Three themes dominated this past week. We cover all three. Inflation, the debt limit and the still ongoing banking crisis along with the emerging commercial real...

The FCOJ charts show a sideways range has developed and futures are near the middle of the range for both the daily and weekly charts. Futures...

The Fed hiked another 25 bp as expected. The Fed outlined some of the problems but downplayed the bank crisis. They also left things open for...

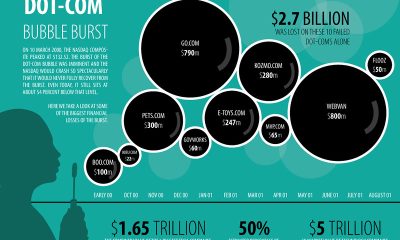

Although we cannot know what the future may bring, reflecting on the past will allow us to make better predictions about what is to come. Based...

New York and London closed higher and made new highs for the move with the market supported by tight supplies once again. Sugar production is not...

A big week coming up with the FOMC May 2-3 and the expected 25 bp hike with a pause. Friday brings us the April job numbers...

Despite the decline in Repsol results, there are business areas that have performed positively, such as Customer (+82%), Industrial, and Low Carbon Generation (+21.4%), which were...

While we live in an ever-changing world we have events today that could leave the world dramatically changed from where it was prior. We re-chronicle the...

Cost pressure is taking a toll on almost 400 Spanish companies in the food industry. By company size, the largest companies, with 1,000 or more employees,...

Cotton was a little lower last week and held to the recent trading range. The market acts firm and might work higher over time. The USDA...