Business

What investment property can a budget of €100,000 buy in Europe?

You don’t need to be a millionaire to invest in property. If you are an individual with about €100,000 to spare and you can still allocate it in property as an investment or income-generating resource, there are a few ways to invest money solely for capital preservation and accumulation. Here we discuss in detail buy-to-let properties and collective investment vehicles.

Many of our clients at Tranio are individuals with budgets starting from €100,000, who want to invest in property abroad. While skimming the market, it may seem like this amount is not enough to buy a decent income-generating property in Europe in locations where quality commercial spaces go for no less than €5 million, while small retail facilities can fetch anywhere between €3-5 million.

However, dig a little deeper, and one can find investment products with an entry threshold of €100,000-€500,000 on the international market. The options can vary from micro-apartments (which can yield around 5% p.a) to club deals in development projects (10-15% p.a).

First, let us clarify what “investment or income-generating property” means. I’m not talking about buying property for personal use, like snapping up a holiday home or purchasing a home to obtain a residence permit or citizenship. The investment products I am addressing are intended for clients who are looking for a return on investment. I don’t recommend trying to achieve more than one goal when it comes to pumping money into property, because different criteria correspond to different aims. Those looking for residential real estate for personal use will obviously opt for a property and location that suits them, while those who desire a passport or golden visa—for example—will have different search criteria. A property bought simply for residency will rarely generate a significant income.

However, people who want to invest money solely for capital preservation and accumulation have the following options they can choose from:

Buy-to-let property

- Rooms in student residences, retirement homes, and/or hotels

- Micro-apartments and flats

- Apartment renovations

Collective investment vehicles

- Loans for development or renovation projects

- Club deals in development projects

My recommendations are made based on our extensive experience with projects in Germany (Berlin, Bavaria), Greece (Athens), and Spain (Barcelona, Torrevieja). However, the same options exist for investors in other European countries with well-developed real estate investment markets.

1. Buy-to-let property

The first three products are united by a common strategy: one acquires ownership of a property and receives an income by renting it out. When making such investments, it’s better to aim at owning the property for at least five to ten years, while the yield runs at 3-5% per annum. The risks, in this case, are minimal, and in addition to the rental income, the owner should get an average property value increase of 2-3% per annum. This is a conservative strategy, suitable for those mainly interested in maintaining their capital and protecting it from inflation.

Property operation and maintenance, as well as the accommodation of tenants, are the responsibilities of a management company if the owner chooses to use one.

1.1 Rooms in student residences, retirement homes, and/or hotels

The prices for such properties usually start from €100,000, with both separate facilities and blocks of several residential units available. The owners of such properties cannot live there themselves, but this restriction is offset by a relatively high yield rate running at an average of 5% per annum.

1.2 Micro-apartments and flats

I recommend buying conventional residential property in large, well-situated cities, and my advice is to pay special attention to micro-apartments or small 20-35 m² flats priced upwards of €120,000. As a rule, they tend to sell in new-builds, and the average annual rental yield is 4.5% per annum. This format has special advantages in Germany:

- Micro-apartment rental contracts are mostly mid-term (up to one year), for which reason the owners can regularly adjust the rental rate and evict the tenants easily if they turn out to be insolvent.

- Regular-sized (70-80 m²) flats cost upwards of €300,000-400,000 and yield about 3% p.a when leased for long terms, but they are more liquid than micro-apartments.

- In the most advantageous locations—the well-developed central districts of large cities—there are few new-builds, and existing properties account for the majority of offers. When buying an existing property, be prepared for higher maintenance costs.

I often have to warn clients about offers promising extremely high yields (7-10%) and guaranteed rental contracts in the first few years of ownership. This is usually a sign of the property’s illiquidity and the asking price being overestimated by at least 1.5 times. Buying such property will usually involve paying for the 10% yield on top of everything else, and at the end of the guaranteed rental term, the investor is likely to be left without the tenants and the chance to sell the property at a profit.

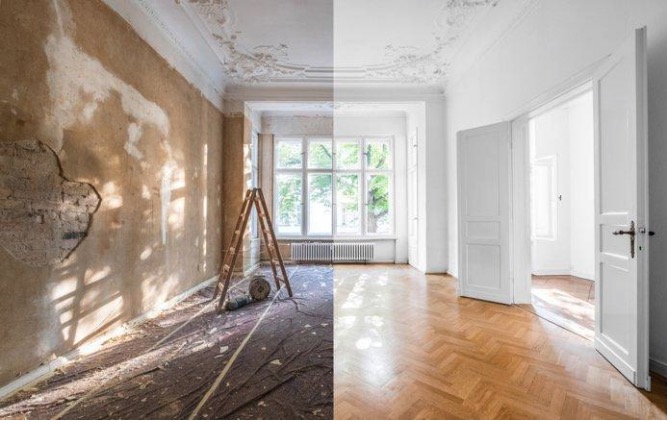

1.3 Apartment renovations

In this scenario, investors buy existing apartments in poor condition and splash some cash on renovation, after which they can rent the apartments out or resell them at a profit. The process of renovation averages three to six months with the total purchase and renovation costs often running from €200,000-400,000. The most successful Tranio projects of this kind were carried out in Athens, which still has a lot of rundown residential properties sold at attractive prices by the owners, as they are often unable to renovate them by themselves.

Renting out renovated apartments on a long-term basis yields 4% per annum on average while selling them can bring a 10-15% net yield.

Short-term rental yields are about 1% higher than the long-term, but the idle capacity risks are also higher.

When referring to the rental yield, I mean the gross yield. I have mentioned the average market figures; the actual yield will diverge by ±0.5% from these, depending on the location and property condition, among other factors.

The net income after all expenses averages 75-80% of the gross income. These expenses primarily include property purchase and ownership taxes, management company fees, the costs associated with opening a bank accounting and making fund transfers, as well as lawyer, notary and auditor fees, and other overhead costs. The acquisition of property ownership is also associated with other efforts: investors will have to attend property viewings, do a lot of paperwork, find bank financing (if needed), and report the state of their foreign accounts to the tax authorities of their home country. This is the payment for low-risk investments and an appreciation of 2-3% per annum.

2. Collective investment vehicles

The following two products are suitable for experienced investors who expect to have higher yields and are ready to take the corresponding risks. In this case, one will not become a property owner but put funds into development or renovation under the management of a professional project company.

2.1 Loans for development or renovation projects

The point of this product is that project companies attract loans for their own value-added projects, from apartment renovations to property construction from scratch. Loans are accepted at a fixed interest rate, usually ranging from 8% and 12% (before personal taxes). The entry threshold is about €100,000 and most projects last from one to two years.

2.2 Club deals in development projects

For such deals, several (usually no more than five) participants come together under the guidance of a general partner. Unlike loans, yields depend on the project results and are potentially unlimited, but in practice, they usually range between 10% and 15% (also before personal taxes). The delivery time is two to three years per project. Club deals are complex in terms of structuring and make sense in large capital projects because the minimum contribution is about €500,000.

The advantage of joint investments is the fact that project budgets can often reach several millions of euros, which leads to better bank financing terms and provides tax optimisation opportunities that are unavailable to individual investors with smaller budgets.

Collective investors do not incur any tax or administrative expenses associated with property ownership, but they usually pay taxes at the time of receiving an income. The specific tax rates depend on each investor’s country of tax residence, the project’s legal framework, and other factors. For instance, in the case of a loan, Russian residents pay a 13% personal income tax.

Even the most competent project company cannot completely eliminate the risks which are significantly higher in value-added projects compared to rental businesses. However, responsible investment teams are usually able to offer properties that, even in the least favorable scenario, enable investors to recover their capital. The organizers of collective investments frequently offer additional terms to enhance their credibility among clients: for instance, when Tranio manages investments, we invest our own funds on equal terms with the rest of the partners and risk together with them.

I believe that loans and club deals will play an increasingly influential role in global real estate investment markets over the next three to five years. This is why we’ve been actively developing these vehicles at Tranio.

—

(Featured image by Alex D’Alessio via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto5 days ago

Crypto5 days agoCaution Prevails as Bitcoin Nears All-Time High

-

Africa2 weeks ago

Africa2 weeks agoMorocco’s Wheat Dependency Persists Despite Improved Harvest

-

Biotech1 week ago

Biotech1 week agoEcnoglutide Shows Promise as Next-Generation Obesity Treatment

-

Markets2 weeks ago

Markets2 weeks agoCocoa Prices Drop Amid Speculative Selling and West African Supply Concerns