Business

Real estate, nursing homes face effects of boomer retirement until 2024

Recently we talked about why millennials aren’t buying a house at the same rate as their boomer and Gen X parents.

Today, let’s talk about how boomers and Gen Xers are actually contributing to the housing shortage, and so driving up prices and thwarting the ability of younger people to buy.

And, why that could start to change rapidly just ahead.

First, an interesting insight

A recent Freddie Mac study estimates that 2.5 million homes are being kept off the market, mostly by seniors aging in place rather than downsizing or moving into nursing homes, etc.

One million of those people were born between 1931 and 1941. 300,000 of them were born between 1942 and 1947. 250,000 of them were born between 1948 and 1958.

That means that the majority of these “aging-in-placers” aren’t boomers (according to how I count that generation).

Turns out, we can’t blame them for this trend!

But there is a massive boomer retirement trend that started in 2000 and will last into 2024.

It will see more homes kept off the market as this great generation chooses to age in place. But it will also see a ton of homes hitting the market when others opt for downsizing and nursing home care.

The question is: which scenario will trump the other?

There are two big problems here

One, boomers are watching in horror as their McMansions are falling in value while the value of the smaller homes they could downsize into are holding up better. That makes trading down less attractive.

Two, nursing homes are increasingly expensive, with subpar service.

However, contrary to popular opinion, boomers haven’t yet started their trek through the peak spending wave for this sector, which peaks at age 84-plus. That’s why there is some excess capacity. They only start this journey this year.

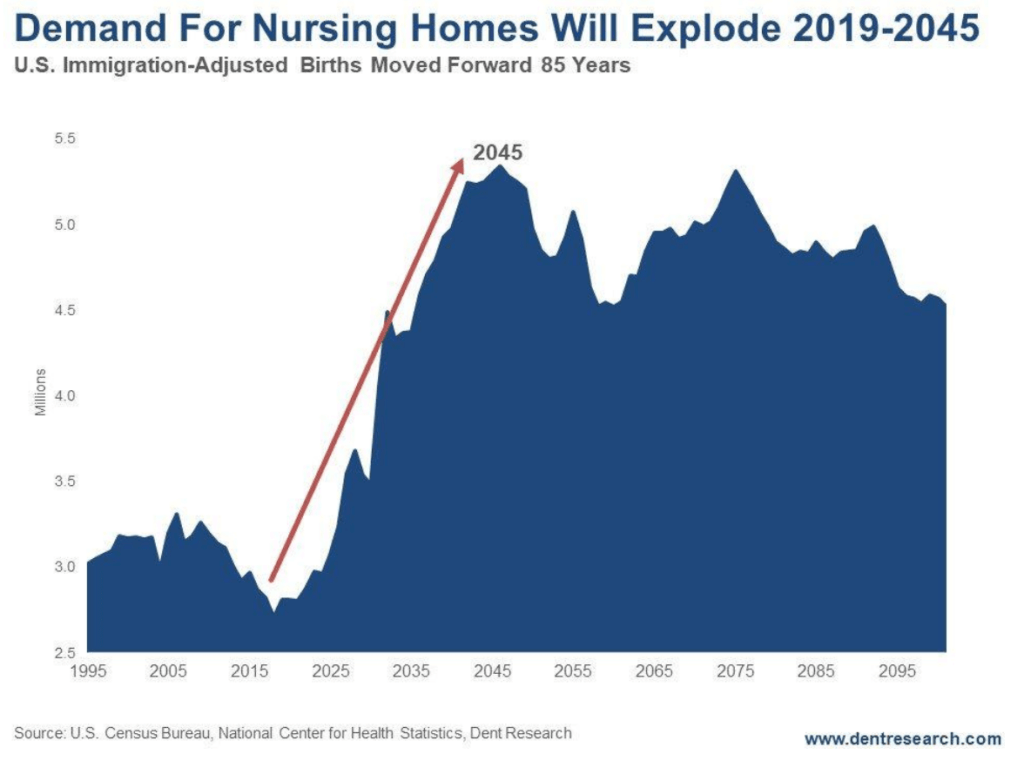

Just look at this:

© Harry Dent

Note that I’ve lagged the birth index 85 years in this chart.

And I reckon that the number of boomers who will choose NOT to age in place will quickly overwhelm the numbers that do.

Overall, I clearly see the nursing home trend flooding the property market with boomer homes for sale. That’s what my “dyers versus buyers” indicator has said would occur in line with this trend into around 2040.

Real estate prices will buckle under the deluge

Japan’s aging population and eight million empty homes, trending towards 15 million, would vouch for this trend.

So, don’t believe this housing shortage will continue, especially with the “Great Reset” in consumer and asset prices just ahead from 2020 into 2023 or so. It will reverse and likely rapidly!

Lower prices and boomers moving rapidly into nursing homes will make home buying more affordable again and raise ownership for millennials.

But, this younger generation seems to buy less and rent more regardless of affordability. They’re more interested in spending money on “experiences.” So, millennial home buying won’t save the property market.

Mark my words: real estate will never be what it was before the 2006-2012 crash.

Most important: Look for the great opportunity in nursing homes ahead.

The companies that can deliver lower costs and more responsive service via room sensors and other technology will make billionaires in this industry in the next 25 years!

(Featured image by MIND AND I via Shutterstock)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto1 week ago

Crypto1 week agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Biotech4 days ago

Biotech4 days agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

-

Impact Investing2 days ago

Impact Investing2 days agoEU Industrial Accelerator Act: Boosting Clean Industry and Resilient Supply Chains