Biotech

Why you should consider buying biotech stocks

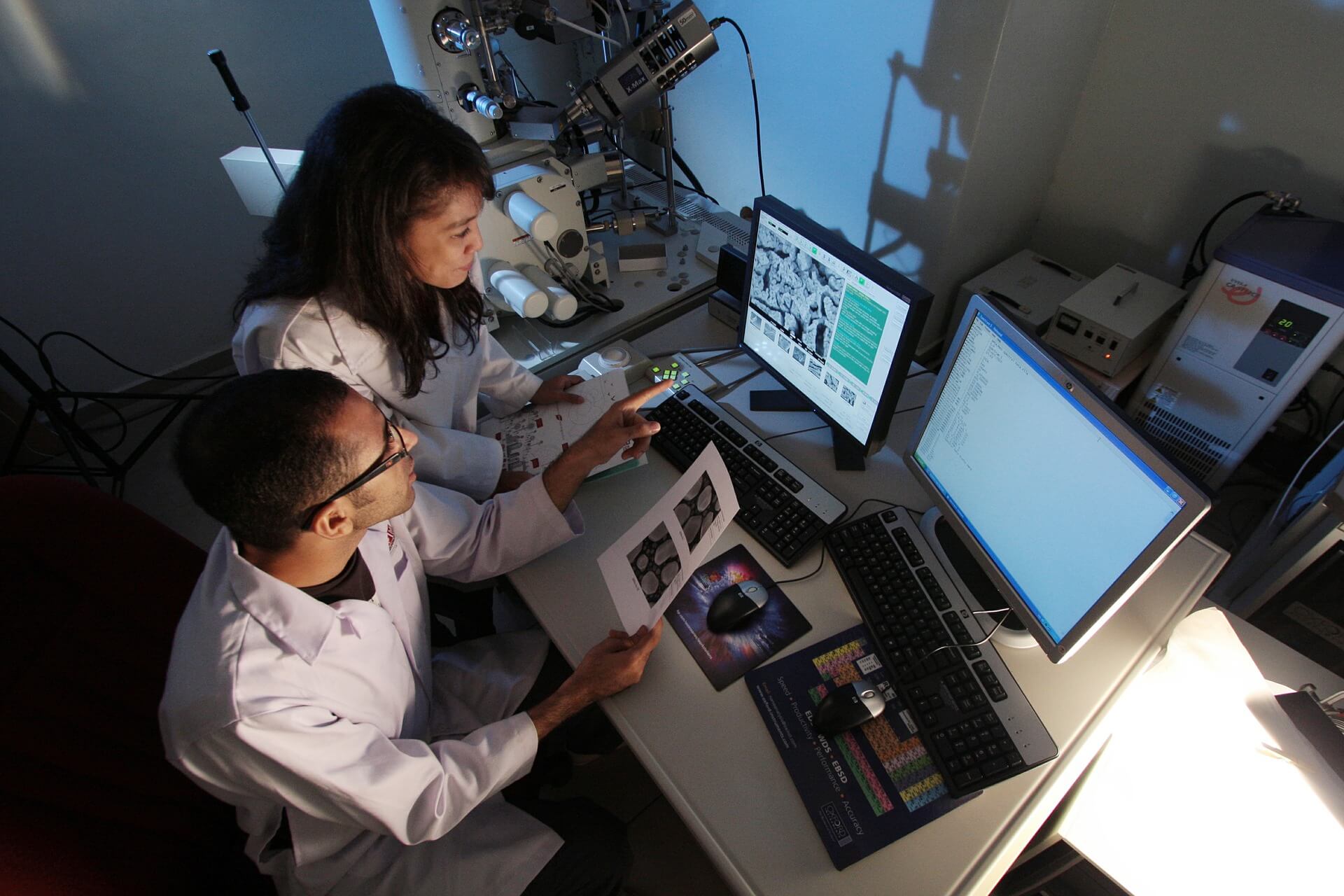

Innovations in the industry are enticing investors to buy biotech stocks.

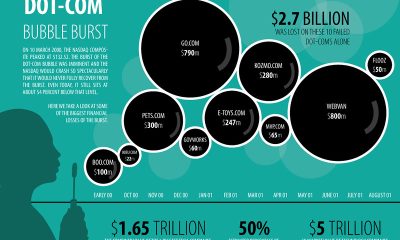

The biotechnology industry is an interesting field to explore as it has a lot of companies that aspire to save and improve people’s lives with their revolutionary ideas for medicines or innovative medical technologies. However, it can also be an intimidating segment of the stock market because it holds a lot of risks. For instance, the chance of biotech products failing to deliver what they promised will lead to the failure of these products and the companies that made them, as was the case with Theranos.

But once you’ve studied the plans of a biotech company you intend to invest in and are convinced it will become successful, then the risks are worth taking. The payoffs will also be rewarding.

With a lot of diseases threatening human lives and many companies striving hard to provide new medicines, it looks like now is a good time to look into biotech stocks.

What is biotechnology?

According to Investopedia, biotechnology is an industry that works on creating new drugs and performing clinical research to combat ailments. There are a lot of instances where many biotechnology firms end up becoming unsuccessful. Their medical-research efforts were in vain, and they also do not receive a lot of earnings after their endeavors.

People tend to confuse the biotechnology and pharmaceutical industries with each other, but there are few distinctions to keep these two apart. First, as what was mentioned before, the biotechnology industry is all about taking risks, while the pharmaceutical industry is focused on handling and balancing risks.

In terms of dividends, most biotech companies rarely pay dividends since they only acquire little income. Pharmaceuticals have it the other way around as dividends can bring a huge amount of money to a pharmaceutical stock’s expected return.

Biotechnology is an industry where firms within that sector research and develop new treatments to fight diseases. (Source)

Biotech vs pharma

Biotechnology companies handle the marketing of their drugs without any grandiosity. Their knack for research and development may have caused them to be more straightforward and focused on giving facts. Meanwhile, pharmaceutical companies seem to handle marketing very well, and they are always looking for new medicines from biotech to promote.

The pharmaceutical industry may have some sort of edge in the market, but stocks in the biotech industry are worth investing in once the risks associated with the industry have been set aside. You know what they say: high risks come with high rewards. If you are still thinking about buying a stock in biotech but need an extra push, here are five reasons to consider, per MarketWatch.

The biotech industry has a lot of innovations that are under-appreciated

Because of the lack of attention in the biotech industry as a whole, only a few investors have the knowledge or expertise to invest in the industry despite the possible heights that biotech companies may reach when they finally develop inventive treatments and drugs for diseases.

While notable tech companies compete in releasing the latest, most advanced gadgets, biotech companies are doing the same, but for the medical field. They are looking for new ways to provide medical care for patients and researching how to develop better treatments.

For instance, back in August, Moleculin Biotech, Inc. (NASDAQ:MBRX) developed an active drug component, the WP1122, which will be used in the company’s study for treating brain tumors. Upon announcement, the stock went from a low of 70 cents to a high of $3.40 and has now settled comfortably into the $2.75 range.

Pharmaceutical companies are more adept in marketing medicines since biotech firms are straightforward and focused on providing facts. (Source)

Meanwhile, London-based biopharmaceutical company Hemogenyx has developed two products that can change the way we currently treat leukemia, lymphoma, and other blood diseases. The market potential of Hemogenyx has prompted Silver Falcon (LON:SILF), a London based shell to propose a reverse takeover which is just waiting for final approval at the AGM on October 4th, 2017. The new company will trade under the symbol (HEMO) starting October 6th.

The company’s technologies help reduce the dangers and limitations of bone marrow and hematopoietic stem cell (HSC) transplantation. One of them can also remove the need of looking for a matched donor for the transplant.

The first is the CDX Antibodies, which helps condition patients before the transplant without the toxicity of chemotherapeutical agents obtained from radiotherapy or chemotherapy. In short, this could possibly replace chemotherapy and its dreadful effects. These antibodies also specifically remove HSC/hematopoietic progenitors and can also eradicate malicious cells that are part of a leukemia subset.

Its second product is the Hu-PHEC or postnatal human hemogenic endothelial cells. Hemogenyx uses these cells to produce cancer-free HSCs, which will be applied in transplants for best results in the treatment of blood cancers. According to Hemogenyx, these cells can also bring many advantages in the treatment due to them being easy to be separated. Hu-PHEC cells are also considered to be “healthy” since they do not build up mutations linked to blood cancer.

Mergers and takeovers are part of this still-growing industry

Mergers and acquisitions will always be part of any industry, including biotech, as evident by Silver Falcon’s reverse takeover of Hemogenyx, per DigitalLook. Silver Falcon issued 228.57 million shares, priced 3.5 pence per share, to Hemogenyx. Silver Falcon will also use the US biotech company’s name starting October 5th, when they will start trading again.

Following the deal, Hemogenyx has raised approximately £3.0 million. The company thinks this will be sufficient in finishing the CDX antibodies’ preclinical development and in funding more preclinical development of some candidates for its Hu-PHEC cell therapy.

The rise of impact investing and social entrepreneurship have driven growth towards this sector. The fact that these life sciences developments brought by biotech companies can be advantageous not just to countries with economic power but to developing nations as well

“There’s definitely opportunity in the space. I’m very optimistic for the prospects for doing good work and analysis going forward whether the market goes up or down,” Visium Asset Management Jacob Gottlieb says of the industry.

Many investors and companies are interested not just on the payout of these biotech startups but in the difference they could make in our health care today. The biotech industry is flourishing and will continue to do so as many of these life sciences companies’ motivation stem from personal experiences that urge them to improve the quality of human life.

This is encapsulated perfectly by what Hemogenyx co-founder and COO, Alexis Sandler says is the start of their company: “Dr. Vladislav Sandler’s work in the lab, the results of which are at the heart of the HemoGenyx business, was an outgrowth of his own personal experience with the loss of close relatives from blood diseases like leukemia and lymphoma. Thus, the inspiration for HemoGenyx is the widespread need for a more effective treatment for such blood diseases.”

—

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crypto5 days ago

Crypto5 days agoBitcoin Traders on DEXs Brace for Downturn Despite Price Rally

-

Business2 weeks ago

Business2 weeks agoDebt-Fueled Markets, Zombie Corporations, and the Coming Reckoning

-

Crowdfunding2 days ago

Crowdfunding2 days agoFrom Confiscation to Cooperation: Funding Casa de la PAZ’s Social Transformation

-

Impact Investing1 week ago

Impact Investing1 week agoGlobal Energy Shift: Record $2.2 Trillion Invested in Green Transition in 2024

You must be logged in to post a comment Login