The Dow has remained above its BEV -7.5% line since last February, though in May and August it came down to test this level. Now in...

The Dow Jones continues running wild, as the FOMC slows its quantitative tightening. This week it closed only 1.98% from a new all-time high. Next week...

In the past week, the dow Jones gained some traction but only recovered short of 3% from its last all-time high in July’s close. However, further...

Dow Jones ended the previous week with a bearish performance. It poses the question of whether the market is a sell as September 2019 comes to...

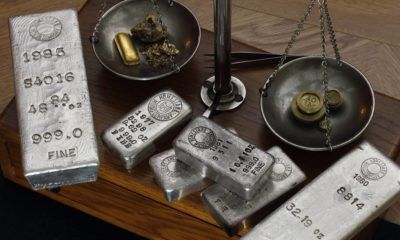

Something is shaking up the precious metals market. In May, the markets advanced, with gold lifting off its BEV -32.5% line. Three months later, the yellow...

Recently, the stock market has smoothed out the extreme volatility it has seen in the past month. But one tweet from President Donald Trump on the...

The Dow Jones closed the week down 5.38 percent from its last all-time high of July 15th, which was over a month ago. Seeing the huge...

The bull market in the US bond market has led to gold and silver markets doing pretty well since it began in early summer. Although, amid...

Are we at an inflection point in the markets? The Dow Jones closed the week down 3.20 percent from its last all-time high. On a week...

Dow Jones could deflate as the economic debts start to default. Stocks and bond markets have pending losses, which will be a boon to precious metals.