Business

What’s new at the agriculture market this week

High protein wheat remains in relatively short supply due to growing problems in many parts of the world, but especially Europe due to too much rain.

Weekly report with detailed analysis and commentary on the state of agriculture markets in the U.S.

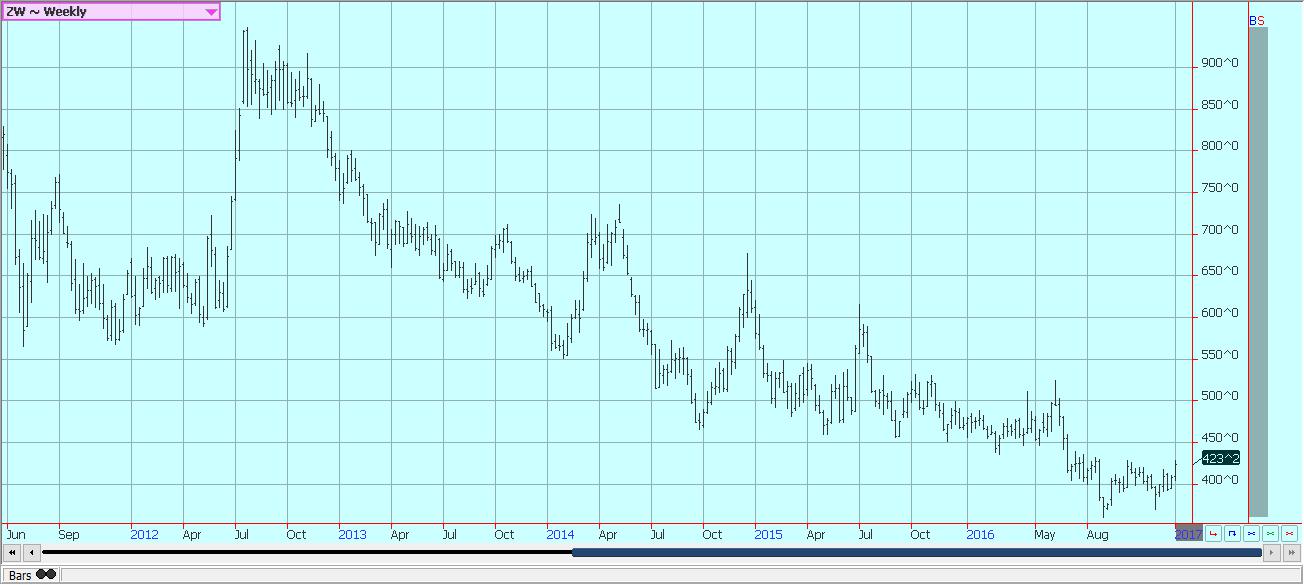

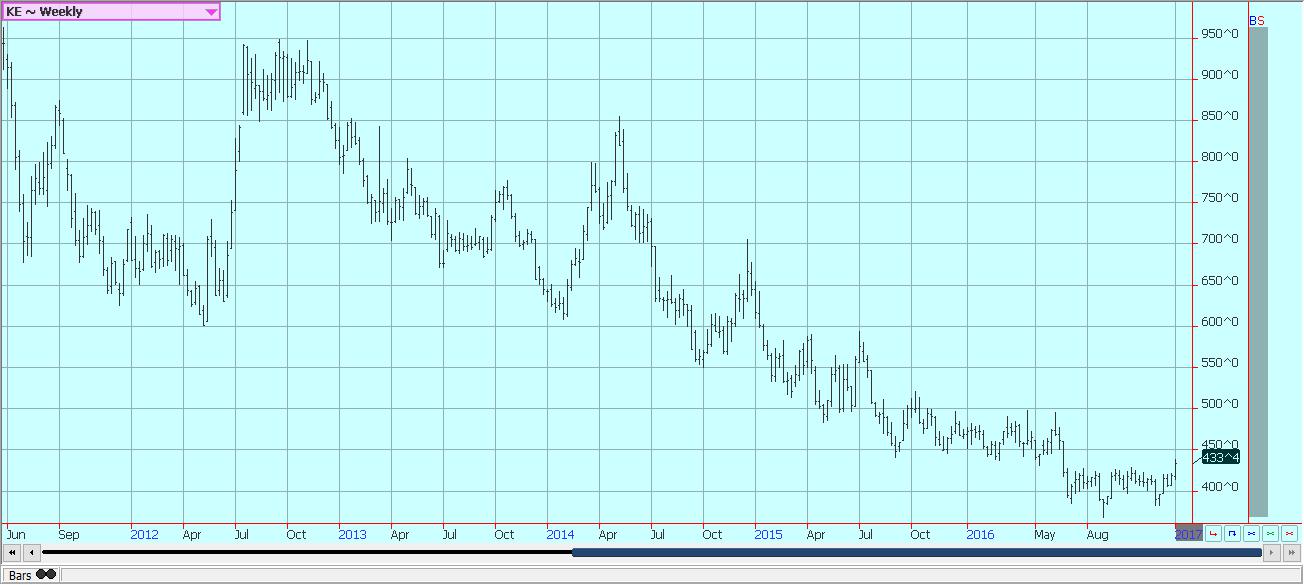

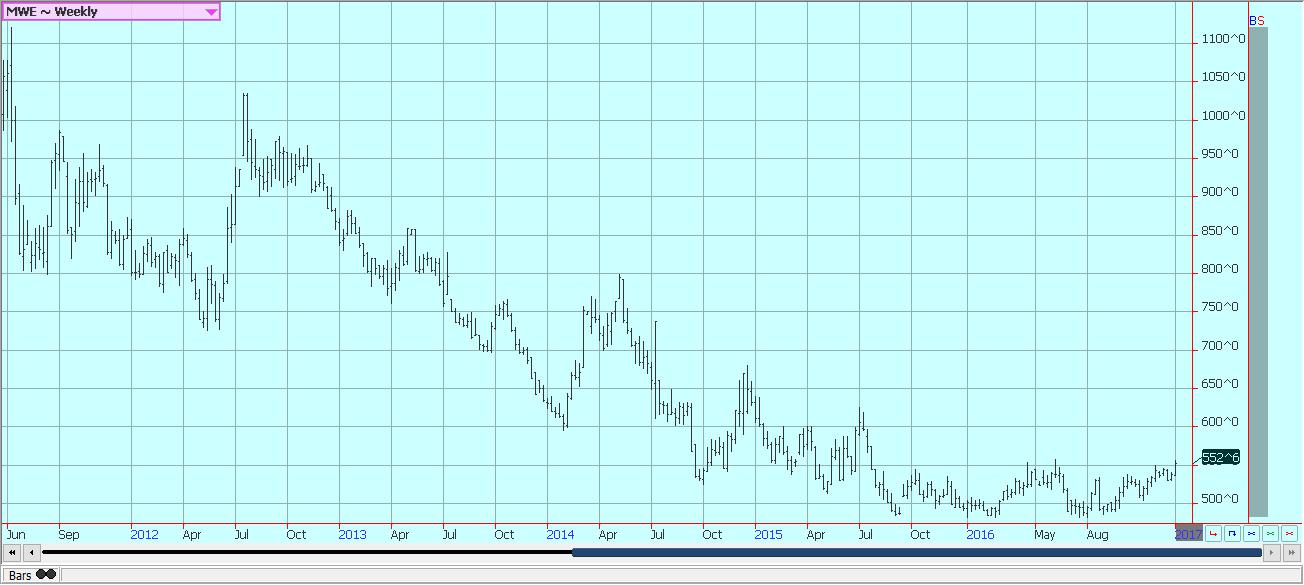

Wheat

US markets were higher for the week. The weekly charts show that trends are turning up in Chicago SRW and have already turned up in Chicago HRW and Minneapolis. The higher protein wheats are leading the way out of the extended sideways pattern as had been expected. High protein wheat remains in relatively short supply due to growing problems in many parts of the world, but especially Europe due to too much rain. Russia has had crops of variable quality this year, and it appears that rains in production areas of China at harvest time has hurt crops there as China has been quietly buying in world markets. On the other hand,. Australia is reported to have very good production and good quality this year. US export demand has held up well as the US can also export good quality Wheat. The weekly export sales report from USDA on Friday was not good, but there were sales of 100,000 tons of HRW in the daily reporting system that probably came as a result of the Algerian tender. Algeria normally buys from Europe and mostly France, so these sales are very welcome. USDA will release its annual production reports, but the small grains report that included Wheat was released months ago. USDA should be able to keep demand strong. The Wheat Seedings report will be watched carefully. There are expectations for reduced planted area in the Great Plains due to weather and price and in the Midwest due to price. Wheat prices should continue to work higher over time.

Weekly Chicago Wheat Futures © Jack Scoville

Weekly Kansas City Wheat Futures © Jack Scoville

Weekly Minneapolis Wheat Futures © Jack Scoville

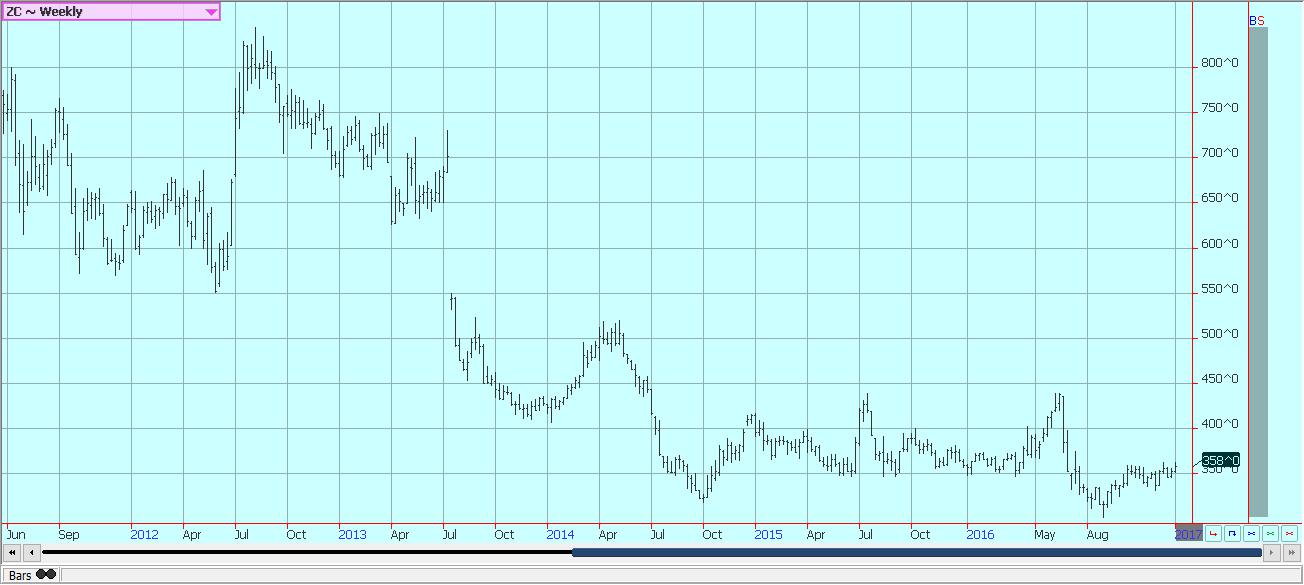

Corn

Corn closed higher again last week. The weekly charts imply that higher prices are possible over the next few months. The export sales report was poor, but US producers are still not real interested in selling. Interior and export basis levels remain relatively firm. The main market attention will be on the USDA annual production data and updated monthly supply and demand reports that will be released Thursday morning Chicago time. Increased product ion due to the high yields is widely expected, and there seems to be little doubt that USDA might increase yields and production marginally. It also has room to increase demand, at least on the export side as export demand is still running well above levels needed to reach USDA targets. The other factor catching attention is the weather in South America. The weather might be more important for Soybeans, but Corn is also affected. It remains too wet in parts of southern Brazil, Uruguay, and northern Argentina. Southern Argentina is hot and dry, as is northern Brazil. Northern Brazil is expected to get some light rains later this week, but the general weather trends are forecast to remain intact. Futures prices are trying to push through some major resistance areas that start at 363 March. These levels have held any rallies in check for months, and for now there does not seem to be a good reason to push prices higher. That means more range trading is likely through at least the reports on Thursday and perhaps beyond unless South American weather problems become more pressing.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

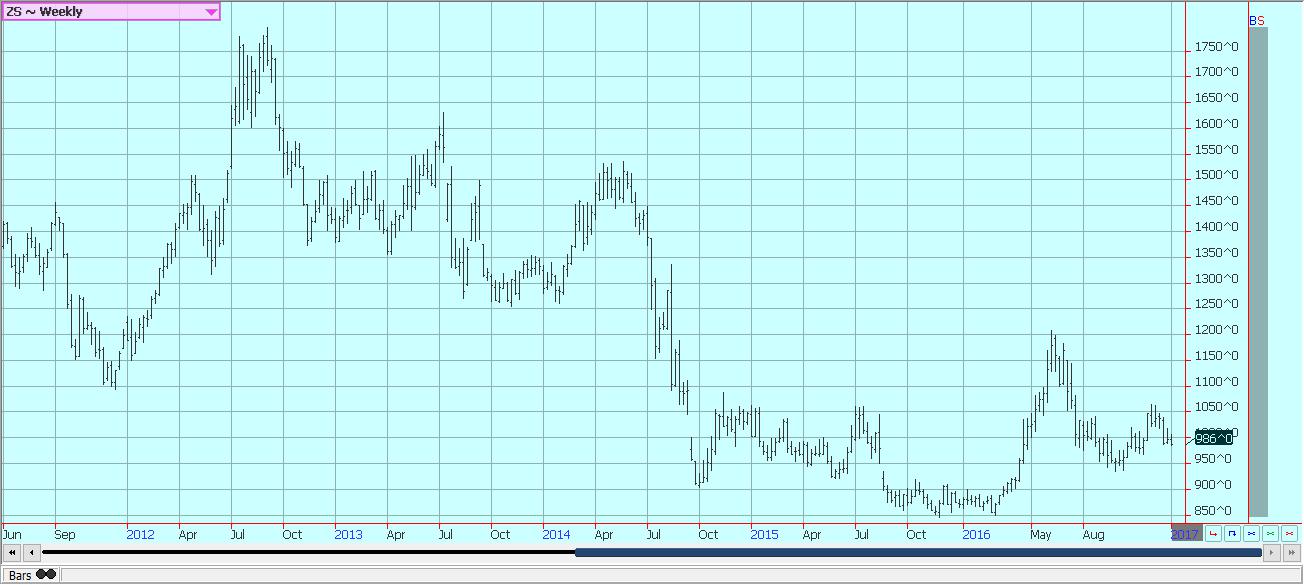

Soybeans and soybean meal

Soybeans and soybean meal were lower for the week after big selling appeared on Friday. The selling appeared to be in response to the weekly export sales report that was dismal, especially for Soybeans. The report showed only minimal net sales as there were also cancellations of almost 900,000 tons of sales seen in the report that had not been seen in the daily reporting system. Meanwhile, South American weather is increasingly important to the trade. Rains continue from northern Argentina to southern Brazil. Some of the rains have been heavy and some flooding has been reported in central Argentina. The crops in Argentina are also facing stress from drier and hotter than normal conditions to the south. Southern Brazil is also reporting rains. The area to watch will be northern Brazil as northeast areas especially turn hot and dry. There are some forecasts for light precipitation late this week, but then adverse weather could return. Central areas are also turning warmer and drier, with some areas seeing high temperatures near 100F. The market is also hearing about some initial harvest activity in the far north of Mato Grosso. This is a very early start to the harvest. Most northern Mato Grosso areas will not start until later this month and Soybeans could be available for export by late February or early March. The trade fears lost business for the US once Brazil starts selling. USDA will issue its annual production reports on Thursday morning and at least a marginal increase in Soybeans production is expected. A marginal increase is likely. However, USDA can also easily raise demand estimates as both export and domestic demand are running well ahead of USDA projections.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

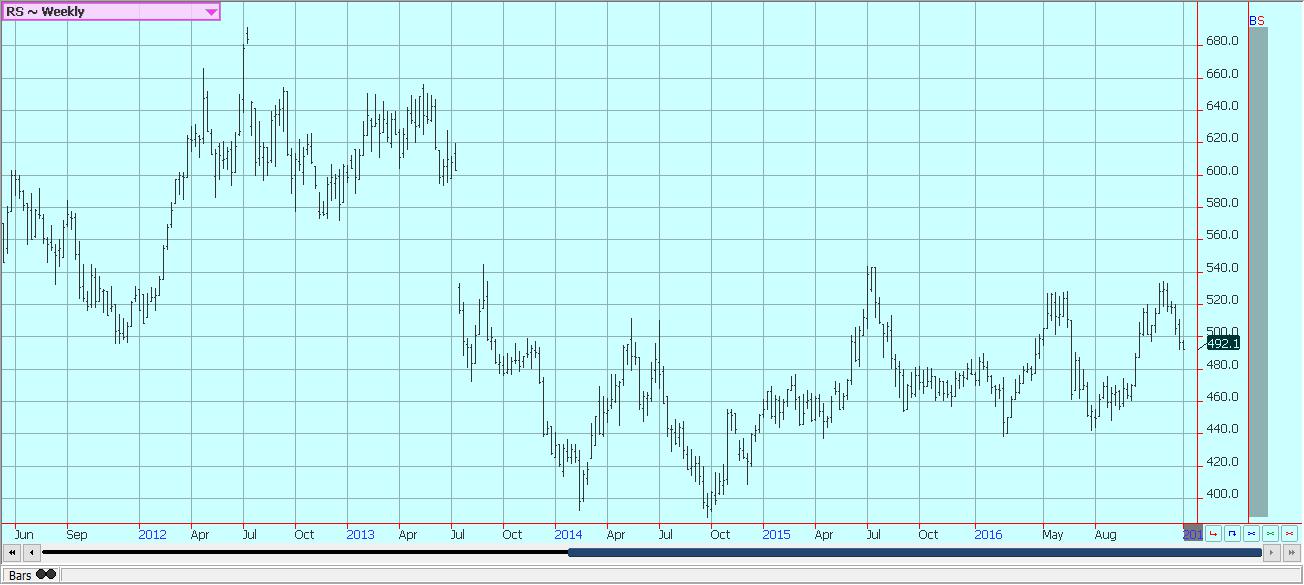

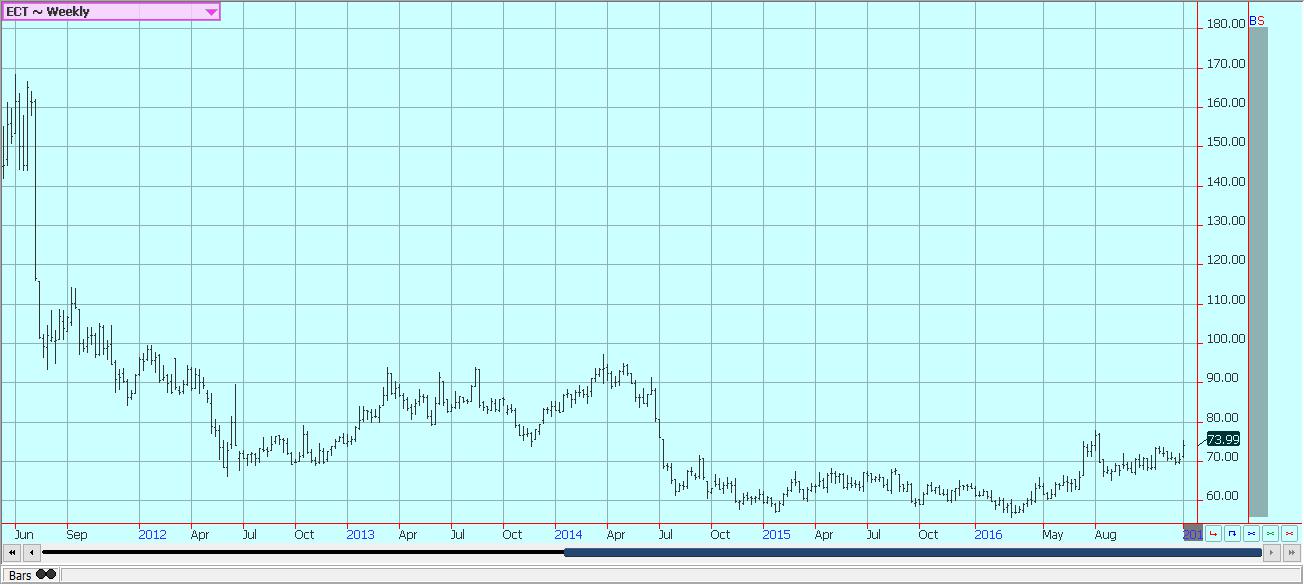

Rice

World markets were mostly stable again last week. Southeast Asian prices were called unchanged all week. US futures markets moved a little higher. Short speculators added to positions, and commercials were seen covering short positions. Short term trends are mixed and medium term trends remain down in Chicago. Most producers will now start to look at prices and try to find a way to make a profit on the crop grown last year. Prices at this time as cash market bids remain well below the cost of production for most sellers. Domestic mills appear to have enough Rice in hand to meet projected demand into next year. The US is facing a big cut in planted area next year unless prices improve this Winter. Planting mix decisions will start being made this month, and most are now expecting a drop of 15% to 25% in planted area due to price. It is not profitable to grow Rice in the US at current prices. USDA will issue its annual production reports on Thursday and it is possible that production, field yields, and milling yields are reduced. The harvest has shown variable quality this year. Export demand has not been real strong, but has been at least as strong as expectations and need not be changed. Domestic demand could also stay unchanged for a reduction in ending stocks.

Weekly Chicago Rice Futures © Jack Scoville

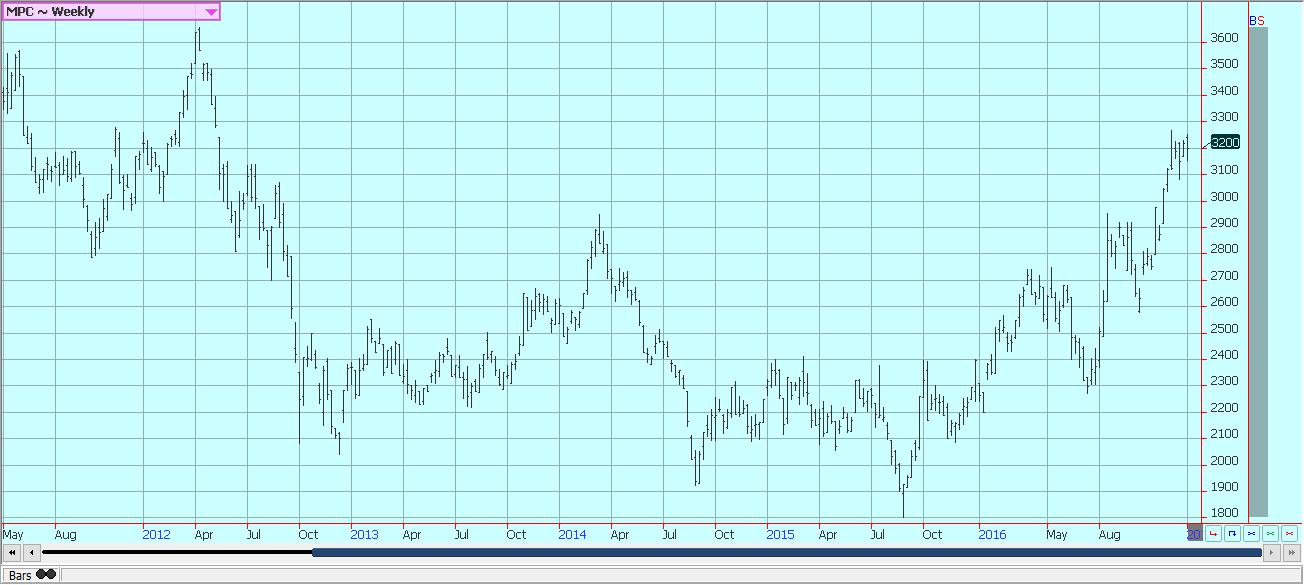

Palm oil and vegetable oils:

World vegetable oils markets showed mixed trends last week. Palm Oil prices were little changed, and Soybean Oil prices were slightly higher. Canola futures were a little lower for the week. World vegetable oils markets will see some big reports this week. MPOB will kick off the week with its monthly supply and demand report tomorrow. Average trade estimates indicate lower totals in all major categories. Production is expected to be about 1.43 million tons, from 1.57 million in November. Exports are estimated near 1.31 million tons, from 1.37 million in November.

Ending stocks are estimated at 1.62 million tons, from 1.66 million in November. USDA will issue updated supply and demand estimates on Thursday, and Soybean Oil demand should be very strong. Demand for vegetable oils has been good, but not great. The export volumes have been dropping in Malaysia on a month to month basis as Palm Oil is currently very high priced. Soybean Oil has seen good sales, but supplies are very good as well. The reduced sales pace partially reflects the smaller crops produced in the last six months due to the drought losses from El Nino. The smaller Palm Oil production has pushed Palm Oil prices to points where it makes sense for buyers to consider Soybean Oil. Chart patterns have turned mixed in the last couple of weeks.

Weekly Malaysian Palm Oil Futures © Jack Scoville

Weekly Chicago Soybean Oil Futures © Jack Scoville

Weekly Canola Futures © Jack Scoville

Cotton

Futures were higher last week. The weekly charts show that the longer term uptrend remains intact. Speculators are the major longs and this fact could create some down side price risk. USDA will issue its annual production reports on Thursday morning, and strong production is anticipated after the big increase in production estimates seen in November. However, it is an open question if USDA needs to increase production again, and it could cut production slightly if it finds it overshot the estimate in November. Demand estimates should remain strong as export sales and shipments in general have been very strong. The situation in India remains difficult as the market has yet to open much due to the changes in monetization of the country. The government has changed bills and appears to be forcing more electronic transactions to open the economy and increase transparency. The US has been able to sell more Cotton into the world market this year due to these developments, and even Pakistan has become a good buyer as they look to replace purchases normally made from India. China has been buying US Cotton to blend with their own production. The US should remain a strong seller for the next few months and the longer term sideways to up trend should remain intact.

Weekly US Cotton Futures © Jack Scoville

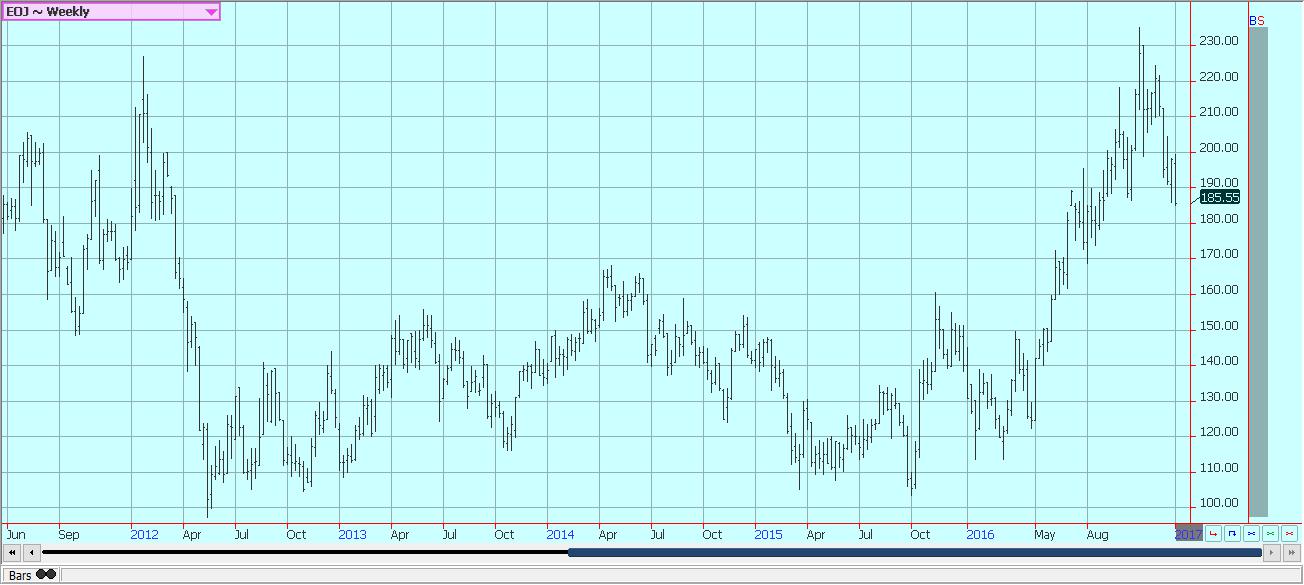

Frozen concentrated orange juice and citrus:

FCOJ closed lower last week as the Florida harvest was active amid good weather conditions. Early and Mid oranges are being harvested for processing. The market is looking at stable production estimates for Florida and the potential for increased competition from Brazil. There are no frosts or freezes in the forecast for Florida as temperatures remain warm. It has been dry, and producers have been forced to irrigate frequently. Brazil is expecting a sharp recovery from the drought induced production losses of last year. That would put production near the historical normal and alleviate many concerns about the reduced Florida production as the Brazil production will be available for import and blending. Sao Paulo state is getting good weather and crop conditions are called good. However, the production area has turned drier and trees could soon show signs of stress.

Weekly FCOJ Futures © Jack Scoville

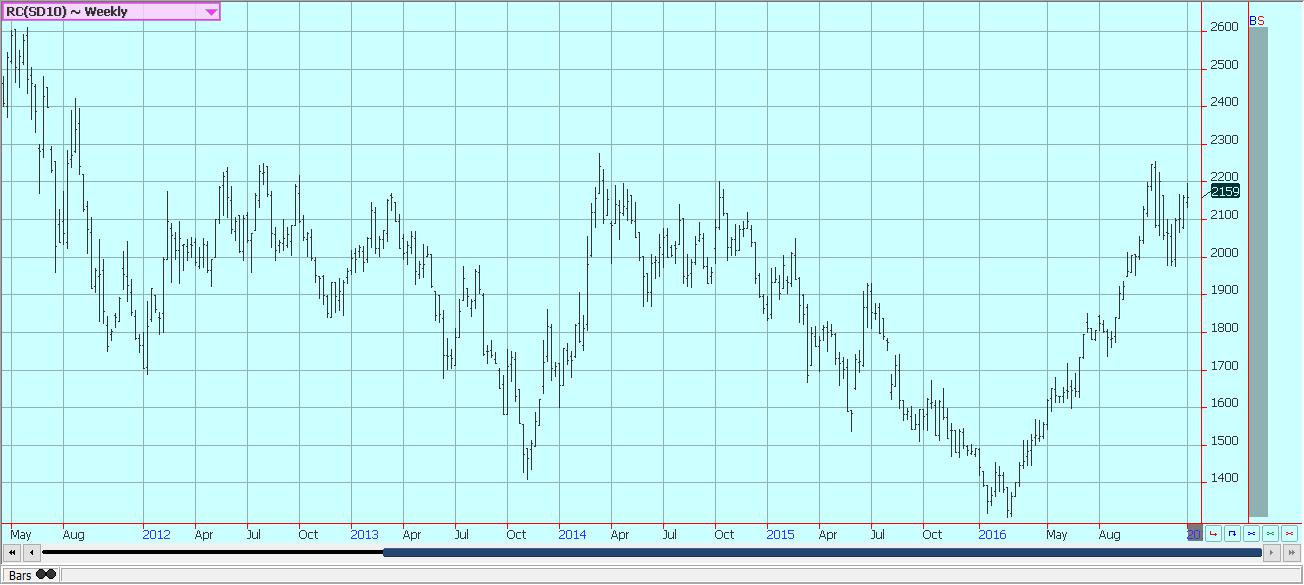

Coffee

Futures moved higher last week, with London once again the stronger market. New York prices are getting close to support areas on the weekly charts, so down side potential might also be limited after several weeks of falling values. This could be especially true if London can stay strong and trade higher. The offer side of the market is quiet, but interested in selling rallies. Differentials paid in Central America appear stable at weak levels. Little selling is being reported, but offers are available as the harvest is active. Differentials are also stable in Colombia. Brazilian producers have become quiet as the fear further weakness in the Real against the US Dollar. Differentials have turned stronger in the past week in an effort to encourage new sales. Coffee becomes a bank account when these fears get big enough. Roasters have become more withdrawn in the marketplace due to the recent surge in prices, and now due to the price weakness. They will probably start to buy again if a more stable price outlook appears.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

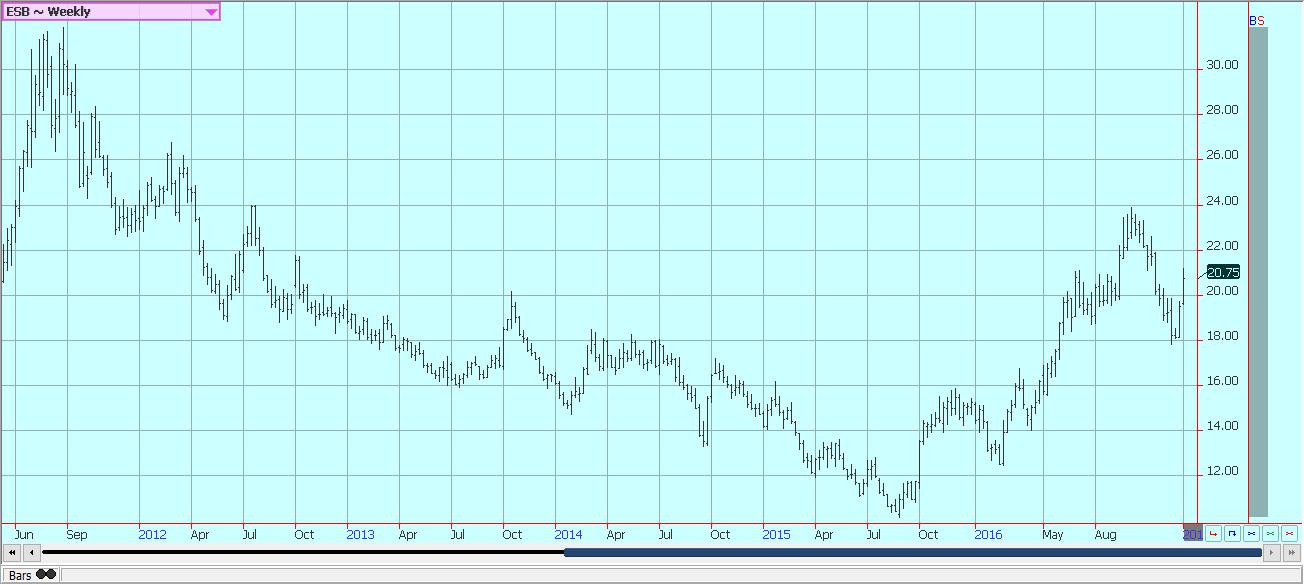

Sugar

Futures closed higher once again last week as the market recovered in a dramatic way. News of less than expected production in Brazil combined with talk that India might relax import tariffs due to short production there last year created some massive buying that triggered more liquidation buying as the week progressed. India denied it was ready to ease import tariffs despite higher internal prices and indications of short supplies, and the market gave back some of the rally on Friday. The weekly charts show that New York futures have moved above down trend lines and could trade more in a sideways fashion for a while. Demand news remains bearish for futures prices.

China has imported significantly less Sugar in the last couple of months as it starts to liquidate massive supplies in government storage by selling them into the local cash market. There could be smaller crops coming from India and Thailand due to uneven monsoon rainfall in Sugar areas in both countries. India has said that its production and amounts in storage are sufficient and that there is no need for imports that had been expected earlier. The weather in other Latin American countries appears to be mostly good, although parts of Brazil remain too dry. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures © Jack Scoville

Weekly London White Sugar Futures © Jack Scoville

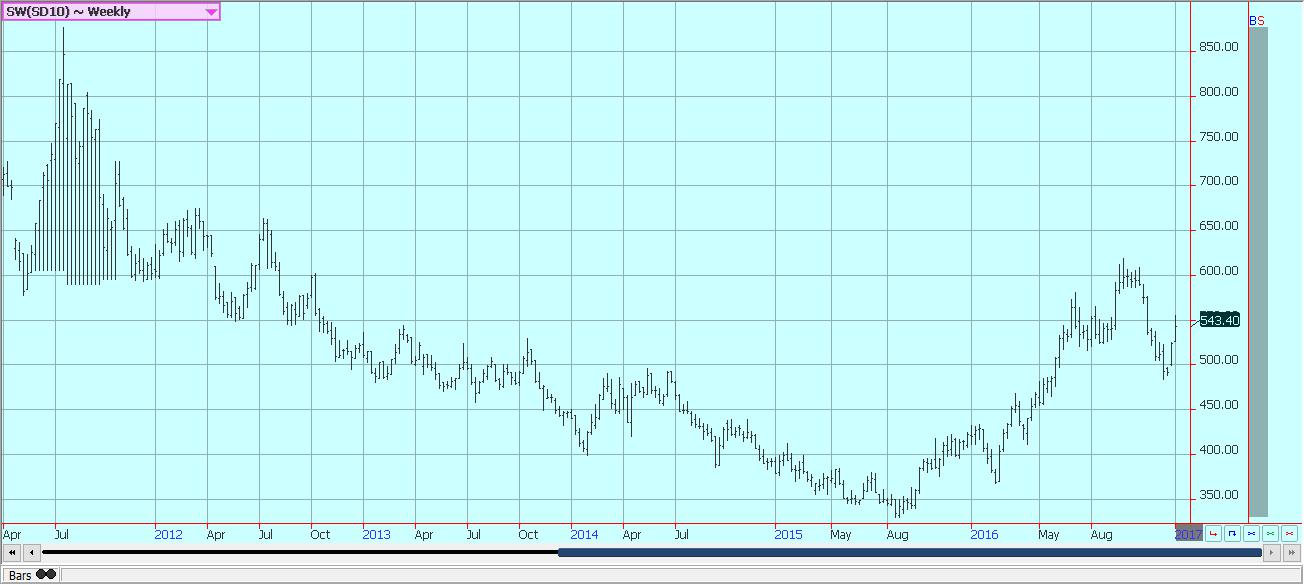

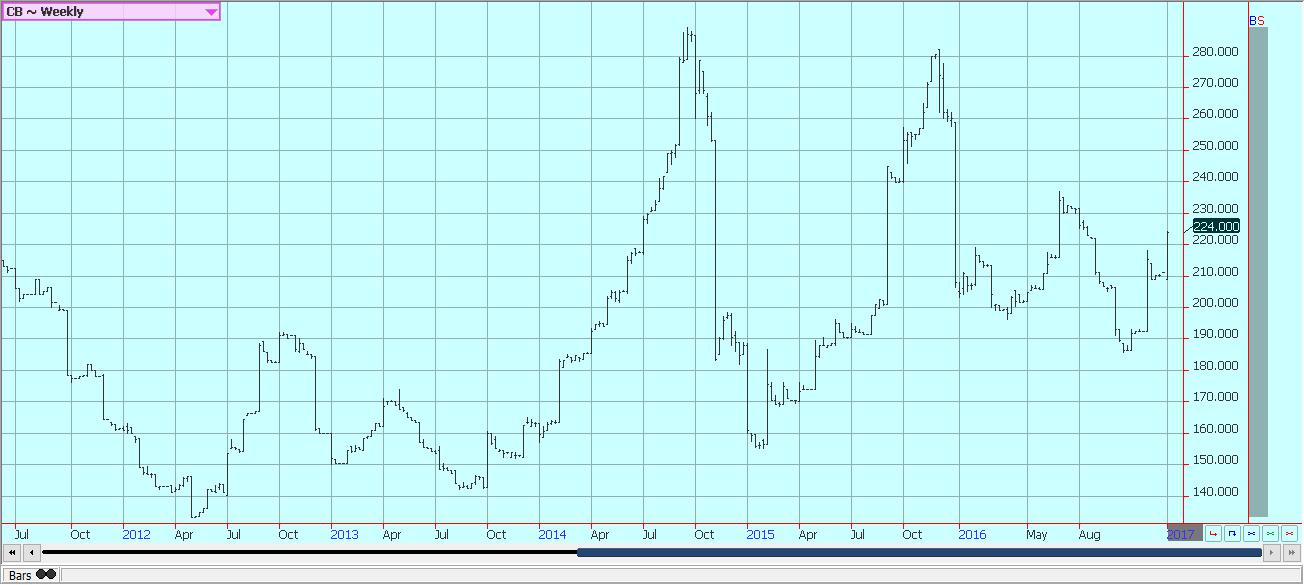

Cocoa

Futures markets were higher in both New York and London in what appeared to be a big short covering rally from speculators and commercials. Trends have turned sideways as it is possible that both markets are making some intermediate lows. However, neither market has been able to penetrate some important resistance areas on the charts and to complete a low formation. Overall price action remains weak as the main crop harvest continues in West Africa under good weather conditions. Reports exporters have bought a lot and have plenty of product to sell. Many can no longer buy as storage in West Africa has been filling up and as demand in consuming countries has not been all that strong.

The demand from Europe is reported improved, but still weak overall. The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and alternating warm and dry weather with the rains. There have been some reports of disease to crops in the wetter areas, but so far there is not a lot of market concern. Bigger production is expected this year in all countries. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

The demand from Europe is reported improved, but still weak overall. The next production cycle still appears to be bigger as the growing conditions around the world are generally improved. West Africa has seen much better rains this year and alternating warm and dry weather with the rains. There have been some reports of disease to crops in the wetter areas, but so far there is not a lot of market concern. Bigger production is expected this year in all countries. East Africa is getting enough rain now, and overall production conditions are now called good. Good conditions are still being reported in Southeast Asia.

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

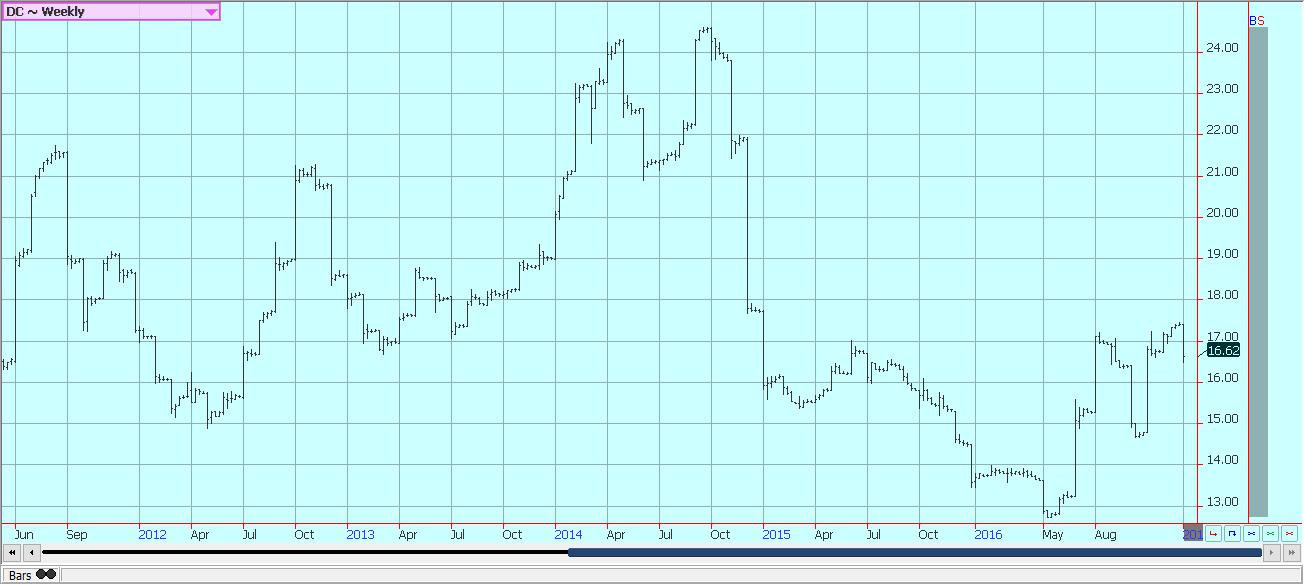

Dairy and meat:

Dairy markets were firm as good supply met very good demand. Butter and cheese manufacturers report strong demand, but inventories are starting to increase as there is a lot of milk available. Demand has been at least as good as expected for butter and especially cheese as many retailers buy ahead of the Super Bowl. Butter manufacturers are mostly producing bulk butter for inventories, but there is increasing print butter production ahead of the game. Cream demand has been strong in the domestic and world market, but is available with schools reopening and taking milk. Cheese demand is being met with adequate to strong milk supplies and manufacturing is active. Raw milk production has also been stronger in all areas. Dried products prices are mixed to firm. Whey prices are strong, and whole milk prices are firm.

NDM prices are mixed to firm. International markets are featuring higher prices due to reduced production. Production is less in Europe and Russia. Export demand for New Zealand has increased due to stronger demand from China. Chinese demand has been increasing for much of the past year, and New Zealand is the primary beneficiary of the demand. The Global Dairy Auction featured lower prices, but ideas are that the lower prices were caused by reduced demand during the holiday period and that the lower prices will not be sustained. South American prices are firm as raw milk production goes into a seasonal decline. Argentina is seeing weaker production due to a big storm in central and northern areas that has also affected production in parts of Uruguay.

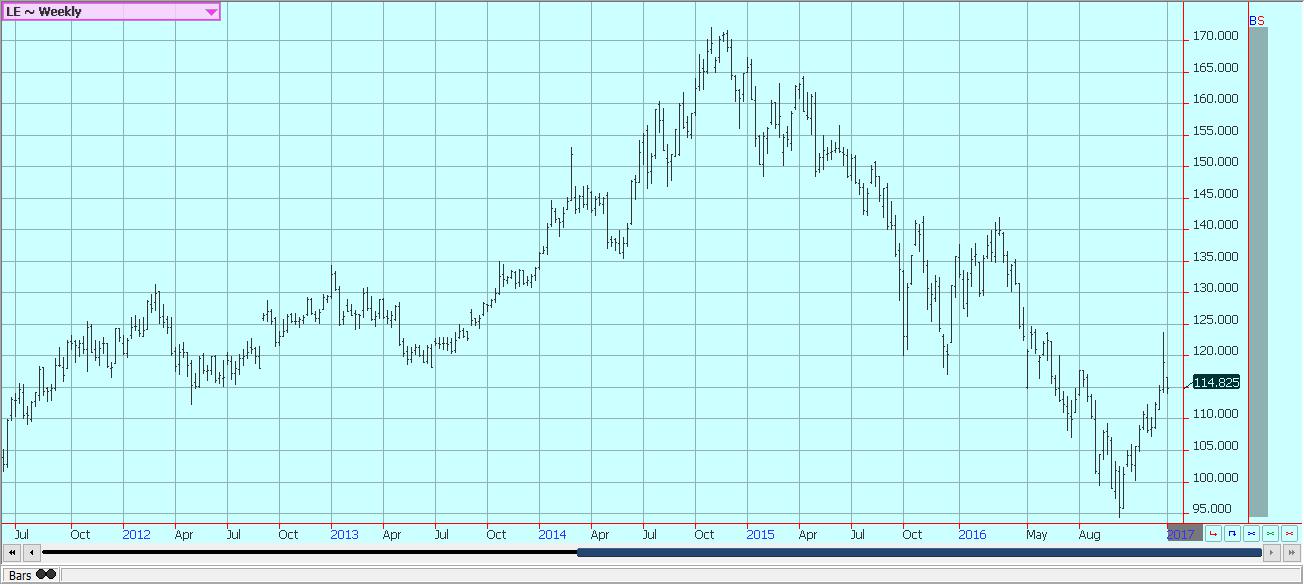

US cattle and beef prices were stable to higher last week. Beef prices were firm in the early part of the week, but fell late in the week as retailers pulled back from the market. Cash cattle markets traded at stable prices at the end of last week and in good volumes as packers recovered from a short bought position. Prices paid in the cash markets were in line with futures. The charts show that market could move higher. Demand is expected to become more stable this week and more stable pricing is expected in cash markets. Australia has less to offer and very high prices. Herd culling has slackened in both Australia and New Zealand. Pasture conditions in both countries is better than a year ago on colder and wetter weather seen until now.

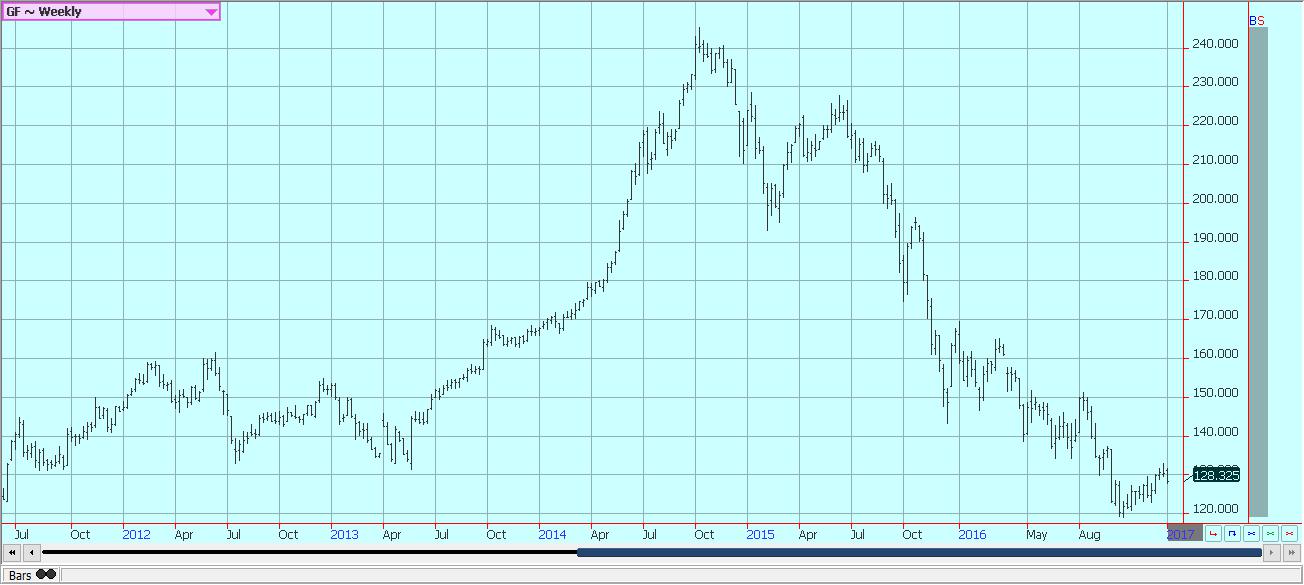

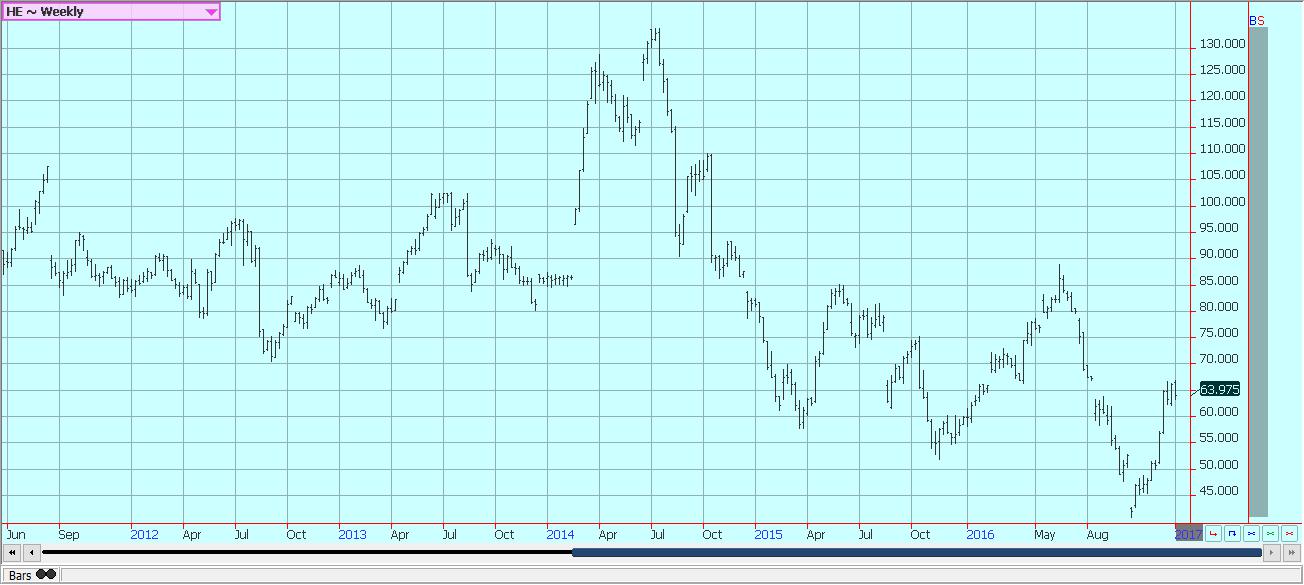

Pork markets have been firm, and live hog futures trends are sideways for the short term, but still higher for the longer term. Pork demand has been stronger than expected and ham prices have been contra seasonally strong. Pork prices have trended higher in retail and wholesale markets. Packer demand has been stable as many packers expected reduced supplies of Hogs late in the Winter or in the Spring. This is a seasonal tendency. The charts show that the market could remain higher, but seasonal studies indicate that futures could make an intermediate high soon.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Cannabis6 days ago

Cannabis6 days agoRecord-Breaking Mary Jane Fair in Berlin Highlights Cannabis Boom Amid Political Uncertainty

-

Impact Investing2 weeks ago

Impact Investing2 weeks agoGlobal Gender Gap Progress Slows Amid Persistent Inequality and Emerging Risks

-

Biotech3 days ago

Biotech3 days agoVytrus Biotech Marks Historic 2024 with Sustainability Milestones and 35% Revenue Growth

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoColombia Approves Terrenta’s Crowdfunding Platform for Real Estate Financing

You must be logged in to post a comment Login