Business

Recently delivered cocoa is not of exportable quality

The main crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the remaining main crop is not good and that much of the Cocoa delivered recently is not of exportable quality.

There are reports that suggest that the quality of the remaining main crop of cocoa is not good and that much of the cocoa delivered recently is not of exportable quality.

Wheat

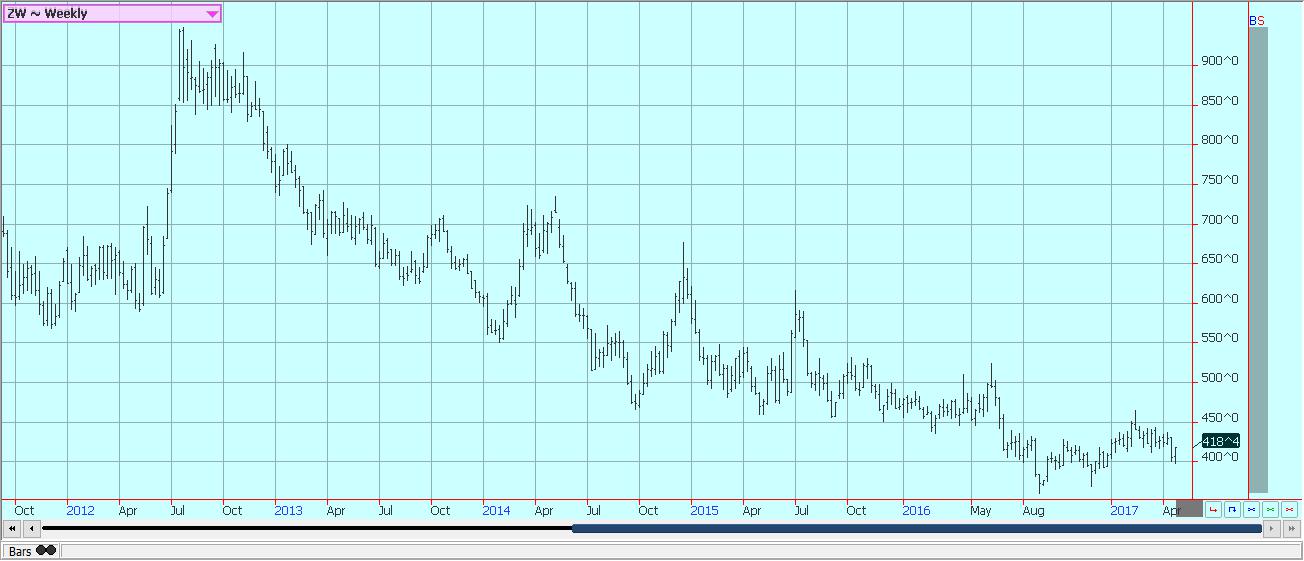

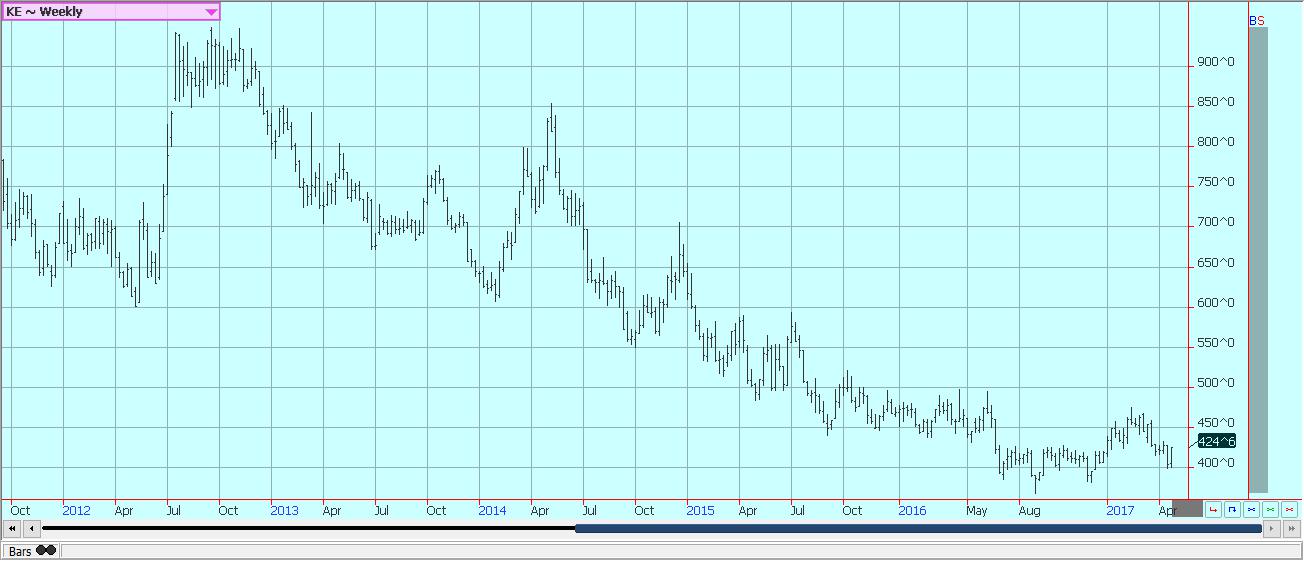

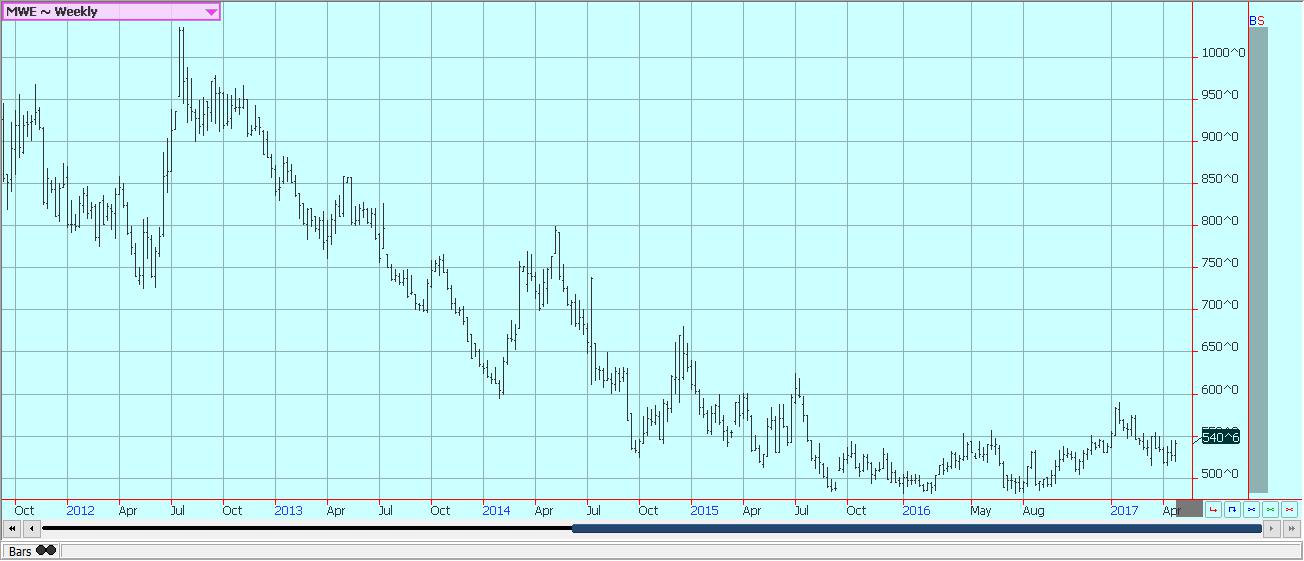

US markets were higher as cold weather invaded the Great Plains late in the week. It was cold enough in some areas to freeze a crop that was at its most vulnerable state. Much of the Winter Wheat crop is heading and could be killed most easily at this time. The Kansas Crop Tour is this week, and participants will look for signs of freeze damage. Some of the damage might not be visible. Temperatures are expected to moderate this week, but below normal temperatures will be desired to help minimize damage. The market is noting the slow planting pace for crops in both the US and Canada and have been more willing buyers in Minneapolis. Canadian producers have indicated that they will plant less area to Wheat this year due to the overall price weakness on world markets. They plan to plant 23.182 million acres of Wheat this year, from 22.212 million last year. It has been wet and cold in the northern US and into Canada so far this year, and farmers have been slow to do initial fieldwork and planting. There is some talk that more oilseeds could be planted and less Spring Wheat if conditions do not improve. There are reports of dry weather in Europe and North Africa. Western Europe is expected to get some very timely precipitation this week. The weekly charts show that Hard Red Winter and Hard Red Spring markets have better rally potential than Soft Red Winter at this time and that Soft Red Winter prices face significant resistance just above the close of last week.

Weekly Chicago Soft Red Winter Wheat Futures © Jack Scoville

Weekly Chicago Hard Red Winter Wheat Futures © Jack Scoville

Weekly Minneapolis Hard Red Spring Wheat Futures © Jack Scoville

Corn

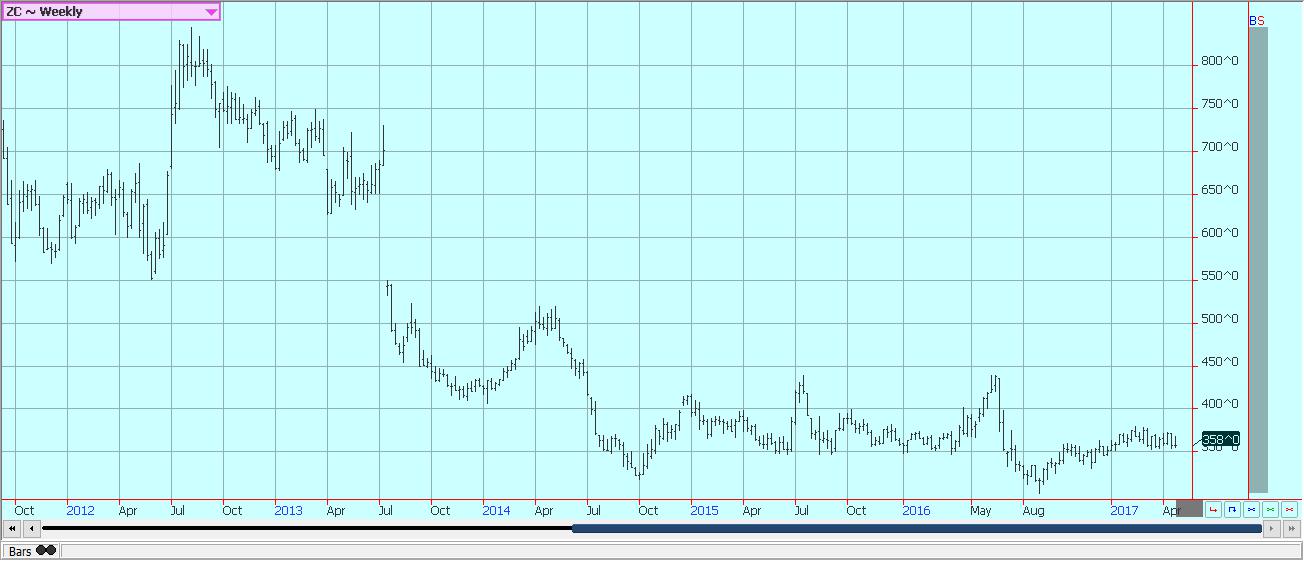

Corn was a little higher last week, but gave back the best gains on Friday when First Notice Day deliveries against May contracts were higher than expected. The big initial deliveries against futures contracts implied that futures prices are high enough and that there is still plenty of Corn in the Midwest that needs to be sold. The selling came on ideas of big supplies available in the US and increasing supplies available in South America against ideas of limited demand. Demand in the export market for US Corn was very strong last week, and export sales remain well ahead of the pace of last year and are at least strong enough to meet USDA targets. Ethanol demand remains very strong as well. Midwest weather is becoming and increasing market factor and will become more important in the next couple of weeks. Big rains were reported from Michigan to Arkansas over the weekend, with Chicago getting some extreme rains as the system arrived on Saturday afternoon. Farmers had been working as fast as possible to get crops planted before the system moved through, but now will be forced from the fields for an extended period of time. It will turn drier this week, but cool temperatures will keep drying to a minimum and planting progress slow. The weather could become a big market factor if planting conditions do not improve soon. Most producers want to plant Corn as early as possible in the year to avoid pollination in the heat of the Summer, but this is proving difficult this year. Producers have the equipment to plant the crop very quickly, but still need that window of opportunity from the weather to make it happen.

Weekly Corn Futures © Jack Scoville

Weekly Oats Futures © Jack Scoville

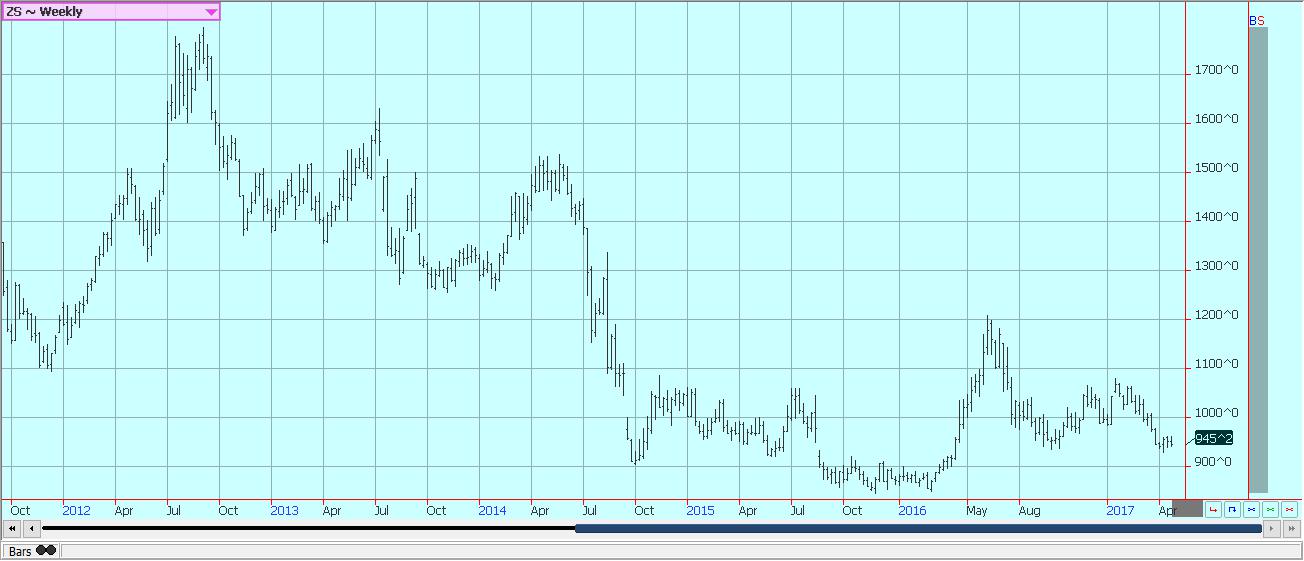

Soybeans and soybean meal

Soybeans were slightly lower and Soybean Meal was slightly higher last week as the market anticipates big supplies and less demand for US Soy products. However, the market has seen much better demand than expected and sales last week were about double the average trade expectations. USDA has been forced to raise export demand once and will most likely be forced to raise export demand in future monthly updates. The domestic crush has also held strong. USDA cut residual demand in the updates from a couple of weeks ago as the demand is good. Demand for US Soybeans and products could remain strong. US prices for Summer months are now competitive again with those from South America as producers in Brazil and Argentina have been reluctant sellers recently due to weaker world prices and stronger local currencies. A major political scandal is unfolding in Brazil that has started to affect the economy and the willingness of the Brazilian producer to sell. The trade in the US is also thinking of the potential for even bigger US planted area if weather conditions do not improve in the short term for planting Corn and Spring Wheat, and there was a lot of rain in much of the Midwest over the weekend. So, the demand is good, but the prospects for more than ample supplies remain. Overall price action might remain weak unless or until actual US weather problems develop this Summer.

Weekly Chicago Soybeans Futures © Jack Scoville

Weekly Chicago Soybean Meal Futures © Jack Scoville

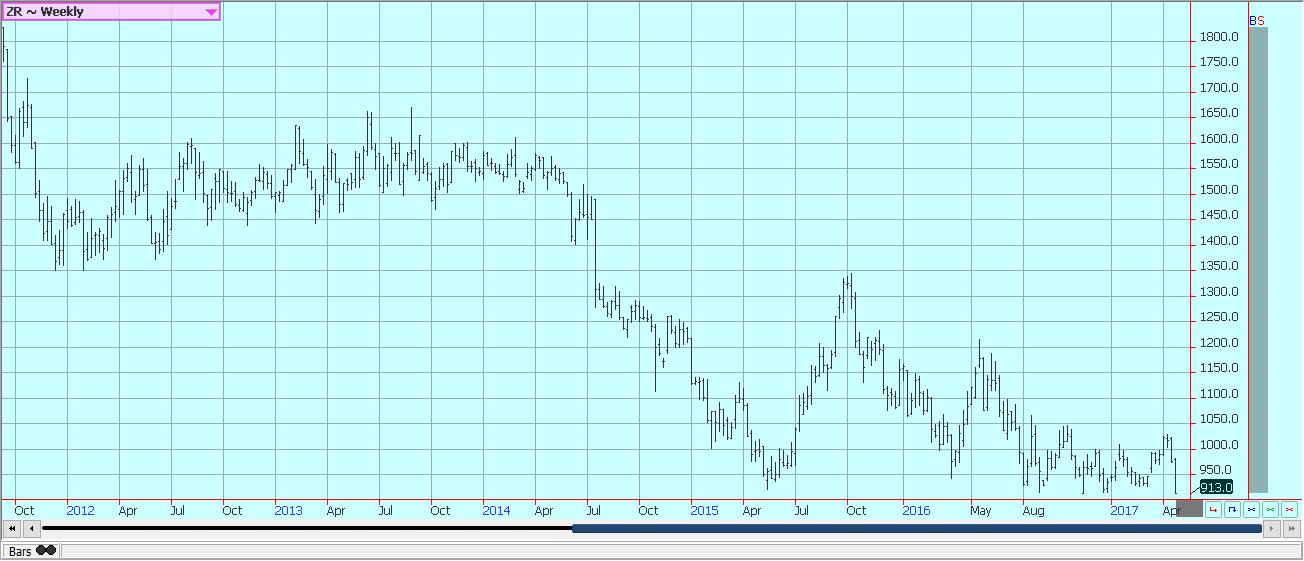

Rice

Futures closed lower and prices are now testing important weekly support areas on the weekly charts. It was a bad week for sellers as prices moved sharply lower despite a very good week of export sales. There is nothing going on in the short term to force prices higher, but things could change with the move to the next crop year. The fundamentals of the market are starting to change even if the current cash market remains quiet and steady. Prices have held and improved slightly in some areas as the last of the crop appears to be mostly sold in Texas and southern Louisiana. There is still plenty of Rice available in Arkansas, mostly from the cooperative pools. US producers will plant significantly less Rice this year, and US ending stocks will most likely be much less next year than they are this year. Farmers near the Gulf Coast are planted now or will be done in the very short term. Texas farmers have also mostly got the crop planted. Initial development reports have been good. Farmers have been active planting in Mississippi and north into Arkansas and Missouri, with most now done and initial development called good. Growing conditions have generally been good although some producers have expressed concern about the cooler and wetter weather. Arkansas and southern Missouri in particular saw flooding rains over the weekend.

Weekly Chicago Rice Futures © Jack Scoville

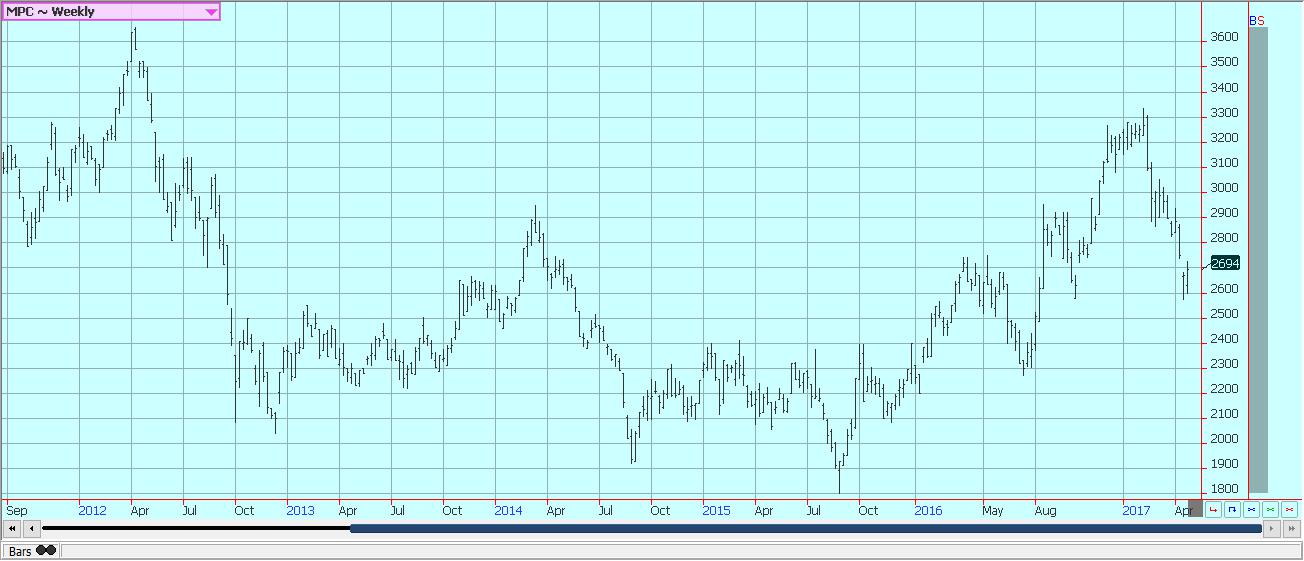

Palm oil and vegetable oils

World vegetable oils markets were mixed. Palm Oil was the strongest market as export demand held relatively well and on mixed production ideas. The demand seemed to fade a bit last week and is now close to month ago totals. However, trees in both Indonesia and Malaysia have been slow to respond to improved conditions. Trees have seen plenty of rain and production should be seasonally increasing, and traders will watch for these tendencies in the updates. Ideas are that the increase so far has been less than expected and that the production is not increasing at the expected rate. Canola closed lower last week amid tight Canadian market conditions. May was especially on long liquidation as deliveries against the contract start on Monday. Producers in Canada are unwilling sellers.. Some Canola was left in the fields last Fall as the snows came early, and farmers have not been big sellers of the current crop of the next crop in the local cash markets. Demand from both the processor side and the export side has been strong enough to generally support the market. Soybean Oil was a little weaker and found limited trading interest. There was no real news around to push Soybean Oil higher, and deliveries against the May contract were high on Friday.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures © Jack Scoville

Cotton

Futures closed higher last week after holding the highs seen five and six weeks ago on the weekly charts. The buying was impressive as May is now in delivery and should not be seeing the buying from the mills. That buying had kept the market firm in recent weeks, with May the strongest month. The mills appear to have a lot of July positions to cover as well. The market is still enjoying strong demand in the export market and the demand is supporting values. Export sales were below 200,000 bales for the first time in several weeks last week, but the overall pace of sales remains strong and above forecast levels from USDA. The weaker export sales only had a momentary negative effect on prices. Planting progress was slow last week due to the rains and should be slow again this week as temperatures will be cool and soils will be slow to dry. The slow planting pace is not a concern yet, and the moisture overall is welcomed by producers. However, dry and warm weather will be needed soon to avoid big planting delays. Trends are up on the daily and weekly charts.

Weekly US Cotton Futures © Jack Scoville

Frozen concentrated orange juice and citrus

FCOJ closed a little lower, but really did not do much as prices held inside the trading range of the last few weeks. The market remains in a bullish supply market mode, with reduced domestic demand remaining the main bearish influence. Domestic production remains very low due to the greening disease and drought, but processors have imported FCOJ from Brazil to cover the shortfall. Trees now are showing small fruit. Irrigation is being heavily used to prevent loss. The Valencia harvest is moving to processors and into the fresh market and will start to wind down at this time. Major freezes in southern Europe this Winter have damaged the citrus production. Reports are that losses are extensive. Brazil crops remain in mostly good condition. Brazil imports will arrive starting this month.

Weekly FCOJ Futures © Jack Scoville

Coffee

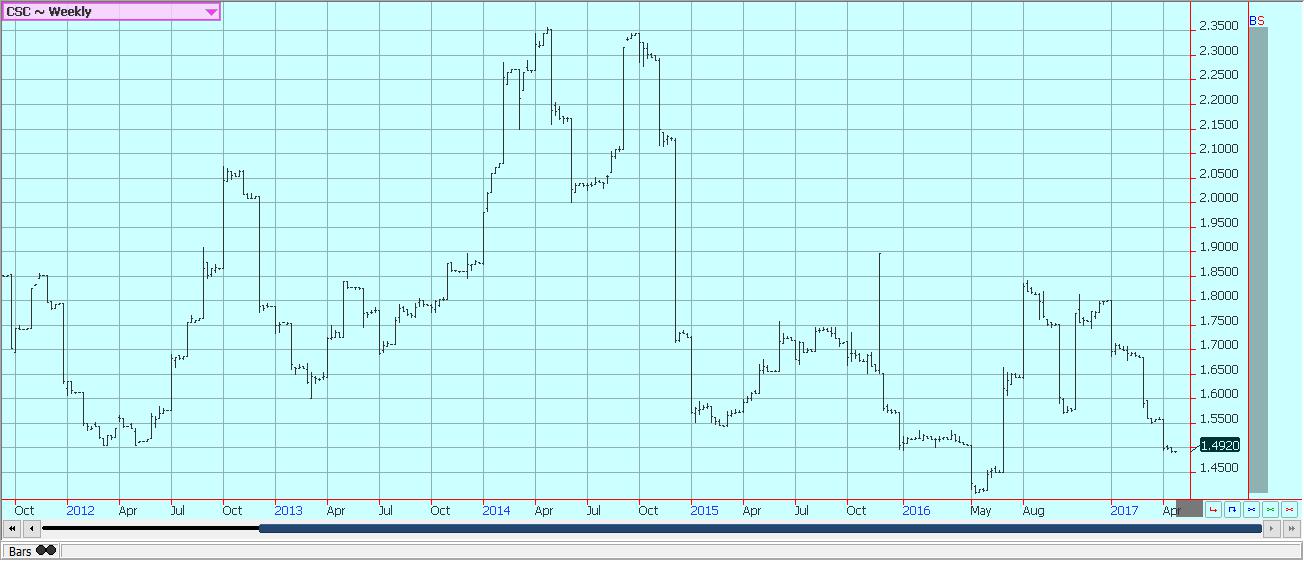

Futures were higher on strong and late buying on Friday and after New York made new contract lows. The recovery came amid forecasts for some very cold weather in Brazil over the weekend. It did not get cold enough to freeze Coffee crops, but it was an impressive cold spell and a strong reminder that Winter is just around the corner. Ideas of good supplies and reports of weak demand kept selling in the market. The cash market remains slow. Offers remain in the cash market, and differentials are stable to weak. Buyers remain quiet and appear ready to use already contracted supplies. This is in line with the narrative of big supplies in importer countries and is seen in official statistics like the month GCA reports highlighting the big supplies. New York has featured buying support from commercials as they fix prices for differentials purchases. Speculators have been the best sellers. London had been trading sideways as supplies available to the market remain tight, but the market finally broke last week due to weak demand. Offers are less and seen at high prices from Robusta countries such as Vietnam, and has been a short crop there as well due to dry weather at flowering time. Indonesia and Brazil are also very low on supplies.

Weekly New York Arabica Coffee Futures © Jack Scoville

Weekly London Robusta Coffee Futures © Jack Scoville

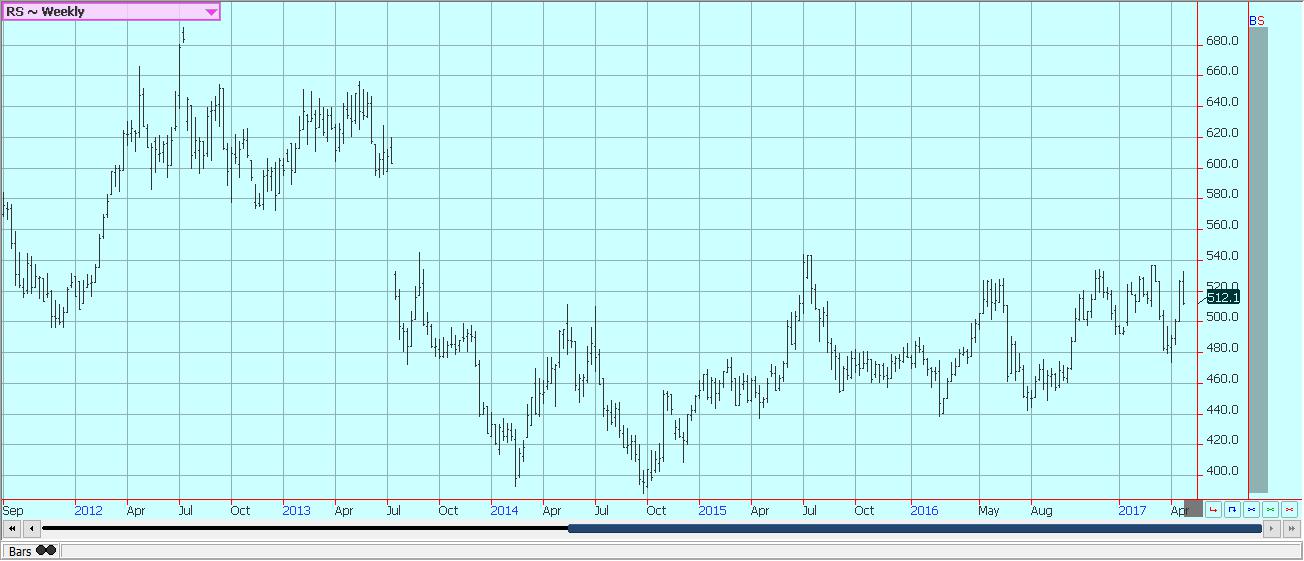

Sugar

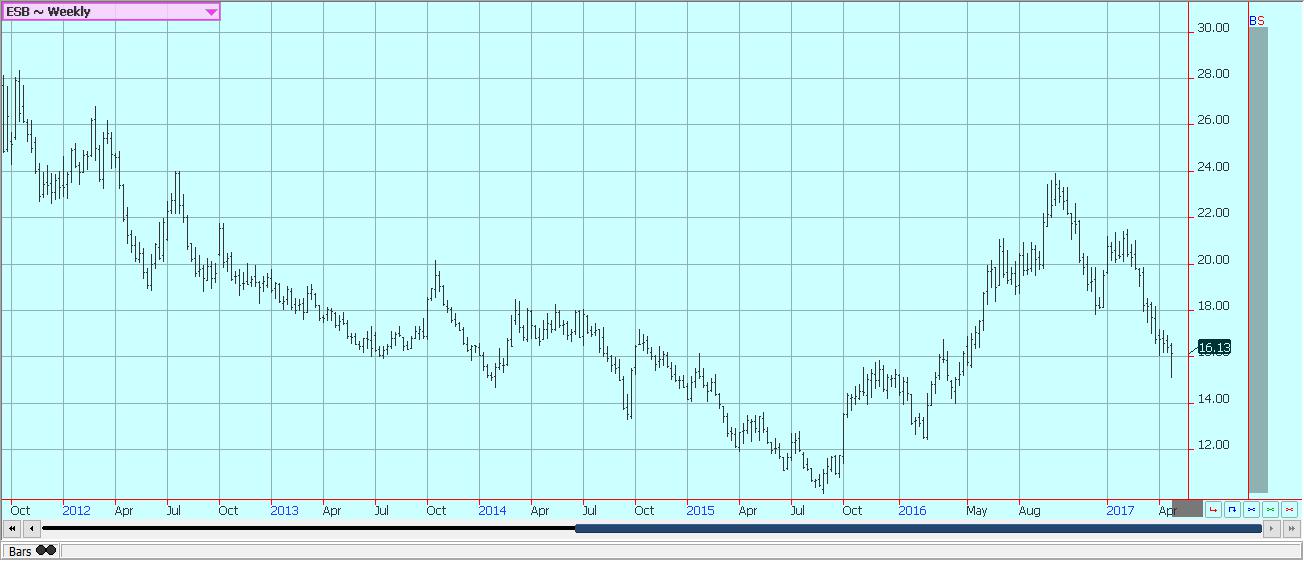

Futures closed a little lower in New York and London despite a strong rebound in prices on Friday. Some important support areas were broken early in the week in both markets and significant speculative selling was seen. Futures in New York held at 1500 May and forecasts for some very cold temperatures in Brazil for last weekend created some big short covering. It got cold over the weekend, and freezing temperatures were seen in areas south of Curitiba in Parana. This is not really Sugar producing areas, but reminded everyone about the time of year. UNICA reported sharply lower Sugarcane processing for the start of the new crop season. The crush was about half as large as last year at 17.7 million tons. Ideas are that prices can remain generally weak, and futures are still below breakdown points on the weekly charts. The fundamentals appear to be changing from a tight situation to one with more available to the market. Production conditions have been better this year in Brazil, and a better harvest is anticipated in the next couple of months despite the weak start. Production is also less in India and Thailand. The Indian weather service there expects a normal monsoon with good rain distribution this year. That has increased hopes for a strong rebound in production and has kept import ideas to a minimum. China has imported significantly less Sugar so far this year and Cofco was the major issuer of delivery certificates against May contracts in new York on Monday. The weather in Latin American countries away from Brazil appears to be mostly good, although northeast Brazil remain too dry. Center South areas have had plenty of rain. Most of Southeast Asia has had good rains.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures © Jack Scoville

Cocoa

Futures markets were lower last week but held within the trading range of the previous week. Increasing offers in world cash markets and increasing supplies certified for delivery in New York remain reasons to keep prices under selling pressure. The main crop harvest continues in West Africa under good weather conditions. However, there are reports that suggest that the quality of the remaining main crop is not good and that much of the Cocoa delivered recently is not of exportable quality. The mid-crop harvest should be in full swing this month. The demand from Europe is reported weak over all, and the North American demand has been weaker. The grind reports from both regions and also Asia showed increases between 1% and 1.5%. Supplies in storage in Europe are reported to be very high. The next production cycle still appears to be big as the growing conditions around the world are generally very good. West Africa has seen much better rains this year and now getting warm and dry weather. Growing conditions are good. East African conditions are now called good. Good conditions are still being reported in Southeast Asia.

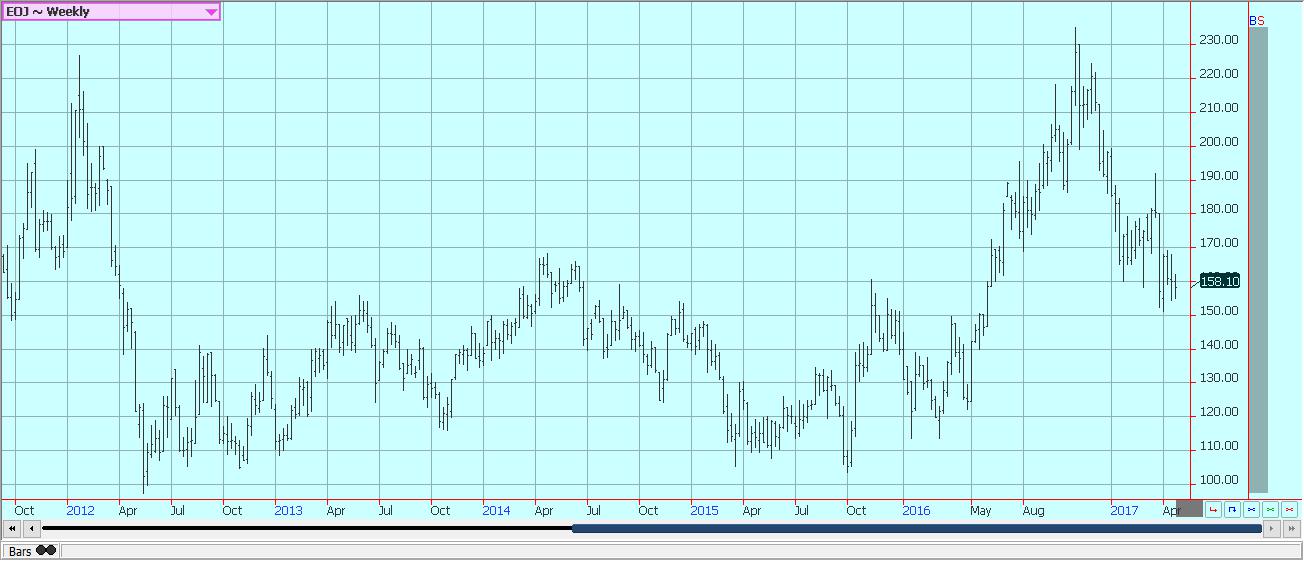

Weekly New York Cocoa Futures © Jack Scoville

Weekly London Cocoa Futures © Jack Scoville

Dairy and meat

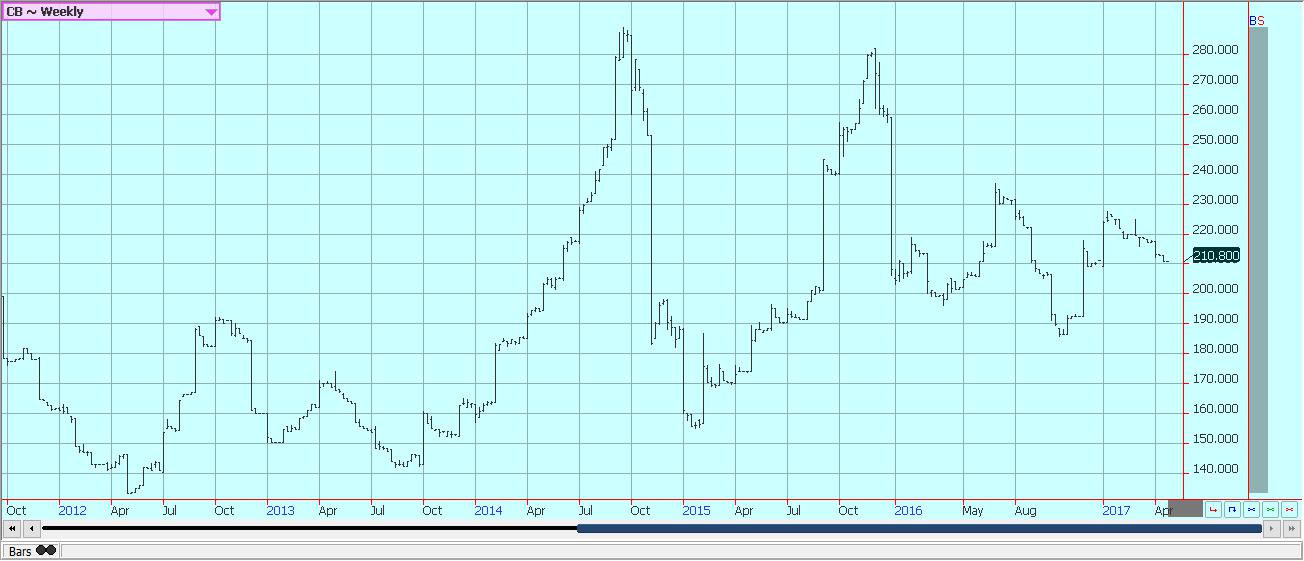

Dairy markets were higher. Supplies are strong seasonally in all areas as the annual flush is active in the US. Demand is good for cream, and cheese makers are displaying increasing demand. Cream demand for Butter has been very good as orders for print butter have increased. However, butter inventories in cold storage are increasing in some areas. Demand for Ice Cream has been mixed depending on the region. Cheese demand appears to be getting stronger due to promotions on the retail level. Exports are reported to be stronger. Dried products prices are generally weaker. Bottled milk demand has been steady to lower due to school holidays.

US cattle and beef prices were higher. The beef market has been strong and packers paid higher prices for cattle this week. Feedlots are very current with supplies. The trade is worried about a trend change to down given that the market has been very strong, but the cash market keeps holding and demand is also holding. April went off the Board on Friday and now June is too cheap when compared to cash prices. That implies that the market will need to rally again this week.

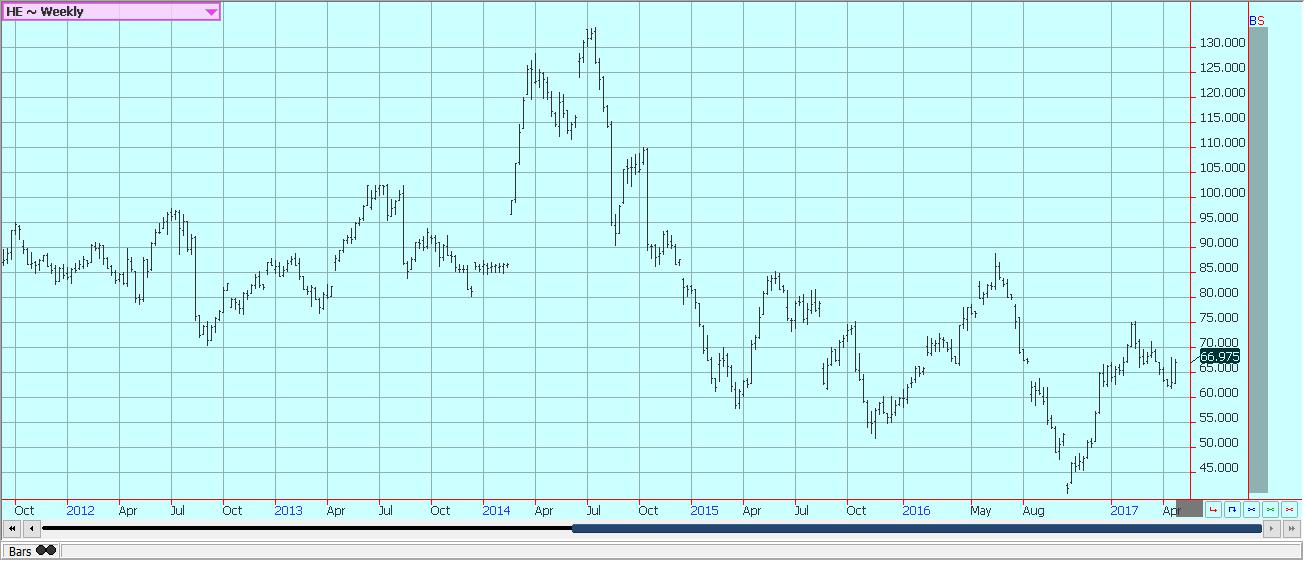

Pork markets and Lean Hogs futures were firm on ideas that cash market values had bottomed recently. Pork demand remains stronger than expected, but packers have been pulling back from the market as they sense increasing supplies are coming. Packer demand has been very good until now. There are big supplies out there for any demand. The charts show that the market could work lower.

Weekly Chicago Class 3 Milk Futures © Jack Scoville

Weekly Chicago Cheese Futures © Jack Scoville

Weekly Chicago Butter Futures © Jack Scoville

Weekly Chicago Live Cattle Futures © Jack Scoville

Weekly Feeder Cattle Futures © Jack Scoville

Weekly Chicago Lean Hog Futures © Jack Scoville

—

DISCLAIMER: This article expresses my own ideas and opinions. Any information I have shared are from sources that I believe to be reliable and accurate. I did not receive any financial compensation in writing this post, nor do I own any shares in any company I’ve mentioned. I encourage any reader to do their own diligent research first before making any investment decisions.

-

Biotech5 days ago

Biotech5 days agoBiotech Booster: €196.4M Fund to Accelerate Dutch Innovation

-

Markets2 weeks ago

Markets2 weeks agoCoffee Prices Decline Amid Rising Supply and Mixed Harvest Outlooks

-

Crypto2 days ago

Crypto2 days agoBitcoin Traders Bet on $140,000: Massive Bets until September

-

Crypto1 week ago

Crypto1 week agoCaution Prevails as Bitcoin Nears All-Time High

You must be logged in to post a comment Login