Business

Will Mexico blow US corn market and why?

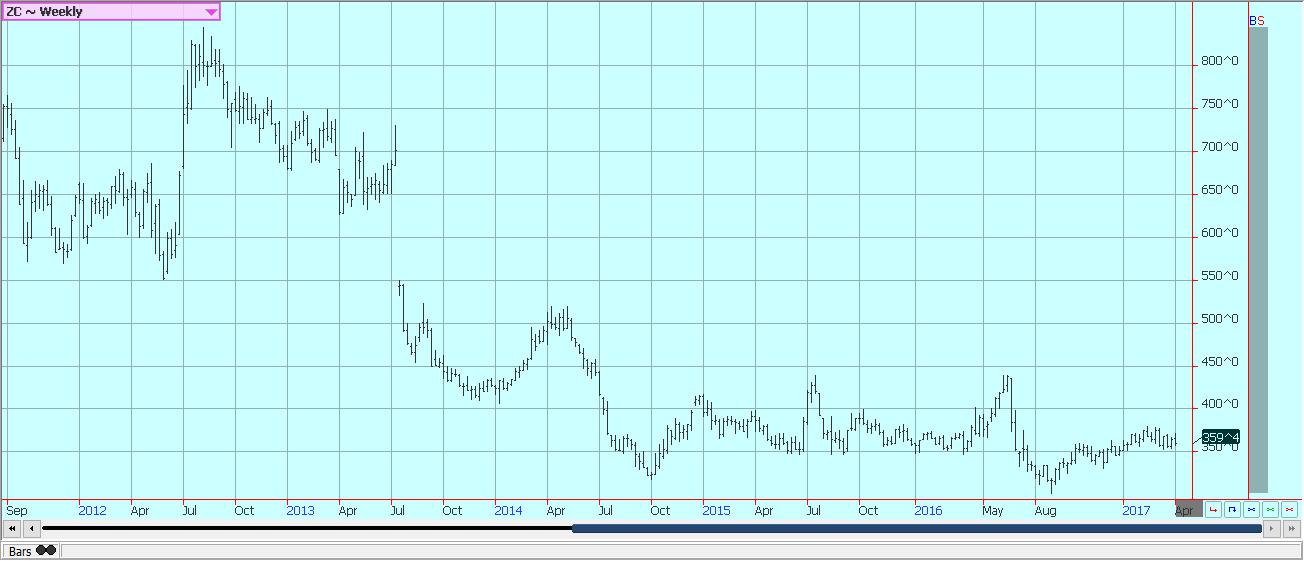

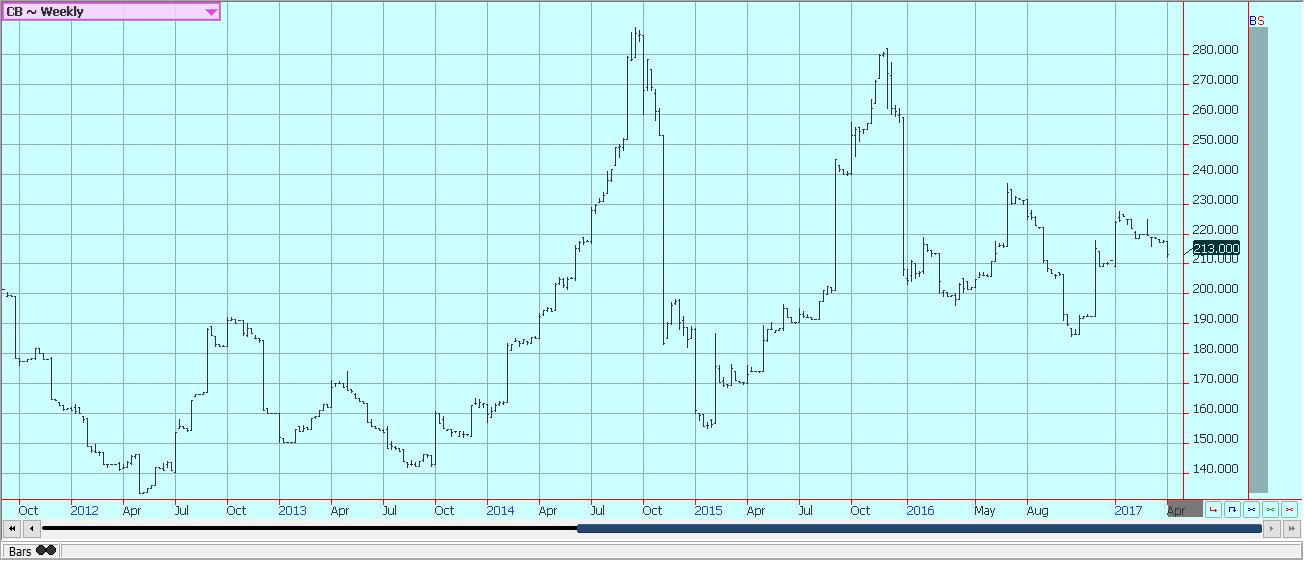

The charts show that corn futures are in a trading range.

Mexico is seeking at importing some South American corn with no tariff. It appears that this could be a blow to the US corn market.

Wheat

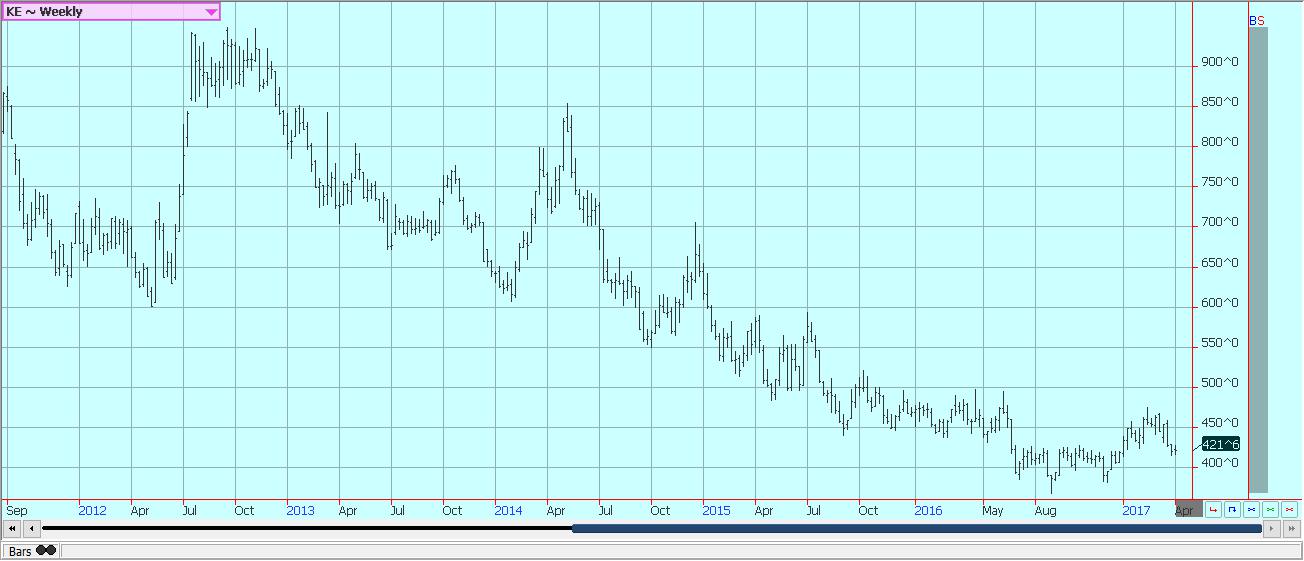

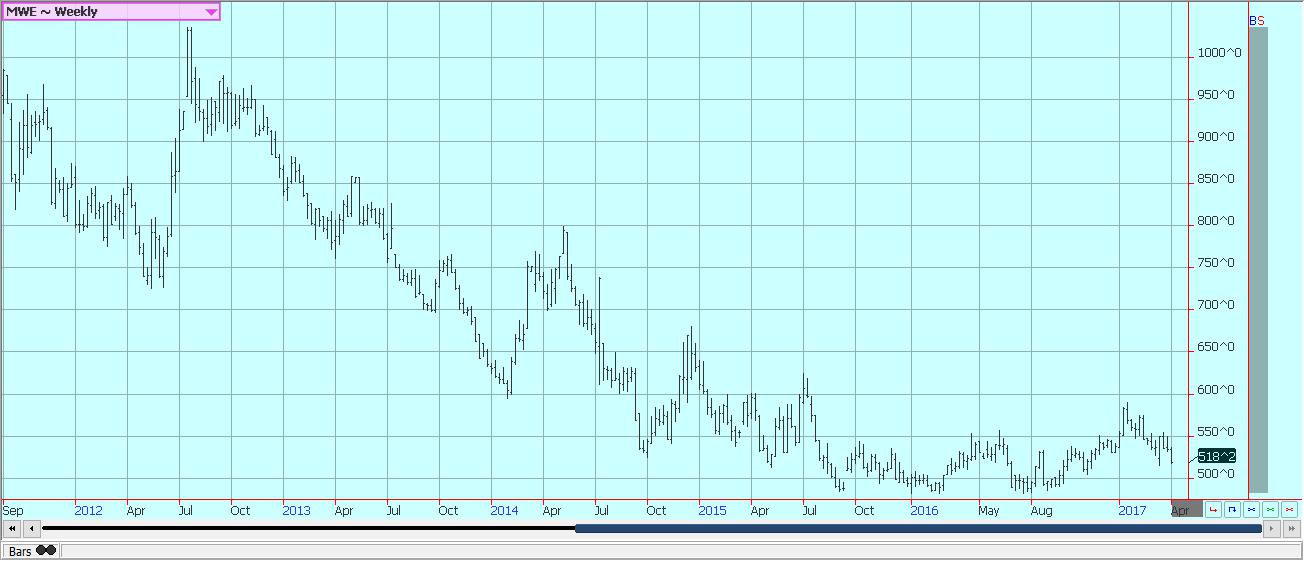

US markets were mixed as the Chicago markets reacted to improved growing conditions in the Great Plains. SRW futures were slightly lower, but HRW futures were slightly higher. Minneapolis SRW futures were lower and tht market still shows the weakest chart formations of the complex. Data released by NOAA at the middle of the week showed that drought conditions had eased in the region. The crop conditions issued by USDA a week ago also showed this as conditions were improved from the previous state reports. Conditions look to stay generally improved as the storms keep moving into the West Coast and moved over the mountains and into the Plains. Temperatures remain warm in the Great Plains, but cool in the Midwest. World markets have shown slightly firmer prices as Black Sea prices have been firm. The trade is monitoring conditions in North Africa as growing areas have been dry. Yield loss is possible as the crop should be in the reproduction phase. The trade will also react to the USDA monthly supply and demand estimates that should not show bottom line changes for the US. The weekly charts show that Chicago futures are testing support areas, but that these areas are holding. Overall world Wheat supplies remain ample, but that has been known for some time and is part of the market. Wheat is looking for some fundamental reason to rally or move lower at this time.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

Corn was lower last week despite more strong demand. The USDA export sales reports remain solid on a weekly basis, and ethanol demand has been very strong. Planted area is still likely to be significantly less in the coming year. Futures seem to be looking ahead at increased world competition from Latin America, but this is not likely to become a factor until late this Summer. However, there are other potential problems for US demand as Mexico is looking at importing some South American Corn with no tariff. This would be a blow to the US Corn market as US Corn has had an overwhelming share of the trade due to NAFTA and location. That might be changing. Farmers in the south are trying to plant, but ran into rains and storms last week and had to shut down. Some planting might be possible this week, but more precipitation is expected, too. It is still too early for farmers in the north to plant, but some initial fieldwork is going on where weather permits. It is still very early in the season, and too early to be real concerned about delays. But, traders are taking note and are watching the situation. USDA will issue its latest supply and demand estimates on Tuesday, but no real change is expected for US ending stocks. The charts show that futures are in a trading range, and there does not seem to be anything going on right now to suggest that the range needs to be broken in either direction.

Weekly Corn Futures

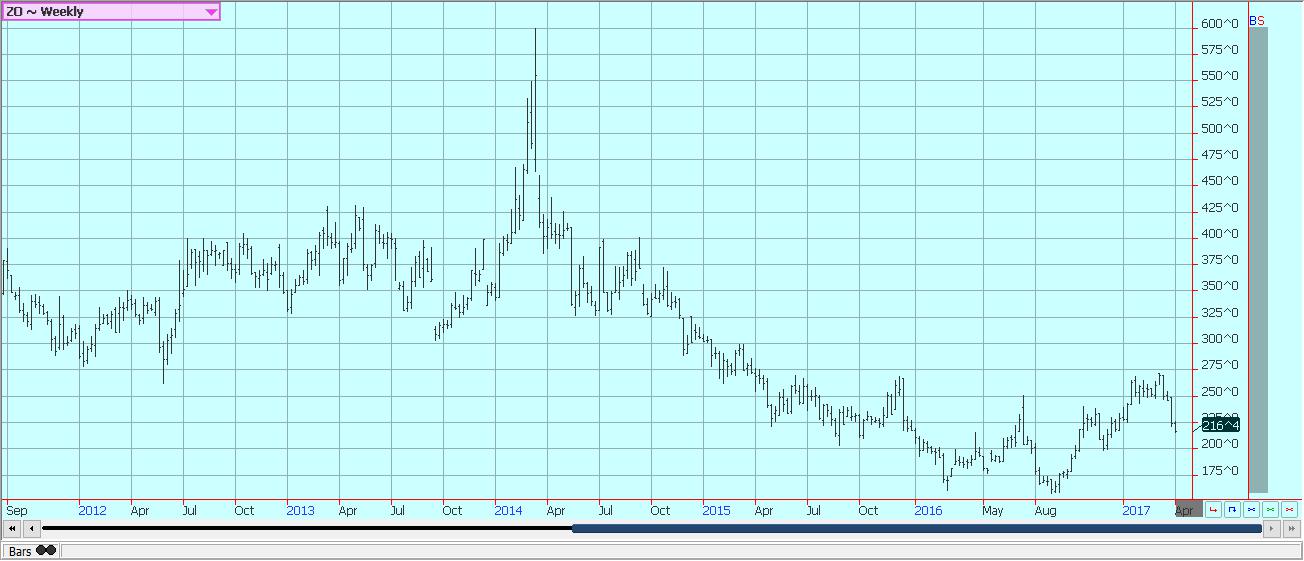

Weekly Oats Futures © Jack Scoville

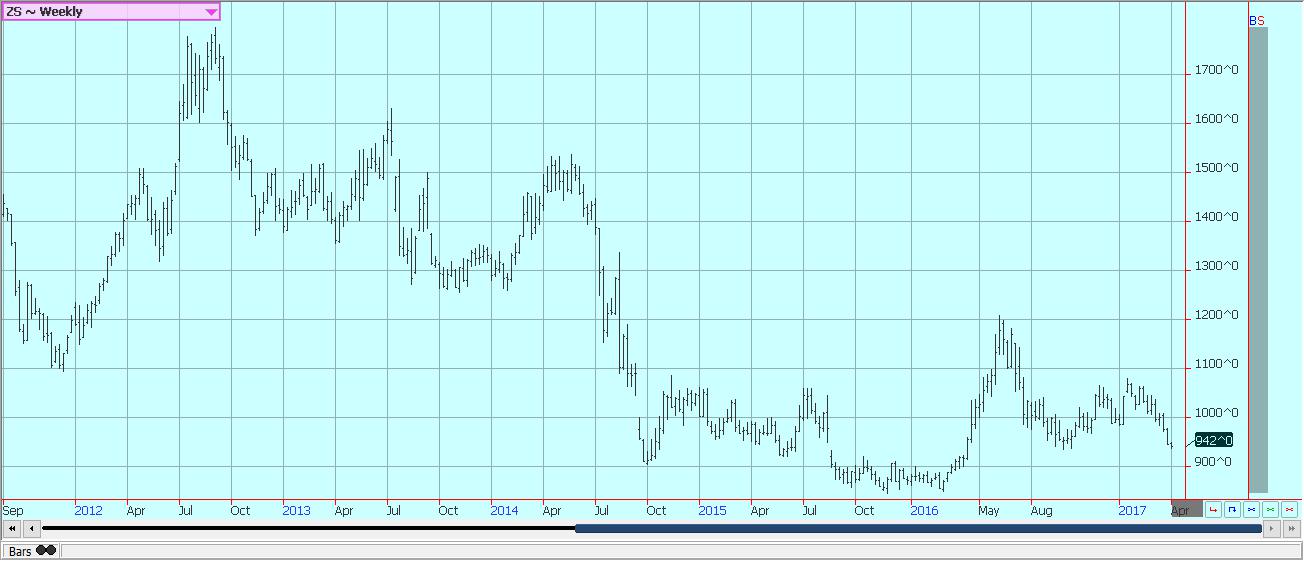

Soybeans and soybean meal

Soybeans and Soybean Meal were slightly lower again last week as the market anticipates big supplies and less demand for US Soy products. The US is expected to grow a very big crop this year due to the big increase in planting intentions, but it faces big offers before the haervest. Production reports from Brazil keep getting bigger and now are often more than 111 million tons. That seems like a lot of Soybeans and is much higher than previous expectations, but there is no doubt that the country has grown a big crop. Argentina seems to have recovered from earlier flooding and is expected to produce a bumper crop in excess of 56 million tons. The offer from South America into world markets is expected to be huge. Chinese demand is dropping in world markets just as the offer is expanding. The reports of bird flu that have killed humans continue, and feed demand is thought to be dropping. Crush margins have been much lower. The country has bought a lot of Soybeans and probably has enough on hand. It has started to buy US Soybeans again for the next harvest, so the demand is still there longer term. Export demand for US Soybeans has already exceeded USDA forecasts, and USDA will be forced to increase this demand area in the monthly supply and demand updates on Tuesday. It will most likely cut residual demand to keep ending stocks unchanged. Futures still hold a bearish stance and prices are starting to move slowly below some big resistance areas. Most see no real reason to buy the market except for short covering.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

Rice

Futures closed higher and trends turned up on the weekly charts. Speculators were covering short positions due to the trend change, but they have more to buy. The market just got too cheap in both futures and cash markets and the selling interest dried up. It is likely now that the market has found a longer term low and will work generally higher over time. Chart targets for the move higher should be close to 1100 and then 1200 on the weekly charts. The fundamentals of the market are starting to change even if the current cash market remains quiet and steady. US producers will plant significantly less Rice this year, and US ending stocks will most likely be much less next year than they are this year. These ideas have created the buying interest. The Commitments of Traders report showed that the funds and other speculators remain short the market. Commercials used the rally to liquidate some longs and add to shorts. Southeast Asian markets remain sideways to firm. China has been a steady buyer, mostly from Vietnam and Thailand. However, most Southeast Asian countries have been selling to China. Philippines and Indonesia remain mostly quiet.

Weekly Chicago Rice Futures © Jack Scoville

Palm Oil and vegetable oils

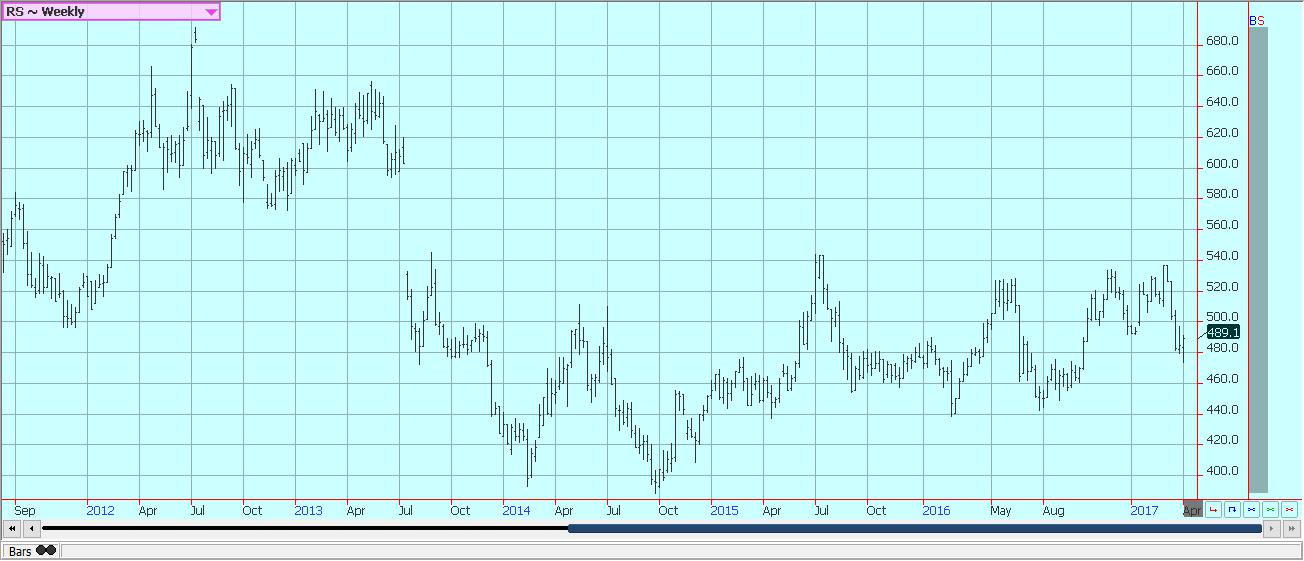

World vegetable oils markets were mixed, and selling interest might be fading now. The market seems ready to turn higher and charts show that the potential for at least a short term move is there. Traders will get a lot of new data this week. MPOB releases its latest monthly data on Monday and USDA follows with its monthly updates on Tuesday. Palm Oil demand has been rather lackluster lately and this should be reflected on the reports. However, trees in both Indonesia and Malaysia have been slow to respond to improved conditions. Trees have seen plenty of rain and production should be seasonally increasing, and traders will watch for these tendencies in the updates. Canola closed higher last week amid tight Canadian market conditions. Some Canola was left in the fields last Fall as the snows came early, and farmers have not been big sellers in the local cash markets. Demand from both the processor side and the export side has been strong enough to generally support the market although selling was seen in recent weeks from speculators liquidating long positions. It looks like this selling pressure has faded.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures closed sharply lower last week, with about a third of the losses coming on Friday. The market appears to be looking ahead and seeing increased supplies coming here and around the world by the end of the Summer. The latest drought map from NOAA showed that the dry areas of the western Great Plains had diminished and implied that most Cotton areas have enough moisture for now. Some good precipitation was seen in the Texas Panhandle and some big rains were seen in the Delta and Southeast. Planting progress was slow last week due to the rains and should be slow again this week. Cotton remains mostly a demand story as US export demand has been stronger than any trade expectations so far this year. USDA has been forced in its monthly updates to increase export demand estimates at the expense of ending stocks and might be forced to do it again this week when it releases its monthly supply and demand updates. US producers appear ready to meet the demand with increased production, but they might not be alone as growing conditions could also improve this year in countries like India, where weather was not optimal and the monsoon was erratic. US export sales are still strong, and demand for the nest crop has increased, so the strong demand story will remain a part of the market structure.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ posted a strong recovery from the previous week. the markets were able to hold support early in the week, and sellers became buyers as prices started to move higher again. The market remains in a bullish supply market mode, with less and less domestic demand hurting any upside potential. Domestic production remains very low due to the greening disease and drought. Trees now are showing small fruit as the bloom season has ended. Irrigation is being heavily used to prevent loss, although there were a few showers reported in parts of the state last week. The harvest has been very active. Early and Mid Oranges are now mostly harvested. The Valencia harvest is moving to processors and into the fresh market. Major freezes in southern Europe this Winter have damaged the citrus production. Reports are that losses are extensive. Brazil crops remain in mostly good condition. Brazil imports will arrive after May and will provide some space for juice producers.

Weekly FCOJ Futures © Jack Scoville

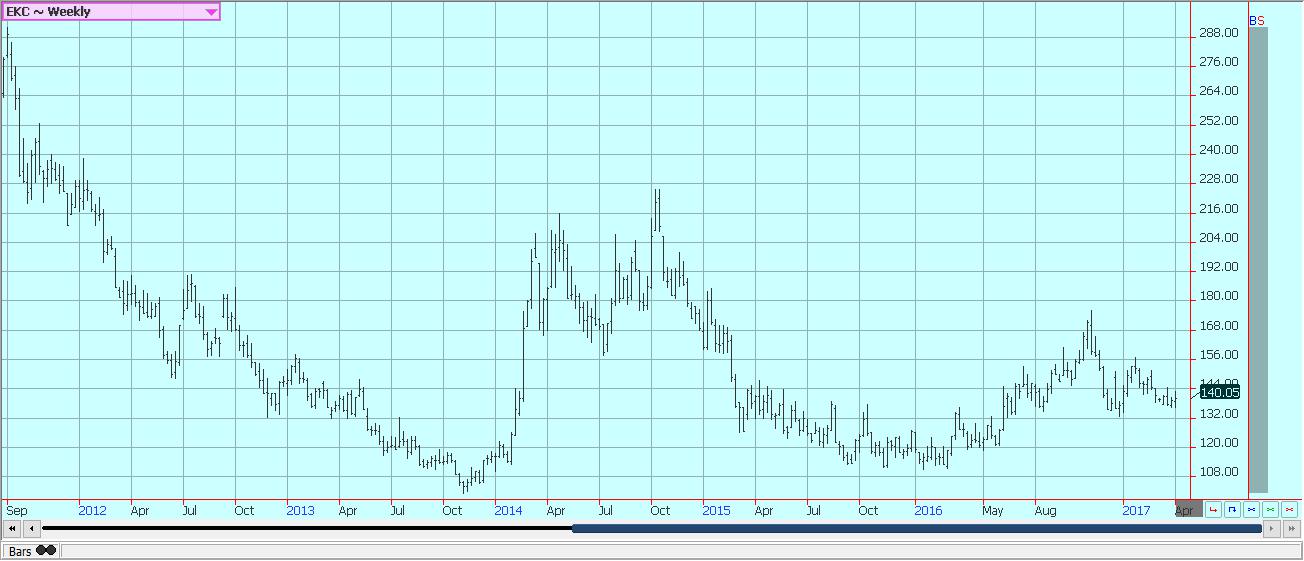

Coffee

Futures were slightly higher and continue to hold support areas in the face of bearish trade ideas. Futures remain in a trading range at this time and appear to be trying to turn trends back up again. The change could come this week. The ICO last week noted that overall world supplies remain ample and that production prospects for the next production year are good. It expects prices to generally work lower over time. The cash market remains slow. Offers remain in the cash market, and differentials are stable to weak. Buyers have turned quiet and appear ready to use already contracted supplies. This is in line with the narrative of big supplies in importer countries.. New York has featured buying support from commercials as they fix prices for differentials purchases. Speculators have been the best sellers. Overall traded volumes have been light to moderate. London is trading sideways as supplies available to the market remain tight. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia and Brazil are also very low on supplies.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

Sugar

Futures closed higher for the week after making new lows for the move. It looks like the market has entered a short term correction phase, but ideas are that prices can remain generally weak. The fundamentals appear to be changing from a tight situation to one with more available to the market. However, the market did get some positive demand news last week. India finally decided to allow some imports of Sugar duty free. It will allow 500,000 tons to be imported after insisting in the face of all contrary evidence that no imports were needed. The EU also said that it was considering imports as internal supplies have run low. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months. Production is also less in India and Thailand. India had lower production last year due to the uneven monsoon rains. China has imported significantly less Sugar as it continues to liquidate supplies in government storage by selling them into the local cash market. Demand from North Africa and the Middle East is consistent. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Center South areas have had plenty of rain. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were lower last week, with all of the losses seen on Friday as the market broke to new lows out of a congestion formation. Funds and other speculators were adding to short positions, but everyone pointed to increasing offers in world cash markets and increasing supplies certified for delivery in New York as reasons to keep prices under selling pressure. The main crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the remaining main crop is not good and that much of the Cocoa delivered recently is not of exportable quality. The mid crop harvest should be in full swing next month. Ivory Coast and Ghana are searching for ways to support farmers due to the weak world prices that are now below the cost of production and delivery into the ports for many. They are finding some support from world organizations in the form of eased rules. The demand from Europe is reported weak over all, and the North American demand has been weaker. New grind data is coming soon. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

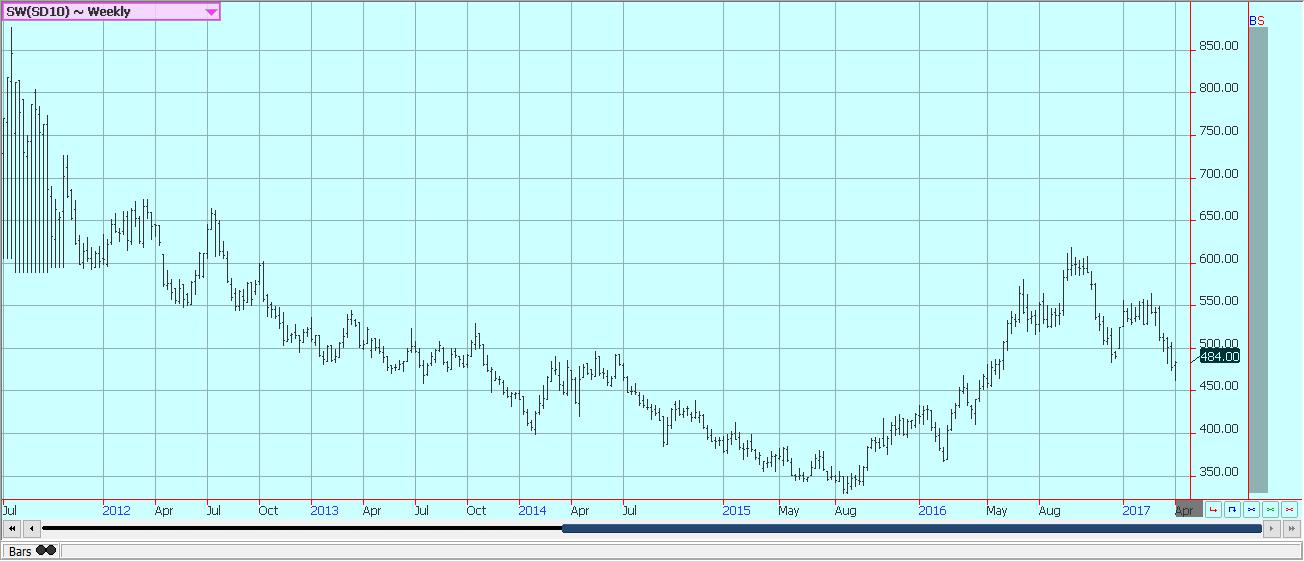

Dairy and meat

Dairy markets were lower on big supplies of milk available to the market. Supplies are strong seasonally in all areas as the annual flush is active in the US. Demand is good for cream, and cheese makers are displaying increasing demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing in some areas. Demand for Ice Cream has been mixed depending on the region. Cheese demand appears to be getting stronger due to promotions on the retail level. Exports are reported to be stronger. Dried products prices are generally weaker. Bottled milk demand has been steady to lower due to school holidays.

US cattle and beef prices were lower. However, cash prices were at $124.00 and remain well above futures. Beef prices have been weaker in the last week and have led Cattle futures lower. The show list was very big last week, adding to the selling pressure. Overall beef exports have been very strong this marketing year, but were only average last week.

Pork markets and Lean Hogs futures were weaker last week on reports of large supplies. Pork demand remains stronger than expected, but packers have been pulling back from the market as they sense increasing supplies are coming. Packer demand has been very good until now. There are big supplies out there for any demand. The charts show that the market could remain in a trading range at good levels for both processors and producers.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto2 weeks ago

Crypto2 weeks agoCaution Prevails as Bitcoin Nears All-Time High

-

Fintech2 days ago

Fintech2 days agoOKX Integrates PayPal to Simplify Crypto Access Across Europe

-

Africa1 week ago

Africa1 week agoBridging Africa’s Climate Finance Gap: A Roadmap for Green Transformation

-

Business1 week ago

Business1 week agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [uMobix Affiliate Program Review]

You must be logged in to post a comment Login