Featured

Gold proves resilient while silver slumps, post-Brexit

Three things factor in both the performances of gold and silver: the strength of the U.S. dollar, the rise in longer-term interest rates and the astoundingly high speculative interest in metals.

Gold futures ended on its lowest for the past 3.5 months in early October since the EU Referendum results or post-Brexit.

The precious metal tumbled three percent to $1,270.40 which is its poorest performance. According to MarketWatch, the drop was due to the dollar’s continued show of strength against the pound and other rivals. Consequently, the demand for commodities valued in the U.S. dollar decreased. December gold plunged $43, or 3.3 percent, to reach $1,269.70 an ounce. Gold’s biggest drop in more than a year put a stop to its 21 percent rally this year.

“The dollar is steadily regaining some momentum across the currency markets and if U.S. interest-rate expectations increase over the upcoming days, we can expect further losses for gold,” FXTM vice president of market research Jameel Ahmad said.

Yet, only a few weeks later, the price of gold continues to rise as it struggles to capture lost ground. This time, James Stanley, currency analyst of Daily FX, reports that it will soon near the “$1,285 zone.” British gold is also on an upswing, even as the British pound continues to deteriorate after the country’s historic departure from the European Union. According to the Gold Eagle News, British gold closed in the middle of October at above 1,000 GBP. This is only 20 percent lower than its all-time high above the British pound in 2011.

Stanley observes that gold’s structure has always remained formidable, remaining almost impervious to currency fluctuations. Investors also tend to buy a lot of it in the light of events that will have a strong impact on the world economy. Those include the projected Federal interest rate hikes to the uncertainty of the outcome of the U.S. presidential election.

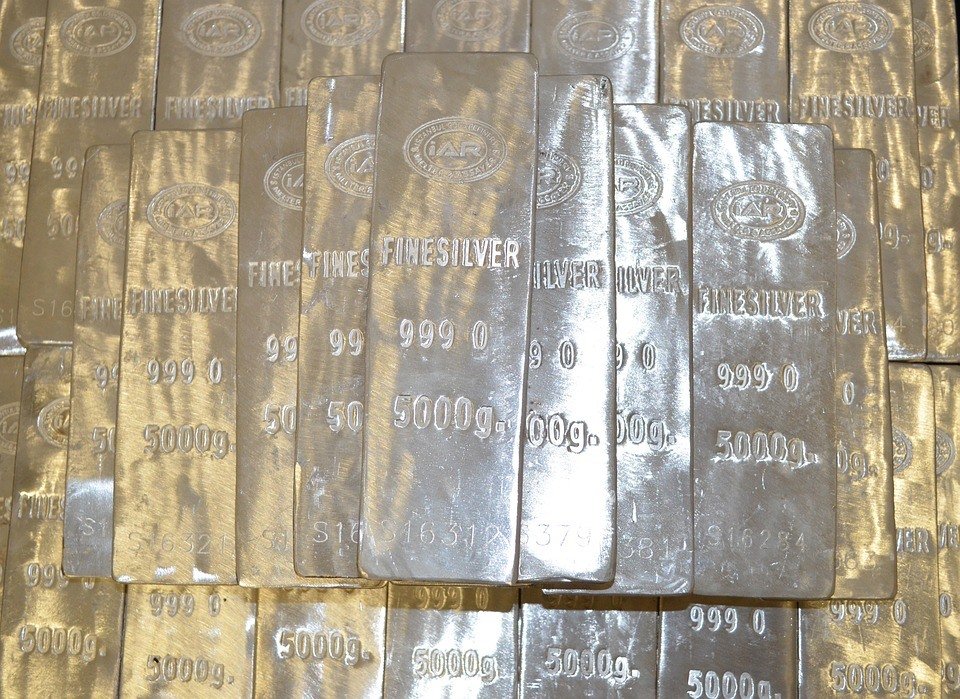

Silver’s post-Brexit struggle

Silver suffered a bigger loss, on the other hand, finishing with a steep decline of over 5 percent during the same period. December silver dropped $1.09, or 5.8 percent to $17.775 an ounce. Silver prices finished at their lowest finish post-Brexit, amid British leaders’ deadline in beginning the process of leaving the EU. Investopedia reported that weak production data and dwindling automotive sales also burdened the industrial metal.

Silver struggles post-Brexit (Source)

Three things factor in both the performances of gold and silver. First, as mentioned, is the strength of the U.S. dollar. Second, in relation to the first, is the rise in longer-term interest rates. Finally, there is the astoundingly high speculative interest in metals.

Luckily, Investing.com reported that “the Fed is not expected to take action on interest rates at the conclusion of its two-day policy meeting on Wednesday.” In addition to that, inflation and inflation expectations still remain key. These could lift gold even if the rates increase pushes through. As Deutsche Bank told The Financial Times, “Low inflation and weak global growth could sustain low real yields—the yield after taking into account inflation—a positive for gold.”

Gold forecast

Expert analysts forecast gold to trade around $1,300 to $1,350 a troy ounce in December. Secular Investor research head Nico Pantelis also says they still believe that “Q4 of 2016 could jump-start the next leg up for gold.”

Gold companies such as Mineral Mountain Mining & Milling Company (OTC: MMMM) are riding this upside. It is currently putting its efforts in the Iditarod Gold Project in Alaska, just 35 miles north of the Donlin Project owned by NovaGold and Barrick Gold. The Donlin Project is being developed for its resources which exceed 45 million ounces of gold.

The Iditarod Gold Project is in an area with numerous gold occurrences. The area also has good geochemistry in rocks and soils—gold, arsenic, and antimony—similar to other Alaska premier development gold projects. Moreover, it has good geology and structure. The project is seven miles from Alaska’s third largest placer district which has 1.5 million ounces of historic gold produced and is added evidence that Mineral Mountain may find a major mine.

In addition to the potential boost in gold amid possible Fed rate hikes, the precious metal has soared overall this year. British investors who converted their pounds to gold following the June fallout from the Brexit are up about 25 percent by the end of October. Undoubtedly, post-Brexit negotiations with the EU would drag on. In turn, gold would remain an easy, low-stress way for anyone holding British pounds to go through the process intact.

—

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoEnfinity Launches First Solar Plant in Italy with Microsoft

-

Crypto3 days ago

Crypto3 days agoBitcoin Wavers Below $70K as Crypto Market Struggles for Momentum

-

Markets1 week ago

Markets1 week agoSilver Dips Sharply, While Gold Gains Amid Mixed Stock Market

-

Africa11 hours ago

Africa11 hours agoMorocco’s Tax Reforms Show Tangible Results

You must be logged in to post a comment Login