Biotech

Diesse company develops special tests to diagnose COVID-19

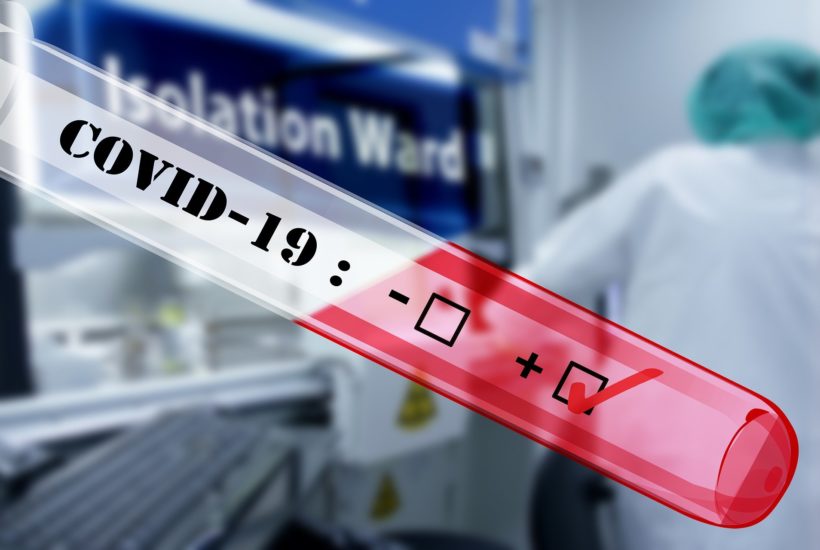

The pharmaceutical company Diesse is developing a new blood test that could track COVID-19 antibodies. The company said the test should be ready by the end of April. The first to be screened with Diesse’s test will be doctors, nurses and workers in the public and private sectors. ArhiMed took over the majority of Diesse Diagnostica and helped the company to further develop.

Diesse Diagnostica Senese spa, a company controlled by the ArchiMed fund, which develops innovative in vitro diagnostic systems for infectious and autoimmune diseases, is developing a blood test to diagnose the coronavirus, to both symptomatic and asymptomatic patients.

For the latest discoveries in the biotech sector, download our companion app, Born2Invest. Stay informed with everything that matters to you, from possible vaccine developments against the new COVID-19 to economic news about the world’s financial markets.

Diesse’s test is innovative because it could track COVID-19 antibodies

This is the only blood test in the world that can track Covid-19 antibodies and indicate whether a person is affected or an asymptomatic carrier of the coronavirus. Diesse’s test will help determine the preventive measures (e.g. quarantine) applied to asymptomatic and active carrier COVID-19 patients and allow a more accurate analysis of how the infection spreads among populations.

The test should be distributed by the end of April, following the evaluation of its performance by the Lazzaro Spallanzani National Institute for Infectious Diseases in Rome. The first production batches of Diesse will be used for screening doctors, nurses and workers employed in the public and private healthcare sector in Tuscany. Diesse is planning to distribute the test throughout Italy and the rest of the world.

The partnership with ArchiMed allowed Diesse to further develop

Massimiliano Boggetti, Diesse CEO, commented: “The partnership with a specialist in the field such as ArchiMed has provided Diesse with the funding and freedom to effectively combat major health hazards such as COVID-19 and remain at the forefront”.

Loic Kubitza, Partner of ArchiMed, added: “We want to see partner companies grow profitably in the long term, providing them with the financial, consulting and industry resources they need to successfully tackle challenges like COVID-19”.

ArchiMed took over the majority of Diesse in May 2019. The acquisition was made through the newco Duomodiag sarl, controlled by ArchiMed’s MED II fund, which was financed by MPS Capital Services and BPER Banca. Orphée, which received €13.3 million for its share, as well as an earn-out of up to €1.2 million based on 2019 results.

Orphée sa, which took over 45% of Diesse from Diagnostica Holding in February 2013, is in turn 79.6% owned by the Polish company listed in Warsaw PZ Cormay sa, which develops, manufactures and sells diagnostic reagents and laboratory equipment in Poland.

Diesse Diagnostica Senese was founded in 1980. Since then it has gained a solid position in the IVD market segments of hematology, serology, and bacteriology. The company’s initial development is due to the invention and subsequent patenting of a revolutionary method for the determination of sedimentation rate (ESR), characterized by the reduction of sample volume, the use of a closed system that eliminates any risk of contamination by the operator, the drastic reduction of examination time and the perfect correlation of results with the reference method.

The company is based in Siena, plants in Monteriggioni (Siena), research centers in Siena and Trieste. It employs 167 people, sells its products in 104 countries around the world and is present in all 5 continents through a network of 148 distributors. It is part of the Elite community of Borsa Italiana.

__

(Featured image by geralt via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

First published in Be Beez, a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail.

Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

-

Fintech1 week ago

Fintech1 week agoRuvo Raises $4.6M to Power Crypto-Pix Remittances Between Brazil and the U.S.

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis and the Aging Brain: New Research Challenges Old Assumptions

-

Biotech5 days ago

Biotech5 days agoEurope’s Biopharma at a Crossroads: Urgent Reforms Needed to Restore Global Competitiveness

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoAWOL Vision’s Aetherion Projectors Raise Millions on Kickstarter