Featured

Understanding growth rates as an investment metric

Although Compound Annual Growth Rate (CAGR) is a good tool for measuring an investment’s growth, it lacks the concept of stability.

High-quality stocks are an investor’s dream because all high-quality stocks have two things in common investors are looking for:

1. Capital gains in the long run.

2. Increasing dividends (if dividends are paid).

The reason for capital gains and growing dividends the growing profit of a company. A company growing its profits becomes more valuable, and finally, the stock price goes up. Bear markets and trends may delay this fact, but finally, the stock price will go up.

In “When cheap means crap,” I showed why the notorious price-earnings-ratio isn’t helpful in finding high-quality stocks. In contrast, it is misleading, and you may lose hard-earned money if you succumb to its false promises.

The price-earnings-ratio fails because it does not respect if profits are growing or declining. But another key metric does: Welcome to the compound annual growth rate (CAGR).

The CAGR: quantifying growth rates

The idea is to quantify the change of an underlying value (e.g. profit) in a specific period of time (e.g. five years). The result is a yearly average rate of increase or decrease in percent. Simple example:

- Company’s profit in 2015: $10 million (start value)

- Company’s profit in 2018: $15 million (end value)

- Time range: three years (period)

CAGR calculation: (15/10) ^ (1/3)-1 = 14.5 percent yearly growth rate of profit.

CAGR formula: (Start value/End value) ^ (1/ Period) – 1

The CAGR in the wild

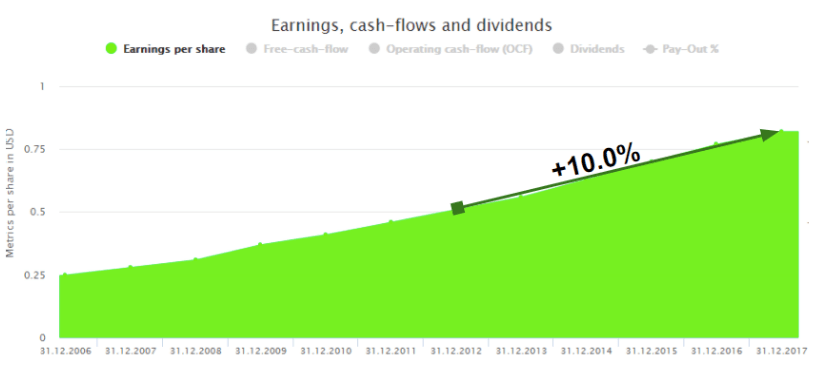

The chart below shows the earnings history of Rollins (ROL) including the CAGR for five years from 2012 to 2017. Rollins increased profits by a yearly average of 10 percent. It becomes obvious that increase is related to the company’s quality to increase its profits. In fact: Rollins looks like a high-quality stock!

Source: DividendStocks.Cash

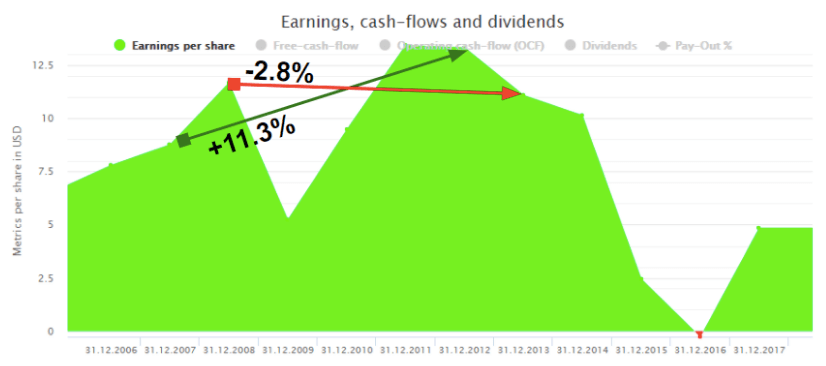

Is this the metric we are looking for? Before start cheering, let’s look at another stock. With 30 years of increasing dividends, Chevron (CVX) is a dividend aristocrat. But is Chevron a high-quality stock, too?

Source: DividendStocks.Cash

The CAGR for five years from 2007 to 2012 is 11.3 percent. Even higher than Rollin’s CAGR just seen. But one year later the CAGR for five years drops to -2.8 percent. What happened? In 2012, Chevron enters a period of declining profits due to a weakening oil prices. As a result, the CAGR gets worse from year to year.

The CAGR: blindness for stability

After a promising start, we found the CAGR’s weak spot. The CAGR has no clue what stable growth means. All it does is calculating the average increase between two points. What happens between these points, before and after isn’t considered at all. In the case of Chevron, rolling the CAGR to the period one year later yields a completely different result. But long-term investors need stability.

Although popular, the CAGR isn’t the solution we were hoping for. The quest for finding high-quality stocks continues.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech2 weeks ago

Fintech2 weeks agoDruo Doubles Processed Volume and Targets Global Expansion by 2026

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]

-

Africa5 days ago

Africa5 days agoAir Algérie Expands African Partnerships

-

Crypto2 weeks ago

Crypto2 weeks agoEthereum Pushes AI Integration With ERC-8004 and Vision for Autonomous Agents

You must be logged in to post a comment Login