Business

Credit Crisis Brewing in China

But should the Dow Jones break down in a big way next week, that would be a signal that the “policymakers” have failed. In such an event, my advice to readers would be to exit the stock market. And Jeeze Louise, don’t begin thinking about “scooping up all the bargains” so soon after a selling panic takes the markets by storm. Get out, and stay out until the smoke clears before coming back again.

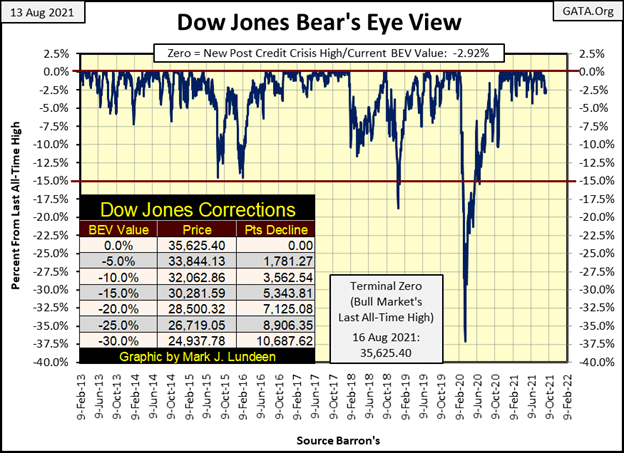

Writing market commentary for an unremarkable market is becoming tedious. The Dow Jones began struggling to get above, and then staying above its 35K level since last May. It closed today at 34,584, only 2.92% below its last all-time high of a month ago.

So, the Dow Jones continues its series of daily closes within scoring position, or within 5% of its last all-time high, a pattern it began last November. So, then we too continue our watch to see which comes next; another BEV Zero in the Dow Jones’ BEV chart below; its 43rd since last November. Or, will we next see a Dow Jones daily close below scoring position in the BEV chart below, which would be a BEV value of -5.00% or more.

Which will come first? I don’t care to predict which will come next. When I do, it seems I always get it wrong. But a new BEV Zero will only indicate a continuation of a very stale, ten-month long pattern, that in reality began losing steam last May. Today’s close below 35K tells us nothing much has changed for the Dow Jones in the past four months.

One thing I can promise is a day is coming when the Dow Jones will close outside of scoring position, a daily BEV of -5.00% or more. How it does this will be important. Will the Dow slowly deflate to a BEV Value of say -5.10%, just slightly out of scoring position? Or will it in a single day close with a BEV Value of -6.00%, or deeper, as advancing issues at the NYSE are overwhelmed by decliners?

Such a day would most likely produce two extreme market events; a Dow Jones 2% day of extreme market volatility, and a NYSE 70% A-D Day, a day of extreme market breadth.

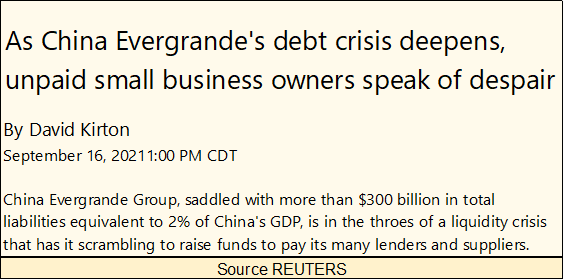

Exactly when this very bearish day will come is unknown to me – BUT – it could come early next week, should China’s Evergrande, a real estate property developer’s debt-servicing woes begin to spread into the global debt markets.

A $300 billion dollar default from China may prove to be only the first of many dominos to fall in the global financial system in the coming months. That’s not a prediction on my part. However, in a global financial system carrying the massive debt burden as is ours, this is precisely how the system will ultimately deleverage itself; in a chaotic fashion.

China Uncensored has published a video on Evergrande’s credit woes that goes into this important story’s more personal details.

https://www.chinauncensored.tv/

Maybe this “liquidity crisis” will fail to ignite multiple waves of debt default. The “policymakers”, as I write, are spending much time on their telephones trying to keep this Evergrande situation from falling apart. And they just may do it. After all, they’ve had lots of practice doing exactly this for decades now.

But should the Dow Jones break down in a big way next week, that would be a signal that the “policymakers” have failed. In such an event, my advice to readers would be to get “the Hell out of Dodge City” and exit the stock market. And Jeeze Louise, don’t begin thinking about “scooping up all the bargains” so soon after a selling panic takes the markets by storm. Get out, and stay out until the smoke clears before coming back again.

As a reaction to a pending crisis, the “policymakers” will almost certainly whack the old monetary metals and their miners. But the downside to these assets, in terms of time and valuation, should be very limited.

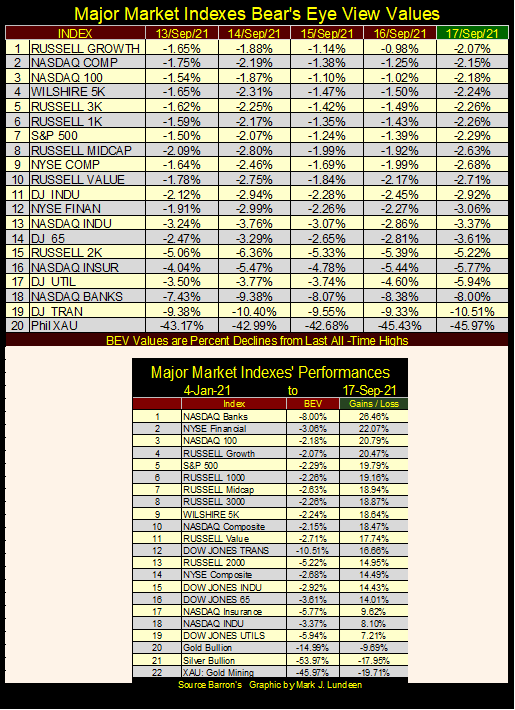

Moving on to the Major Markets Indexes BEV Values table below, this week we saw no new BEV Zeros (new all-time highs). Also, the number of indexes closing in scoring position contracted from last week. Looking at Friday’s data, no index was within 2% of their last all-time high. It’s been a while since we have seen that; “liquidity” flowing out of the stock market.

For months now, actually for many years, nay decades, gold, silver, and their miners have underperformed the market (#20 to 22 above).

I’ve noted how in the past, precious metal assets have historically proven to be safe harbor assets in a storm of deflation on Wall Street. Should Wall Street once again come under attack by Mr Bear and his cleanup crew, expect these assets to once again become the assets of choice by many, who currently have none in their portfolios. And they will pay top dollar to get them. With trillions of dollars of capital in flight from Deflation in the global stock and bond markets, the potential gains for precious metal assets could be astounding.

Below is the Dow Jones in daily bars. I wanted to call out this chart as a real stinker. Since early May the Dow Jones has struggled. It closed today where it was in early May, four months of no progress.

But then, one could also see the Dow Jones below as a correction of a continuing market advance. This advance began off the bottom of the Dow Jones’ March 2020, 38% flash crash, making this advance now eighteen months old. That is a long time for an uncorrected advance.

What’s a correction in a bull market advance? I’d say a decline of 10% to 20% over a term of six months to maybe over a year. But since March 2020, this market has been “injected” with so much “liquidity”, that should the Dow Jones correct 10%, it may continue deflating down to levels, in percentage terms not seen since the depressing 1930s.

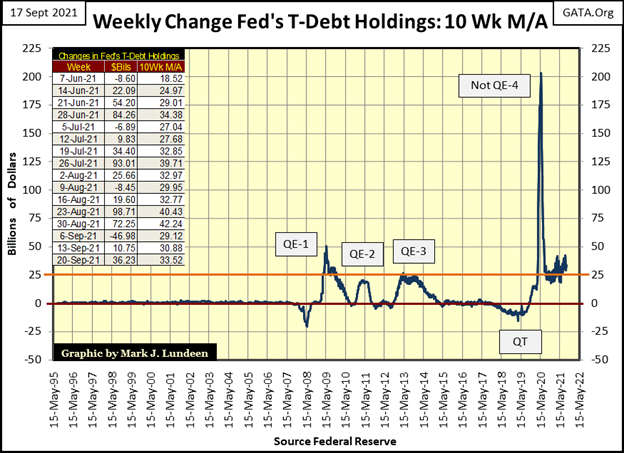

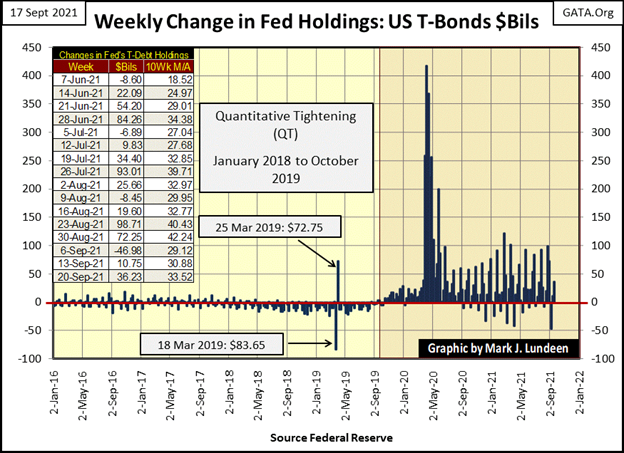

Below is how the Dow Jones’ current advance, off its March 2020 lows began; when Fed Chairman Powell, with his Not QE#4, “injected” a few trillion dollars into the financial system to reflate the stock and corporate bond markets. Since then, the FOMC’s weekly “injections” remained at levels above those Doctor Bernanke’s typically “injected” weekly into the financial system with his three QEs.

Our markets and financial system are profoundly addicted to cheap credit and the bogus bucks flowing from the FOMC. How this market advance (chart above) will end could never be good. Still, we may see a few new all-time highs from the Dow Jones, if the “policymakers” are successful in containing the “liquidity crisis” now playing out on China’s Evergrande balance sheet.

Continuing with my thoughts concerning cheap credit and bogus bucks; our Congress’s Chairman of the House Budget Committee offered an interesting insight on Modern Monetary Theory in practice.

After reading that, do you feel better? Not me! The quote above from Representative Yarmuth (D-KY), Chairman of the House Budget Committee, is astonishing it its hubris. In Greek mythology, such arrogance by a mere mortal almost guaranteed that Zeus would strike them down.

The above quote came from Pastor James Kaddis (Calvary Chapel Signal Hill) in the short five-minute video below.

I agree with Pastor Kaddis; our Congress is determined to collapse the US Dollar as a necessary step for the imposition of a cashless economy, where “You will own nothing, and you will be happy”, AND THAT IS AN ORDER! There are religious aspects to this; prophecies made thousands of years ago now coming true. But I’m writing an investment article, so watch the video for that.

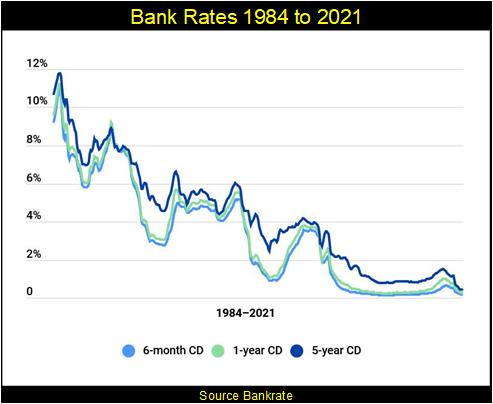

Money today is actually worthless. Before Doctor Bernanke’s series of QEs, bank deposits once paid savers over 3%. In Barron’s latest issue, banks paid 0.07% on deposited funds. This makes saving money today at a bank only a convenient depository for savers, and an unprofitable bookkeeping burden for the bank.

Our politicians have played fast and loose with the American people for a long time, as you can see from the Barron’s quote below from their 21 September 1936 issue:

The Foundation for Economic Education (FEE), has some thoughts on the Social Security Trust Fund in the link below, which illustrates nothing has changed for the Social Security System since 1936.

https://fee.org/articles/the-myth-of-the-social-security-trust-fund/

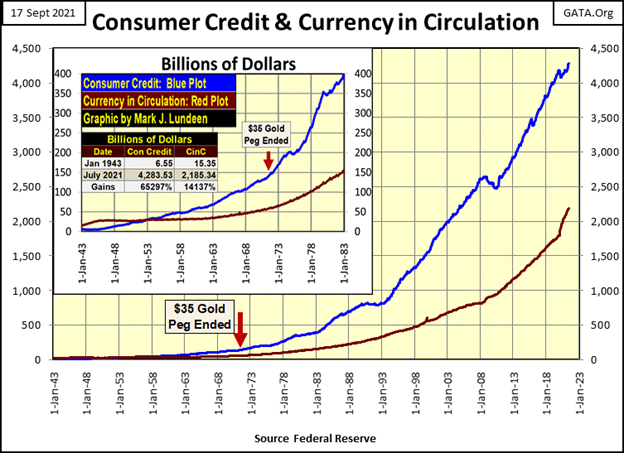

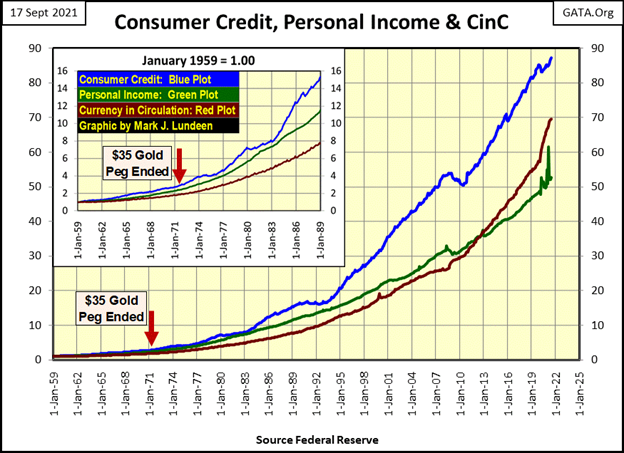

The above sorry commentary on contemporary “policy initiatives” is an introductory to my charts on consumer debt and personal income below. The growth in both are functions of Congress’ “power to create as much money as we need to spend to serve the American people.” There was little love lost in Washington DC when the Bretton Woods $35 gold peg was done away with in August 1971. We are all much poorer for the loss of it.

My first chart is for consumer debt from 1943 to 2021. Consumer debt (Blue Plot) is plotted along with currency-in-circulation (CinC / Red Plot), or paper money issued by the US Government. In the insert, I placed a table listing the first and latest values for these data series. In January 1943, CinC was more than twice the value of consumer credit. In July 2021 (latest data), consumer debt is about twice that of CinC.

People were thrifty in 1943, they had to be. Yes, there was WWII going on. Still, if one wanted to purchase something, they would first save their money in a bank until they had sufficient funds to buy it. In 1943, people had no other choice.

The depressing 1930s was the result of debt (credit) deflation, caused by credit inflation flowing from the Federal Reserve System during the booming 1920s. Many commercial banks in the depressing 1930s went out of business due to jobless consumers defaulting on debts they’ve assumed during the booming 1920s. Banking management of the post-Great Depression era, of the 1940s and 1950s, were not going to make that mistake again. But then came the 1970s and beyond.

From 1943 to 2021, CinC has inflated by a factor of 141, as consumer debt has inflated by a factor of 652. What’s to make of this? Most people today wouldn’t want to know my opinion. And it seems the more “higher education” people today have, the less they want to hear about what a horrible institution the Federal Reserve has proven to be over the past century.

The 1943 survivors of the banking catastrophe of the depressing 1930s would look at the data below with disbelieve and dismay. The horrors of the 1930s were still fresh in their minds. They had intimate knowledge of what must come from the unchecked inflation in credit for consumption. Intimate knowledge the Chinese “policymakers” are currently relearning as they attempt to control the pending defaults of Evergrande.

My next chart plots consumer debt (Blue Plot), CinC (Red Plot), and personal income (Green Plot) indexed to 1.00 = January 1959. Why 1959 and not 1943? That’s where the Federal Reserve begins their personal income data series.

What’s nice about plotting personal income, along with consumer debt, is we see if people are living above their means. Since August 1971, when they did away with the Bretton Woods $35 gold peg, that has certainly been so.

Yes, and by design. Why else would they have severed the dollar from its gold peg, except they wanted to destabilize the financial system and personal finances from exactly what we see below; people spending dollars (via credit) they may, or may not earn tomorrow with their personal income.

Another thing to notice in the chart above, soon after Doctor Bernanke began his series of QEs following the FOMC’s sub-prime mortgage debacle, CinC began inflating faster than personal income. That can’t be good.

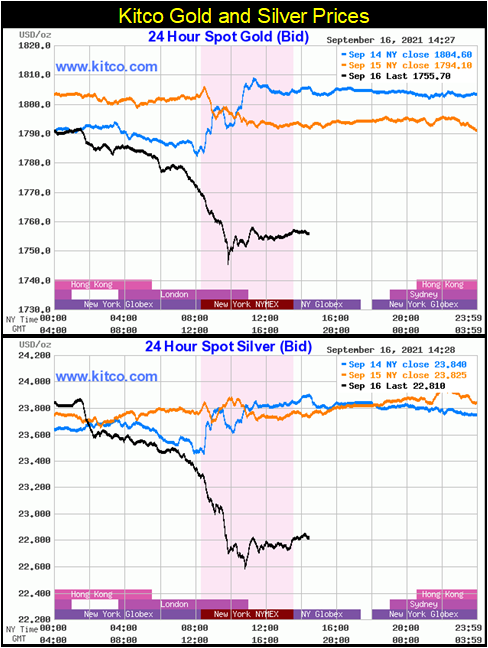

Again, this week COMEX goons flooded the precious metals futures market with insincere-paper promises to deliver metal that doesn’t, and never will exist. On Thursday they drove the price of gold down $45, and silver by $1.20 (charts below).

On Thursday? Thursday, September 16th? The same day Reuters reported news that China’s Evergrande’s $300 billion dollar debt crisis was deepening, how thousands of unpaid small business owners were in despair? Move on, nothing to see here folks.

Thursday is also the day when the FOMC publishes its balance sheet. This Thursday the FOMC reported they “injected” an additional $36.23 billion dollars into the financial system, and the prices of gold and silver tumbled at the COMEX? In the late 1990s, Chris Powell of GATA said we no longer had markets, only market manipulations. How right he was.

Jeeze Louise! This week gold closed with a BEV value of -14.99% ($1752.40). Just $0.18 short of hitting its -15% BEV line below. Will gold hold this critical line in its BEV chart below? Maybe. But should the “credit crisis” now playing out in China continue to unfold, and spread beyond China’s borders, the “policymakers” will do a full-court press on the gold and silver markets. You have been warned.

So, maybe we should look at gold’s BEV chart in another light; the worse the Chinese credit crisis becomes, the deeper the declines in the gold and silver markets will go. We may see gold below, breach its BEV -20% and -25% lines before this “correction” in the gold market concludes.

But in a world pregnant with counter-party failure, with hundreds-of-trillions of dollars of asset valuation at risk of default, you’d be foolish to sell gold and silver. Why? The old monetary metals are assets with no counter-party risk. This would be true no matter how low the “policymakers” can grind down their valuations in the fraudulent COMEX futures markets.

For those who can keep an iron hand on the tiller, the future remains bright. If someone wants to buy some bargains in a declining market, precious metals assets; bullion, and mining companies that produce them would be where I would look should they begin selling off.

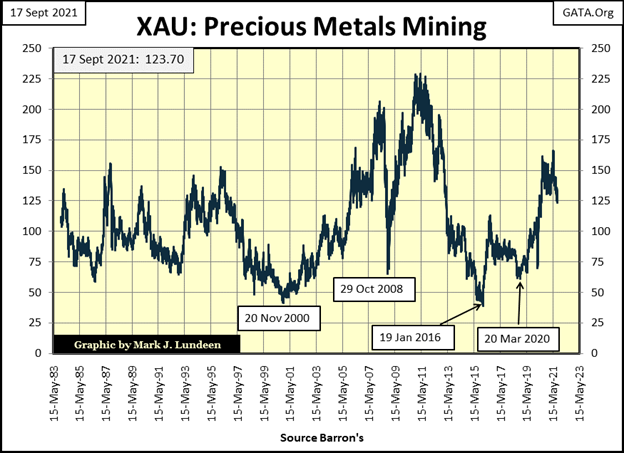

Look at the XAU below. It began trading in December 1983, closing its first day at 107.06. Where did it close this week? At 123.70, for a four-decade gain of 15.5%, or up $16.64 after thirty-eight years.

During this time the Dow Jones is up 2685%, a gain of $33,342. The NASDAQ Composite is up 5380%, a gain of $14,769. Simple logic tells us the markets with the greatest risks of deflating, are the ones whose valuations have been inflated the most. Which in September 2021 aren’t precious metals assets.

And then there are the bond markets, fixed-income assets whose valuations and yields have been manipulated as a matter of “policy” for many decades. In March 2020, Chairman Powell was forced to begin “monetizing” corporate bonds during a panic sell-off in the corporate-bond market, before he could reflate the stock market. In September 2021, our long-abused financial markets are a total mess. It’s in the broad stock and bond markets where the greatest risks of massive deflationary losses are to be found.

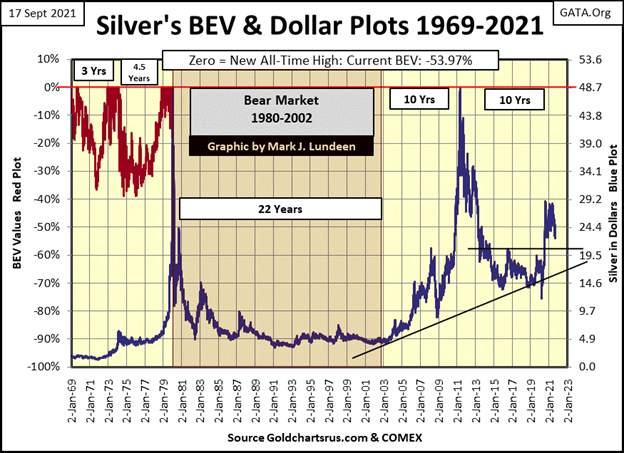

There isn’t any hot money flowing from the FOMC to be found in the precious metal markets – NONE. In fact, the efforts of the idiot savants at the FOMC for past decades has been to keep precious metal asset valuations deflated, which so far, they have been very successful. It’s not just the XAU whose valuation is still mired in the 1980s. Silver’s last all-time high is still January 1980, forty-two years ago. At today’s close, silver closed with a BEV Value of -53.97%, less than half the price of its last all-time high from decades back (see chart below).

So, in September 2021, the ability of the “policymakers” to inspire panic in the gold and silver markets, as well as for their miners is very limited.

* In the storm to come; precious metal assets are where I want to be. *

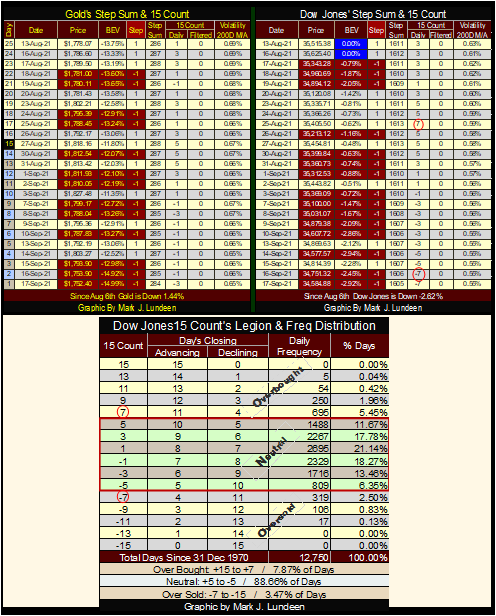

I’m going to skip gold and the Dow Jones’ step sum charts this week, and move on to their step sum tables below. For the past three trading weeks, since August 27th, both gold and the Dow Jones have seen down days overwhelm advancing days, especially for the Dow Jones. On August 25th, the Dow Jones’ 15 count was a +7, meaning it was an overbought market due for a pullback. This week the Dow Jones closed with a 15 count of -7, an oversold market now due for a rebound.

Now let’s look at this in light of the current credit crisis in China. I haven’t been following China’s Evergrande credit crunch all that close. I don’t know on what day the American financial media first noted it. But on September 16th Reuters published the article I quoted from above, on the day the Dow Jones’ 15 count first declined to a -7 above.

In the frequency table above, we see how since 31 December 1970, the Dow Jones’ 15 count closed with a -7 for only 319 NYSE trading sessions, or for only 2.50% of the total 12,750 daily closings in this sample. That’s not many. And then to see the Dow Jones’ 15 count decline from an overbought +7 to an oversold -7 in only fifteen NYSE trading sessions is an even rarer market event, possibly a first.

The following is just my opinion. That, plus a nickel would have gotten you a cup of coffee and a donut at a diner in 1943. But looking at the Dow Jones’ side of the step sum table above, we may have been observing the deterioration of the global financial system, as the Dow Jones’ 15 count above declined from a +7 to a -7.

To confirm whether I’m on to something, or not, we only have to see what the Dow Jones does in the next few weeks. Should the Dow Jones begin a series of extreme days-of-volatility (daily moves of greater than 2%), that would be very bad, in a potentially depressing, 1930s sort of way. I hope I’m wrong.

Eskay Mining had a press release on September 16th. What’s with September 16th? Anyway, Eskay announced they have identified two new VMS (Volcanic Massive Sulfide) deposits on their 100% owned, British Columbia property. Such VMS deposits were the rich paydirt that made the old Eskay Creek Mine famous.

No more commentary should be expected from the company on these new discoveries until the company drills cores from these deposits, and receive the assay results on them. Most likely not until next year.

But that’s okay, as in September we’re still waiting for this year’s drilling program (30,000 meters / or 18.64 miles of core samples) to be assayed and published. This’s a big job, and the assay lab is conducting assays on many other companies’ core samples. So, expect this season’s assay’s findings to come out bit by bit, util sometime in January and February of 2022.

I’m not going to speculate on how this year’s drilling program will impact Eskay Mining’s share price when all is said, done and published, as that would be wrong to do. But I have to admit to my readers who followed me into Eskay Mining, that personally, I’m sitting on the edge of my seat waiting for this season’s first batch of assay results. I’m anticipating excellent results.

—

(Featured image by sergeitokmakov via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto1 week ago

Crypto1 week agoHong Kong Approves Bitcoin and Ethereum ETFs: A New Chapter for Cryptocurrencies

-

Africa17 hours ago

Africa17 hours agoAgadir Signs a Partnership to Boost the Horticultural Sector

-

Fintech2 weeks ago

Fintech2 weeks agoFintech Report 2023: Venture capital Funding for Fintech and Crypto Startups Collapses

-

Impact Investing7 days ago

Impact Investing7 days agoGreen Arms Raised Almost 1 Million in its Crowdfunding Round on CrowdFundMe