Business

Gold mining news: Peru prioritizes gold mining in COVID-19 lockdown ease and Inca One Gold is positioned to benefit

As lockdowns ease around the world the Peruvian government has made a surprise announcement. Artisanal gold miners are to be allowed to go back to work significantly earlier than expected and this is good news for gold. These miners have significant unsold ore stockpiles and Inca One Gold Corp. is set to help them take advantage of this.

While most of the investor world is busy trying to decipher a confusing stock market situation they’re missing out on a key story. Peru, the world’s 6th largest gold mining nation, has suddenly accelerated the re-opening of its gold mining sector. This will provide a big boost to gold companies like Newmont Goldcorp (NYSE: NEM, TSX: NGT) and GFG Resources Inc. (TSX-V: GFG, OTCQB: GFGSF), but nobody is better placed to take advantage of this than Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F).

Why is Peru so important to the gold industry?

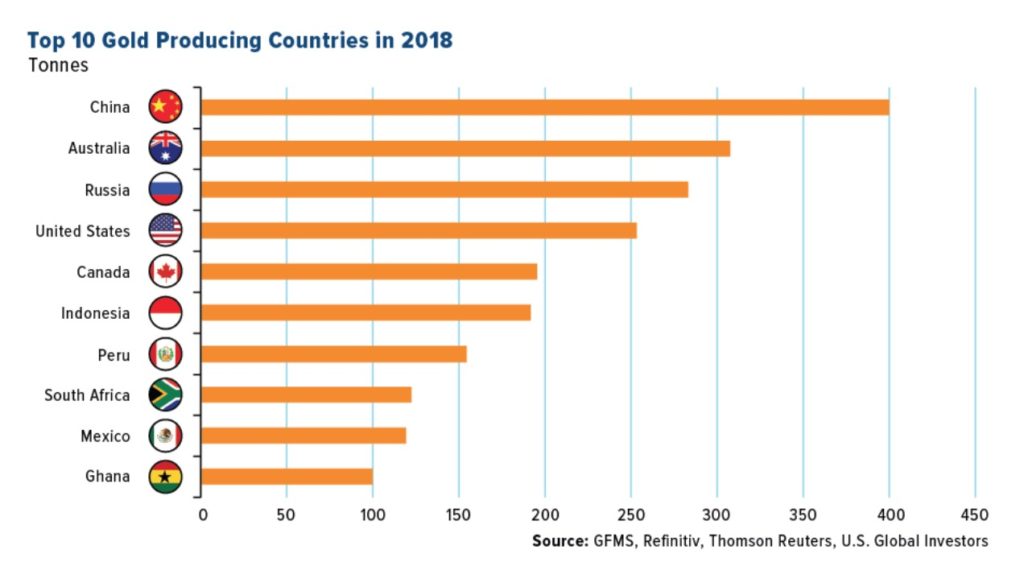

On paper Peru doesn’t seem that important. It is “just” the 6th largest gold producer according to the official statistics, but as is often the case the official numbers don’t tell the full story. Peru has the world’s largest unexploited gold reserves and a large number of unregistered mining operations. If these grey market operations were taken into account Peru would likely be one of the largest gold producers on the planet today.

It is difficult to overstate just how important the gold mining industry is to Peru. Currently over 330,000 Peruvians make their living from gold mining and the sector represents 14% of Peru’s GDP and 60% of the nation’s exports. Around 20% of the country’s total gold production comes from small scale artisanal mining.

Peru is slowly coming out of lockdown

All of this means that the enforced lockdowns to combat the COVID-19 pandemic have hit the Peruvian gold mining sector hard. Many companies were forced to scale back operations and artisanal gold miners have been stuck unable to sell existing ore stockpiles, thus missing out on the recent gold price boom.

Originally the government had planned to include gold mining in the 4th phase of the lockdown easing process. This would have forced gold mining companies to wait until August 1st in order to restart operations. Thankfully the Peruvian government pivoted and elected to include the all-important gold mining sector in the second phase of the process. This will allow 80% of the economy to reopen and let gold miners get back to work two months earlier than originally planned.

This is excellent news but it also means that small scale mining operations may be caught off guard. As Peru’s head of the National Society of Mining, Oil and Energy Manuel Fumagalli said: “Peru needs its mining industry to operate at 100% in the shortest possible time”. This particularly applies to small scale miners who are an essential component of the wider economy and support a variety of businesses. It is also where Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) comes in.

Inca One Gold provides essential support to Peru’s gold mining industry

One of the biggest challenges for artisanal miners at the moment will be obtaining the liquidity necessary to restart operations. This is where Inca One wants to help. The company was the first publicly traded gold processor to achieve full permitting. It has already taken steps to cultivate a positive relationship with the Peruvian government and it is working to do the same for the Peruvian mining sector in general.

During lockdown the Inca One team has been preparing its ore buying teams to go out and purchase existing ore stockpiles. The company plans to make it as quick and easy as possible for artisanal miners to send ore to its Chala One and Kori One processing facilities. This is a hugely positive move for both Inca One and the Peruvian gold mining sector in general.

Inca One’s facilities are firmly geared towards artisanal miners. This has created a symbiotic relationship where Inca One takes steps to support the Peruivian gold mining sector, and in turn the Peruvian gold mining sector helps to drive growth for Inca One Gold.

Inca One Gold is perfectly positioned to take advantage of Peru’s gold mining boom

Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) currently uses just 35% of its total permitted capacity in Peru and this is a very good thing. The company has the spare capacity to grow with the Peruivian mining sector and take advantage of what will soon become a gold mining boom in the South American nation.

In the same vein the company has also taken steps to insulate itself from market volatility. Rather than relying upon big procurers in Europe or Asia, Inca One Gold has taken steps to sell gold bullion directly to consumers via its planned online store. This will enable the company to sell high quality gold at a mark-up whilst also helping to cement Peruvian gold in the global mindset with quality gold coins.

There are few companies as well placed as Inca One Gold Corp. (TSXV: IO.V, OTC: INCAF, FRA: SU92.F) to thrive, COVID-19 or no. Investors, particularly gold resource investors, would do well to take a look at the recent report Fundamental Research Corp to understand just how undervalued Inca One gold is at the moment. It seems likely that Peru, and therefore Inca One Gold, are set to become one of the most important drivers in the gold market in the near future.

—

(Featured image by Pixabay via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Markets6 days ago

Markets6 days agoMiddle East Escalation Sparks Market Uncertainty as Oil and Gold Poised to Rise

-

Fintech4 days ago

Fintech4 days agoMeta Plans New Dollar-Backed Stablecoin for Facebook, Instagram, and WhatsApp

-

Crypto2 weeks ago

Crypto2 weeks agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Impact Investing6 days ago

Impact Investing6 days agoGreen vs. Brown Stocks: Climate Policy, Capital Costs, and the Battle for Market Returns