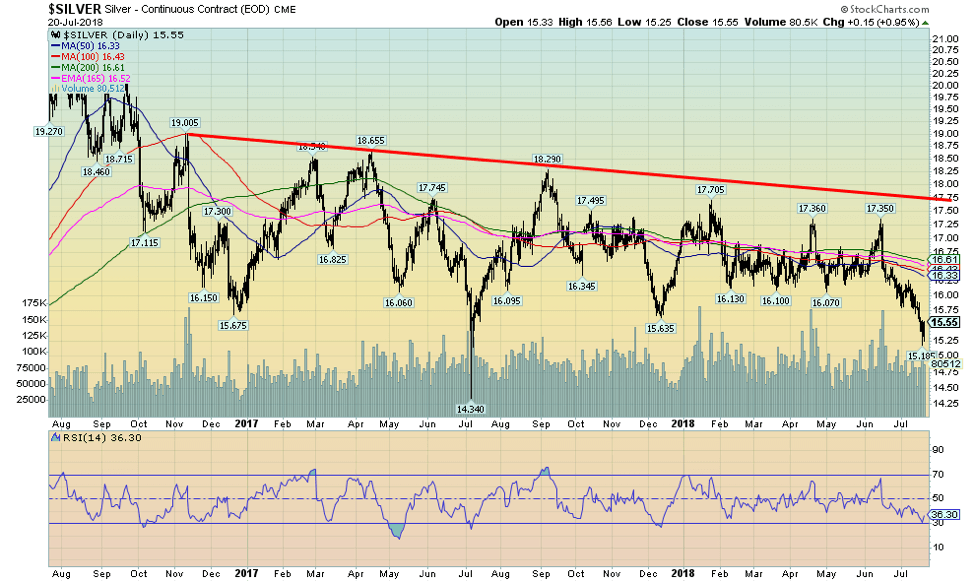

Silver prices have been downright miserable, falling 1.6 percent this past week and are now down 9.3 percent on the year. Silver fell to a new low at $15.18 this past week before recovering sharply at the end of the week to close at $15.55. All of that was thanks to Trump’s musings about the Fed and the US$. We are not sure of the pattern any longer. Maybe it’s a double bottom rather than the original head and shoulders bottom we thought was forming. We are well up from that $14.34 spike low seen last July 2017, but we also took out the December 2016 low at $15.68 that would have been the left shoulder of a possible head and shoulder bottom.

We had, however, been noting before this recent drop of a possible descending triangle forming. Oddly, it had targets potentially down to that July 2017 low. Given Friday’s action, we doubt we will fall that low now, but it remains possible until silver regains at least above $16. But even above that level, there would be considerably more work to do as there is clear resistance up to around $16.60. Finally, there would be major resistance up to $17.75. All of that is $2 away and right now that might as well be $100. But as we saw last July 2017, once silver prices get moving the rise can be quick. Last year, silver rose from that $14.34 bottom to a high of $18.29 by September. Silver remains cheap compared to gold with the gold/silver ratio currently at 79. That is down from highs at 83/84 but a long way from lows seen in 2016 at 65. The recent low at $15.18 should now become support and as long as we make no new lows silver prices could start to rise. Sentiment for silver as it is with gold is as bad as we have ever seen it.

© David Chapman

Like the gold commercial COT, the silver commercial COT improved markedly this past week. The silver commercial COT jumped from 39% to 43% the best jump in weeks. Long open interest rose almost 3,000 contracts while short open interest fell over 10,000 contracts. The commercials were covering their shorts. The large speculators COT fell to 53% from 58% as they added substantially to their short position by roughly 11,000 contracts while trimming their long position by over 3,000 contracts. As we have seen many times in the past, the large speculators either getting short or bailing at the bottom is not unusual.

© David Chapman

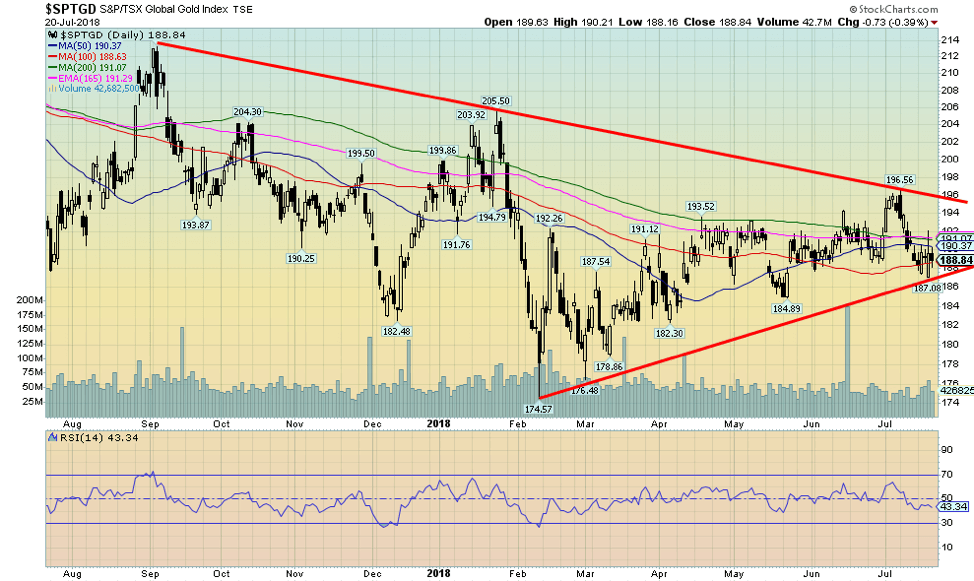

In the face of weak gold and silver prices the gold stocks have been quite resilient. Bill Murphy of GATA fame has repeated in a recent interview the line that gold and silver prices have been manipulated lower. Yes, that is always a possibility. But the gold stocks have outperformed and held up remarkably well. The TSX Gold Index (TGD) was essentially flat this past week despite the decline in both gold and silver. The Gold Bugs Index (HUI) continued its losing ways, falling 0.9% and is now down 10.6% on the year. We like the fact that the gold stocks have been diverging with gold and silver. The TGD got a boost this week with stories of a potential takeover of Detour Gold (DGC-TSX).

As a result, Detour jumped 6.6% on the week. The rumour emanated from Paulson & Co., a large shareholder and a NY-based hedge fund. Indeed, a spat broke out between Detour and Paulson leading Detour to lodge a complaint with the OSC. Nonetheless, Detour broke out on high volume and closed over its 200-day MA. From a technical perspective the breakout looks good. And that in turn should help the gold mining market. The TGD has found some support at the 100-day MA but once again 192/193 looms as resistance and the major breakout point appear to be at 196. The TGD has made a nice series of rising highs and rising lows, the very definition of an uptrend. The last time we saw a strong divergence between gold and silver and the gold stocks was the major low in 2001.

© David Chapman

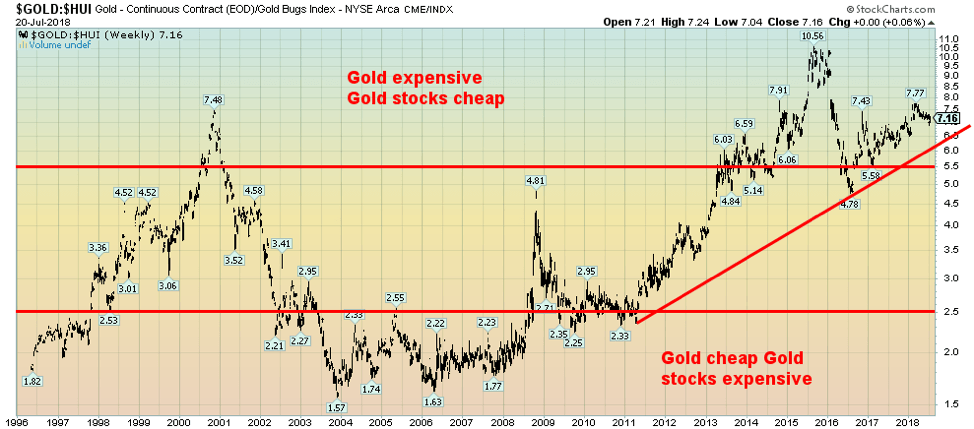

Gold stocks remain cheap compared to gold. This has been going on now for the past 5+ years. Unlike what occurred back in 2000, the gold stocks have remained cheaper compared to gold than anything seen before. The Gold/HUI ratio currently sits at 7.16, well down from the high seen in 2016 at 10.56 and down from the recent high of 7.77. There still could be an awkward head and shoulders forming here, but we are loath to call it that now. There are two key breakdown zones for the Gold/HUI ratio: first at 6.5 and again at 5.5.

The gold stocks’ relative outperformance of late is encouraging, but there remains so much work to be done that even we would agree the skeptics rule. Since the beginning of 2000, gold itself remains the best performer with a gain of 325%. Silver is up 185%, but the gold stocks have underperformed with the HUI up 132% and the TGD up 114%. Despite the huge gains of the past few years and the clear outperformance of the broader markets, the S&P 500 is up only 90% during the same time period. Yet right now it is gold, silver, and the gold stocks that are unloved and unwanted. The precious metals saw their best gains up to 2011. Since then it has been a downward struggle.

© David Chapman

WTI oil responded positively to the drop in the US$ on Friday as it rose for third day in a row. So far, it appears to have found support around the 100-day MA just as it did back in June. As we noted elsewhere, Trump’s jibe at the Fed at hiking interest rates and causing the US$ to rise sparked the US$ lower and commodity prices higher. WTI oil still ended down on the week, losing almost $3. Brent crude fell only $1.90, closing just above $73. Comments from the Saudis that they would not oversupply the market also helped support oil prices at the end of the week. The energy stocks fell on the week as the TSX Energy Index (TEN) lost 3.2%. We are not convinced that the energy rally is over as the TEN holds above its 4-year MA.

The reality is, however, the TEN needs to take out the 213 high seen back in May to suggest higher prices. There is support for the TEN down to 200 and below that down to 190. WTI oil has resistance now at $69/$70, but above that level a test of the $75 high would most likely get under way. New lows below $66 would suggest a fall to next good support at $63/$64. The positive response of oil prices as well as other commodities at the end of the week was a result of the fall in the US$. As we noted under our discussion of the US$ Index it is quite possible now that it has topped.

Chart of the week

© David Chapman

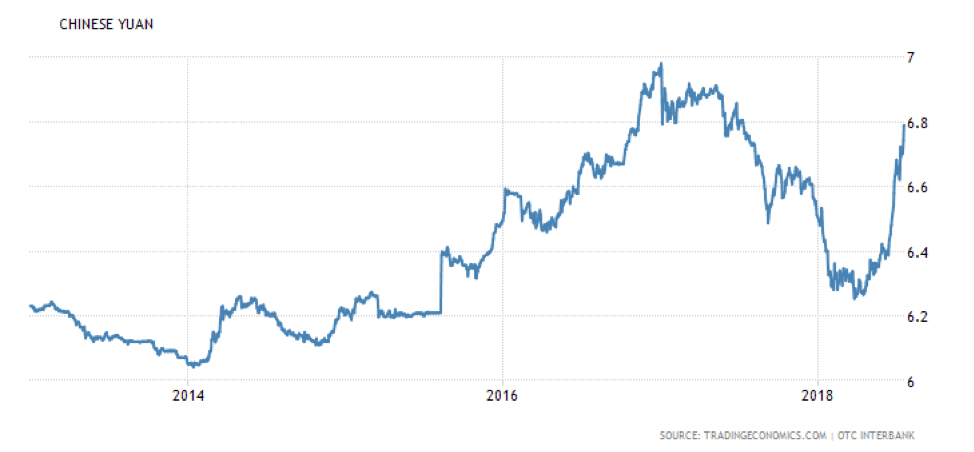

Is a currency war about to erupt? Well, in a way it has already been ongoing. James Rickards wrote a book titled Currency Wars back in 2011. He called currency wars one of the most destructive and feared outcomes in international economics. Currency wars have occurred twice in the past century. One helped bring about the Great Depression and the other brought about the inflationary years of the 1970s. Rickards had two chapters devoted to these wars, the first being from 1921–1936 and the second one from 1967–1987. The current currency war is pegged to have started in 2010.

In currency wars nobody wins. They are an extension of trade wars. And now that trade wars are heating up currency wars will also heat up. China has started devaluing the Yuan as a measure to combat Trump’s trade wars. Trump has hinted at an additional $500 billion of tariffs, up from his previous $200 billion. The Chinese Yuan has fallen over the past few weeks from about US$1=6.25 Yuan to US$1=6.84 Yuan a 9.4% devaluation. Chinese banks have been selling U.S. Dollars to support the currency and there are expectations that PBOC will inject more liquidity into the financial system to support industries under pressure from Trump’s tariffs. PBOC is doing this through a form of QE.

So, the fear now is that China will push a currency war to counteract trade wars. The US$ had moved higher as a result against all major currencies including the Euro, the Japanese Yen, and the British Pound. With a higher US$ commodities including oil, metals and gold all fell.

But has round two of currency wars now been shot? President Trump has criticized the Fed for hiking interest rates. As we noted earlier, this is something that Presidents do not comment on so as to maintain a separation between the Fed and administration. It can be perceived as the White House interfering in monetary policy, which is the responsibility of the Fed. He also spoke against the high US$. The President accused China and the EU of manipulating currencies and keeping their interest rates too low. The result was instant as the US$ fell against major currencies including the Yuan and gold, metals, and oil all rose.

The result of all of this is that Trump will threaten more trade tariffs against both the EU, China, and most likely Canada and Mexico too. That, in turn, will trigger counter-tariffs against U.S. goods and probable moves to weaken their currencies once again. It’s a race to the bottom. In the end, no one wins and a global recession or worse is the most likely outcome.

—

DISCLAIMER: David Chapman is not a registered advisory service and is not an exempt market dealer (EMD). We do not and cannot give individualized market advice. The information in this article is intended only for informational and educational purposes. It should not be considered a solicitation of an offer or sale of any security. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor before proceeding with any trade or idea presented in this article. We share our ideas and opinions for informational and educational purposes only and expect the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor.

-

Crowdfunding6 days ago

Crowdfunding6 days agoSavwa Wins Global Design Awards and Launches Water-Saving Carafe on Kickstarter

-

Biotech2 weeks ago

Biotech2 weeks agoAsebio 2024: Driving Biotechnology as a Pillar of Spain and Europe’s Strategic Future

-

Business1 day ago

Business1 day agoDow Jones Nears New High as Historic Signals Flash Caution

-

Business2 weeks ago

Business2 weeks agoFed Holds Interest Rates Steady Amid Solid Economic Indicators

You must be logged in to post a comment Login