Business

Vegetable oils need another factor to get the rally started

Trees have seen plenty of rain and production should be seasonally increasing.

World vegetable oils markets were lower last week and price trends started to turn down on the weekly charts.

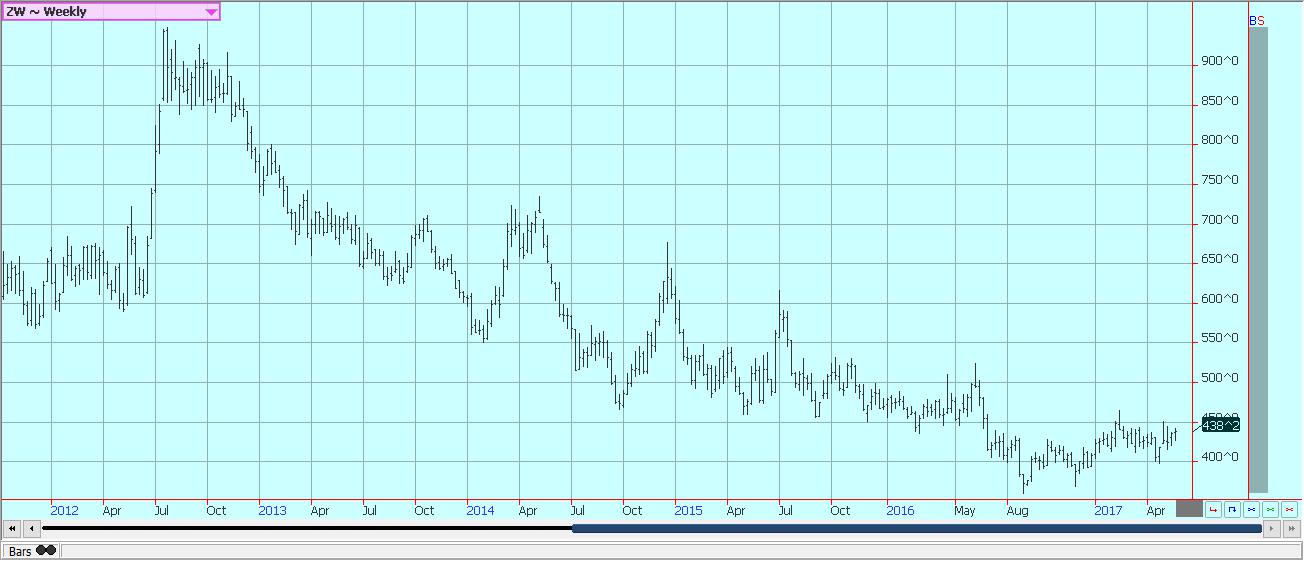

Wheat

US markets were higher as more bad weather was reported in the Great Plains. It was cold there again last week, and rains were reported from Texas to Canada. More wet weather is forecast for this week as showers and storms should return to the region. The harvest is underway in Texas and could expand into Oklahoma this week. No yield reports are being reported so far in the press, but southern Texas should have some of the better crops. Yield reports should be worse as the harvest moves north. There have been problems reported in planting the Spring wheat crops, especially in Canada. The northern Great Plains have been drier for the last couple of weeks to allow for better planting progress in these areas. Canadian problems are concentrated more in western parts of the Prairies, but just about all parts of the Prairies have had some difficulty with the wet and cold weather.

Minneapolis prices have been strongest when compared to the Winter wheat due to the poor planting pace. The demand for US wheat is holding well in world export markets and the US dollar is weaker to help keep US wheat in the mix for world demand. The chart patterns are positive, especially in HRW and HRS. Both markets are feeling the demand for high-quality wheat in world markets, while SRW, more of a feed Wheat market, is not seeing the same demand. All markets are feeling the bad growing and planting conditions due to rains and cold weather that have hurt HRW quality and made for planting delays for HRS and other spring wheat in both the US and Canada. There are reports of improving conditions in Europe as rains have returned, but much of Europe had to deal with freezes in the last few weeks as well as dry weather, so production ideas are uncertain there.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

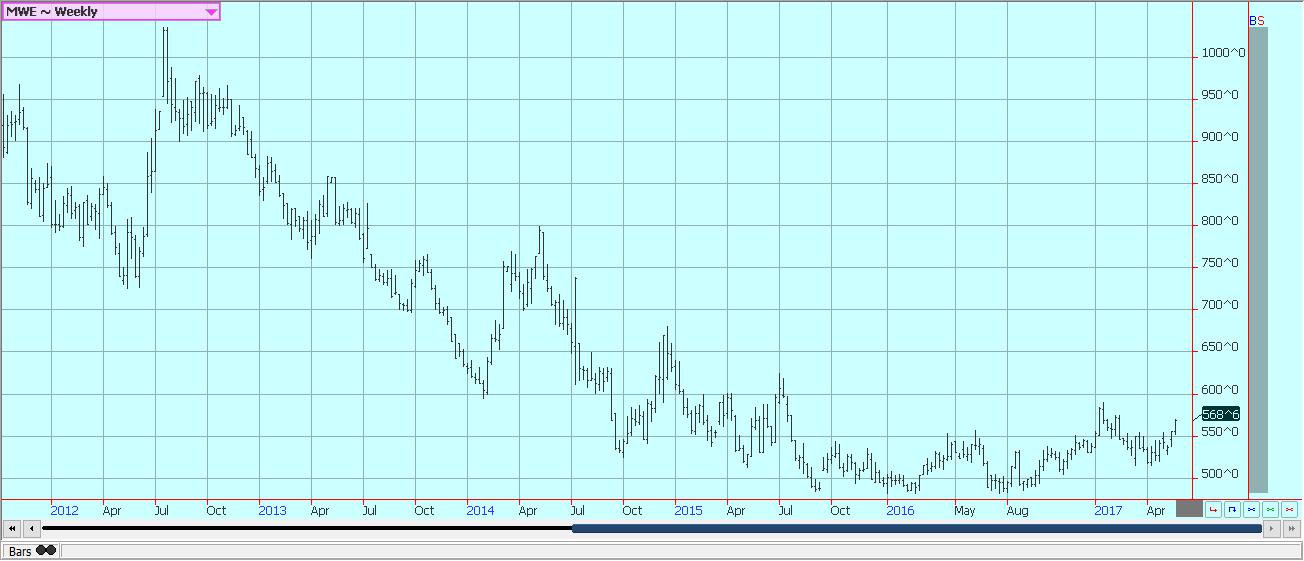

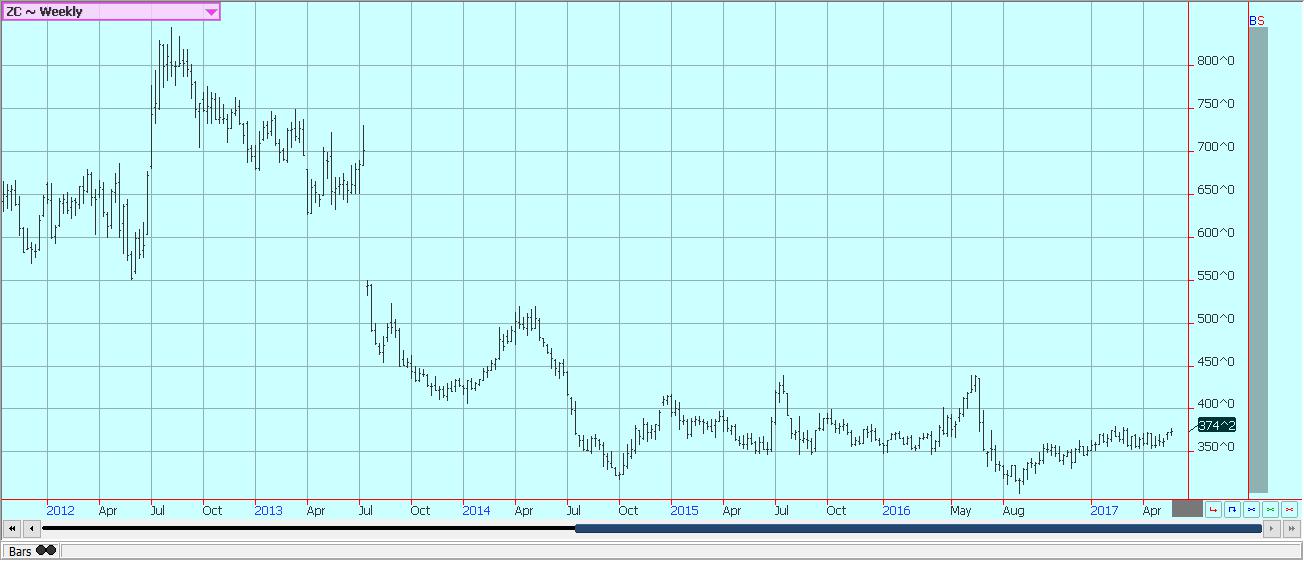

Corn

Corn and oats were both higher last week. Corn continues to hold support on the charts and the trade is increasingly taking notice. It looks like the downside is limited for now or until more is known about crop production potential. The weekly charts show the potential for the market to move higher over time. The export sales report was solid again last week as demand for US corn remains good in the wake of little competition. Domestic demand remains strong in ethanol as ethanol production levels remain high. Ethanol demand could remain strong as OPEC has moved to keep production down and prices somewhat higher. The crop saw another wet weekend and temperatures will be cooler this week in the Midwest amid unsettled weather. It is the consistent rain that has helped keep buying support in the market as crop conditions have been suffering. The crop needs some sun and drier weather but little of that sort of thing is in the forecast. The weather will continue to be the biggest topic for traders this week as everyone keeps an eye on the forecast and actual crop conditions.

Weekly Corn Futures

Weekly Oats Futures © Jack Scoville

Soybeans and soybean meal

Soybeans and soybean meal were both lower last week and made new weekly and monthly lows on the charts. It was a weak performance and one dictated by the threat of South American selling and the potential for even more soybeans to be planted due to the tough planting conditions for corn. Brazil producers remain very reluctant sellers amid the political problems inside the country and both Brazilian and Argentine producers are unhappy with the strength of their currencies against the US dollar as they earn less in local terms for exported Soybeans and products. The currencies were higher last week as the US dollar moved lower again. Demand for US soybeans and products could remain strong as the US dollar remains weak in world markets. US prices for summer months are still competitive with those from South America as producers in Brazil and Argentina remain reluctant sellers due to weaker world prices and stronger local currencies. The competitive pricing now runs through the summer. There could be lower prices this fall if the US does, in fact, produce a huge crop. South American producers will be forced to sell more sooner or later, and appear to be hoping for some weather problems in the US to cause higher prices. The US has weather problems now, but so far those problems have served more to depress oilseeds prices as the bad weather has primarily affected feed grains and increased the potential for even more area this year to be planted to Soybeans.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice closed higher on follow through buying from the big rally the previous week. There also appeared to be some producer and speculative selling so the gains were not as big as the previous week. The potential for big production problems in US Rice growing areas is supporting the move higher. Most of the problems are in the Delta, but California has had trouble planting the crop in a timely way due to previous rains and snows in the state. Conditions are reported to be good in Texas, and the crop is starting to go into the flood in areas near Houston. There are reports of some crop damage in southern Louisiana after the recent big rains, and the damage could extend into parts of Mississippi. Arkansas remains a big problem area as little work is able to get done. The soils are still too wet and producers have been sidelined for a couple of weeks in northeastern parts of the state. California is also having problems as planting is very late due to bad weather this year. USDA showed reduced planted area in its new crop estimates, but a very high yield that could be overestimated in any case and especially with the bad weather seen in Arkansas and California so far this season. The weekly charts show that the rally could move higher over time, with final targets near 1275 basis the nearest futures contract possible.

Weekly Chicago Rice Futures © Jack Scoville

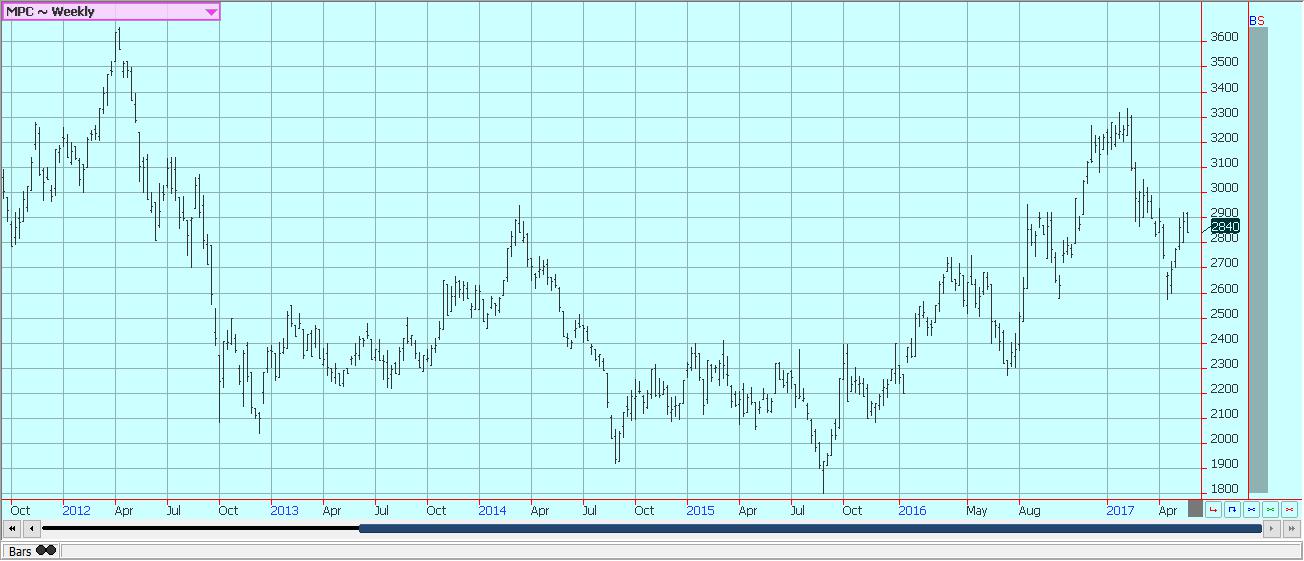

Palm oil and vegetable oils

World vegetable oils markets were lower last week and price trends started to turn down on the weekly charts. Palm oil was the strongest market as export demand was higher against improving production ideas. Both of the private surveyors estimated Malaysian palm oil exports above 1.0 million tons with five days left to go in the month. This is about a 10% to 15% improvement on the export pace of a month ago. A lot of the demand is thought to be related to buying ahead of Ramadan, so the export pace could fade again in the next few weeks. Reports from the interiors of both countries suggest that trees have seen plenty of rain and production should be seasonally increasing. Ideas are that the increase so far has been less than expected and that the production is not increasing at the expected rate. Canola remains relatively strong amid tight Canadian market conditions but moved lower at the end of the week due to weaker prices in the US and around the world for competing oilseeds. Producers in Canada are unwilling sellers due to cold and wet weather in the Prairies that has kept field work to a minimum in many areas. Producers are now actively planting, but are still working around rain in western areas. Demand from both the processor side and the export side has been strong enough to generally support the market. Soybean oil was lower and chart trends started to turn down again. The market moved lower despite the announced OPEC deal to keep production reduced and prices somewhat higher. The OPEC deal should help keep demand for biofuels low, but it looks like vegetable oils need another factor now to get the rally started again.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures © Jack Scoville

Cotton

Futures moved lower again last week. It looks like the rally is over and that the short mills position in the on call market has been factored into prices. The market showed stability in prices during the second half of the week and it is possible that mills are starting to cover part of the short position they have now. The weekly charts now show mixed trends. Supplies available to the market are still increasing. Certified stocks levels have been increasing for the last couple of weeks and are now well over 400,000 bales. Export demand remains solid but has been weakening lately with the higher prices. The US mills still appear to have a lot of July positions to cover in the market, but are working to buy futures on breaks and are also working in the cash market to resolve the short in futures. Planting progress was good last week and should be good this week as the weather is expected to be wet, but not completely wet. Crop condition should also be improving as some areas have turned warmer and drier. The Great Plains needs warmer and drier weather now to promote more active fieldwork and development. The Delta and Southeast could also use drier weather, but temperatures have been warmer.

Weekly US Cotton Futures © Jack Scoville

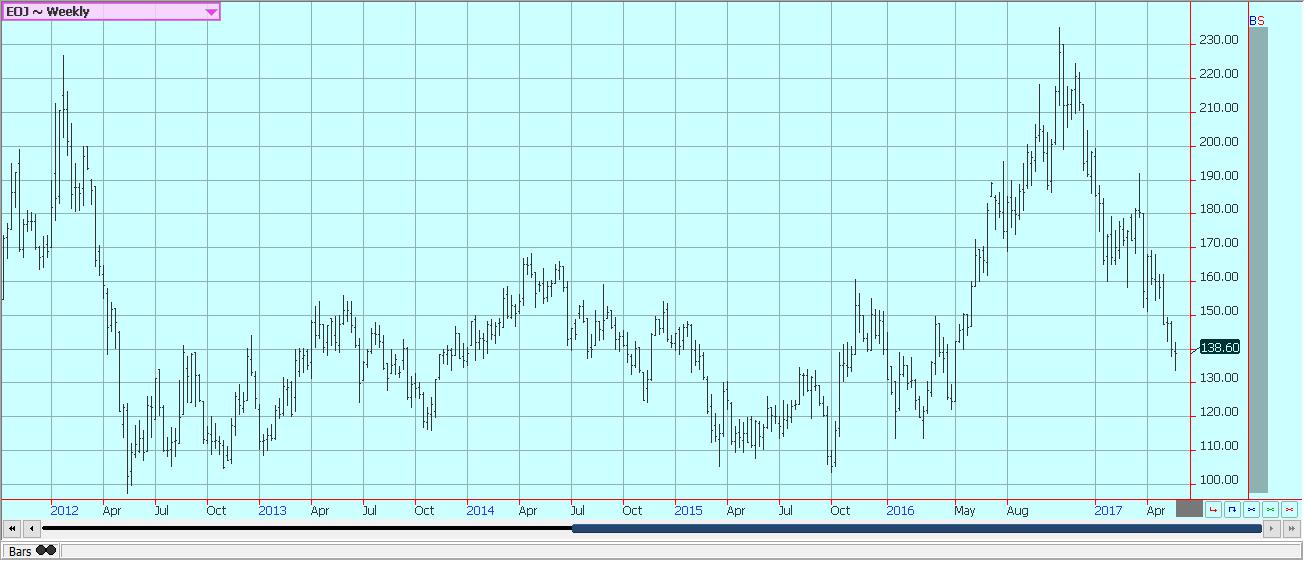

Frozen concentrated orange juice and citrus

FCOJ closed higher on Friday as NOAA released its hurricane outlook for the Atlantic. The Outlook calls for an above normal season, with more storms and more named storms in the general trend. It makes no predictions on if or haw many storms could make landfall, the trend to an able normal season implies that chances for a landfalling hurricane are enhanced. There are no storms out there yet, and nothing to change overall growing conditions at this time. A storm in the state could actually be beneficial as the soils are dry due to the ongoing drought. The hurricane season starts this week with the beginning of June. Trends remain mostly down on the charts, and so far there has been very little buying interest. The demand side remains weak and there are plenty of supplies in the US. Brazil has been exporting FCOJ to the US to cover the short Florida crop. Not even a very small Florida crop has been able to create much of a sustained rally in futures due in part to the weak demand and in part due to the increased imports from Brazil. Domestic production remains very low due to the greening disease and drought. Trees now are showing the fruit of varying sizes and overall conditions are called good because of the irrigation. The Valencia harvest is moving to processors and into the fresh market and is almost over. Brazil crops remain in mostly good condition.

Weekly FCOJ Futures © Jack Scoville

Coffee

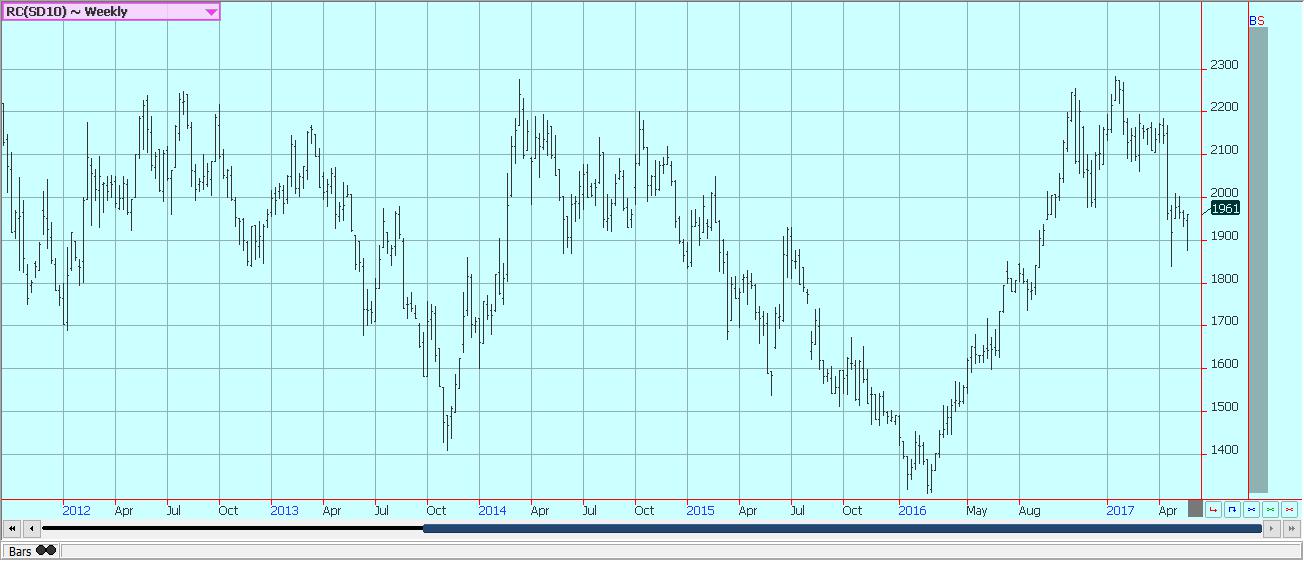

Futures were slightly lower for the week, but the recovery on Thursday and Friday erased almost all the losses posted in earlier trading. The changes in the relationship between the Real and the US dollar dictated almost all of the price action. Mostly it was the US dollar moving lower that helped provide some support. The market action remains weaker overall due to ideas of good supplies and reports of weak demand. The cash market remains slow. Offers remain in the cash market, and differentials are stable. Buyers remain quiet and appear ready to use already contracted supplies. New York has featured some buying support from commercials as they fix prices for differentials purchases, and speculators have become more tow-sided in trading the market as the Winter season is approaching in Brazil. London had been lower as demand seemed to back off but posted a strong rally on Friday. The market traded to new lows for the move but also was able to recover in late-week trading. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia and Brazil are also very low on supplies. The Robusta market is still relatively strong compared to Arabica and due to the short supplies available to the market as it works to curb demand through the higher prices.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

It was a lower week in New York and London, and charts show that prices are testing or breaking through support areas. The fundamentals are changing from a tight supply situation to one with more supplies available to the market, and it is the threat of increased supplies to the market that has pressured prices in the last few weeks. In the short term, there is still potential for a recovery rally due to the slow start to the Brazilian harvest. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months despite the weak start as demonstrated in the initial UNICA data a couple of weeks ago. Ideas are that Unica will show an increased crush pace in its data this week as arrivals of cane to mills should have increased. Production is also less in India and Thailand but is expected to improve in the coming year. The Indian weather service estimates that the monsoon will be within the normal range. Thailand also hopes for an improved monsoon season this year. China is still importing significantly less Sugar so far this year. The weather in Latin American countries away from Brazil appears to be mostly good. Northeast Brazil remains too dry but has seen some light precipitation lately. Center South areas have had plenty of rain. The harvest has been slow to get going, and the first two UNICA reports have reflected the reduced flow of Sugarcane to mills. Mills have increased the percentage of Sugar produced from the cane at the expense of Ethanol production, so supply from Brazil is good despite the reduced crush pace so far. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

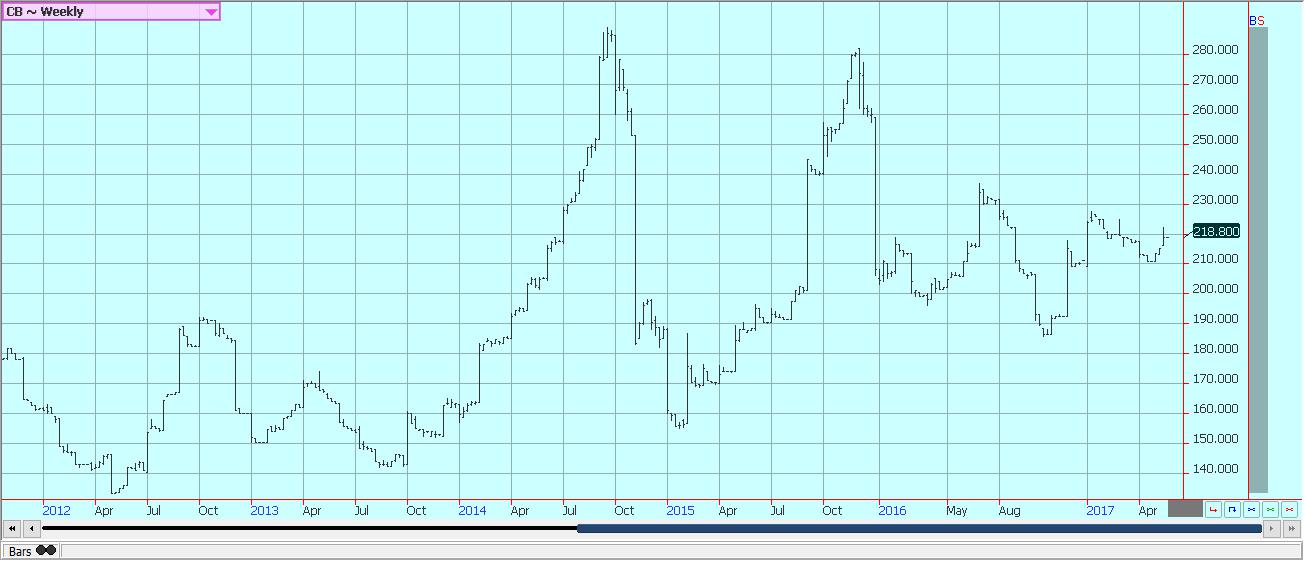

Cocoa

Futures markets were sharply lower last week and gave back the gains from the recent rally attempt. Both markets are now testing back into the low area that the markets left just a few weeks ago. The overall market situation remains generally bearish, although fundamentals could change in the longer term. Harvest activities in West Africa should start to wind down soon. The mid-crop harvest continues in West Africa, and ideas are that the quality of the mid crop is good. The demand from Europe is reported weak over all, and the North American demand has been weaker. The grind reports from both regions and also Asia showed increases in the most recent reports and ideas are that demand should continue to increase as prices are lower now. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big on the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures © Jack Scoville

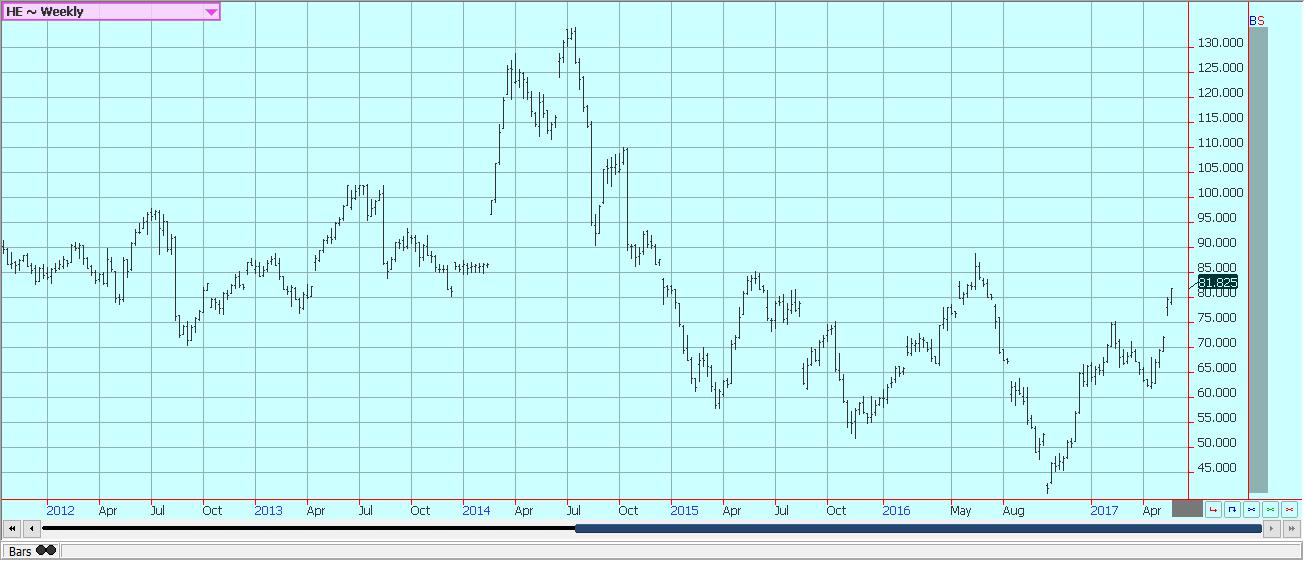

Dairy and meat

Dairy markets were higher again and made new highs for the move again. The daily charts imply that a seasonal low was made a couple of weeks ago and that a trend to higher prices should continue It looks like the annual US flush is over. Supplies are strong seasonally in all areas of the US. Demand is good for cream, and cheese makers are displaying increasing demand. Cream demand for butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing in some areas. Demand for ice cream has been mixed depending on the region. Cheese demand appears to be getting stronger due to promotions on the retail level. Exports are reported to be stronger. Dried products prices are generally weaker. World prices have been firming in the last month on reduced Oceana production and steady to firm demand prospects, mostly from Asia.

US cattle and beef prices were lower. The beef market has been strong, but packers paid lower prices for cattle last week after the big move higher in prices that was seen in the previous week. Feedlots are very current with supplies and are pulling cattle ahead in order to take advantage of the high prices. The trade is worried about a trend change to down given that the market has been very strong, but the cash market keeps holding and demand is also holding. April went off the Board on Friday and now June is too cheap when compared to cash prices. That implies that the market will need to rally again this week or that cash will continue to fall.

Pork markets and Lean Hogs futures were firm on ideas that cash market values had bottomed recently. Cash markets have had a firm tone inside the US despite strong hog availability. Pork demand remains stronger than expected, but packers have been pulling back from the market as they sense increasing supplies are coming. Packer demand has been very good until now. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Fintech1 week ago

Fintech1 week agoFindependent: Growing a FinTech Through Simplicity, Frugality, and Steady Steps

-

Crypto5 days ago

Crypto5 days agoBitcoin Surges Past $69K as Ethereum Staking Hits Record Levels

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Business4 hours ago

Business4 hours agoEchoes of 1929: Inflated Valuations and Warning Signs in Today’s Dow

You must be logged in to post a comment Login