Featured

Crop Losses in South America Influenced the Price of Corn Futures

Corn closed higher on Friday and for the week as the inflation market returned and as the market took a look at South American crop losses. The weekly export sales report showed strong demand for US Corn. The markets heard about potential improvement in growing conditions in South America but there have already been estimates of losses to Corn in both Argentina and Brazil.

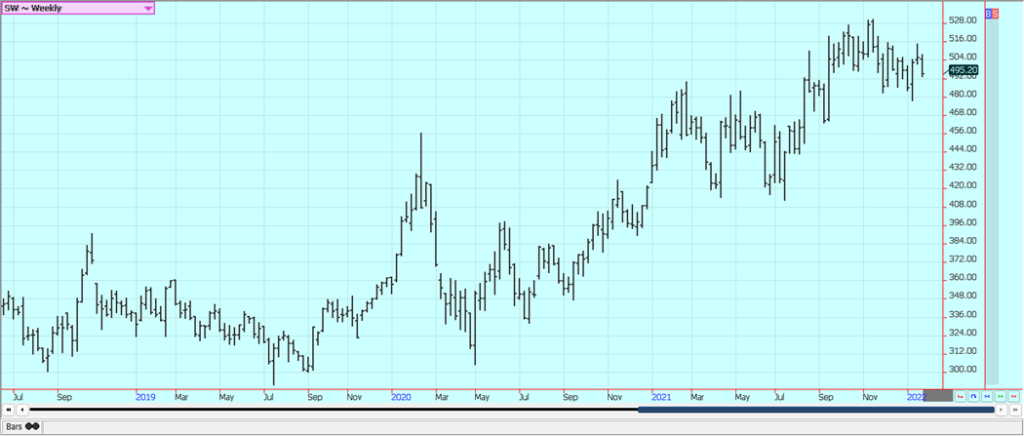

Wheat: Wheat markets closed higher on Friday and mixed for the week as tensions between the west and Russia eased and as Mr Putin said he would not do anything during the Olympics. The Dollar moved to new highs for the move and could now trade to 100.00 on the March Dollar Index. Russia has been escalating the crisis to test US and NATO resolve and war is now more likely or at least some severe sanctions that could end the export programs for both Russia and Ukraine. The US and Russia are talking and Russia has said it will not do anything during the Olympics. The weekly export sales report was strong and featured a marketing-year high in sales. It remains dry in the western Great Plains. Ideas had been that the US will have good demand for Wheat as the rest of the northern hemisphere is short production this year but so far demand has been average or less against previous years. Offer volumes are down in Europe. Dry weather in southern Russia, as well as the US Great Plains and Canadian Prairies, caused a lot less production. The lack of production has reduced the offers and Russia has announced sales quotas. Australian crop quality should be diminished. North Africa is very dry.

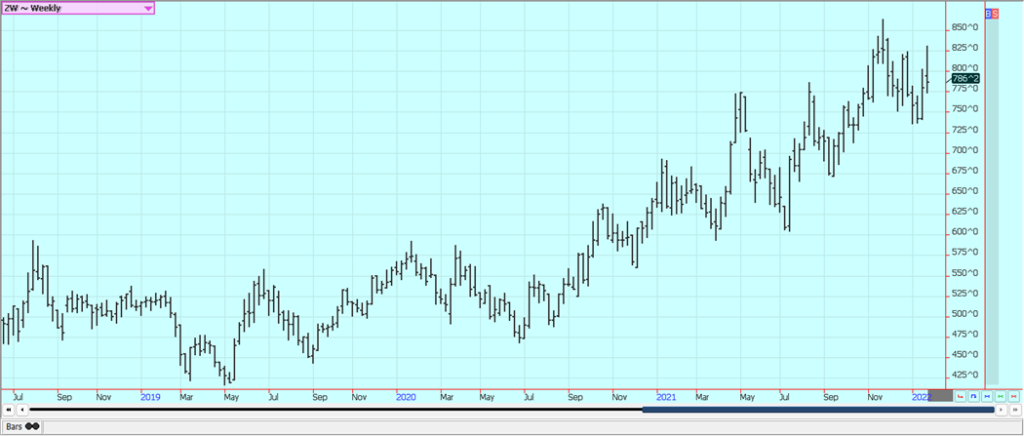

Weekly Chicago Soft Red Winter Wheat Futures

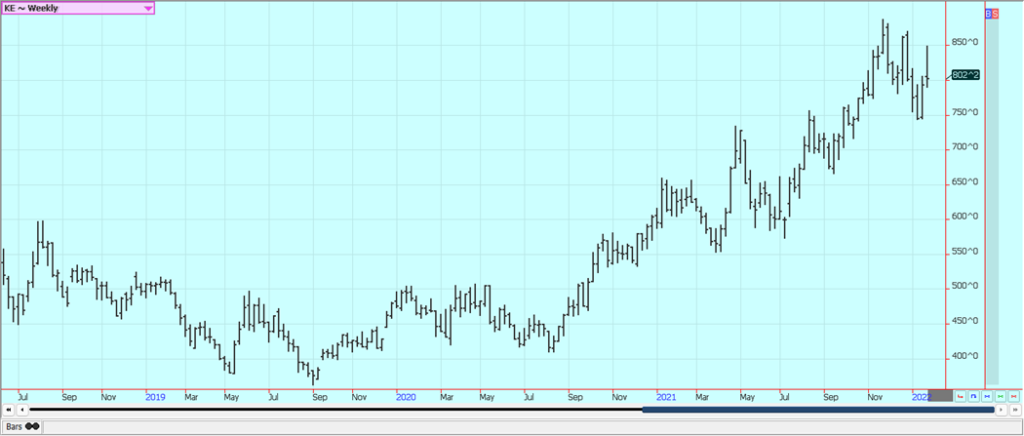

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn closed higher on Friday and for the week as the inflation market returned and as the market took a look at South American crop losses. The weekly export sales report showed strong demand for US Corn. The markets heard about potential improvement in growing conditions in South America but there have already been estimates of losses to Corn in both Argentina and Brazil. Central Argentina got the best rains again and the other areas were still dry or got significantly less rain. Showers are now predicted for southern Brazil and the rest of Argentina and Paraguay and the situation there should become more stable. Northern Brazil is expected to be drier to help with conditions there. Ukraine is a major Corn and Wheat exporter and the market fears that a disruption in the export pace from there could mean more demand here. Russia has eased tensions by indicating that nothing will happen until the Olympics end but the market is still watching.

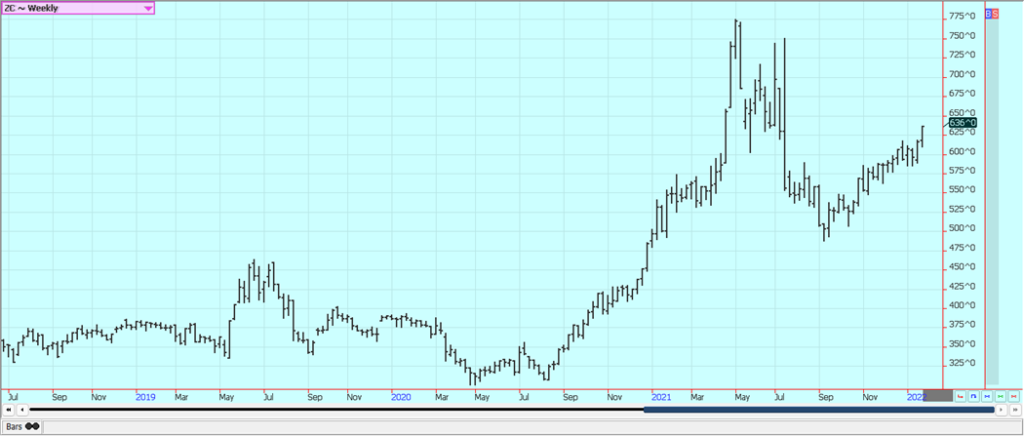

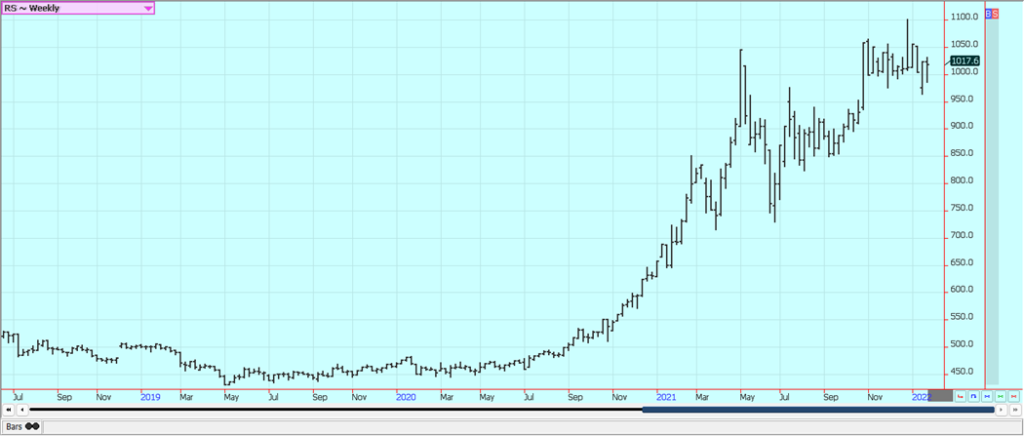

Weekly Corn Futures

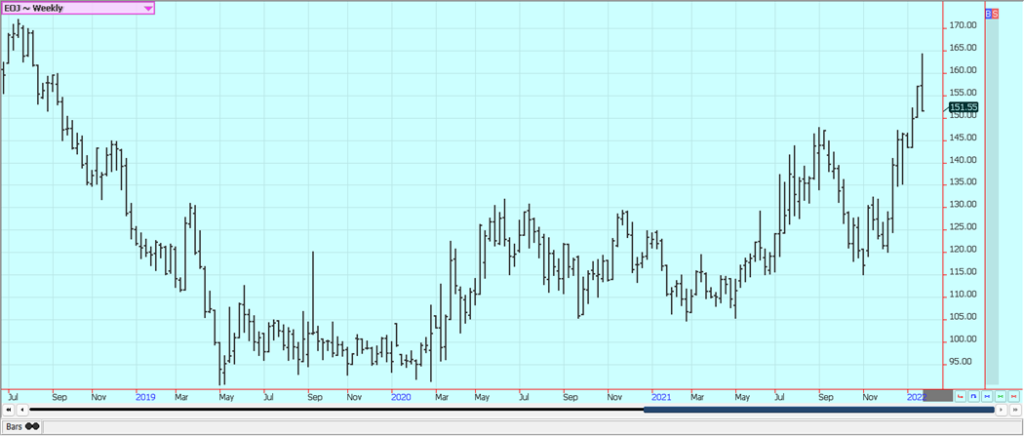

Weekly Oats Futures

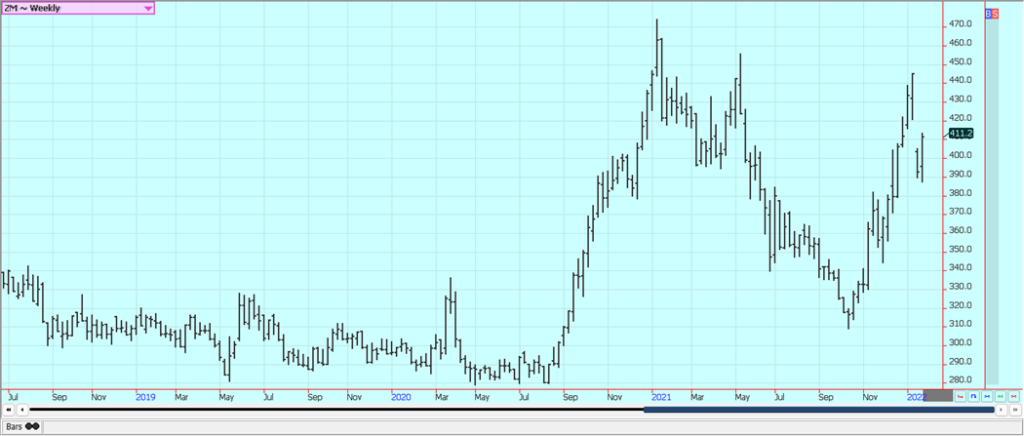

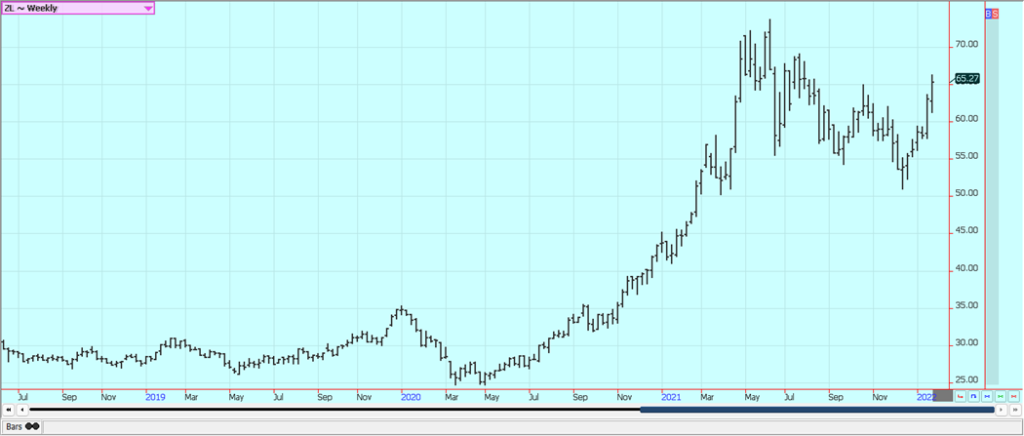

Soybeans and Soybean Meal: Soybeans and the products closed higher on Friday and much higher for the week on news that Brazil state Ag agencies had drastically cut back their production estimate for Soybeans in the states. The states were Mato Grosso do Sul on Wednesday and Parana on Thursday. Yields were reduced and production was reduced by more than 5%. Mato Grosso do Sul did the same thing yesterday. The data implies total Brazil production at 125 million tons to 127 million tons according to at least some analysts here in the US. Production ideas at the beginning of the crop season were closer to 150 million tons for Brazil so the cuts are drastic and imply much more demand for US Soybeans down the road. Rains returned to dry soils in South America last week and are likely to continue this week. However, the benefits will be felt mostly in central Argentina and perhaps southern Argentina. Showers are forecast for southern Brazil, Paraguay, and much of Argentina late this week. There are ideas of better demand for US Soybeans due to the crop losses that Brazil and Argentina have already incurred due to the drought and due in part to the situation between Ukraine and Russia that could hurt agricultural and energy exports from both countries. New demand is now thought to come from China as rumors of new business with that destination hit the floor. China has now been a buyer for two days this week. Trends are up on the daily and weekly charts.

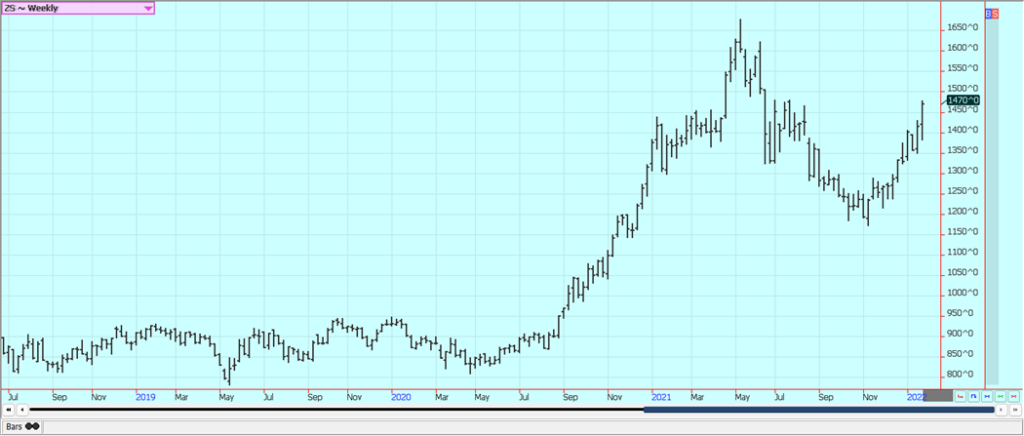

Weekly Chicago Soybeans Futures:

Weekly Chicago Soybean Meal Futures

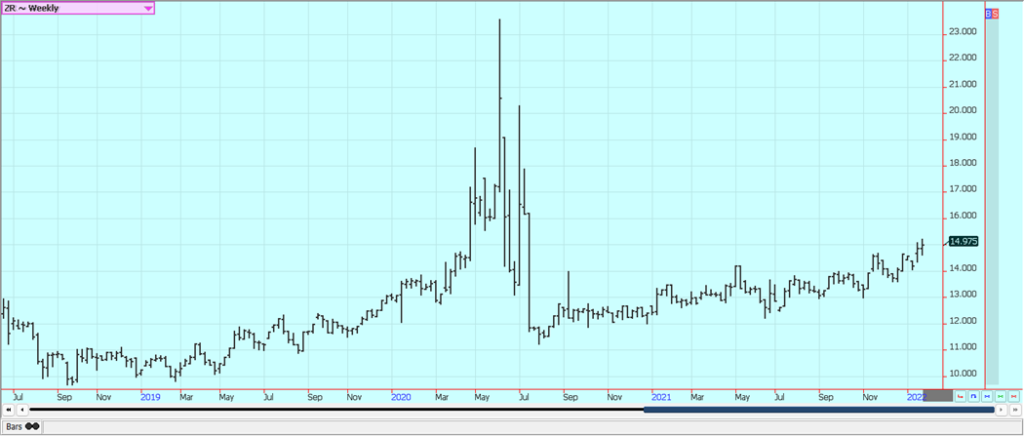

Rice: Rice closed slightly higher on Friday after pushing lower early in the session. Trends have turned mixed on the daily charts. The US Dollar moved sharply higher last week and made new highs for the move. It has the potential to trade to 100.00 on the Dollar Index. The weekly export sales report showed much higher sales levels than previous weeks. Futures and cash market trading have been quiet until now and the cash market is showing that domestic mill business is around everywhere. Many producers are not interested in selling but some are selling the current crop and generating some needed revenue. Producer sales are report4ed to have been way ahead of average early in the marketing year so stocks on hand in first hands are reported to be lower than normal. Mills are showing more interest in the market as previously bought supplies start to run low. The cash market is reported to be relatively strong as prices have held firm and as activity increases.

Weekly Chicago Rice Futures

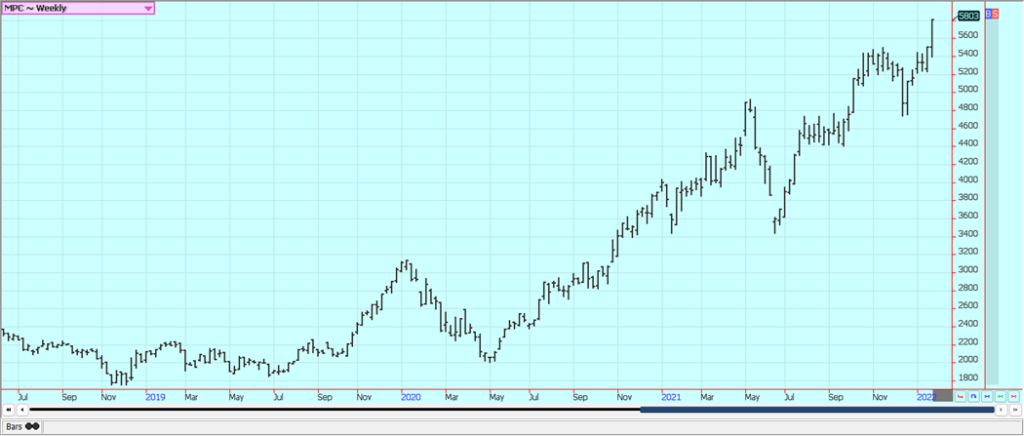

Palm Oil and Vegetable Oils: Palm Oil was sharply higher last week in sympathy with the outside markets and on ideas of low supplies. Indonesia is once again making moves to cut the availability of Palm Oil for export as it seeks to keep more at home for biofuels purposes. Short covering was noted on Friday. Crude Oil was higher. There are still poor production conditions in Malaysia and Indonesia. Traders are mostly worried about demand from India who has been buying Soybean Oil in the US instead of Palm Oil from Malaysia and Indonesia and is also worried about China and its demand for Palm Oil for biofuels. Production conditions have been very poor and workers are not often in the fields. Canola was higher in range trading. Support came from the rally in Chicago. Farmers are bullish and reluctant to sell because of the sharp reduction in Canola production in Canada this year. The buy-side thinks that Canola is fully priced but the farmers are still holding out for more. Chart trends are mixed for the daily charts.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures:

Cotton: Cotton futures closed higher on Friday and made new highs for the move. Traders are monitoring the Russia-Ukraine situation as any invasion of Ukraine by Russia could mean an end or at least a severe restriction to energy exports from Russia. Concerns about an invasion seem to be receding at this time. That would hurt polyester pricing and help Cotton demand. It’s been a demand market and futures have been correcting lower over the last few sessions in search of new demand. Ideas are that demand remains strong for US Cotton even with the weaker export sales reports over the last couple of weeks. Analysts say the Asian demand is still very strong and likely hold at high levels for the future. US consumer demand has been very strong as well despite higher prices and inflation. Good US production is expected for next year as planted area is expected to increase due to high Cotton prices and the expense of planting Corn. Chart trends are still mostly up in this market.

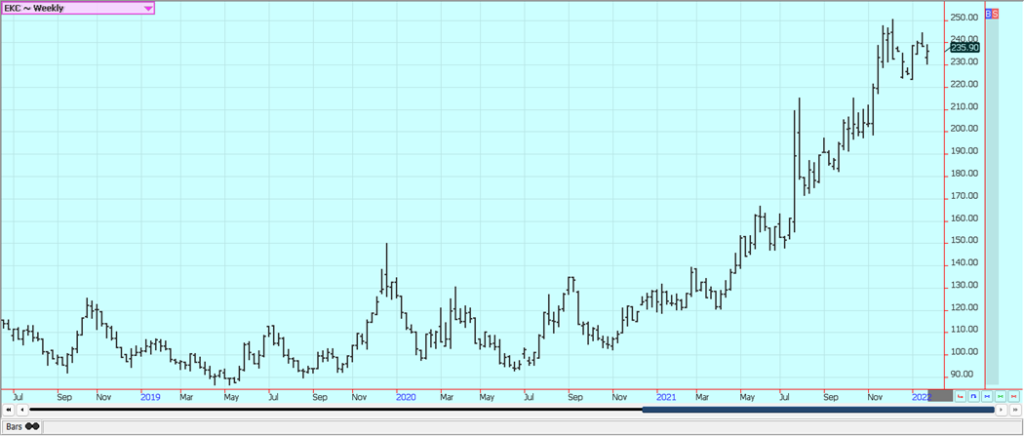

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ was sharply lower to limit down as forecasts called for very cold temperatures in Florida. The market had rallied on freeze fears but those fears eased on Friday and futures were lower. It has been cold, but it has not been cold enough for long enough to do more than damage some leaves on the trees. The trends are mixed on the daily charts on the reduced Florida Oranges production estimates seen recently. USDA cut its Oranges production estimate for Florida, but increased production when compared to the last report for the whole of the US. Production overall remains less on a year to year basis. Brazil has some rain and conditions are rated very good. Brazil production was down last year due to dry conditions at flowering time and then a freeze just before harvest. Mexico is rated in good condition.

Weekly FCOJ Futures

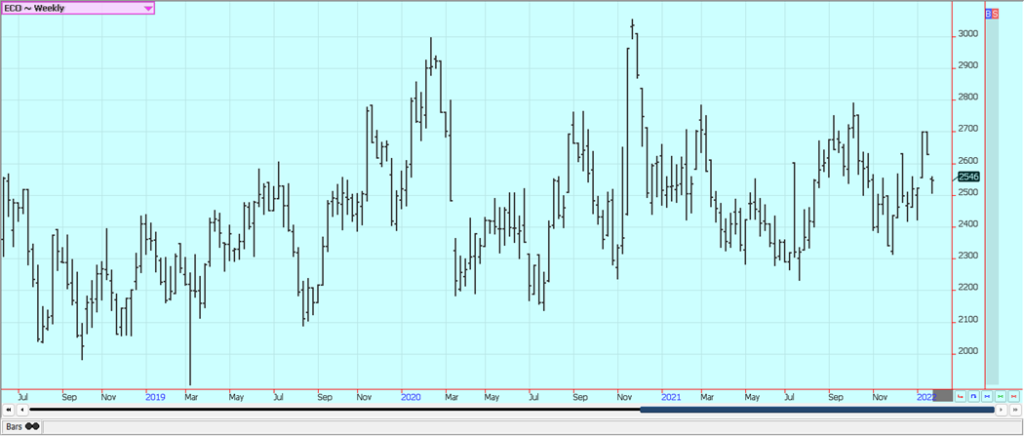

Coffee: New York and London closed higher on Fri with most of the gains in New York as inflation came into the market again. Futures were lower for the week. The fundamentals have not really changed. Ideas continue that the next crop in Brazil is experiencing good growing conditions. Vietnamese producers have been selling so differentials have gone down in that market and it now pays to send Coffee to London and the rest of Europe. The dry weather and then the freeze in Brazil have created a lot of problems for the trees to form cherries this year. Big rains more recently in some Brazil growing areas have hurt cherry formation as well. Containers are not available in Vietnam or in Brazil to ship the Coffee, but logistical situation in both countries has eased in recent weeks. Brazil producers have sold most of the current year crop and are forward pricing for next year. Vietnam producers are also selling and some of the Robusta is going to the exchange in London as differentials have weakened. Vietnam is getting scattered showers on the coast but dry conditions inland. The rest of Southeast Asia should get scattered showers in the islands and mostly dry conditions on the mainland. Production conditions for the next crop in Colombia are not good.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York and London were a little lower again Friday and lower for the week on good growing conditions from Brazil. Support comes from ideas that the market tries to ensure that there will be enough White Sugar production and imports from India and Thailand. A stronger US Dollar hurt bullish demand ideas. Ideas are that stronger Crude Oil prices imply stronger ethanol prices for more ethanol production and less Sugar production in Brazil and those ideas help keep Sugar prices supported. Crude Oil closed higher again yesterday. There have been reports of improved growing conditions for the crops in central-south areas of Brazil. Showers will continue into much of this week and crops should benefit from the return of moisture to the region. Ideas are that the supplies are available from India and Thailand as harvests there are off to a good start but it will take a stronger price to get them into the market.

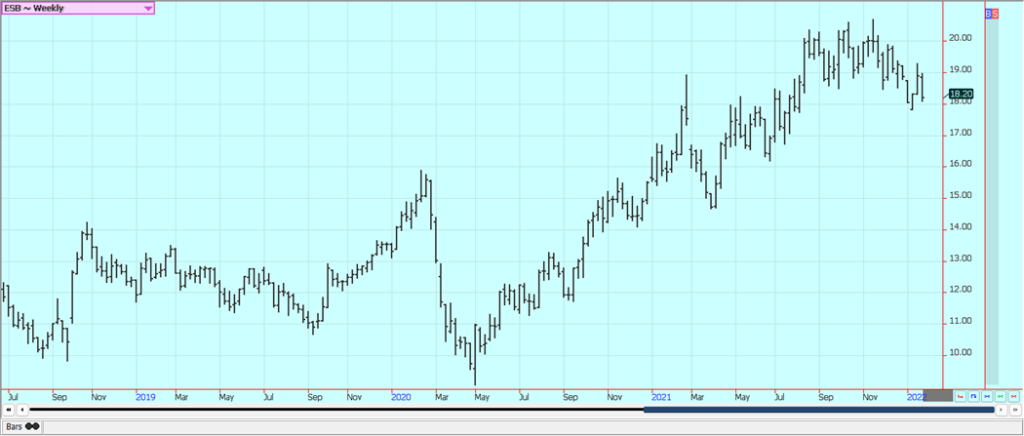

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

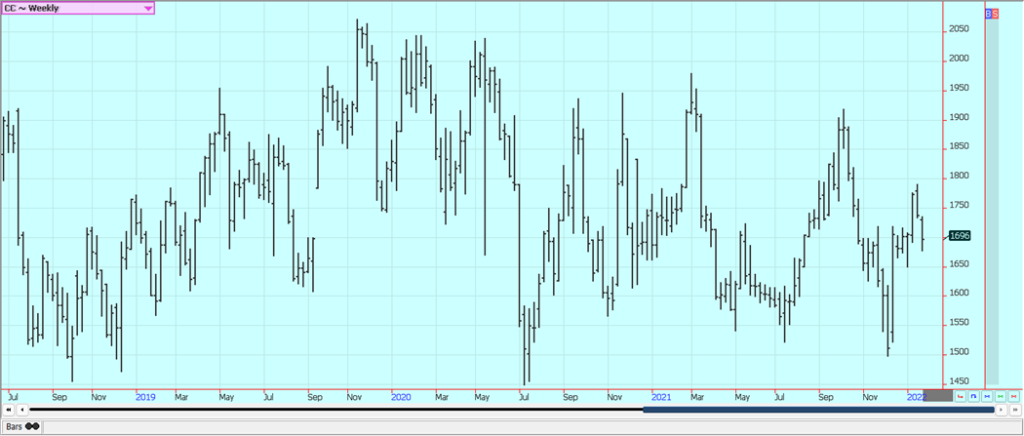

Cocoa: Both markets closed lower last week in part on a very strong US Dollar. New York closed much lower than London. The weather is generally good for West Africa and Southeast Asia. Ideas are that demand will continue to improve and production in West Africa appears to be good this year. Both Ivory Coast and Ghana are reporting improved weather as it is now mostly sunny with some scattered showers around. Some farmers want more rain for the best Spring harvest results.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

__

(Featured image by Wouter Supardi Salari via Unsplash)

DISCLAIMER: This article was written by a third-party contributor and does not reflect the opinion of Born2Invest, its management, staff, or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The PRICE Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this report is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted. The leverage created by trading on margin can work against you as well as for you, and losses can exceed your entire investment. Before opening an account and trading, you should seek advice from your advisors as appropriate to ensure that you understand the risks and can withstand the losses.

-

Business2 weeks ago

Business2 weeks agoThe TopRanked.io Weekly Digest: What’s Hot in Affiliate Marketing [NordVPN Affiliate Program Review]

-

Impact Investing11 hours ago

Impact Investing11 hours agoVernazza Autogru Secures €5M Green Loan to Drive Sustainable Innovation in Heavy Transport

-

Cannabis1 week ago

Cannabis1 week agoCannabis Company Adopts Dogecoin for Treasury Innovation

-

Business3 days ago

Business3 days agoLegal Process for Dividing Real Estate Inheritance