Business

The French connection: Major nickel companies in New Caledonia

With nickel supplies from the Philippines and Indonesia diminishing, New Caledonia has the opportunity to gain momentum in the nickel industry.

The nickel industry is shimmering in New Caledonia as three major nickel companies are gaining momentum. The global demand for this promising resource is continually increasing at a rate of 5 cents per annum due to the export freeze of two of the world’s leading sources: the Philippines and Indonesia. Typhoons and floods in the Philippines caused a decrease in its supply, while a legislative change in Indonesia resulted in its halt.

Kwinana Nickel Refinery in Perth, Australia. (Photo by orderinchaos via Wikimedia Commons. CC BY-SA 3.0)

These major changes are expected to bring a nickel deficit this year and New Caledonia’s booming nickel industry could aid this shortage since it is prospected to be one of the leading nickel providers in 10 to 15 years. Though New Caledonia is a relatively small island, it has an abundant source of cobalt and nickel resources and three companies are expected to thrive in this industry.

120-year old ERAMET operates in New Caledonia through subsidiary SLN (Société Le Nickel) and has five operations centered in at Kouaoua, Thio, Nepoui, and Tiebaghi, and Doniambo, the biggest nickel plant in the world.

The second largest nickel producer in the island is Vale, which has the Goro Nickel project located in the South of the island. Founded in 2010, Vale started their operations in August 2010 and boasts of over an estimated 55 million tonnes of mineral reserve, a hefty amount for a project located in a humble island. Vale’s annual production is even more impressive, with an estimated 60,000 tonnes of nickel and 5,000 tonnes of cobalt. These estimates are gathered through an open pit operation that has an on-site processing plant.

The aerial view of Wilmington North Carolina port. (Source)

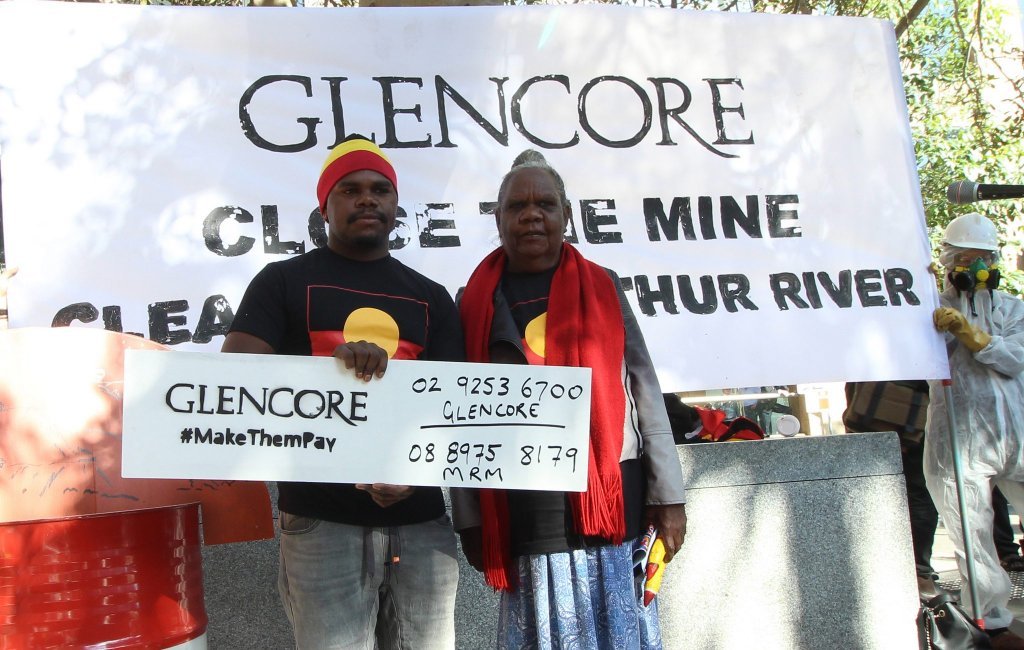

The bronze medalist for New Caledonia’s booming nickel industry is SMSP, which is joint-owned by Glencore Nickel. SMSP’s Koniambo mine began operations in 2013 in the north with a processing plant, and is expected to be a valuable contributor to New Caledonia’s mining prospect because of its high-grade nickel deposit of 6.1 MT that carries a continuous productive forecast of 25 years.

Meanwhile, Glencore is continuing to expand its operations with a recent partnership with Société Minière du Sud Pacifique (SMSP) for a $7 million nickel mine project in New Caledonia, according to Mining Weekly. SMSP is a nickel ore exporter, with operations based in South Korea and China. The partnership began in 2007, and is deemed to apply a state-of-the-art nickel smelting technology. This new partnership gave 2,750 direct local jobs to New Caledonians and 1,500 indirect jobs, shooting in a massive $2 billion worth of financial benefit into the area.

When it comes to proficiency on production costs and the improvement of safety and a reliable efficiency, Vale and Glencore are striving to slim down costs as much as possible. With this, Australian METS that associate themselves with this kind of strategic approach are expected to thrive in the market. Several companies have already established themselves in New Caledonia because of this cost efficiency platform, such as ABB, Leighton Holdings, Orica, ATCO, and Hatch, among others.

With these three leading companies expected to lead the New Caledonia nickel industry, the island could be one of the leading nickel providers in the prospected 10 to 15 years.

The flourishing nickel industry of New Caledonia is not alone in the global aid of the supply deficit. Russian-based junior exploration company, Amur Minerals Corporation (OTC:AMMCF), is expected to extract as much as 67 million tonnes of 0.59 percent nickel and 0.18 percent copper once its detailed exploration begins in the Kun-Manie region. Other countries expected to alleviate the nickel shortage are Australia and Canada, which will supply 20 to 25 percent of the global nickel supply.

(Source: 1)

—

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Biotech4 days ago

Biotech4 days agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Impact Investing15 hours ago

Impact Investing15 hours agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains

-

Cannabis1 week ago

Cannabis1 week agoSnoop Dogg Searches for the Lost “Orange” Cannabis Strain After Launching Treats to Eat