Biotech

Immunotherapy companies to keep an eye on

Nascent Biotech, Aduro Biotech and Juno Therapeutics are three immunotherapy companies that are worth checking out for.

Immunotherapy is not only “red-hot” as a cancer cure these days, but it’s also the most famous sector in the biotech market. According to a report by Financial Times, the Arca biotech index on the New York Stock Exchange has risen by more than 200 percent since 2011 (4,131 points). FT continued to predict that the next couple of years will particularly be favorable to the biotech market, as it could grow to as much as $1 trillion.

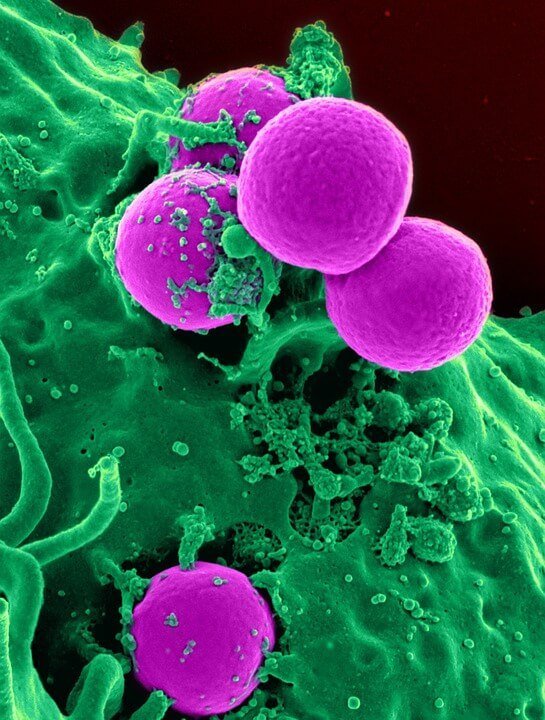

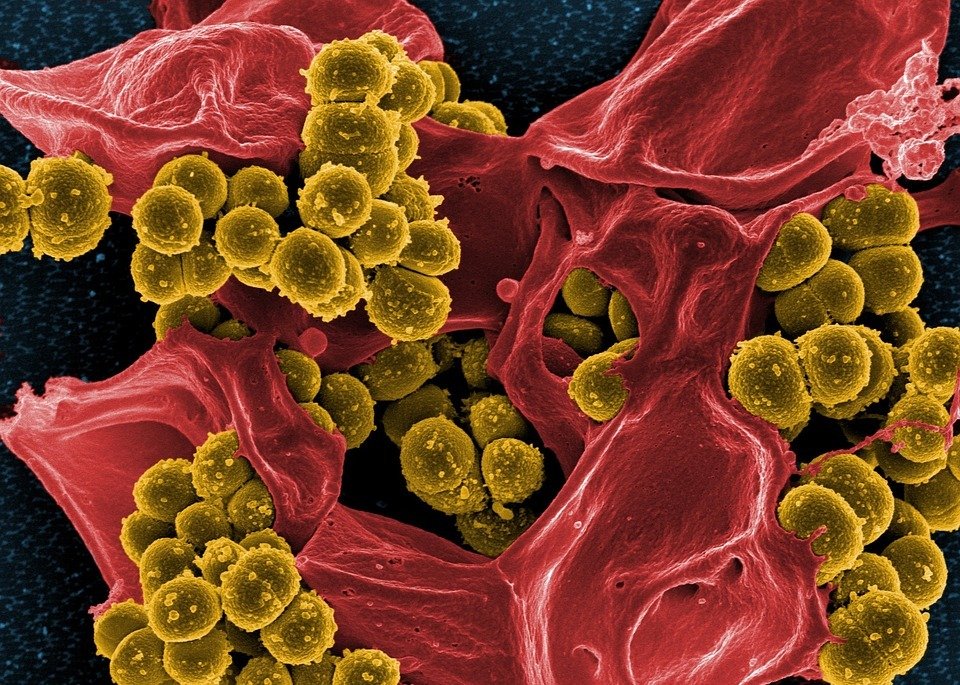

Bacteria magnified by electron microscope. (Source)

In a nutshell, immunotherapy is a type of treatment that uses the body’s own immune system to attack cancer from within, stimulating the healthy cells to combat the cancerous ones. Several kinds of immunotherapies are used in different kinds of cancers, and initial stages show positive results, at least according to multiple reports on the matter.

Because of the heavy interest in companies developing immunotherapy cures, start-up companies are able to get financial backing from bigger pharmaceutical companies. FT further reports that according to Credit Suisse, 82 public biotech companies were offered in 2014, a huge increase from the 67 companies recorded in 2000.

Currently, there are a handful of immunotherapy companies that are taking the limelight when it comes to the cure, and below are some of them.

Nascent Biotech

California-based Nascent Biotech (OTC:NBIO) made waves in the biotech industry with its development of Pritumumab. Pritumumab is a natural human antibody that targets the abnormal cell protein in brain cancer cells. According to Nascent Biotech, Pritumumab has been used to treat 250 cancer patients. Patients who have been treated with this antibody have an overall survival rate of 25 to 30 percent, compared to the 3 percent that standard therapies promise.

Because of Pritumumab’s positive results, Nascent Biotech recently received $1.2 million as an initial funding to fund upcoming research. The money will be used for manufacturing more antibodies, preparation for human clinical trials, and general working capital. “We were overwhelmed by the interest in our initial round. We chose to accept strategic money in this first round as we believe the right partners will prove to be more beneficial in the long run,” said Nascent Biotech’s president Sean Carrick.

Aduro Biotech

Another emerging biotech firm is Aduro Biotech, known for their immunotherapy vaccine targeting prostate cancer. According to a report by Proactive Investors, pharmaceutical bigwig Johnson & Johnson invested $55 million in the privately-held Aduro in June last year. It was reported before that Johnson & Johnson has expressed interest to enter the immunotherapy market and quickly shifted its gaze to the emerging California-based biotech company. Aduro is getting known for its “LADD” method of engineering Listeria monocytogenes bacteria into turning them into therapeutic agents that then stimulate the immune response to tumor antigens.

Juno Therapeutics

Seattle’s Juno Therapeutics (OTC:JUNO) is currently listed in the LONCAR Cancer Immunotherapy Index, along with several other companies leading the race in this biotech sector. Currently, Juno is in its clinical stage, developing cellular immunotherapies based on two complementary platforms: Chimeric Antigen Receptors (CARs) and T Cell Receptors (TCRs) technologies. According to a report by Zacks.com, Juno stocks have increased to 18 percent in the last month, signaling the company’s steady growth in the market.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoSpain’s Real Estate Crowdfunding Boom: Opportunity, Access, and Hidden Risks

-

Crypto2 days ago

Crypto2 days agoBitcoin Steady Near $68K as ETF Outflows and Institutional Moves Shape Crypto Markets

-

Fintech1 week ago

Fintech1 week agoDruo Doubles Processed Volume and Targets Global Expansion by 2026

-

Business1 week ago

Business1 week agoTopRanked.io Weekly Affiliate Digest: What’s Hot in Affiliate Marketing [Health Trader Affiliate Program Review]