Business

Sunbelt dominates America’s biggest boomtowns

Most of the top boomtowns in the U.S. are in the sunbelt, and these are some of the best places to consider moving to, especially for your children.

I’ve never read so many good articles and rankings on cities by growth, affordability, and desirability. Especially during a time when the real estate market is crazy. This is the last one I’ll bring you for now.

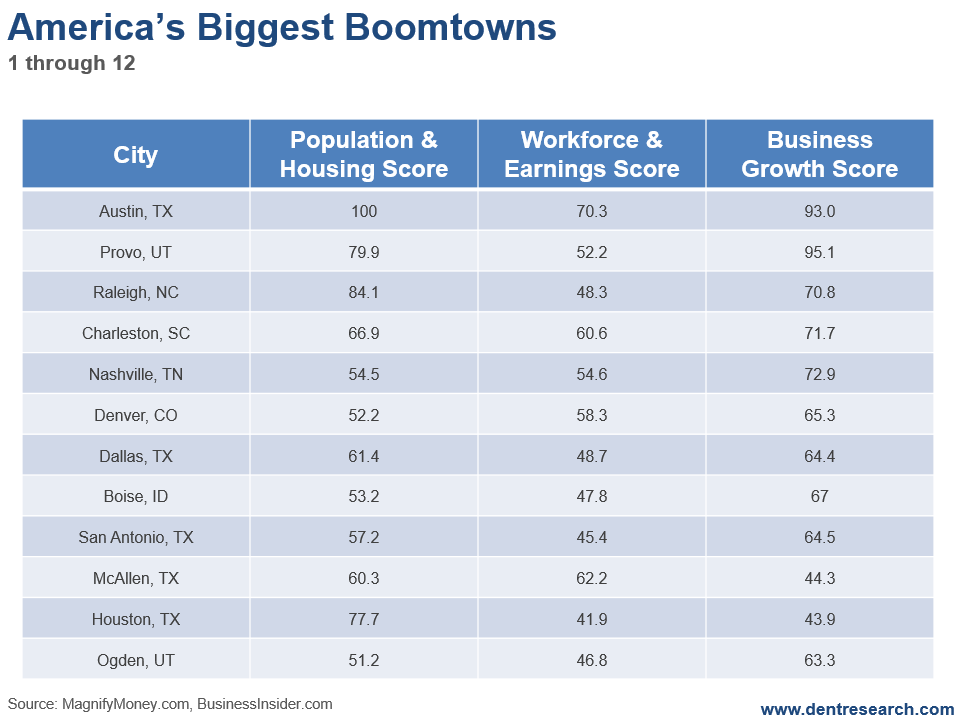

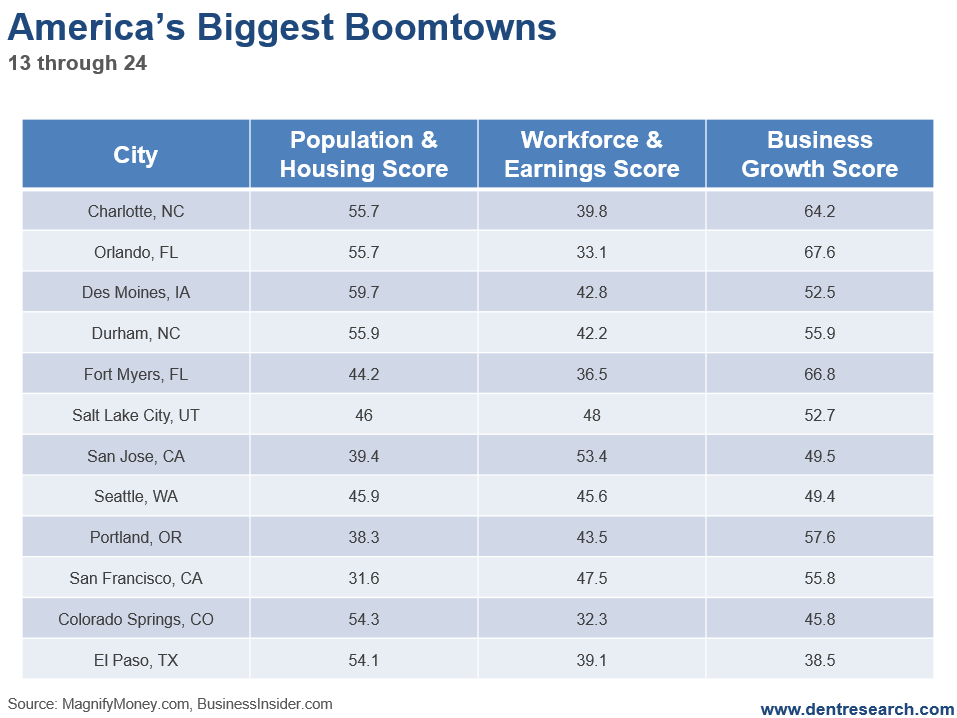

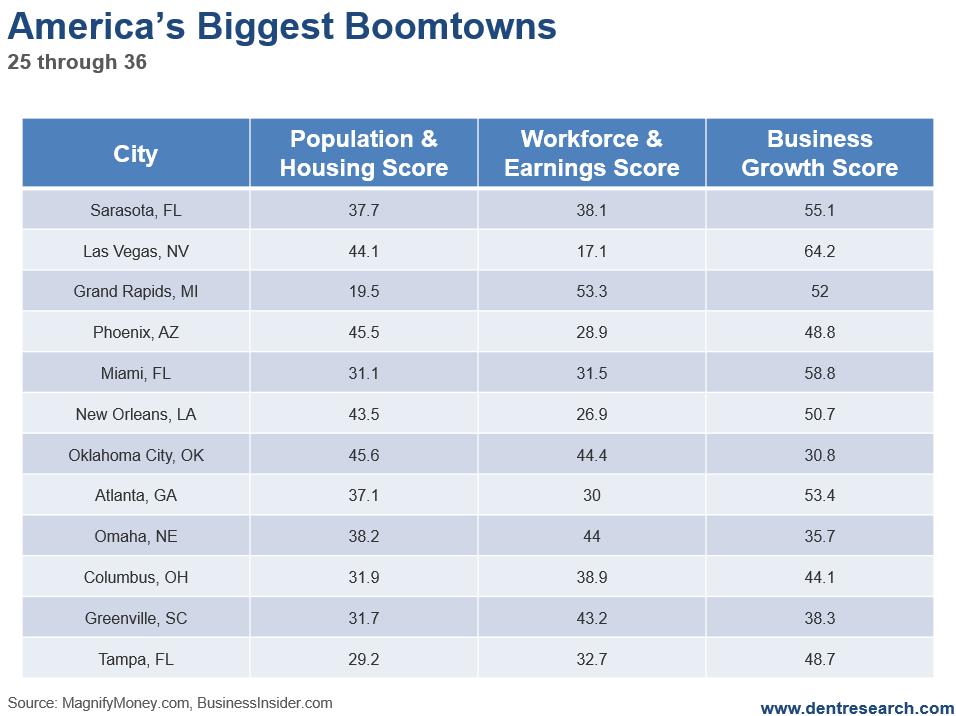

This study rates the market on three measures, population and housing, workforce and earnings, and business growth. So, you can decide which of these are most important to you or your kids.

The only surprise in the top five is Provo, Utah.

Austin is on top with its hip culture and restaurant scene.

Then Provo comes in after Austin, with its dry, sunny weather. It’s less than an hour from Salt Lake City.

Raleigh’s third with its research triangle and universities, followed by Charleston with its booming restaurant scene and massive tourism.

Nashville, the country music capital, falls in right behind Charleston with strong tourism. Both of which are always bachelorette destinations, making them busy nearly year-round with their mild climates.

© Harry Dent

© Harry Dent

© Harry Dent

We had our last Irrational Economic Summit in Nashville. This year it’s in Austin. Maybe in the future we’ll host it in Charleston.

Out of the top 12, five of the boomtowns are in Texas. None of them are in Florida. And 11 of those 12 are located in the sunbelt.

No surprise there!

Out of the top 36 boomtowns, 28 are tucked along the sunbelt.

The top boomtowns for population and housing are Austin (100), Raleigh (84.1), Provo (79.9), Houston (77.7), and Charleston (66.9).

Those that lead in workforce and earnings are Austin (70.3), McAllen in Texas (a southern border town) (62.2), and Charleston (66.9).

And the top areas for business growth are Provo (95.1), Austin (93.0), Nashville (72.9), Charleston (71.1), and Raleigh (70.8).

The boomtowns that stand out most to me Austin, Charleston and Raleigh. These are some of the best places to consider moving to, especially for your kids.

But the best strategy is to rent for a few years to make sure you love it, and to look for better buy opportunities when the next real estate decline sets in.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Impact Investing6 days ago

Impact Investing6 days agoThe Sustainability Revolution: Driving a Net-Zero, Nature-Positive Economy

-

Biotech2 weeks ago

Biotech2 weeks agoNew Molecular Clues Explain Aggressive Neuroblastoma and Point to Targeted Treatments

-

Business4 days ago

Business4 days agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [EKSA Affiliate Program Review]

-

Fintech2 weeks ago

Fintech2 weeks agoSwissHacks 2026 to Launch Inaugural Swiss FinTech Week in Zurich

You must be logged in to post a comment Login