Featured

Is the futures market slowly recovering?

Corn closed slightly higher as the shock and awe tactics employed by the Saudi Arabian government hurt domestic ethanol production and the effects of the Coronavirus became part of the market. Prices for Crude Oil and also gasoline and heating oil are at extremely low levels. In addition, ethanol plants in the US are shutting down or greatly reducing run times. That means a lot less Corn demand.

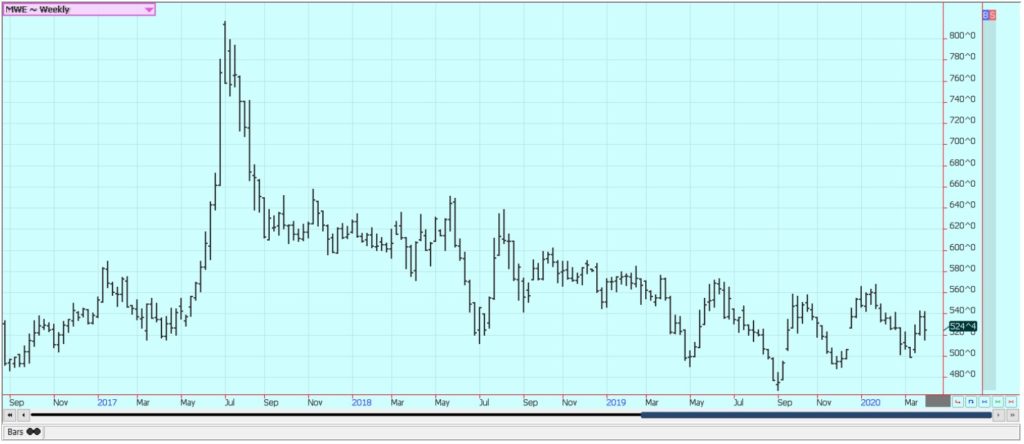

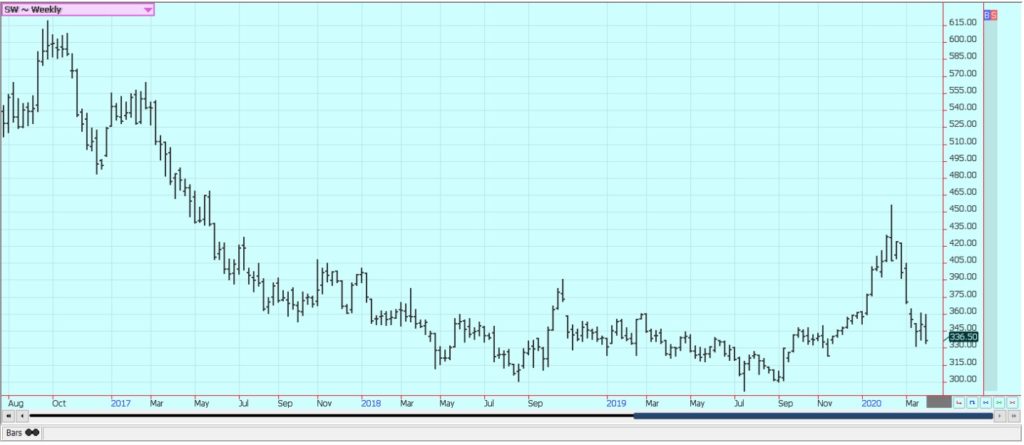

Wheat

Wheat markets were higher for the week but spent the second half of the week going up and down with much volatility. These markets could all be forming tops. The Coronavirus and stay at home orders in many states have created a rush of buying of Wheat products and have caught the mills short bought. They have been very active in buying Wheat in domestic cash markets, especially in the Great Plains, and basis levels have moved sharply higher. In addition, there was a lot of talk of restricted exports from Russia as Wheat prices have moved sharply higher as have flour prices in local markets. For now the restrictions imposed do not seem to be onerous, but the situation bears watching. It remains dry in most growing areas near the Black Sea and there was some talk of damage early in the week in Ukraine northern Wheat areas from freezing temperatures and no snow cover. But, the market did not react much if at all to the news. The dry weather pattern continues in these areas and must still be watched although it is too early for any kind of a market reaction.

Corn

Corn closed slightly higher as the shock and awe tactics employed by the Saudi Arabian government hurt domestic ethanol production and the effects of the Coronavirus became part of the market. Prices for Crude Oil and also gasoline and heating oil are at extremely low levels and ethanol plants in the US are shutting down or greatly reducing run times. That means a lot less Corn demand. The Saudis are using the cheaper price to punish Russia for balking at cutting production a few weeks ago but also to eliminate competition from shale oil producers in the US and Canada as well as bio fuels producers around the world. The loss in ethanol demand inside the US is so large that even a major purchase of US Corn by China did little to create any lasting buying interest. The sideways trade implies that the market could have found a low, but any real upside potential is very hard to find given the current fundamentals.

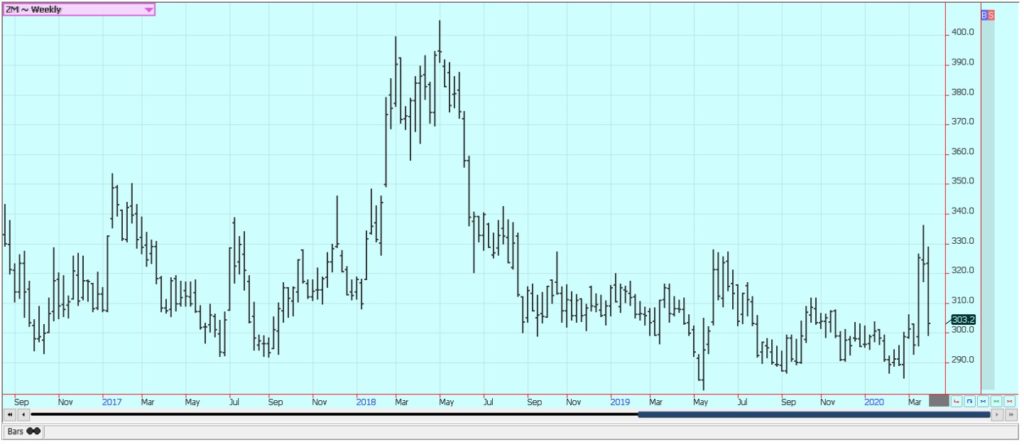

Soybeans and Soybean Meal

Soybeans closed higher on logistical problems in South America. Soybean Meal moved sharply higher early in the week, then melted and closed slightly lower. Soybean Oil closed a little higher. Both markets were supported in part by the lack of ethanol production here in the US. Little or now ethanol production means little or no production of DDG as well, so a potential competitor to Soybean Meal in domestic and world markets has been effectively removed. Logistical problems caused by the Coronavirus in South America also played a major roll in the rally. Argentina and Brazil are having trouble getting trucks from farms to crushers and exporters. The problems are especially in Argentina, where several towns have moved to block traffic in defiance of federal orders. Exports are not supposed to be affected, but there are signs that transportation inside the countries has become very difficult.

Rice

Rice continued to work higher after the correction trade of late last week and early this week. Mills and speculators were early week buyers and speculators bought later in the week. The domestic situation remains tight and sales to western countries have been generally good although not so strong in recent weeks. Some producers are selling the next crop and some significant hedge selling has been seen in new crop months in futures. Demand for US Rice remains generally positive and the export sales pace, in general, has been very good. Mills and exporters are calling previously bought Rice to keep the market supplied. This is happening mostly in Arkansas as Gulf Coastal areas are mostly sold out of Rice.

Palm Oil and Vegetable Oils

World vegetable oils markets were higher last week. Palm Oil and Soybean Oil were the upside leaders. All markets are still factoring in potential demand changes and the demand outlook for biofuels is poor. However, there are logistical problems as well, including loading problems everywhere, but especially in Argentina due to the closure of the borders and the inability of Malaysian and world producers to get tankers due to previous logistical problems caused by the Coronavirus. In addition, Malaysian producers are having trouble getting labor n the fields and the processing plants due to the Coronavirus. It is becoming an increasingly dire situation. Canola has been firmer due to the collapse of the Canadian Dollar against the US Dollar last week.

Cotton

Cotton was lower Gain last week and made new lows for the move on the weekly continuation charts. Much of the selling was related to lost demand potential due to the Coronavirus and the extremely weak petroleum prices. The Coronavirus has the chance to hurt trade in Cotton between the US and China. Chinese buyers might need less Cotton now as factories inside their country were closed for an extended holiday. All are reopened now, but the manufacturing pace has been slow. China has also been slow to buy products from Southeast Asia and demand for US Cotton has been hurt in the entire region. The weakness in Petroleum futures comes from the moves by Saudi Arabia to ramp up production just at the time when the world economy is slowing down. The threat of a worldwide recession is very real.

Frozen Concentrated Orange Juice and Citrus

FCOJ was higher for the week on demand considerations here in the US. Industry sources suggest that demand has improved as consumers are returning to FCOJ due to the Coronavirus. Grocery stores in many areas have sold out and need to restock. The increased demand has really turned the market around. The early and mid crop harvest is about over and the Valencia harvest is increasing. Good growing conditions and increased oranges production estimates by USDA this season have been bearish. The weather has been great for the trees as there have been frequent periods of showers and no severe storms so far this year. Many areas have been dry lately and irrigation is being used. Reports indicate that new crop fruit is progressing well.

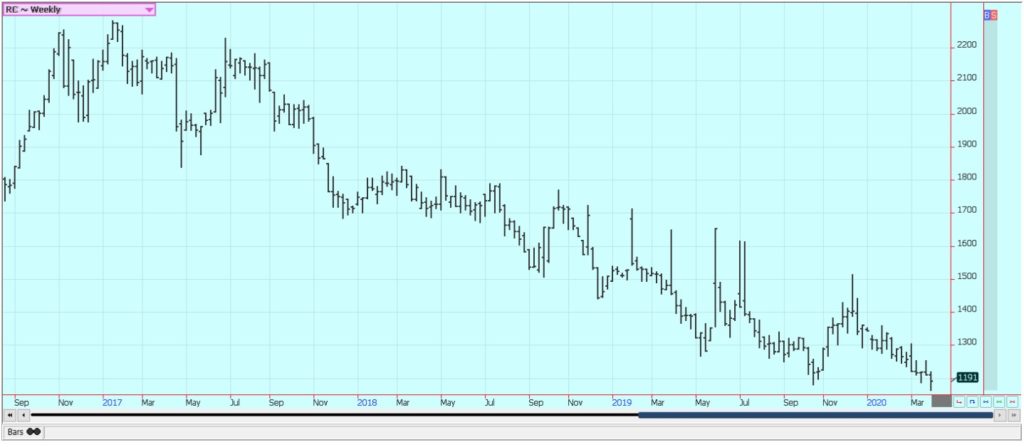

Coffee

Futures were lower in New York and in London but the logistics of shipping Coffee from anywhere in Latin America remain difficult at best. Containers are bottled up in China and are increasingly hard to find for shipping in most Coffee exporter countries. The chart trends are down in New York and mixed in London due to big production ideas. Rains were reported in Brazil Coffee areas over the weekend and showers are continuing through this week. It is dry in other parts of Latin America. Central America has had less than normal rains, especially in Honduras. The Asian harvest is underway but producers do not seem to be selling on ideas that prices are too low.

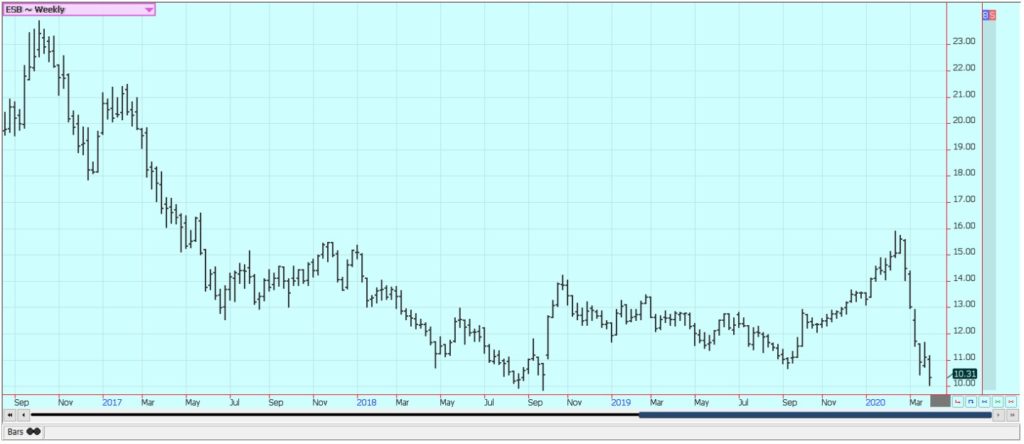

Sugar

New York and London both closed a little higher for the week. Sugar futures were supported by the lack of container availability in Brazil for shipping. The recently weaker petroleum futures make higher-priced ethanol that much more expensive to blend and cut demand. That makes more Sugarcane available for processing into Sugar. The Brazil mills are trying to cover the lack of White Sugar in the market but are having trouble getting containers for shipping. Reports indicate that little is on offer from India. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. Reports of good weather in Brazil imply good crops there.

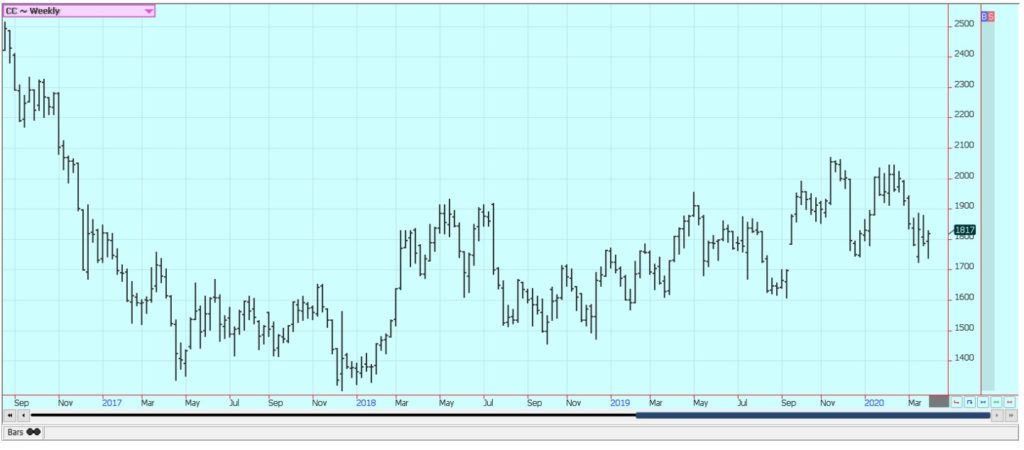

Cocoa

New York and London closed mixed, with London lower and New York a little higher. It was a week for currency trading in this market. Harvest is now over for the main crop in West Africa and the results so far are very good. Ideas are that demand is currently strong but less than before due to the Coronavirus problems in Europe. The reports from West Africa imply that a big harvest in the region. The weather in Ivory Coast is good. The weather is too dry in Ghana and Nigeria and there are fears that the mid crop is not developing well at this time.

—

(Featured image by Elias Shariff Falla Mardini from Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Africa2 weeks ago

Africa2 weeks agoBank of Africa Launches MAD 1 Billion Perpetual Bond to Boost Capital and Drive Growth

-

Markets2 days ago

Markets2 days agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto1 week ago

Crypto1 week agoBitcoin Recovers After U.S. Strikes Iran, While Altcoins Face Sharp Losses

-

Africa7 days ago

Africa7 days agoMorocco’s Wheat Dependency Persists Despite Improved Harvest