Business

Why the decline of the middle class should scare everyone

The incomes of the top 1% have increased by 242% since 1980, while the middle three quintiles have seen just 50% income growth in just under forty years. The Fed keeps printing money, causing the middle class to go extinct. Regrettably, most members of the FOMC want even more inflation, which will exacerbate the pace of decline.

It is not at all a mystery as to the cause of the wealth gap that exists between the very rich and the poor. Central bankers are the primary cause of this chasm that is eroding the foundation of the global middle class. The world’s poor are falling deeper into penury and at a faster pace, while the world’s richest are accelerating further ahead. To this point, the 500 wealthiest billionaires on Earth added $1.2 trillion to their fortunes in 2019, boosting their collective net worth by 25%, to $5.9 trillion.

In fact, Jamie Dimon, CEO of JP Morgan, made a quarter of a billion dollars in stock-based compensation in 2019. As a reminder, shares of JPM were plunging at the end of 2018; that is before the Fed stepped in with a promise to stop normalizing interest rates. And then, soon after, began cutting them and launching a bank-saving QE 4 program and REPO facility on top of it, in order to make sure Mr. Dimon’s stock price would soar. Slashing interest rates hurts savers and retirees that rely on an income stream to exist, just as the Fed’s QE pushes up the prices for the things which the middle class relies on the most to exist (food, energy, clothing, shelter, medical and educational expenses).

Therefore, what we have is a condition where those who own the greatest share of assets, such as stocks, bonds and real estate, are becoming more wealthy. Meanwhile, those that have to spend a greater percentage of their income on the basics of raising a family are falling further behind. The saddest part of this charade is that the Fed isn’t at all happy or content with the current pace of middle-class erosion. Instead, it actually wants to aggressively speed it up.

According to the Congressional Budget Office and Fortune.com, the incomes of the top 1% have increased by 242% since 1980, while the middle three quintiles have seen just 50% income growth in just under forty years. President Trump is correct; this is indeed the best economy ever–but unfortunately, only for the ultra-rich. Nearly 80% of Americans now live paycheck to paycheck. According to a survey done each year since 2014 by GOBankingRates, in 2019, 69% of respondents said they have less than $1,000 in a savings account, which compares with 58% in 2018.

According to the LA Times: Adjusted for inflation, wages for the top 5% of earners rose from $50.46 an hour in 2000 to $63.10 in 2018, an increase of 25%. The median worker’s hourly wage, meanwhile, rose by just 7% over that period, to $18.80.

According to economics professor Gabriel Zucman in a paper he submitted to the NBER, the wealthiest 0.1% of Americans now hold the largest share of total household net worth than at any time since 1929. This just happens to coincide with the period just before the historic Wall Street stock market crash and the start of the Great Depression.

A study done in 2015 showed that America’s top 10% of wealth holders averaged more than nine times as much income as the bottom 90%. And Americans in the top 1% averaged over 40 times more income than the bottom 90%.

The richest 1% of the world’s population now holds over 50% of its wealth.

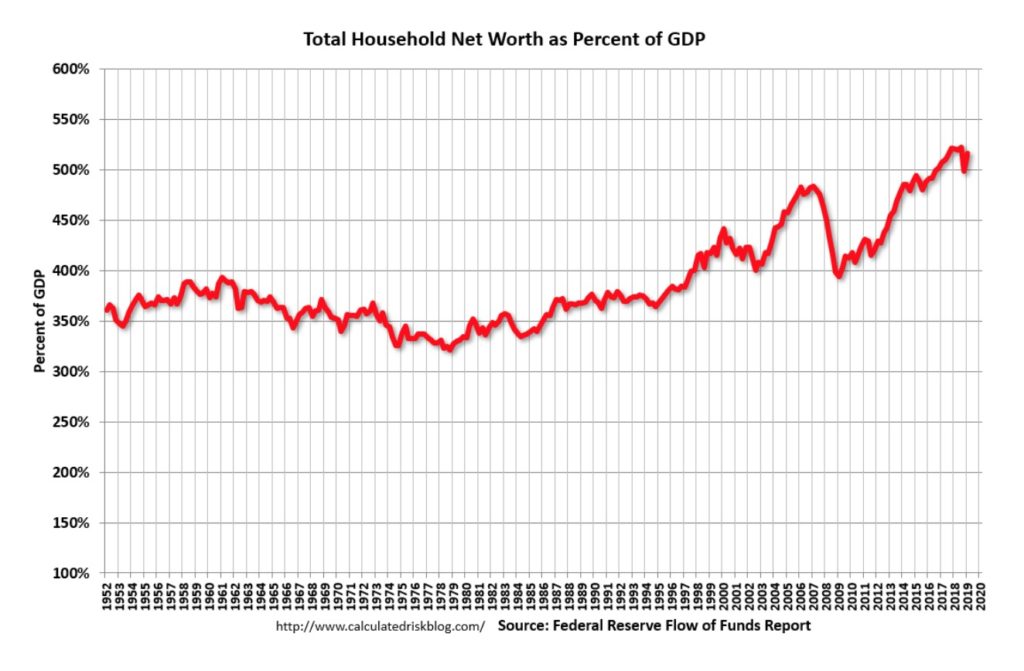

Perhaps it is not a coincidence either that the United States has lost 20% of its factory jobs since 2000. The chart below illustrates clearly how the Fed is pushing up asset prices far ahead of GDP…leaving the middles class in its wake.

Central banks are creating new money at an unprecedented pace and throwing it at the wealthiest part of the population—pushing asset bubbles ever higher and further away from economic reality. The Fed is turning a blind eye towards a middle class that is heading towards extinction.

Make no mistake about it…the level of fiscal and monetary insanity has jumped off the charts, along with the value of assets in relation to GDP. Global governments are now borrowing money at a record pace, which is adding more debt to the already insolvent and intractable existing pile. And, in order to keep all the bubbles afloat, central bankers have become trapped in a permanent condition of ZIRP and QE. What could possibly go wrong? Unfortunately, it will be nothing short of mass economic chaos when the bond market finally implodes. But this doesn’t have to be bad news for all investors. Having a process that navigates the crashes and booms will make all the difference in the world.

—

(Featured image mage by Steve Buissinne from Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Business4 days ago

Business4 days agoThe Dow Jones Teeters Near All-Time High as Market Risks Mount

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoWorld4All, a Startup that Makes Tourism Accessible, Surpasses Minimum Goal in Its Crowdfunding Round

-

Biotech1 day ago

Biotech1 day agoGut-Derived Molecule Identified as Early Marker and Driver of Atherosclerosis

-

Crypto1 week ago

Crypto1 week agoThe Crypto Market Rally Signals Possible Breakout Amid Political Support and Cautious Retail Sentiment