Business

How to conduct a proper business valuation

Determining the realistic value is always a challenging part, hence it has been said that business valuation is not just calculation; it is the process to determine the business worth of the company based on the business model, industry size and promoter background.

Business valuation is not just 30 minutes PowerPoint presentation

Economic worth of an entity could never be same from the perspective of buyer and seller. The seller asks for the premium for their years of hard work but the subjective part of the valuation is that every buyer has its own view and logic due to which two different buyers can observe the same set of business with two different growth potential and due to which the consideration offering also varies to a great extent. One of the main reason for this is, most sellers believe that business valuation is just 30 minutes snappy PowerPoint presentation. After giving 30 minutes presentation, sellers offer investment opportunity and ask valuation in millions with nil top-line. To which seller believes that business top-line will have 4-5 digits growths in forward years.

Business valuation neither an art nor a science but an outcome

Determining the realistic value is always a challenging part, hence it has been said that business valuation is not just calculation; it is the process to determine the business worth of the company based on the business model, industry size and promoter background. There are various other factors that play a vital role while developing the value of business.

I. Standards & premises of value

Business may be valued for various purposes such as sale, M&A, private equity, family dispute, joint venture, tax, distress or for investment perspective. Such differences can lead to different interpretation, different method and results. For e.g. Distress Valuation requires more precision, as investing in a distressed firm is a gamble between higher risk and return. On the other hand, start-up valuation depends more on qualitative factors, thus adoption of valuation methodology differ in case of start-up valuation. Hence, it is the standards of value that allow buyers and sellers to set uniform prices for each kind of transactions.

Standards of value

-Fair market value

-Investment value

-Intrinsic value

-Fair value

Once the standards of value are determined the next step is to determine the premises of value. Compare a business which is for sale with a business which is in continuous operation but under a new ownership, both have a different meaning (value) and different methodologies shall be applied based upon the purpose of valuation. Hence before valuation deciding the premises of value is very significant

Premises of value

-Liquidations

-Value in use

-Value in exchange

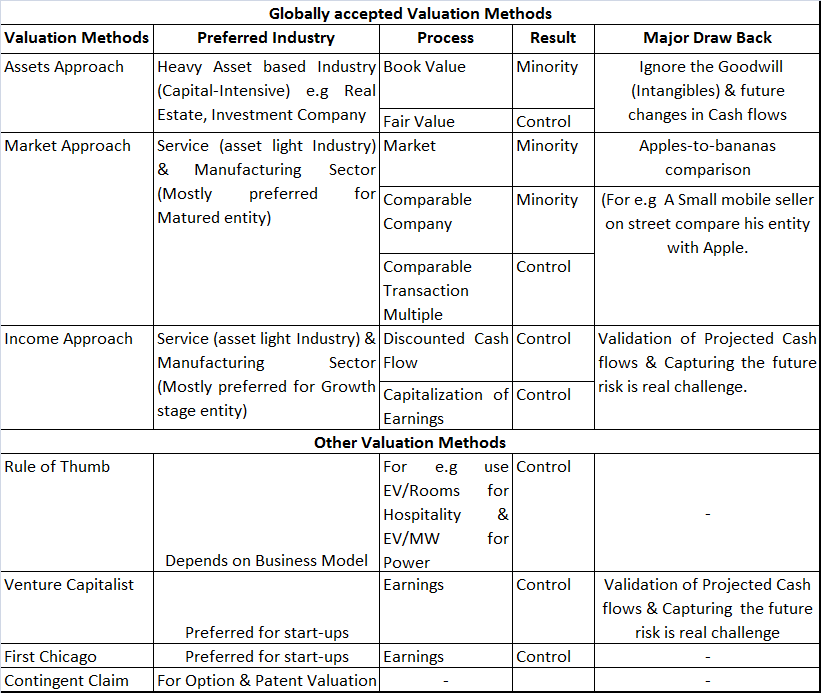

II. Which valuation methodology shall be applied?

© Gaurav Barick

Unfortunately, we don’t have any particular standard which we could say is best suited in every situation, since every entity is different and each industry has his own uniqueness. Although in this article we have tried to explain cases and most appropriate methods.

III. Role of intangible in valuation

The worth of business can be divided into two parts namely tangible and intangible. Tangibles are easy to value, but the challenge lies in valuing the intangibles. Brand, patents, trademark, IP rights and technical know-how are important intangibles, thus it is essential to value these intangible separately instead of allocating the surplus as goodwill. Identification of the categories of intangible plays vital role, as most of the intangible, are in the form of technology, customer, contract, brand or marketing and application of valuation methodology varies in each case.

IV. Valuing complex capital structure

Nowadays most of the firms have a complex capital structure like preference shares/convertible instruments CCPS, OCPS, FCCDs. In general, investors often invest in companies with some preference rights like downside protection, liquidation preference. Thus the value of such preference is on the higher side than common preference shares. Therefore allocating the value of the company among different classes of securities like equity shares, CCPS, and OCPS etc. plays a significant role.

V. Proposed dilution/investor invest on a fully diluted basis

Another important area of business valuation is factoring dilutive instruments, like employee stock option plan/sweat equity, warrants, convertible instruments and application money. For e.g. ESOPs are the plan through which corporate rewards stock options to their employees, but the most interesting thing with ESOPs is, it dilutes over time. So whenever an entity issue employee equity, convertible instrument or receive application money, an entrepreneur shall be prepared for equity dilution. Therefore one has to factor in the dilution part while valuing the company.

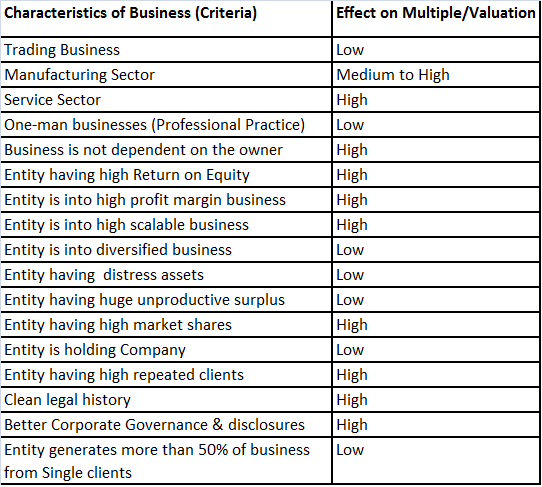

VI. At what multiple one should sell their business: Rule of thumb

We keep on hearing that businesses selling at “x” times top lines or earnings. However, the fact is that determining the multiple is very subjective because multiples range depends on quantitative and qualitative factors. Usually, business owners ask for valuation of one to three times multiple of its top line or ten to fifteen valuation of its bottom-line, which indeed is an extensive range of multiple expectations. Apparently, it is also at times difficult to determine the accurate multiples, as exactly listed comparable is not always available. In that case, the best way is to determine the base/tentative valuation based on a rule of thumb and thereafter adjust the final value for a certain set of criteria (Characteristics of business). Characteristics of business and nonfinancial activities sometimes play an important role, for e.g you might be ready to pay 20 to 25 percent premium for a restaurant if it is next to education institute you own.

© Gaurav Barick

Conclusion

Principally valuation depends on expectation, future cash flow and tangible capital assets, but the result depends on the assumptions which you have taken while ascertaining the valuation. Each buyer will likely have a different perception of the risk involved or may have a different business plan; hence even same valuation methods may give different results. Thus, buyer measures the business value differently and buyer/investor always set valuation based upon the expected return on investments, exit opportunities, expected time to liquidity (such as IPO) or rule of thumb based upon the assessment of the risk involved & opportunity offered.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Africa1 week ago

Africa1 week agoMASI Surge Exposes Market Blind Spot: The SAMIR Freeze and Hidden Risks

-

Crypto2 weeks ago

Crypto2 weeks agoBitcoin Rebounds Above $70K as Crypto Markets Show Fragile Signs of Recovery

-

Crypto5 days ago

Crypto5 days agoIntesa Sanpaolo Signals Institutional Shift With Major Bitcoin ETF Investments

-

Biotech2 weeks ago

Biotech2 weeks agoEurope Launches Personalized Cancer Medicine Initiative

You must be logged in to post a comment Login