We are returning to quantitative easing, and the Fed has paved the way for that. This can be attributed to the recent spike in borrowing rates...

The Fed’s interest rate hikes and its Quantitative Tightening program, which was the catalyst for a freeze in the bond market in 2018, is now causing...

One of the best examples of Wall Street’s propaganda machine at work is its willingness to dismiss recessionary signals. The inverted yield curve is a perfect...

Global central banks have created an economic time machine by forcing $17 trillion worth of bond yields below zero percent. These are now 30% of the...

Global central banks have created a time machine when it comes to the savings and investment dynamic. As you may have guessed, it is also a...

The Q2 earnings season is upon us and the risks to the rally that started after the worst December on record at the close of last...

The market is dangerously overvalued and global economic growth has slowed to a crawl along with S&P 500 earnings.

Here's a look at what investors should expect in today's economy.

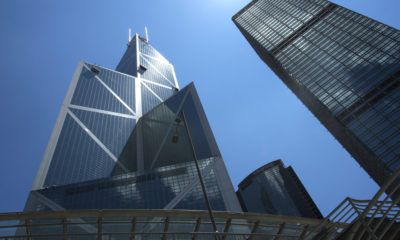

The troubled Baoshang Bank had assets of $84 billion and its seizure is indicative of the deteriorating health of small-scale banks, as China’s economy slows.

The buy and hold mantra from Wall Street bankers should have died decades ago. After all, just buying stocks has gotten you absolutely crushed in China...