Business

Important money lessons from Nobel Prize in Economics winner, Richard Thaler

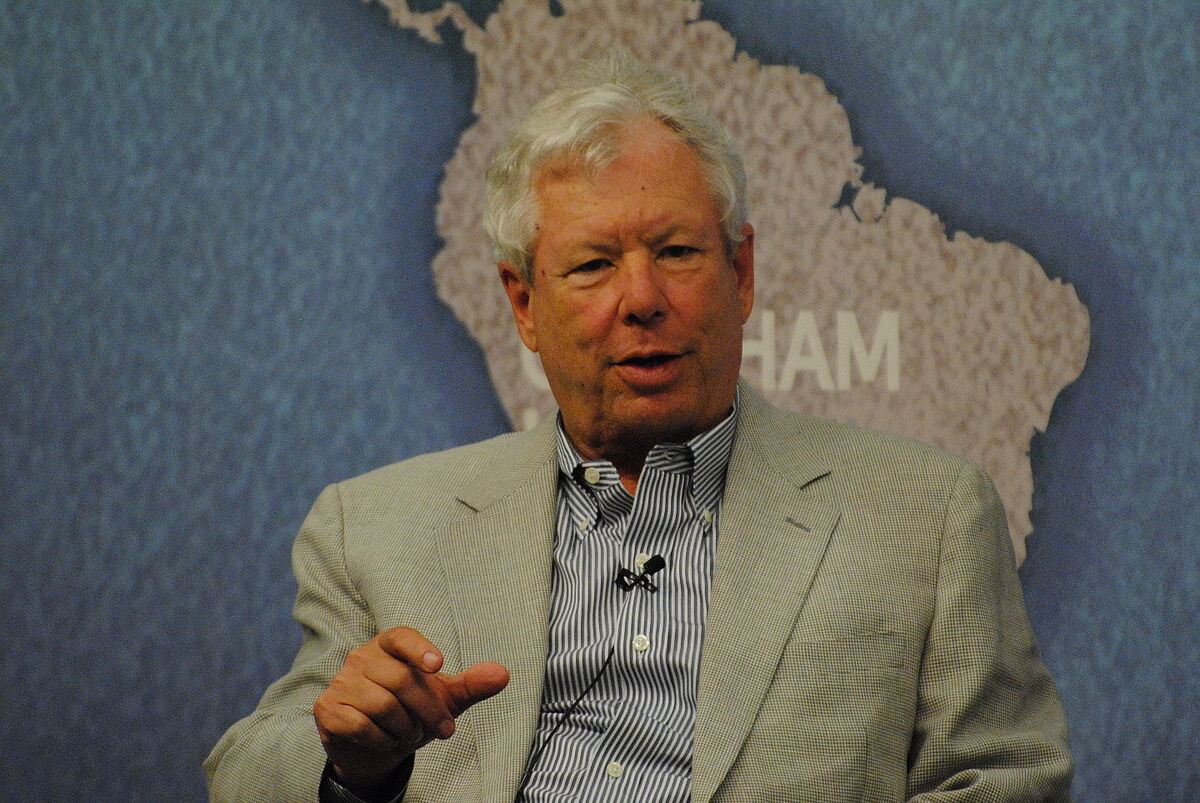

Thaler won the prestigious award for his work on the factors that determine how an individual spends.

In 1968, the Nobel Memorial Prize in Economics was established in memory of Alfred Nobel by the Swedish central bank and awarded by the Royal Swedish Academy of Sciences. The 28th recipient of the prize and along with $1.1 million is an author and a University of Chicago professor, Richard Thaler. He belongs to the six laureates who are currently serving as faculty members at the university.

Considered as the founder of the field of behavioral economics, the 72-year-old professor won the prize as he researched using the psychology and economics of how people make economic decisions. Thaler’s Nobel prize-winning study revealed that people can be irrational in systematic ways when it comes to economics. Historically, economic theory assumes that humans are well-informed and logical when making decisions, but Thaler’s study debunks this. Moreover, people sometimes act against their best interests from making financial decisions such as saving up for retirement or even competing on game shows.

Thaler’s contributions to economics

The Nobel prize committee credited Thaler for moving economics to a more realistic understanding of human behavior. Thaler’s work has also influenced the improvement of some public policies, such as the automatic enrollment of employees in retirement savings programs. Moreover, Thaler has played a crucial role by showing that people tend to depart from rationality in ways that are consistent, allowing these behaviors to be anticipated and modeled. He once said at a news conference following the announcement of his win, “In order to do good economics, you have to keep in mind that people are human.” Apart from helping to influence policy, Thaler has also created investing strategies. A principal at Fuller & Thaler Asset Management, Thaler uses ideas from behavioral science, including the investor’s tendency to overreact to negative news or underestimating the impact of good news to influence investing. Thaler is also an author of books such as “Nudge” and “Misbehaving,” the latter is a book on behavioral economics.

Thaler’s work led to the creation of behavioral economics. (Source)

Important money lessons from Thaler

Here are several nuggets of financial wisdom from Thaler:

- Talking to the Associated Press, Thaler said, “I try to teach people to make fewer mistakes. But in designing economic policies, we need to take full account of the fact that people are busy, they’re absent-minded, they’re lazy and what we should try to make things as easy for them as possible.”

- Thaler’s work includes the irrational labeling of money. He discovered that people have a tendency to assign money to certain categories and it can lead to financial errors.

- Together with other behavioral economists, Thaler discovered that people tend to hold notions of fairness that can be confused with classical economic expectations. For instance, an umbrella peddler who raises his prices during strong rain is a way of the seller responding to the demand. According to Thaler, this kind of thinking keeps people from buying things they enjoy.

- Consumer attitudes allow companies to raise prices aggressively even if there’s a justified demand for it.

(Featured image by Chatham House, London via Wikimedia Commons. CC BY 2.0)

-

Markets6 days ago

Markets6 days agoThe Big Beautiful Bill: Market Highs Mask Debt and Divergence

-

Markets4 days ago

Markets4 days agoA Chaotic, But Good Stock Market Halfway Through 2025

-

Cannabis2 weeks ago

Cannabis2 weeks agoCannabis Clubs Approved in Hesse as Youth Interest in Cannabis Declines

-

Crowdfunding6 days ago

Crowdfunding6 days agoWorld4All, a Startup that Makes Tourism Accessible, Surpasses Minimum Goal in Its Crowdfunding Round

You must be logged in to post a comment Login