Crypto

The Central Bank of Zimbabwe Bets on a Gold-Backed Cryptocurrency

Inflation in Zimbabwe is starting to slow down but it remains at extremely high rates and is causing serious dysfunction in the country. That’s why the governor of the Central Bank of Zimbabwe, John Mangudya, announced the launch of a digital currency in the press. It will be backed by the country’s gold reserves and will therefore allow everyone to have access to small fractions of digital gold.

The Central Bank of Zimbabwe and the local government have been facing serious currency malfunctions for several years. As seen in other countries facing the same types of challenges, Zimbabwe is dealing with a sharply devaluing local currency, significant inflation on basic necessities, and a scarcity of U.S. dollar bills still circulating among the population.

The central bank has already reacted by selling gold coins, but it is now going further by offering a digital currency backed by the country’s gold reserves. Let’s go to the capital, Harare, to find out.

Read more about Zimbabwe’s plans to launch a gold-backed cryptocurrency and find the latest economic news from around the world with the Born2Invest mobile app.

Zimbabwe’s Central Bank is trying to regain control of the country’s currency

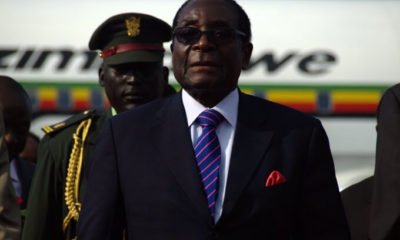

To say that Zimbabwe is facing currency problems is clearly an understatement, as the situation seems so desperate. Sadly famous for having printed under the regime of Robert Mugabe a 100 billion dollar bill, the small southern African country has been trying for several years to stabilize its currency. Since 2019, it has been using the RTGS dollar – Real Time Gross Settlement dollar – a dollar whose value against the US dollar varies in real-time. Under these conditions, the population tends to prefer to stock in US dollars. However, this currency is also in short supply for structural and cyclical reasons.

Currently, it is because of the imminent start of the tobacco season that US dollars have disappeared from circulation, as they were stockpiled in order to pay for future harvests. In order to combat this phenomenon, the central bank decided to offer gold coins for sale to allow people to store value without using foreign currency. Unfortunately, this coin, called Mosi-oa-Tunya, is in the form of an ounce of gold, which costs about €1,800 at the current rate. Far too expensive for the majority of Zimbabweans.

Inflation in Zimbabwe is starting to slow down but it remains at extremely high rates and is causing serious dysfunction in the country.

Zimbabwe to launch a cryptocurrency backed by physical gold

That’s why the governor of the Central Bank of Zimbabwe, John Mangudya, announced the launch of a digital currency in the press. It will be backed by the country’s gold reserves and will therefore allow everyone to have access to small fractions of digital gold. The authorities have announced that they do not want to “leave anyone out in the cold”.

The idea is to be able to exchange RTGS dollars for this digital currency, but also for US dollars. Normally, if we are to believe the statements of the authorities, this initiative should mechanically reduce the pressure on the US dollar, which is traded at a significant premium on the black market in the streets of Harare. To date, we do not really know the operational details of the implementation of this digital currency.

In any case, the actions of the Zimbabwean authorities will have to respond quickly to the multiple and pressing expectations of the population strangled by major monetary problems. RTGS dollars, U.S. dollars, physical or digital gold coins: none of these can replace an efficient monetary and economic policy. In the end, in Zimbabwe as in the rest of the African continent, it may well be Bitcoin that comes out on top, despite the obvious barriers to adoption.

__

(Featured image by Rob via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in JOURNAL DU COIN, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Crowdfunding1 week ago

Crowdfunding1 week agoPMG Empowers Italian SMEs with Performance Marketing and Investor-Friendly Crowdfunding

-

Markets5 days ago

Markets5 days agoMarkets Wobble After Highs as Tariffs Rise and Commodities Soar

-

Markets2 weeks ago

Markets2 weeks agoThe Big Beautiful Bill: Market Highs Mask Debt and Divergence

-

Africa2 days ago

Africa2 days agoORA Technologies Secures $7.5M from Local Investors, Boosting Morocco’s Tech Independence