By claiming your Social Security retirement benefits earlier than usual, you can invest the money at your convenience, giving you financial flexibility.

Some people choose to retire and enjoy the fruits of their labor, but others—after retiring—want to return but only on a part-time basis.

Some factors to consider before making a financial plan include how much you’ve already saved and the remaining years before retiring.

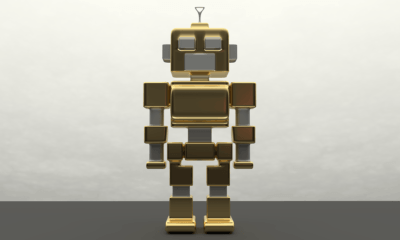

People live longer now and so their retirement funds should also last longer. Discover the pros and cons of robo-advisors for retirees.

Protecting your family's finances is very important. Here are 15 helpful tips on how to secure your family's financial future.

Only a small percentage of American baby boomers is found to have savings that can sustain them in their retirement.

With the current retirement crisis and the extremely low personal savings rate, it is not very likely that most American will be able to retire soon.

What will your dividend income look like a year from now? How about five years from now? Until now, the small investor never had a simple...

Robo-advisors offer an alternative to the high minimum, high fee combo practiced by some traditional investment professionals.

Gold stocks look promising when it made a recent high as early as January 2018. Because of this, various investors are betting on higher prices of...