Barron’s once published bond averages they began in 1938; the Dow Jones’ 10 Utility and 10 Industrial Bond Averages. Combining the two of them, they then...

The second deepest bear-market bottom occurred during the 2007-2009 sub-prime mortgage debacle. Within the Red Oval below, is the second deepest bear market in Dow Jones...

In October 1975, only four years after the US Treasury broke the dollar’s link to the Bretton Woods $35 gold peg, IBM (#1) had an enormous...

Dow Jones above 40,000 by June of next summer? That would be a BIG advance of 5.64% from this week’s close. Damn right the Dow Jones...

Spanish pharma companies started the year maintaining the red of the previous year. In Q1, the aggregate capitalization registered a drop of 10.57%, with values such...

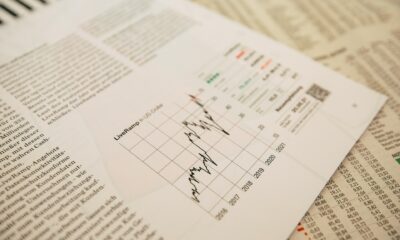

Right now, the Dow Jones is making new all-time highs, which brings to my mind the nice rebound the Debt market has seen since its lows...

My recommendation on the debt market is to leave it alone and watch this show from afar. I say that knowing this advance in bonds may...

Gold closed at a new all-time high on a weekly and daily basis, and I suspect also on a monthly basis. It’s only a matter of...

These past few weeks, bond yields are going down (bond valuations are going up). However, after seeing yields rise as they have since August 2020, it’s...

Big bear markets can take a long time. Looking at the Dow Jones in daily bars, this is a market that isn’t in a hurry to...