Business

Commodity demand shifts as we embrace electric vehicles

Aside from the battery pack, there are differences in materials used in other parts of an electric vehicle.

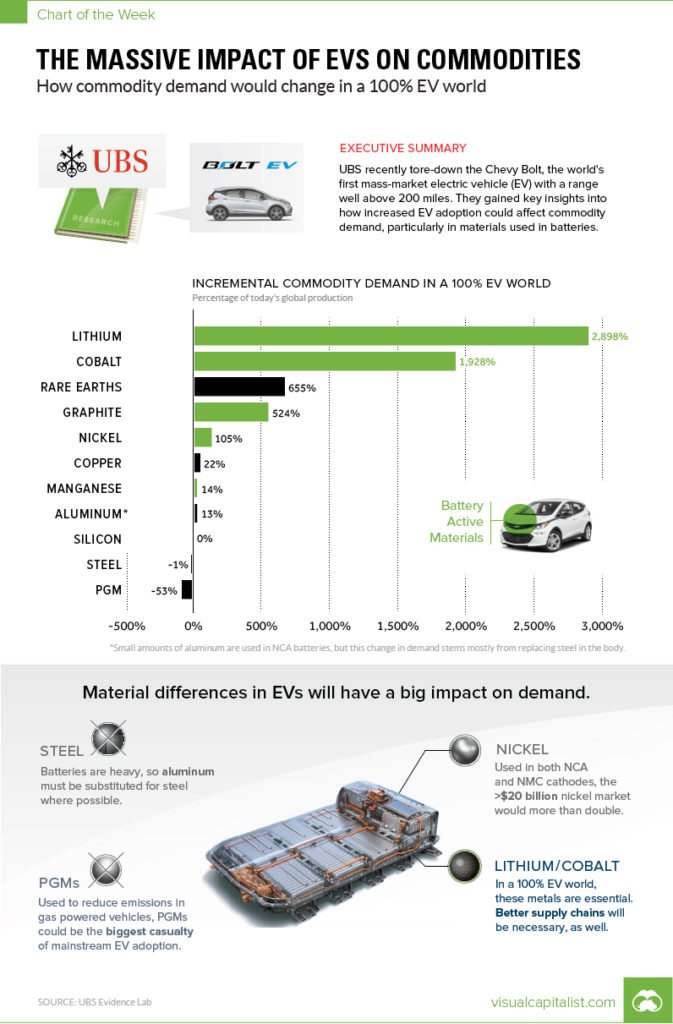

An infographic from Visual Capitalist featured a recent UBS report where the bank tore down a Chevy Bolt to see exactly what is inside. It then had 39 of the bank’s analysts weigh in on the results.

(Infographic by Visual Capitalist)

After breaking down the metals and other materials used in the vehicle, they noticed a considerable amount of variance from what gets used in a standard gas-powered car.

It wasn’t just the battery pack that made a difference—it was also the body and the permanent-magnet synchronous motor that had big implications.

As a part of their analysis, they extrapolated the data for a potential scenario where 100% of the world’s auto demand came from Chevy Bolts, instead of the current auto mix.

If global demand suddenly flipped in this fashion, here’s what would happen on the materials side:

| Material | Demand increase | Notes |

| Lithium | 2,898% | Needed in all lithium-ion batteries |

| Cobalt | 1,928% | Used in the Bolt’s NMC cathode |

| Rare Earths | 655% | Bolt uses neodymium in permanent magnet motor |

| Graphite | 524% | Used in the anode of lithium-ion batteries |

| Nickel | 105% | Used in the Bolt’s NMC cathode |

| Copper | 22% | Used in permanent magnet motor and wiring |

| Manganese | 14% | Used in the Bolt’s NMC cathode |

| Aluminum | 13% | Used to reduce weight of vehicle |

| Silicon | 0% | Bolt uses 6-10x more semiconductors |

| Steel | -1% | Uses 7% less steel, but fairly minimal impact on market |

The chart in the foregoing graphic breaks this down as well.

Now, we aren’t going to see 100% EV penetration in the near term and maybe ever, but it is interesting to contemplate what the potential impacts could be in these markets, let alone possible impacts to the environment.

For example, China accounts for 85% of rare earths mining and it’s not exactly done in an environmentally friendly manner. The picture below shows untreated chemicals from an abandoned leaching pond that flowed into the city of Ganzhou’s surface water.

Untreated residual chemicals flow into Ganzhou’s surface water. (Photo by Liu Hongqiao via China Dialogue. CC BY-NC-ND 2.0)

And there is a robust black market as well:

“China plays an even bigger role in the world’s rare earth trade than is apparent on the surface because of its black market. The main importers who benefit from China’s rare earths production, such as the US, Korea, and Japan, as well as the manufacturers and brands who use rare earths in their products, often tap into a substantial black market in rare earths. Every year tens of thousands of tonnes of rare earth ores are illegally mined and traded, leaving China through the black market.”

It seems like I’m really negative on EVs, always pointing out its downsides. I’m not. The next car I buy will probably be an EV.

There are plenty of people exclusively extolling the virtues of the EV. I want to take a clear-eyed view, as best I can, on all the fuels and vehicles options that lie before us and I don’t want to pick winners and losers. That’s where policy goes wrong and industries get into trouble as a result.

There are some good things about EVs and there are some not-so-good things that are compelling. It’s the same with every fuel-vehicle option out there.

(Featured image by GabboT via Wikimedia Commons. CC BY-SA 2.0)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto1 week ago

Crypto1 week agoMiddle East Tensions Shake Crypto as Bitcoin and Ethereum Slip

-

Business2 weeks ago

Business2 weeks agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Cannabis5 days ago

Cannabis5 days agoCanopy Growth Launches Cheaper 15g Medical Cannabis in Poland

-

Fintech2 weeks ago

Fintech2 weeks agoFirst Regulated Blockchain Stock Trade Launches in the United States

You must be logged in to post a comment Login