Business

Sugar, soybean and wheat prices down for the week

Wheat and soybean closed lower last week following the latest USDA reports while sugar was also down on prospects of huge world production.

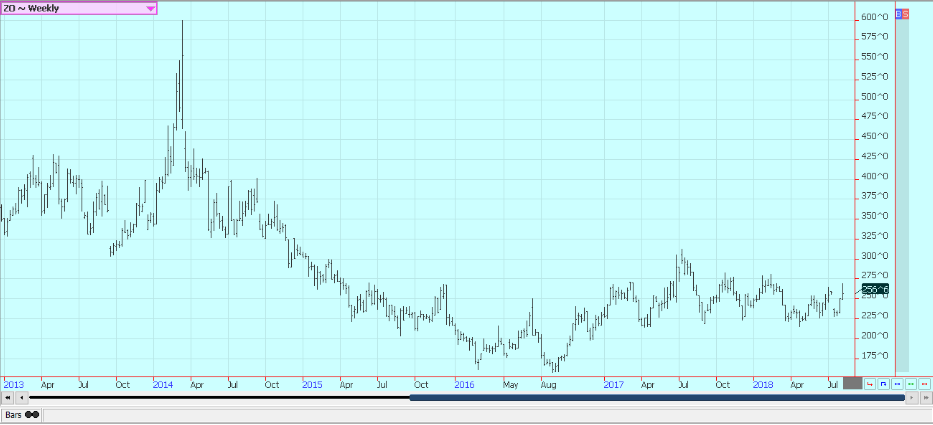

Wheat

Wheat closed lower last week, with most of the selling coming on Friday in response to the USDA production and supply and demand reports. The U.S. data was somewhat bullish as production and ending stocks were cut. However, spring wheat production was left at 614 million bushels, unchanged from July and against the recent crop tour that suggested lower yields. Ending stocks were a little lower than expected at 935 million bushels. The world data showed higher stocks than projected and was the bearish figure for the market at 259 million tons.

USDA kept production estimates for Europe, Russia and Australia higher than other trade estimates. Russian and Ukrainian production estimates were increased. Ideas are that these production estimates can be lower in coming reports. The overall chart patterns are still relatively strong, but the market will need rallies in overseas markets to sustain higher prices here. Significantly lower production is expected in Europe and Russia, and world prices have been moving higher in response. However, Russian prices have become more stable lately. The potential for losses to wheat in northern Europe continues to be reported, and some analysts now say that EU production would be the lowest in many years. The harvest continues in all areas and yields have been disappointing.

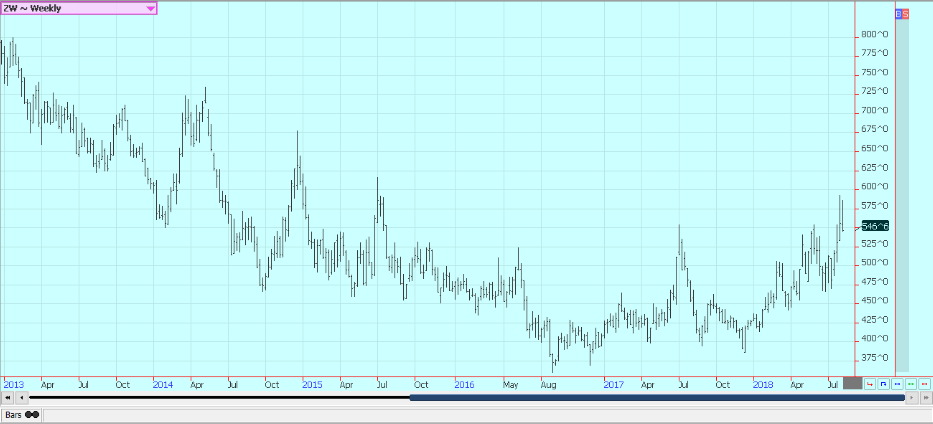

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

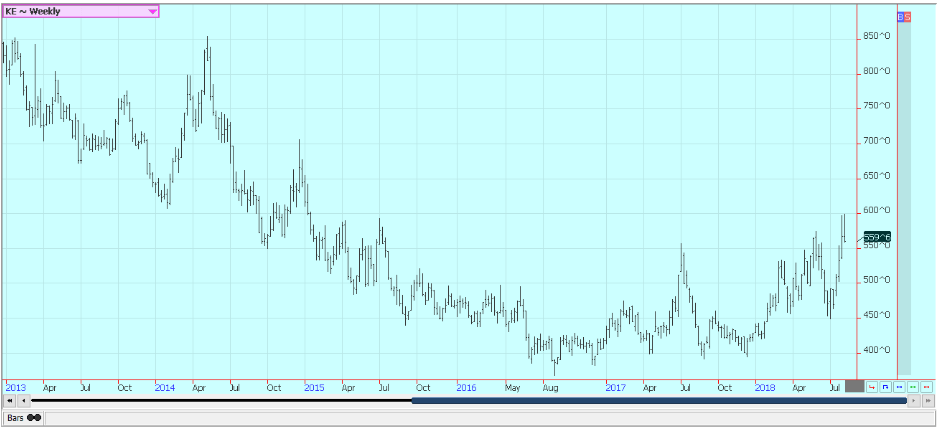

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

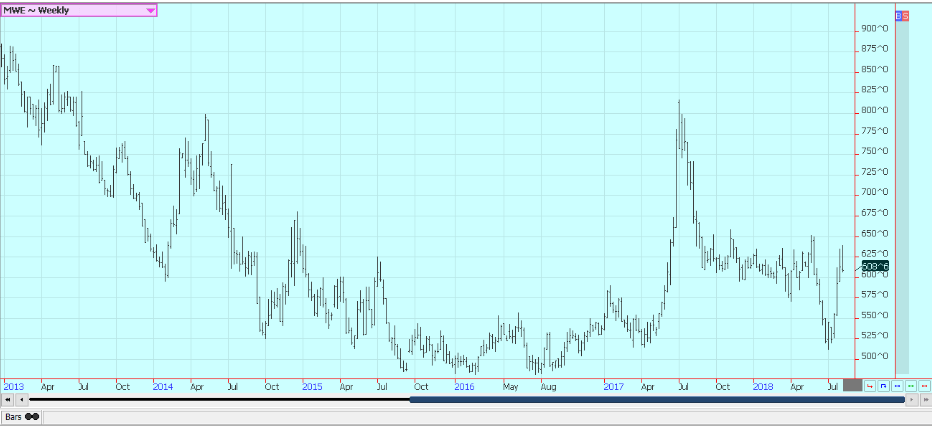

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

Corn was lower last week, with almost all the losses coming on Friday in response to the USDA reports. USDA estimated very strong yields at above 178 bushels per acre and higher than projected production at 14.586 billion bushels. Export and feed demand was increased, so ending stocks were just above trade guesses at 1.684 billion bushels. World ending stocks were higher than expected at 158.5 million tons.

Production of corn in Brazil was actually increased even though Conab cut its estimate on Thursday to 82.18 million tons from 82.92 million in its previous estimate. The report was considered negative to prices, but with question marks, as many are not sure about the U.S. yield potential after recent stressful weather and as the Brazil crop seems overestimated.

U.S. corn has been stressed in some areas by too much rain and in others by dry conditions. USDA did reflect losses in Missouri, one of the driest states this year, but found record yields in some areas where only average yields have been expected. However, the strong demand potential could keep prices from falling too far. The weekly charts show that the market could have completed a double top formation. If so, further selling can be expected early this week.

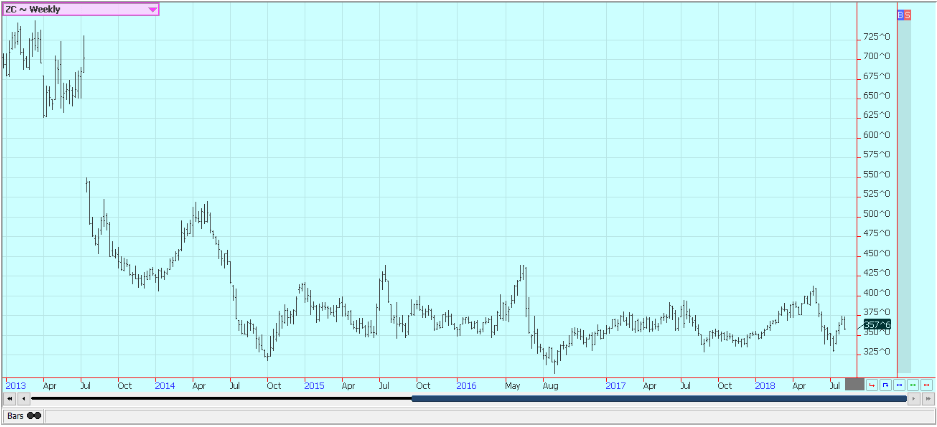

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

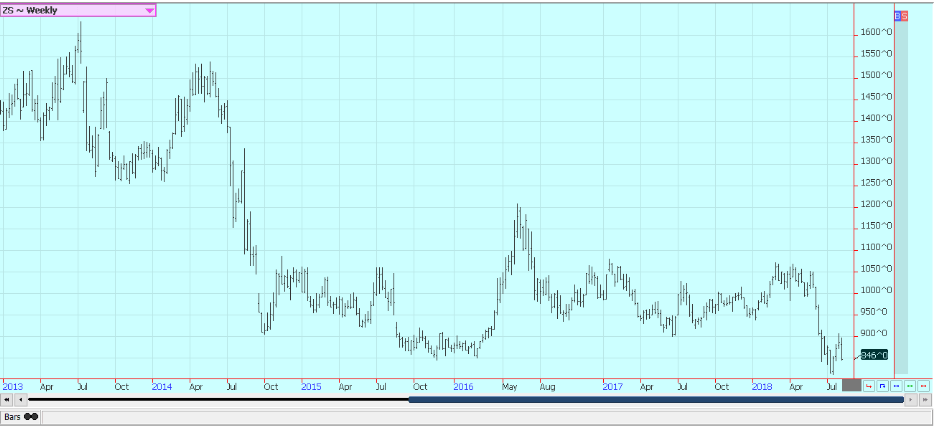

Soybeans and soybean meal

Soybeans were sharply lower on Friday in reaction to the USDA reports and were sharply lower for the week. USDA estimated yield, production, and ending stocks levels above all trade guesses. Production was estimated at 4.586 billion bushels on a national yield of 51.6 bushels per acre. Ending stocks for the coming year were estimated well above all trade estimates at 785 million bushels. World ending stocks were also above all trade guesses at 105.9 million tons.

The U.S. and Chinese governments are still looking for ways to get talks started to reduce the tariff wars and get exports flowing between the two countries again, but things seem to be going in the other direction. The Chinese appear ready to play a waiting game and the U.S. keeps adding to the tariffs list with new and increased tariffs. Even so, the trade is increasingly optimistic that China will have to buy here in the U.S. sooner or later. China will be forced to pay more for Brazilian supplies for now and the rest of the world will enjoy cheaper soybeans from the U.S.

U.S. growing conditions have been variable, with hot and dry conditions in the east and southwest and too much rain in the north, so national yield potential could be somewhat variable. August weather will be important, and longer range forecasts call for warmer and drier weather for the month.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Rice was sharply lower Friday and sharply lower for the week. The funds have been selling and kept the selling pressure on despite good export sales last week and a relatively positive USDA report. USDA showed increased carry-in stocks for the next crop year but cut production from 213 million hundredweight to 210.9 million. It cut exports significantly, especially for milled long grain, so the U.S. ending stocks were a little higher at 43.6 million hundredweight. The average farm price was dropped by $0.20 per hundredweight.

No changes of any significance were made to medium or short grain supply and demand estimates. World ending stocks estimates were slightly lower than last month at 143.57 million tons. It did not matter to the speculators, who have been selling rice and are selling it again.

Reports that the harvest is expanding in parts of Texas and southern Louisiana have been a reason to sell. The harvest is much more active this week in Texas and southern Louisiana and will soon spread north. Producers in Arkansas are reporting that rice fields have a lot of grass, and this could rob some yield potential. Initial reports from Texas and Louisiana indicate good field yields.

Weekly Chicago Rice Futures © Jack Scoville

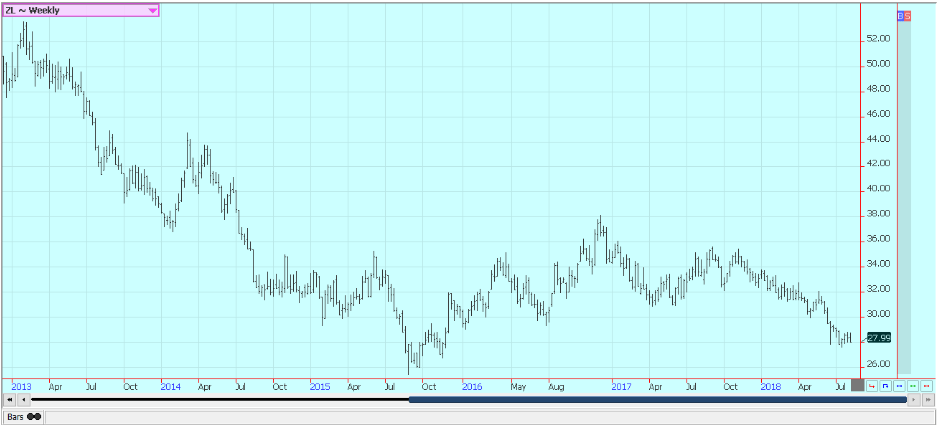

Palm oil and vegetable oils

World vegetable oils prices were higher last week and were led higher by palm oil. Demand showed signs of stability last week as private sources in Malaysia reported stable exports for July and stronger exports for the first third of August.

The MPOB data showed slightly lower than expected ending stocks for July at 2.21 million tons that came on the production of 1.50 million tons and exports of 1.21 million tons. There is still plenty of supply, and the charts imply that upside potential is fairly limited at this time. Indonesia said stocks were 4.85 million tons at the end of June, from 4.76 million tons the previous month. Indonesia expects increased production in the coming months. Malaysian stocks are thought to be increasing at this time on better production, but for now, the increase has been minimal as June ending stocks were 2.19 million tons.

Soybean oil was locked in a sideways trend all week and closed lower. Trends are sideways in the market, but prices could work lower if soybeans stay weaker. Canola was higher as Chicago prices firmed. Some parts of the western prairies saw some beneficial rains last week, and most areas are reported in good condition. Some areas remain hot and dry and are getting stressed. Offers from farmers were down last week as they wait for higher prices and as they work in the fields.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

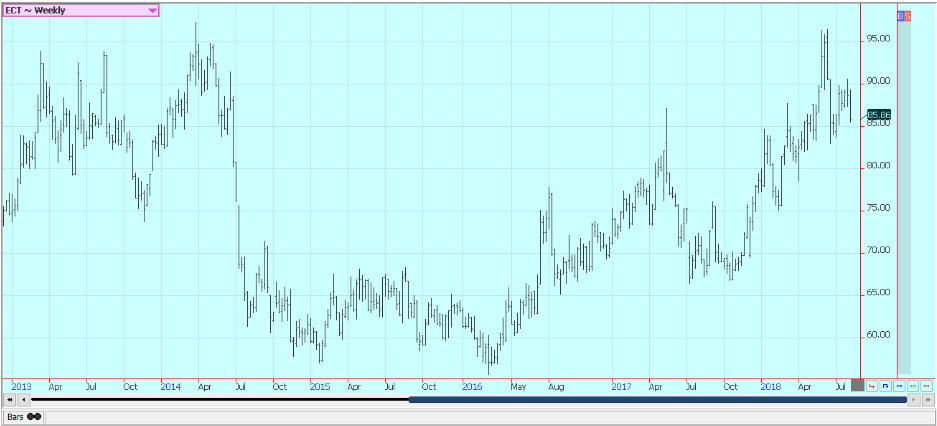

Cotton

Cotton was lower last week and trends started to turn down on the weekly charts. USDA caught the market by surprise and showed increased supplies for the coming year. The carry-in stocks were higher and production was estimated higher at 19.24 million bales. Domestic demand was unchanged, and export demand was increased, but not enough to make up for the bigger supplies. US ending stocks were increased from 4.0 million bales to 4.6 million bales.

The world data showed that major exporters would have less cotton, but the change was not real big. Speculators were the biggest sellers after the reports were released, and they probably have a lot more selling to do this week as they have held major long positions until now.

U.S. weather remains good in the Delta and Southeast, but it is still hot and dry from West Texas to the west. World conditions bear watching as there are questions developing about the Indian monsoon. The rains have been below normal, but generally good enough to support crops. However, reports indicate that August should be drier, and that is not good for the country or its agricultural producers. The trade will keep a close eye on the weather there. It will also watch for signs of demand.

The weekly export sales reports have been good so far, but China has mostly been absent. The U.S. expects to see increased demand from other countries, and there is talk that China will find a way to buy U.S. cotton as it will need the quality. The market needs to factor in the higher than expected production and overall supplies first, then the rally might be able to resume.

Weekly US Cotton Futures © Jack Scoville

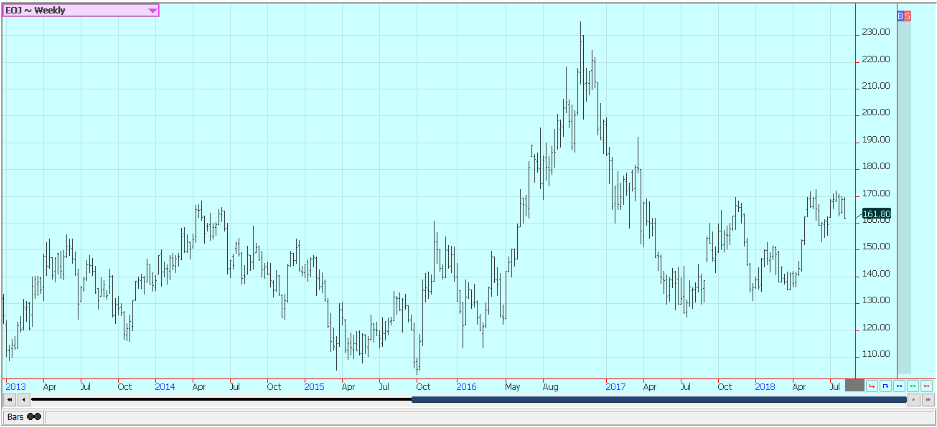

Frozen concentrated orange juice and citrus

FCOJ was lower last week as the weather for crops in Florida remains very good. The daily charts are now showing that prices are fading from resistance areas, and the weekly charts show that prices are fading from the 170.00 area that has held futures in check since spring of 2017.

Short-term trends are turning down as the hurricane season has been very quiet so far. Traders are concentrating on the development of the new crop and the weak demand for the old crop. Overall growing conditions in Florida are good to very good, and there is no storm development in the Atlantic at this time. The state is getting frequent periods of showers.

Florida producers are seeing good-sized fruit, and work in groves maintenance is active. Irrigation is being used when needed, and producers expect a good crop. A good crop now will likely mean increasing inventories of frozen concentrate. Weaker demand has caused FCOJ inventories in Florida to increase on a year to year basis.

Weekly FCOJ Futures © Jack Scoville

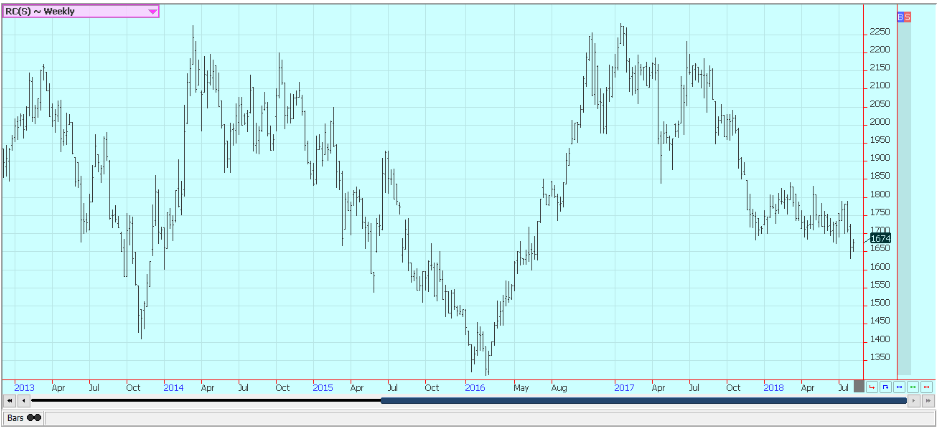

Coffee

Futures were lower again last week. Futures in New York have been testing support at the recent contract lows. London charts show down trends on the weekly charts as well. Price action in New York is bad and trends have turned back to down. Ideas of strong production in Brazil and Vietnam are keeping futures under selling pressure.

Arabica trees in Brazil were starting to show stress due to the lack of rain over the last few months. Some rain was reported a week ago, but it has not rained since, and there are concerns about some premature flowering that could affect trees. The flowers could abort and cause at least a slight loss in production. It will be dry again for the rest of the week. The months leading up to the winter were also dry, and that early dryness is affecting trees now. It is very possible that some production could be lost for the next crop due to the very dry overall conditions.

Estimates for production this year range as high as 60 million bags. Central American is also dry in some areas and some production losses are increasingly expected. Most of Central America is reporting good rains, so the overall losses could be minimal. London remains relatively strong as Vietnamese production is not moving. There is not much Robusta on offer in the world markets right now even though supplies in storage in Europe are very high. It has been dry in Vietnam, but better rains are reported to be improving crop conditions now and production estimates are very high at about 30 million bags. Domestic prices were firmer in the last week on very light farm selling.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

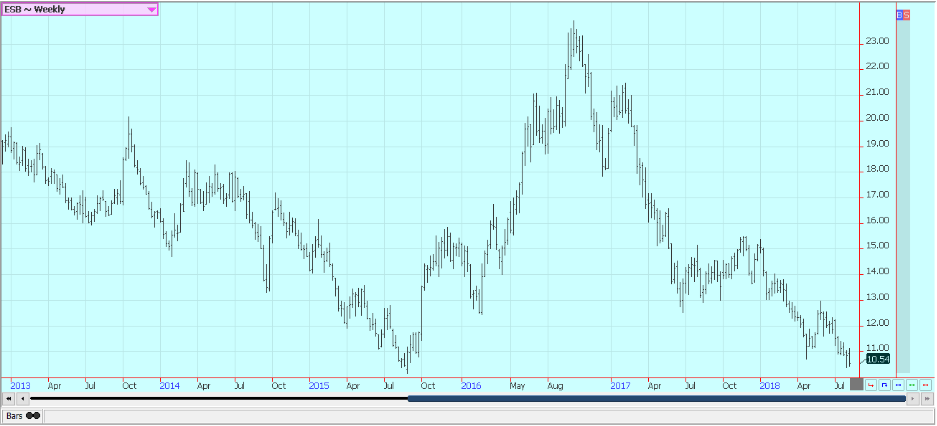

Sugar

New York and London both closed lower and London made new lows for the move. New York price action overall is weak as futures are still near the recent lows. Ideas of big world production are bearish.

Dry conditions continue in Brazil, the EU and Russia. Very good conditions are reported in Thailand and India, but there are forecasts that the Indian monsoon could produce less rain than normal this month. Crops could get stressed quickly in the heat of the country. Brazil producers are also worried about cane production even with the rapid early harvest, and the market is now starting to talk about less production there this year.

UNICA showed a reduced crush in its latest biweekly report, so the fears of less production could become fact in the next few weeks if the trend to a lower processing of the cane continues. The dry weather in much of Europe and in southern Russia near the Black Sea has hurt sugarbeets production potential in these areas. Recent rains in parts of Ukraine have improved production prospects there.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

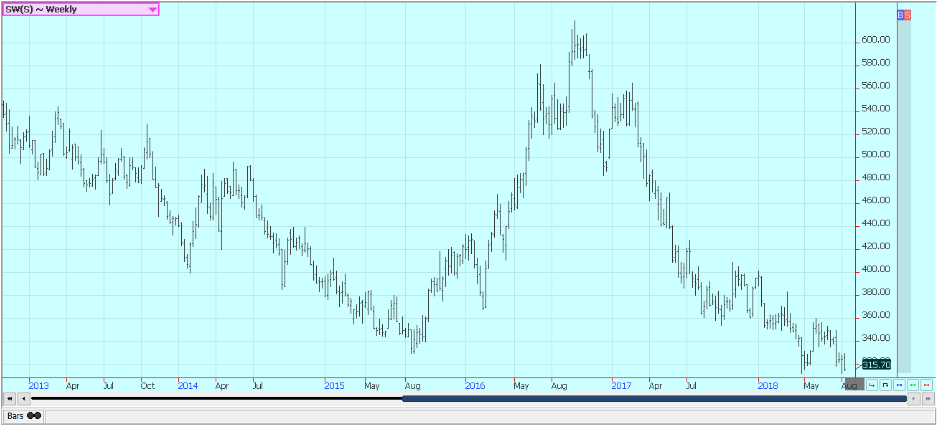

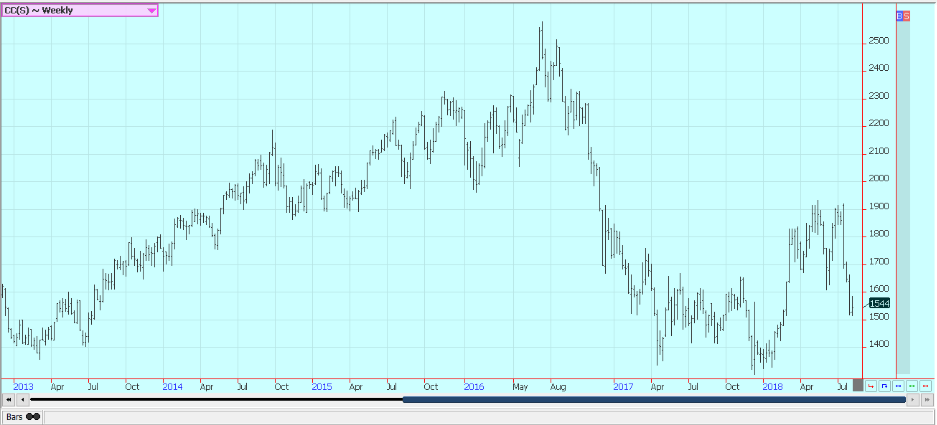

Cocoa

Futures mixed on Friday and were a little higher for the week. The weekly charts show that futures might be making a bottom at this time as there is a potential double bottom now showing on those charts. Ideas of big world production have kept futures on the defensive.

The outlook for strong production in the coming year has been enough to keep the prices weak. The main crop harvest is in its earliest stages in some parts of West Africa, but will not really get going for at least another month. Main crop production ideas for Ivory Coast are still near 2.0 million tons even with the big rains.

Ghana and Nigeria are expecting very good crops this year as well. Ideas that current weather conditions are good for the next crops in West Africa continue. There have been reports of good rains throughout the region and big yields are possible. Showers and more seasonal temperatures have been seen in the last few weeks to improve overall production conditions in West Africa. Conditions also appear good in East Africa and Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing1 week ago

Impact Investing1 week agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Markets4 days ago

Markets4 days agoRice Market Slips Amid USDA Revisions and Quality Concerns

-

Business2 weeks ago

Business2 weeks agoLegal Process for Dividing Real Estate Inheritance

-

Fintech12 hours ago

Fintech12 hours agoJPMorgan’s Data Fees Shake Fintech: PayPal Takes a Hit

You must be logged in to post a comment Login