Business

Housing bubble affects birth rates

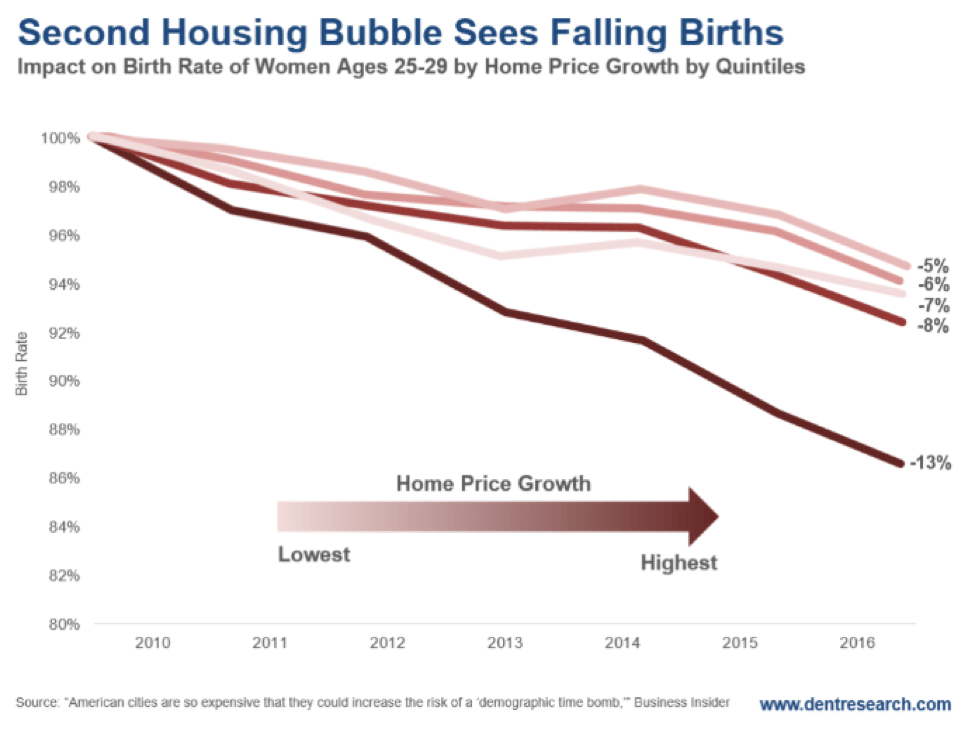

Data shows that while the housing bubble continues to grow, birth rates continue to fall, with a decline of 13 percent between 2010 and 2016.

I’ve been ranting for weeks now about it. People don’t understand that sky-high home prices are bad for countries, cities, businesses, and consumers.

And only the 62 percent of people who already own homes are feeling the “bliss” of the bubble. They’re the ones who want prices to keep going up so they get something for next to nothing.

There’s another side effect of this housing bubble. We’ve seen it in the bubbliest areas for years.

Birth rates fall when bubbles make it even more unaffordable to raise a child.

© Harry Dent

Long-term data is crystal clear on this. People who move from rural to urban areas, and become more affluent as a result, have fewer kids. They strive to educate and raise them better as a result.

In rural areas, housing costs are much lower and the kids often help on the farms — even after elementary school, historically speaking.

But in urban areas, the cost of living is much higher — along with real estate prices — making it costlier to raise kids in the city. That cost then increases as they get older, especially if they decide to go to college.

But there’s more recent evidence to support this as the second housing bubble rears its head…

Births have fallen substantially with home prices rising again in recent years.

The five lines in this chart represent the five quintiles of degrees of housing appreciation. The darker the line, the higher the housing appreciation.

The highest quintile, or top 20 percent for home appreciation, have seen a whopping 13 percent decline in birth rates between 2010 and 2016. The next highest quintile has seen an 8 percent decline. The lowest three quintiles have seen between five percent and 6.5 percent declines.

It’s perfectly clear: Rising home prices correlate with falling birth rates, and the higher, the greater!

That’s just what we need with already falling birth rates and long-term demographic stagnation/decline in the developed countries: A housing bubble that makes that trend even worse.

The sooner this housing bubble crashes, the better.

Despite how difficult it will be for the banks, businesses, and households that own real estate, it’ll be a Godsend for the younger families that are our future. It’ll help lower costs for businesses as well.

All you can do is get out of the way of this inevitable — and ultimately healthy — reset in home prices, which is likely to hit us in 2019, or as late as 2025.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Business7 days ago

Business7 days agoDow Jones Stalls Near Record Highs as Inflation-Fueled Rally Awaits Next Move

-

Fintech4 days ago

Fintech4 days agoFirst Regulated Blockchain Stock Trade Launches in the United States

-

Africa2 weeks ago

Africa2 weeks agoAir Algérie Expands African Partnerships

You must be logged in to post a comment Login