Business

Energy Investing: Why the easing of COVID-19 lockdowns is the perfect moment for investors to target Turkey & Trillion Energy International

Demand for oil & gas is soaring again as COVID-19 lockdowns across the globe ease off. This means that there is a small window of opportunity for energy investors to grab high-potential companies at a discount. The key will be to find high-demand regions being developed by companies like Trillion Energy International Inc.(CSE: TFC) (OTC: TFCC) (FRA: 3P2N).

It has been a tough year for the oil and gas sector. In March tensions between Saudia Arabia and Russia sent oil prices plunging. Then COVID-19 sent the global economy into deep freeze, decimating demand for oil and raising very real concerns about pricing problems. That’s begun to change, as lockdown has eased demand for oil & gas has spiked and this creates a unique moment of opportunity for investors. Companies like Trillion Energy International Inc.(CSE: TFC) (OTC: TFCC) (FRA: 3P2N) could offer excellent return on investment thanks to a unique Turkey focused strategy.

Understanding the importance of Turkey

Why Turkey? Well there are certainly a number of high potential gas & oil markets in the world but Turkey is probably the most interesting. At time of writing the Turkish economy relies upon natural gas for the majority of its energy use and is currently forced to import 98.2% of its gas requirements from abroad.

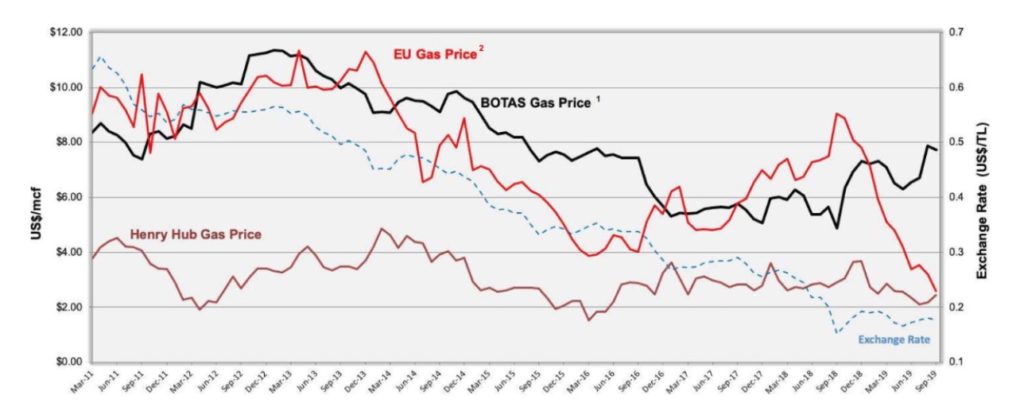

In addition to this the demand for gas in Turkey is rising rapidly as the country continues to develop. Because of this gas prices in Turkey are continuing to rise even as prices in the US & EU have fallen dramatically. This all creates a significant challenge for Turkey. Gas is the energy source of choice in the country and reliance on imports could lead to severe supply chain disruptions in the future. This represents a very real threat to the Turkish economy and the nation is likely to look to more local alternatives in order to ensure a steady supply of natural gas. This is where we come to Trillion Energy International Inc.(CSE: TFC) (OTC: TFCC) (FRA: 3P2N).

Developing the first shallow water natural gas field in the black sea

Trillion Energy is a Canadian based upstream natural gas producer with a focus on high demand gas markets, such as Turkey. Currently one of the company’s key projects is the SASB project. This is the first shallow water natural gas field in the black sea and it has already produced 41 billion cubic feet of natural gas since 2007. The company is making plans to move into phase III & IV of this project and it is expected to produce around 86.9 billion cubic feet of natural gas worth around CND $872 million.

The SASB project is high potential for a number of reasons. The first is geographical. The Turkish market purchases gas at a significant premium compared to North America and Europe. This has enabled Trillion to sell gas from SASB at prices between US $6.50/MCF and US $7.60/MCF. The other advantage is that the company can take advantage of significantly lower operating costs and royalties, compared to similar operations. This allows the company to maximize its potential earnings and therefore value for shareholders.

In addition to SASB the company also has the Vranino gas prospect in Bulgaria. It has drilled over 200 exploration wells and has a 100% interest in 98,205 acres of land which may contain over 1 trillion cubic feet of natural gas. It also controls two key oil fields, Cendere and Derecik. Cendere is currently generating around $234 thousand a month in net revenue and Derecik is a blue ocean oil field with potentially 504,000,000 barrels of oil available for extraction.

The company’s assets also grew in value on the back of an independent report into its reserves. The report increased the amount of P3 (proven, probable, possible) reserves from 342,000 BOE to 4,901,000 BOE. This is an increase of 1,433% and translates to an additional $132.8 million in potential reserves for the company. Even taking into account all costs the company’s NPV 10% valuation has seen an increase in value from $4.97 million to $38.86 million overnight.

SASB redevelopment plans are moving ahead

Trillion Energy’s most important development is undoubtedly the SASB project. This is why it was excellent news when the company announced today that the company was to receive an independent report on the site’s prospective gas resources. This report is a key step in the redevelopment process, which is expected to produce 6.7 billion cubic feet of gas.

The company has also completed its preliminary costing estimates and timelines associated with developing the reserves on SASB. The company plans to prioritize development based on the economic metrics of the four gas fields. A final decision will be taken once a report by GLJ Petroleum Consultants is released in July 2020. The company is expecting to spend approximately USD $26 million on the development.

A unique opportunity for energy investors

For investors Trillion Energy International Inc.(CSE: TFC) (OTC: TFCC) (FRA: 3P2N) demonstrates two things. The first is that there are significant gains to be made in the oil & gas market with the right company. The second is that companies which take a creative approach to high-value markets could be an incredibly high-potential investment in the near future, so long as you can be sure that they really understand the market that they are operating in.

—

(Featured image by jpenrose via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Markets2 weeks ago

Markets2 weeks agoThe Big Beautiful Bill: Market Highs Mask Debt and Divergence

-

Africa2 days ago

Africa2 days agoORA Technologies Secures $7.5M from Local Investors, Boosting Morocco’s Tech Independence

-

Markets1 week ago

Markets1 week agoA Chaotic, But Good Stock Market Halfway Through 2025

-

Business4 days ago

Business4 days agoThe Dow Jones Teeters Near All-Time High as Market Risks Mount