You can use some of your retirement funds to buy a new property. This will give you a steady stream of cash inflow in the form...

A self-directed IRA allows an investor to choose which money from his or her retirement accounts are invested.

Usually, inheritance money is given to a retiree's kid after his or her death. One expert says it's better to pass the money on (or parts...

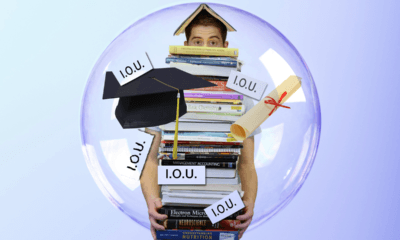

To settle student loans, planning and commitment are required. One needs to learn how to handle debt to be able to plan the payments properly.

401k has become an important part of a person's retirement plan. Here are some things you should and should not do when it comes to 401k...

New homeowners must be aware that unforeseen expenses can eat into their budget.

Actual retirees give financial advice on how to set up a secured, content and happy future.

Overspending during the holidays might seem unavoidable but spend-happy consumers can keep their debt under control.

Contributors would be able to set aside more in 2019 as the Internal Revenue Service announced increased limits for various retirement accounts.

With the current trend in retirement planning, investors need to diversify their accounts to be more flexible in times of needs.