Business

Are San Francisco home prices falling because they are overpriced?

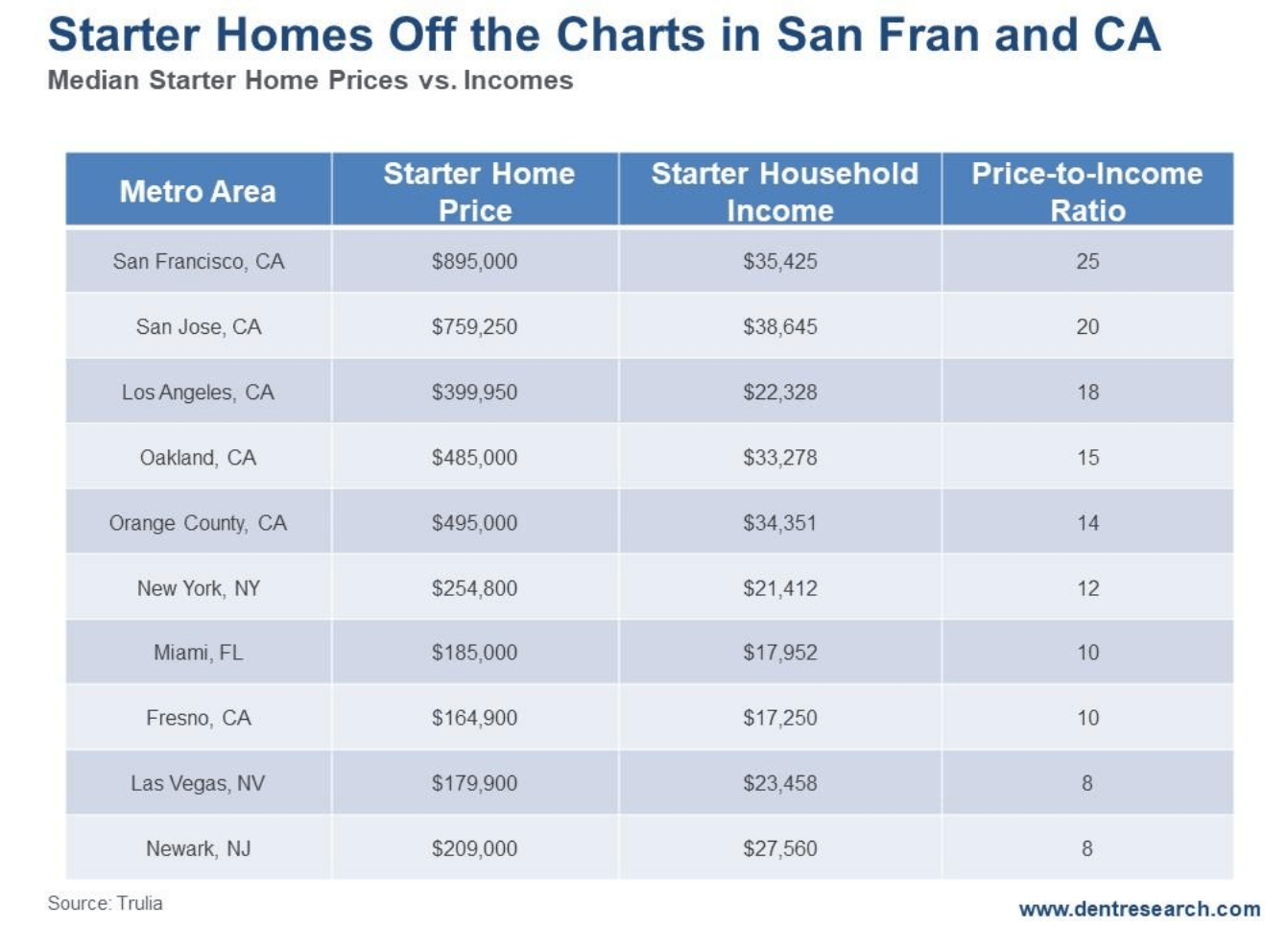

Between the ages of 27 and 33, people make big investments such as buying a home. In San Francisco, the median starter home costs $895,000. Here’s why.

Bubbles ultimately die of their own extremes, although it always helps to have a trigger like the subprime crisis in 2006.

But the San Francisco area takes the cake when it comes to the U.S. real-estate bubbles! (That Canadian honor goes to Vancouver and in Australia it’s Sydney and Melbourne.)

And prices have started to fall, albeit slowly, despite no slowdown in the economy and only modestly rising interest rates thus far.

Why?

Because of the insanity of home prices there! They’re massively overpriced, especially in the large and critical starter-home market.

They have become, literally, unaffordable!

The biggest investment most people make is that first home, which they buy between the ages of 27 and 33 (with the average buying age at 31). The second one, if they get another, is an upgrade that they can usually afford with higher income sometime between the ages of 37 and 41. And for the upscale, into age 65 buyers invest in a vacation home that they rarely use.

So, forget that the median home price in San Francisco is a whopping $1.3 million, pushing on 13 times median income.

The real kick in the head is for starter homes…

© Harry Dent

The median starter home is $895,000. The median income for such families is only $35,425.

That’s 25 times income!

That’s insane!

How could a bank possibly lend against that when the traditional norm is three to four times income?

It takes 41 percent of their income to pay for that home. Thirty percent is considered high and creates “mortgage stress.” To afford that starter home, you can just forget dining out at all those great restaurants in San Francisco.

The six most overvalued areas for starter home affordability are in California. Even Fresno, for crying out loud! That’s in the middle of nowhere in the desert. Last time I was there it was 120 degrees in the summer and felt like an oven.

San Jose isn’t quite as bad as San Fran, but only because they have higher starter family incomes thanks to the tech jobs. The median starter home there is $759,250 against incomes of $38,645… a mere 20 times income!

Oakland is 15 times and L.A. is 18 times.

Then there’s my past stomping grounds: Miami.

I was there for the last bubble, when high-end condos on South beach were pushing $1,000 a square foot. Now they’re $2,000 a square foot, with the very top-end, like Setai, Apogee, and Faena House at $4,000-plus a square foot. Double the bubble!

That’s the biggest reason I ended up in Puerto Rico (not the tax advantages, as one journalist would have you believe).

My condo is 25 percent of the cost, and I deal with far less traffic, enjoy more good restaurants nearby, and suffer far fewer prima donnas per capita. Heck, in Puerto Rico I probably qualify for that label myself.

The everyday person in Miami has those low-end service jobs that David Stockman always harps on about growing the fastest. The town’s starter home household only has a median income of $17,952 (that’s $1,496 a month or $9 an hour). They need 10 times that income to afford a lower median price of $185,000 for starter homes.

Then there’s Las Vegas, which didn’t bubble as much this time around as it did into 2006. It’s coming late to the party, with the highest price rise for a major city in 2018 over 2017. It now weighs in at near 8 times income, as does Newark, New Jersey.

Now this bubble is slowing down in many leading cities here and around the world, most so in San Francisco and Manhattan. Mostly because property is too expensive, especially for the biggest and most price-sensitive buyers, the new families.

Now what…?

When the bubble goes belly up, it’ll be worse than the last property crash because the most-bubbly areas are stretched beyond any reason!

And this bubble is leading the stock bubble in bursting, just like it did last time, by about two years.

We may have one more year in the stock bubble at best, but the real estate bubble is already saying “Game Over,” as it did from early 2006 forward and as we warned in late 2005.

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crypto6 days ago

Crypto6 days agoEthereum Outlook: Key $2,190 Resistance, Whale Accumulation, and Buterin’s Push for True DeFi

-

Cannabis2 weeks ago

Cannabis2 weeks agoAI Can Mimic Psychedelic Experiences but Cannot Truly Feel Them, Study Warns

-

Biotech13 hours ago

Biotech13 hours agoShingles Vaccine Linked to Significant Reduction in Dementia Risk

-

Crowdfunding1 week ago

Crowdfunding1 week agoBSG Stahl Riesa Launches Crowdfunding for New Floodlights

You must be logged in to post a comment Login