Business

Toys R Us failure reflects the big role of demographics in retail market

Toys R Us bankruptcy was attributed much to its growing debt. But did demographics and age play causal roles in the demise of the toy giant?

Toys R Us just joined the unenviable list of top retail failures of the past decade: Circuit City, Linens-N-Things, A&P (the Great Atlantic & Pacific Tea Company), Sports Authority, and Radio Shack (whose downfall we called in 2016).

While there are many reasons for the loss of these once household names—and Toys R Us is citing massive debt burdens as one element in its undoing—there is a much bigger and more predictable underlying factor.

Demographics!

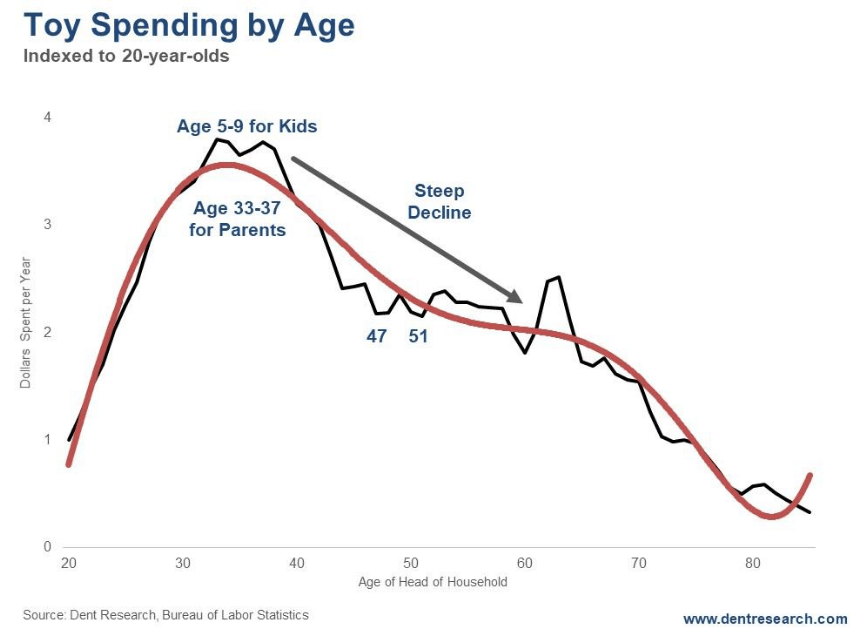

It’s not hard to figure out when toys are most in demand. Age 5 is the peak for kids. There’s a plateau between the ages of 5 and 9—and then a steep drop-off. Kids grow up and graduate to alcohol and ecstasy parties instead.

Look at this chart (we have everything from cradle to grave).

By the way, for kids, spending on babysitting peaks at the same age as spending on toys: 5 for kids, 33 for their parents.

Calorie intake peaks at age 14 (so spending on potato chips peaks at 42 for parents). Height peaks at age 19. And those “minor” bills for a college education? They peak when parents are 51 years old on average. Got any other questions about spending peaks? We’ve got the answers!

But back to toys…

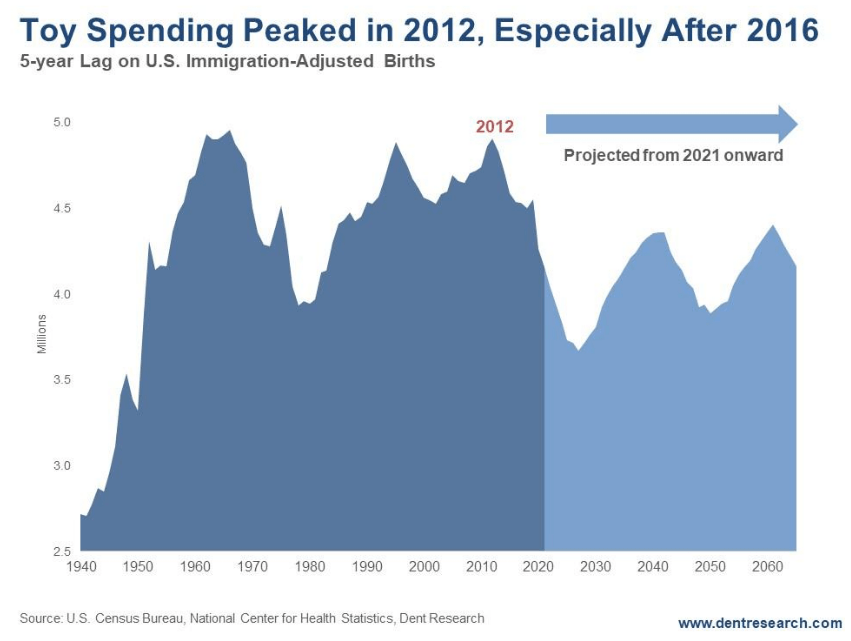

On a five-year lag, toy spending would have peaked for the millennial generation in late 2012. With the plateau into age 9, spending would have stayed buoyant into late 2016. After that? Tickets baby!

Toys R Us was a victim of two key trends in our time: debt and demographics.

But probably more important: Toys R Us (and Lego is in trouble as well) is a leading indicator of our entire economy ahead when endless free money and stimulus hits its nasty hangover.

For Toys R Us, it was a classic leveraged buyout, with $5.3 billion in debt pledged against assets and $7.9 billion in total debt.

Leveraged up to its eyeballs…

And by my old employer, Bain & Company (Bain Capital). If only they’d consulted me before entering a collapsing demographic sector.

Retailers are also leading defaults at three times average for American companies in a shrinking environment… due to slowing demographic trends (more from the aging Baby Boomers) and competition from the almighty Amazon and online retailers… “Heil Bezos!”

Debts will quickly be written off, but demographic trends will continue down into at least 2028.

This is literally a dying industry, but from younger kids, not older Boomers. We’re likely never to see higher birth rates than 2007 again, as I’ve been warning for decades now.

If you’re in the nursing home/assisted living sector, brace for incredible growth in the years ahead, as Baby Boomers age into 2045-plus.

If you’re in a child-focused business, convert childcare centers into assisted living centers. And if you are in the diaper business, focus on adult diapers, not baby diapers.

Demographics will always steer you in the right direction for investment and business.

(Featured Image by Andreas Praefcke via Wikimedia Commons. CC BY 3.0)

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation for writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Crowdfunding2 weeks ago

Crowdfunding2 weeks agoReal Estate Crowdfunding in Mexico: High Returns, Heavy Regulation, and Tax Inequality

-

Cannabis1 week ago

Cannabis1 week agoSouth Africa Proposes Liberal Cannabis Regulations with Expungement for Past Convictions

-

Crypto5 days ago

Crypto5 days agoCrypto Markets Under Pressure as Vitalik Buterin Sells 17,000 ETH

-

Markets2 weeks ago

Markets2 weeks agoWeather-Driven Supply Outlook Lifts Coffee Markets in Brazil and Vietnam

You must be logged in to post a comment Login